Report ID: SQMIG15E2496

Report ID: SQMIG15E2496

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG15E2496 |

Region:

Global |

Published Date: May, 2025

Pages:

196

|Tables:

147

|Figures:

77

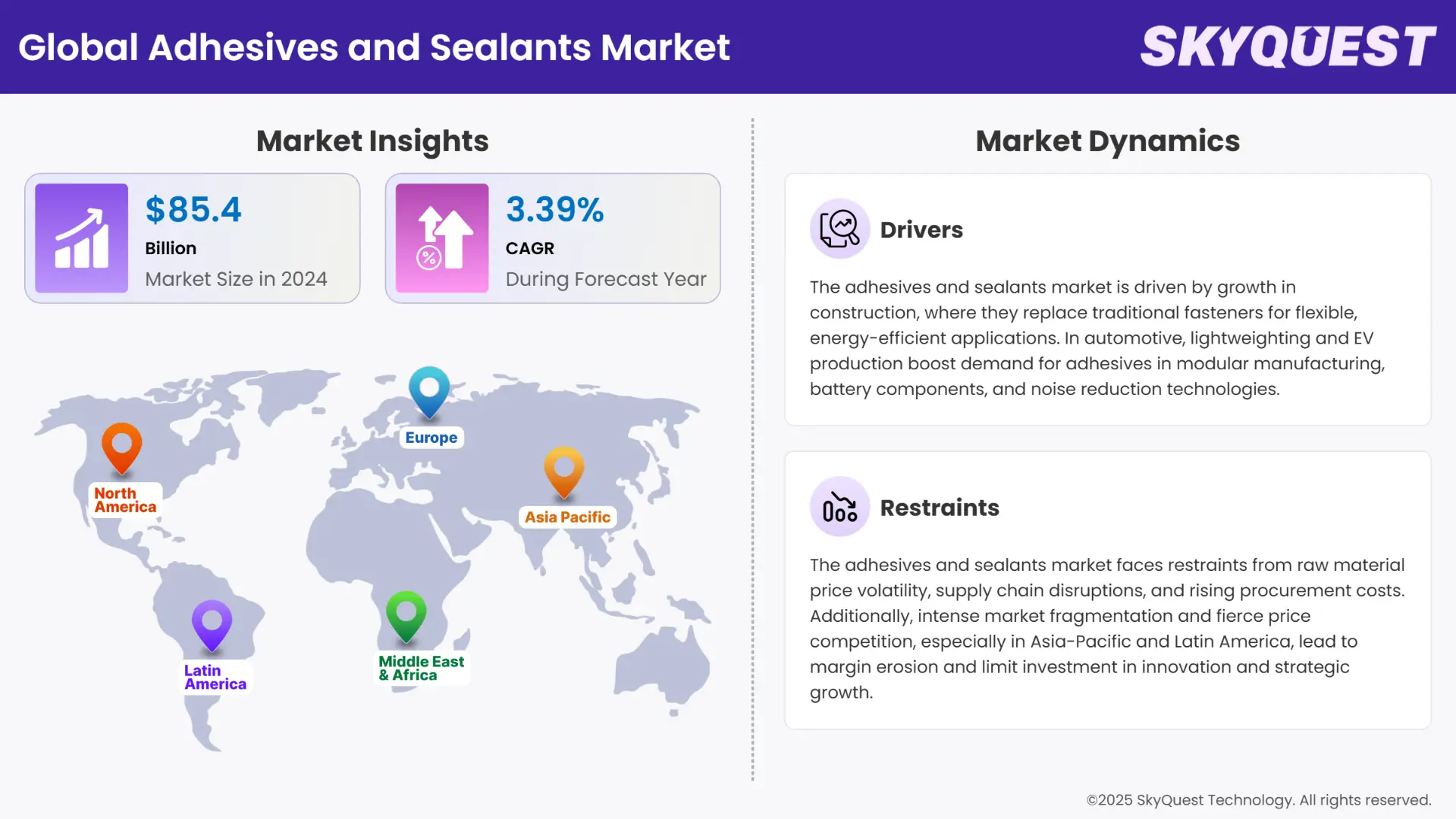

Global Adhesives and Sealants Market size was valued at USD 85.4 Billion in 2024 and is poised to grow from USD 88.3 Billion in 2025 to USD 115.28 Billion by 2033, growing at a CAGR of 3.39% in the forecast period (2026–2033).

The surge in the construction industry simultaneously increased the demand for adhesives and sealants market as these products are one of the main components which are required in buildings, and play a crucial role in uses like tiling, drywall fitting, flooring, ceiling components, and molding. As they prevent water and leakage from walls and ceilings, thus its demand is high in this sector. As the development of infrastructure goes on in Asia-Pacific, the Middle East, and parts of Latin America, the construction adhesives market will grow very significantly.

Also, these adhesives and sealants are being used in automotive applications as well. The historic years have seen a surge in its use cases and our study forecasts the demand is expected to rise by 6.1% in the automotive sector. The demand for lighter, cleaner-running cars has led automakers to substitute conventional mechanical fasteners with sophisticated structural adhesives. These adhesive solutions can lower vehicle weight and make cars more fuel-efficient and better performing in crashes.

Environmental regulations are dramatically redesigning product development and market forces. Adhesives and sealants have historically released volatile organic compounds (VOCs), which have been associated with respiratory and environmental risks. In response, producers are spending on VOC-free and bio-based chemistries to conform to strict environmental requirements in the EU, North America, and elsewhere.

SkyQuest's study found that the adhesives and sealants market will keep expanding throughout the remainder of the decade based on a mix of strong end-user demand and changing ecological expectations. Solely, construction industry-added value makes up about 5% of GDP in developed nations and 8% of GDP in developing nations. Yet this market is also growing more complicated, with a broad range of formulations designed for particular substrates and performance specifications. Product differentiation, compliance, and innovation will continue to be key to success in this adhesives and sealants market.

The adhesives and sealants market is being revolutionized with a major focus on sustainability through the creation of bio-based and low-VOC adhesives. Developments like Evonik's VISIOMER® GLYFOMA, a partially bio-based monomer, enable the manufacture of styrene-free, odorless adhesives, specifically for meeting tough environmental standards. The bio-based formulation is also prioritized and supported by Regulatory Authorities and Governments. For instance, the European Union has granted USD 5.13 million to SuperBark to create adhesives from tree bark, with plans to substitute wood panels' and packaging's fossil-based additives.

Moreover, solventless silicone pressure-sensitive adhesives are increasingly being used in electronics manufacturing, providing lower emissions and increased sustainability. Such developments are indicative of a wider industry move towards environmentally sustainable products due to the regulatory squeeze and consumer pressure for sustainable production and construction practices.

To get more insights on this market click here to Request a Free Sample Report

The global adhesives and sealants market is segmented into product, application and region. By product, the market is adhesives and sealants. By application, the market is segmented into adhesives application and sealants application. By region, the adhesives and sealants market is analyzed across North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

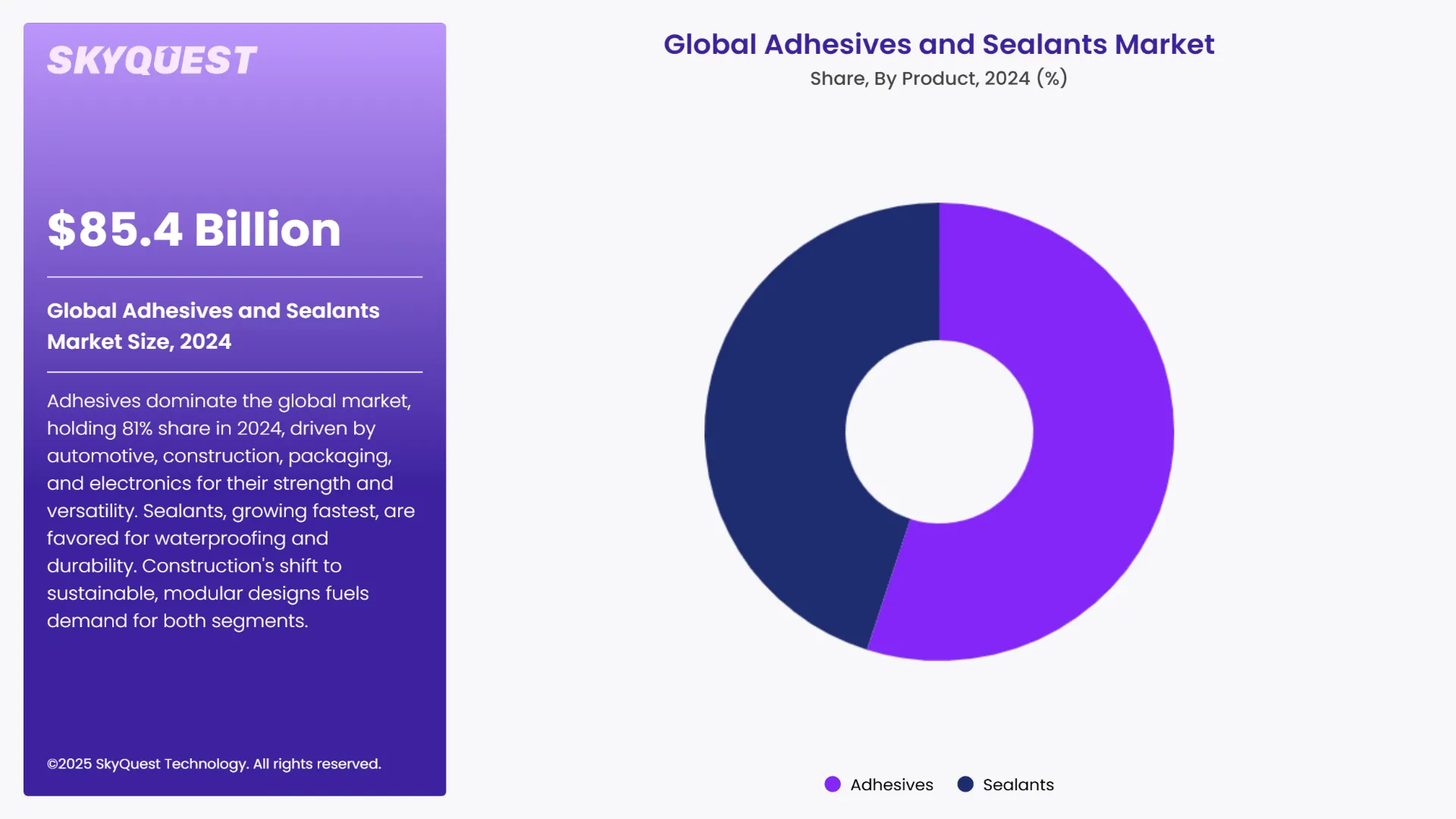

Our study indicates that adhesives will remain the dominant segment in the global adhesives and sealants market share, accounting for 81% of the market in the year 2024. Its higher adoption rates in automotive, construction, packaging, and electronic industries where adhesives are utilized due to their strength, versatility, and efficiency to join dissimilar materials have significantly proven its further dominance in the coming years. As per recent adhesives and sealants market trends, the shift towards water-soluble and bio-based adhesives is to meet VOC regulations and sustainability objectives. In construction, adhesives find broad applications in flooring, paneling, tiling, and insulation systems, with growing use in green buildings. Thus, its increased demand further supports its dominance in coming years.

Sealants are turning out to be the growth leader, expected to expand at a CAGR of 7.1%, especially in waterproofing and moisture-resistant applications. Silicones and polyurethanes take the lead in demand because of their high flexibility, weather resistance, and longer lifespan. The increasing number of infrastructure developments in coastal and flood areas, where watertightness against water entry is essential, is supporting the trend.

The construction industry for both segments has contributed to their market growth in terms of revenue. Still, the largest market share is being held by the adhesives’ application segment, with the most prominent end-use being construction. The increasing trend of smart and modular construction, coupled with the worldwide drive towards sustainable urban infrastructure, is propelling the utilization of adhesives within building materials, floor systems, insulation panels, and prefabricated units. Adhesives deliver greater bonding strength and design freedom, allowing architects and engineers to embrace new, lightweight materials without sacrificing structural integrity.

On the other hand, the diversification of applications has increased the utilization of sealants mainly because of their pivotal importance in new construction work, particularly weatherproofing, glazing, and expansion joints. An increasing emphasis on green buildings and energy-efficient designs is fueling the application of high-tech sealant formulations possessing better thermal insulation, resistance to UV, and water control. Additionally, advancements in low VOC content hybrid sealants are supporting stringent environmental laws by matching well with sustainable building practices.

To get detailed segments analysis, Request a Free Sample Report

In 2024, the Asia Pacific region has been seen as the most favorable region for the global adhesive and sealant market trends due to industrialization, urbanization and a strong manufacturing base. Key players are also generating most of their revenues from this region. In 2024, the region accounted for more than 41% market share in the global adhesives and sealants market. Also, our study for projected years found that the continued growth of the construction industry within the Asia Pacific region as China and India are expected to invest heavily in infrastructure developments to facilitate urban migration and economic growth, will boost the demand. At the same time, the automotive sector is doing well, and there has been a significant movement towards EVs and light-weighting materials, which require higher-end adhesive solutions. Overall, these dynamics set Asia Pacific as a fast-moving and changing market for adhesives and sealants industry.

China Adhesives and Sealants Market

China continues to drive the Asia Pacific adhesives and sealants market growth forward, primarily bolstered by its construction and automotive sectors. With ambitious urbanization plans designed to have its urbanization level reach 70% by 2030, there is strong momentum behind infrastructure development, including residential, commercial, and transportation projects. The construction output in China in 2022 reached USD 4.5 trillion to demonstrate the vastness of this part of the economy. Further, China is also the largest automotive manufacturer in the world and we saw strong performance in 2022 in the electric vehicles sector with 87% year on year for electric vehicles sales supporting the requirement for more advanced adhesives to build EV batteries and lightweight vehicle components, propping China up as the leading market for this sector as well.

India Adhesives and Sealants Market

The adhesives and sealants market in India also seems promising because of the rising infrastructure investments in India and a move toward becoming a manufacturing hub in the coming years. The construction Industry as well as the automotive sector is also raising demand for sustainable adhesives and sealants as per the green initiatives in this country. In India, for instance, Pidilite Industries Limited (Pidilite) is India’s market leader in adhesives and sealants, construction chemicals, hobby colours and polymer emulsions. The company’s flagship brands - Fevicol and M-Seal have a market share of ~70% each in the domestic market. Thus, competition with such well-established companies also requires strategic moves to enter.

Japan & South Korea Adhesives and Sealants Market

Japan's view on earthquake-resistant infrastructure as well as to expanded emphasis on EV adoption, with a goal of 100% clean energy vehicle sales by 2035, fuels the demand for high-performance adhesives. At the same time, South Korea's construction industry has achieved more than 30 billion USD in overseas orders for five consecutive years, which will drive the demand for adhesives and sealants in this country. Both countries have a preference for certain sustainable, energy-efficient technologies making them two of the biggest adopters of low-VOC and sustainable adhesive and sealants.

Demand for adhesives and sealants in North America will have stable growth backed by the growth of infrastructure rehabilitation, energy-efficient building practices, and innovations made in automotive and aerospace manufacturing. The region is also at the forefront of public and private investment in sustainable buildings, retrofitting buildings built before energy-efficient practices became conventional, and lightweight vehicles. North America is also front-moving into the era of VOC-conformant and environmentally friendly formulations and with national and regional legislation that embraced these new regime pushes.

The U.S. Adhesives and Sealants Market

In the United States, the adhesives and sealants industry is heavily influenced by large-scale initiatives to renovate and modernize aging infrastructure. Based on the American Society of Civil Engineers (ASCE), more than 42% of U.S. highways and 7.5% of bridges are classified as structurally deficient or poor condition. This has resulted in multi-billion-dollar investment in the Infrastructure Investment and Jobs Act (IIJA), which is driving demand for sophisticated bonding and sealing solutions in bridge joints, highways, and commercial buildings.

Canada Adhesives and Sealants Market

The adhesives and sealants market growth has seen steady in Canada, largely due to increased residential construction, retrofits, and energy-efficient building requirements. Increased demand for housing in Toronto, Vancouver, and Ottawa is driving the use of sealants for window glazing, insulation, and waterproofing purposes. Furthermore, Canada's national push for sustainable infrastructure, guided by updates to the National Energy Code for Buildings (NECB), is creating more opportunities for low-VOC, solvent-free adhesives.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Growing Construction Industry and Infrastructure Development

Expanding Automotive Production and Lightweighting Trends

Volatility in Raw Material Prices and Supply Chain Disruptions

Intense Market Fragmentation and Price Competition

Request Free Customization of this report to help us to meet your business objectives.

The global adhesives and sealants market is fairly consolidated, with the top five players—Henkel, 3M, Sika, H.B. Fuller, and Dow—representing more than 30% of the market share. While it is difficult for a new entrant to the market to compete with any existing manufacturing competitors because of established brand loyalty, R&D expertise, and global supply chains, new entrants can carve out market position from existing larger players if they target niche applications, sustainability, and innovation. For example, Bostik recently introduced Fast Glue Ultra+, which is made from 60% bio-based materials, which shows the growth in demand for "green" products. Companies that want to expand their competitive positions in this evolving industry will need to invest in R&D, expand their product offerings, and develop an efficient supply chain.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected using Primary Exploratory Research backed by robust Secondary Desk research.

SkyQuest's study suggests that the forecast year is expected to show higher adoptions of adhesives and sealants within the construction, automotive, and packaging industries. A notable trend and opportunity for a new entrant seems in the investment in bio-based and low VOC adhesives and sealants. Regional demand, especially in the Asia-Pacific region, is establishing dominant markets and leadership capacity, while the more mature expense in North America, is more about compliance with regulations and trying to achieve current green building practices. Continued product differentiation and sustainability will define future success in this dynamic market landscape.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 85.4 Billion |

| Market size value in 2033 | USD 115.28 Billion |

| Growth Rate | 3.39% |

| Base year | 2024 |

| Forecast period | 2026–2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Adhesives and Sealants Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Adhesives and Sealants Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Adhesives and Sealants Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Adhesives and Sealants Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

The most critical issues include price volatility of raw materials, broken supply chains, highly fragmented and price-competitive markets, particularly in the low- and mid-performance segments where price competition cuts profit margins.

There is a significant shift in focus on bio-based, VOC-free formulations undertaken by manufacturers of adhesives and sealants. In particular, there are recent regulatory frameworks in this area in the EU and North America, that help promote the adoption of environmentally safe adhesives and materials and are starting to reshape product development.

Construction is the leading application for adhesives and sealants (as the adhesives for tiling, insulation, and modular building). The automotive sector is in second place as structural adhesives have replaced mechanical fasteners in order to reduce weight and improve EV battery efficiency.

Regulation aimed at VOC emissions is changing the game for product innovation. Companies are developing compliant adhesives from renewable feedstock (like SuperBark and VISIOMER® GLYFOMA) to cope with the new regulations in Europe and North America.

The price of raw materials, especially petrochemical derivatives, shapes input pricing. The volatile nature of raw material global supply chains, and constant changes in oil prices cause procurement costs to increase substantially, and overall company profitability and pricing strategy.

Construction demand is driven by infrastructure development, and the demand for green buildings, while favourable automotive demand particularly from the electric vehicles (EVs) movement has prompted considerable interest from the adhesives producers to have advanced adhesives to satisfy lightweighting distribution and battery assembly, this makes the construction and automotive sectors very important for the overall market expansion.

Global Adhesives and Sealants Market size was valued at USD 85.4 Billion in 2024 and is poised to grow from USD 88.3 Billion in 2025 to USD 115.28 Billion by 2033, growing at a CAGR of 3.39% in the forecast period (2026–2033).

Henkel AG & Co. KGaA (Germany), H.B. Fuller Company (US), Sika AG (Switzerland), 3M (US), Arkema (Bostik) (France), Ashland Inc. (USA), Pidilite Industries Ltd (India), Avery Dennison Corporation (USA), Huntsman Corporation (USA), Wacker Chemie AG (Germany), RPM International Inc. (USA), Kuraray Co., Ltd. (Japan), Dow Inc (USA), Asian Paints Ltd (India), DIC Corp (Japan)

The key driver of the adhesives and sealants market is the growing demand from end-use industries such as automotive, construction, packaging, and electronics, where these products enhance product durability, assembly efficiency, and performance in bonding and sealing applications.

A key market trend in the adhesives and sealants market is the increasing adoption of environmentally friendly and sustainable products, including bio-based and low-VOC formulations, driven by regulatory pressures and growing consumer demand for greener solutions.

Asia-Pacific accounted for the largest share in the adhesives and sealants market, driven by rapid industrialization, expanding automotive and construction sectors, growing manufacturing activities, and increasing demand for advanced bonding and sealing solutions in the region.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients