Report ID: SQMIG25K2071

Report ID: SQMIG25K2071

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG25K2071 |

Region:

Global |

Published Date: June, 2025

Pages:

193

|Tables:

114

|Figures:

71

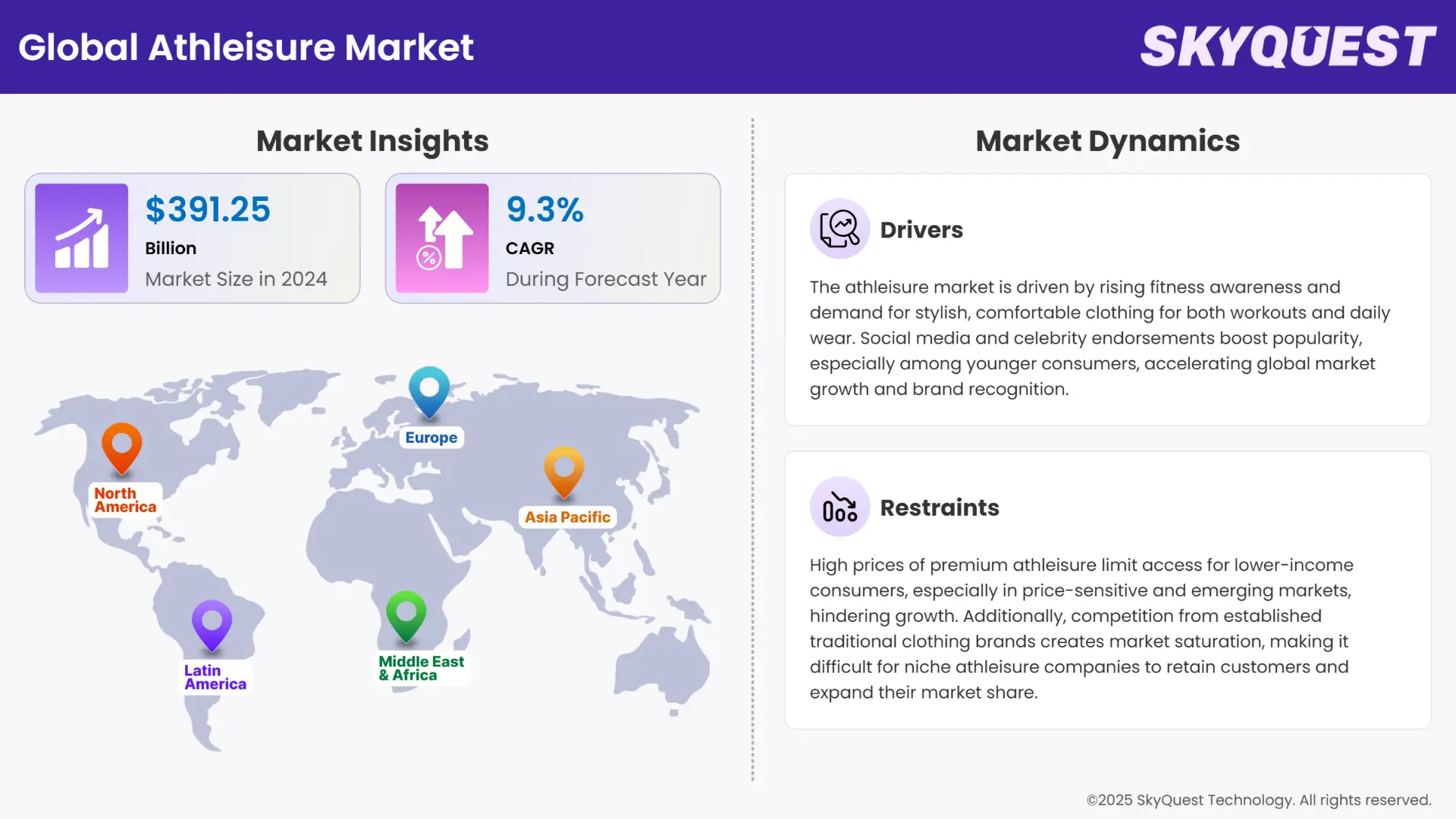

Global Athleisure Market size was valued at USD 391.25 Billion in 2024 and is poised to grow from USD 427.64 Billion in 2025 to USD 871.04 Billion by 2033, growing at a CAGR of 9.3% in the forecast period (2026–2033).

As a result of shifting consumer preferences and demographics, global athleisure market growth is undergoing significant change in terms of personalization and size inclusivity. Major brands are expanding their size ranges and eschewing traditional labels like "plus-size" and "petite" in favor of more inclusive language. Alongside this shift, state-of-the-art technologies are being integrated to enable customized and personalized sportswear. Businesses are developing sophisticated websites that enable customers to personalize their activewear to suit their tastes and requirements, in addition to utilizing technologies that can monitor and evaluate consumer movement patterns to offer tailored product recommendations.

Rising sports participation, especially for health-related reasons, and the increasing influence of celebrity endorsements and international sporting events, are driving increased consumer involvement in sports and leisure activities. This athleisure industry trend is particularly evident in government initiatives and spending on sports venues and activities.

What are the Latest Innovations Driving Athleisure Apparel?

In recent years, technological developments in the athleisure sector are revolutionizing the production of new goods, emphasizing performance enhancement, the use of eco-friendly materials, and intelligent textiles. To meet changing consumer demands, brands are incorporating technology that wicks away moisture, regulates temperature, and combats odors. To enable real-time biometric tracking during workouts, Lululemon, for instance, integrated smart textiles into their Mirror technology in 2025. Additionally, Nike created the "Nike Go" leggings, which are environmentally friendly, and the most comfortable and elastic leggings ever produced due to their InfinaSoft fabric. To give customers the desired level of cushioning, Adidas also provided 3D-printed midsoles for its 4DFWD line. Health-conscious consumers who want a single item of clothing that is stylish, functional, and well-made are very interested in these new products.

To get more insights on this market click here to Request a Free Sample Report

The global athleisure market is segmented into product type, end user, distribution channel, category, and region. By product type, the market is classified into clothing and footwear. Depending on end user, it is divided into men, women, and kids. According to segmentation by distribution channel, the athleisure market is categorized into online retail stores and offline retail stores. As per the category, it is bifurcated into mass and premium. Regionally, it is analyzed across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

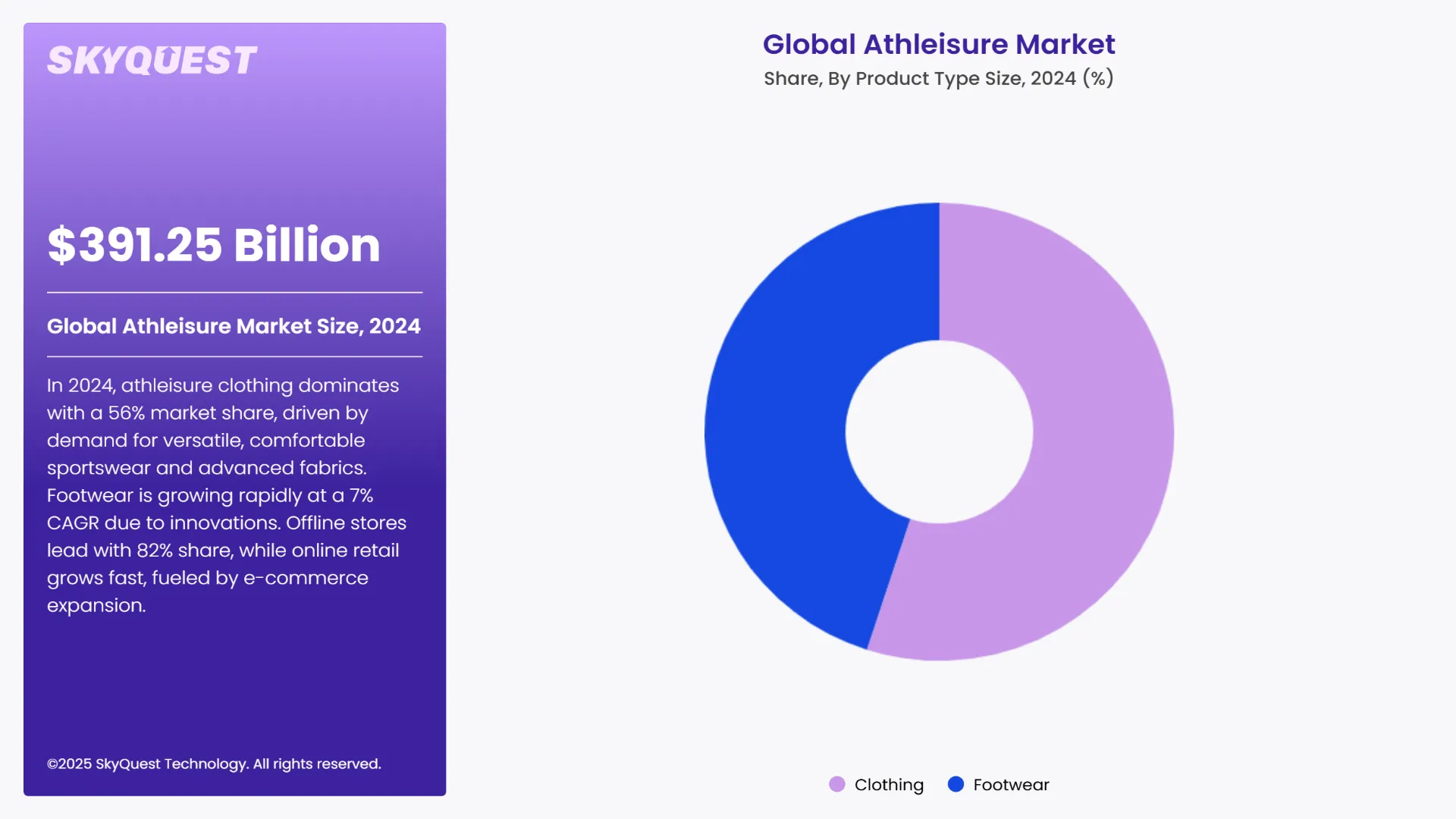

Why Clothing Continues to Dominate the Athleisure Market in 2024?

As per the 2024 global athleisure market analysis, the clothing segment holds a dominant 56% market share. This important market position is primarily driven by the rising demand for comfortable and versatile sportswear for both casual wear and workouts. Improvements in fabric technology are also helping the market expand as manufacturers expand their product lines to include sustainable, temperature-regulating, and moisture-wicking materials. Major brands are expanding their clothing portfolios to offer more options, ranging from performance apparel to lifestyle pieces, in order to satisfy a wide range of consumer preferences. Additionally, consumers' increasing health consciousness and the acceptance of casual athletic wear in a range of social contexts have contributed significantly to the segment's dominance.

Between 2025 and 2032, the footwear segment of the athleisure market is expected to grow at a compound annual growth rate (CAGR) of 7%. This impressive growth trajectory is being driven by ongoing technological advancements in shoe design, such as advanced cushioning systems, environmentally friendly materials, and customizable features. The segment is witnessing an increase in demand for shoes that combine casual sports style with athletic functionality, making them suitable for a range of situations.

How Do Offline Retail Stores Enhance the Athleisure Consumer Experience?

Based on the 2024 global athleisure market forecast, the offline retail stores segment holds a dominant 82% of the market. Physical retail stores still offer unique advantages to athleisure consumers, chief among them being the chance to try on and examine products before buying. Specialty stores are a useful retail outlet for both vendors and customers because they provide a wide range of athletic streetwear and enhanced visibility.

With a projected compound annual growth rate (CAGR) of about 7% between 2025 and 2032, the online retail stores category of the athleisure industry is expanding at an impressive rate. The primary forces behind this faster growth are the expanding global e-commerce infrastructure and the growing consumer preference for simple shopping experiences. Digital platforms are revolutionizing the athleisure retail industry with their extensive product selection, simple checkout procedures, and enticing pricing structures.

To get detailed segments analysis, Request a Free Sample Report

As per the 2024 athleisure market regional forecast, North America dominates the market due to its high consumer awareness and adoption of fitness-focused lifestyles. The region's booming retail e-commerce sector and rising awareness of the positive health effects of sports and fitness activities are the main drivers of the market. The US, Canada, and Mexico are the three primary markets in this region; each has distinct consumer preferences and market features. The region gains from the presence of well-known athleisure brands and their extensive distribution networks, as well as from growing consumer disposable income and health consciousness.

U.S. Athleisure Market

The United States remains the largest athleisure market share in North America, with approximately 85% of the regional market share in 2024. The country's market is defined by well-known athleisure brands and a well-established retail infrastructure. American consumers have adopted athleisure as a mainstay of their everyday wardrobe, going beyond just workout wear.

Mexico Athleisure Market

The fastest-growing athleisure market in North America is Mexico, which is expected to grow at a rate of about 6% between 2025 and 2032. The Mexican athleisure market is rapidly evolving due to rising health consciousness and fitness participation. The nation's young population and expanding middle class are contributing to the athleisure fashion trend. Football, the country's national sport, has a significant influence on consumer preferences and athleisure trends.

Europe's advanced and sophisticated athleisure market is characterized by high adoption rates of fitness-oriented lifestyles and strong consumer awareness. The markets in the region are varied and include the UK, Germany, France, Spain, Italy, and Russia, each with its own consumer preferences and market dynamics. The primary factors propelling the European athleisure market are rising health consciousness, rising fitness participation, and the growing trend of wearing sportswear in casual settings. Due to the region's strong fashion influence, athleisure has entered the mainstream and created a distinct market niche by fusing fashion with functionality.

UK Athleisure Market

The UK is currently the largest athleisure market in Europe, holding about 21% of the regional athleisure market share in 2024. The UK market is characterized by a strong fitness culture and high consumer spending on sports and leisure clothing. Consumers in the country show a clear preference for sustainable athleisure brands and innovative products. About 60% of UK consumers consider sustainability when purchasing athleisure items, indicating a strong preference for goods produced in an ethical and environmentally responsible manner.

France Athleisure Market

An IFOP survey indicates that in 2024, French consumers' demand for sustainable athleisure rose by 35%. Businesses like Lululemon and On expanded their Paris locations as consumer preferences for high-end, environmentally friendly products increased. Government programs that promote active lifestyles, like "Bougez Plus" (Move More), have also led to an increase in athleisure purchases associated with fitness and wellness trends.

Germany Athleisure Market

German athleisure sales increased by 28% in the second quarter of 2024 thanks to technologically advanced textiles like moisture-wicking and odor-control, which are highlighted by brands like Adidas and On Running. Retailer Zalando reported a 22% increase in athleisure sales during the 2024 Olympics and UEFA Euro events, demonstrating the importance of sporting events as catalysts. An increase in fitness participation, particularly in running and cycling, also increased demand for high-performance apparel.

With varying consumer preferences and varying levels of market maturity across countries, the athleisure market in Asia-Pacific is dynamic and rapidly evolving. China, Japan, India, and Australia are the region's main markets; each has its own growth patterns and characteristics. The primary factors propelling the market are rising levels of fitness activity participation, growing disposable income, and growing health consciousness. Due to the region's large youth population and increasing adherence to western fashion trends, the market has expanded significantly.

China Athleisure Market

China is the largest country in the Asia-Pacific athleisure market growth. The Chinese market is characterized by rapid urbanization, growing health consciousness, and rising levels of disposable income. The country's large population and expanding middle class provide a substantial consumer base for athleisure products. By the end of 2024, China's urbanization rate was 67%; by 2035, it is predicted to reach 75–80%. This urban shift has increased the middle class's size and disposable income, which has increased demand for athleisure products. The per capita disposable income of urban dwellers in 2024 was 54,188 yuan, a 4.6% increase from the year before.

India Athleisure Market

India is rapidly emerging as the Asia-Pacific athleisure market demand with the fastest growth rate due to shifting consumer lifestyles, rising health consciousness, and a developing middle class. In places like Bengaluru, Mumbai, and Delhi, "fitness raves," where participants work out hard to electronic music, have gained popularity. These events, which are usually held in the morning, combine fitness and social interaction, which reflects the trend toward more active and group-focused forms of exercise.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Increasing Knowledge About Fitness and Health

Growing Influence of Social Media and Celebrity Endorsements

High Price Factor Limiting Mass Product Reach

Traditional Clothing Brands Pose a Serious Threat

Request Free Customization of this report to help us to meet your business objectives.

Two of the most well-known brands in the athleisure sector are Nike and Adidas. They maintain their competitive edge by being creative, offering a wide variety of goods, and operating in numerous countries. Customization and sustainability are two markets that new brands are concentrating on. Influencer marketing, celebrity collaboration, and e-commerce growth are a few of the tactics. Direct-to-consumer sales channels and digital transformation assist companies in growing and retaining clients. Being creative and implementing sustainable practices are still essential strategies to differentiate yourself in this competitive, fast-paced economy.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected by means of Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, the global athleisure market outlook is predicted to change rapidly due to fashion and function amalgamating, the surge in health consciousness, and the world of online marketing proving effective. The market is starting to change where companies are beginning to focus on "sustainability" and the use of new technology, despite costs and fierce competition. Companies utilizing sustainable materials and technology associated with smart clothing are exciting and attractive to consumers today. Using digital platforms as a way to communicate with customers and access to new markets with influencers and social media is extremely important today. The athleisure market is a lively and fast-growing market which has much potential for companies who can respond to dynamic consumer behaviour choices and sustainability expectations.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 391.25 Billion |

| Market size value in 2033 | USD 871.04 Billion |

| Growth Rate | 9.3% |

| Base year | 2024 |

| Forecast period | 2026–2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Athleisure Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Athleisure Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Athleisure Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Athleisure Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Global Athleisure Market size was valued at USD 391.25 Billion in 2024 and is poised to grow from USD 427.64 Billion in 2025 to USD 871.04 Billion by 2033, growing at a CAGR of 9.3% in the forecast period (2026–2033).

Nike, Inc., Adidas AG, Puma SE, Under Armour, Inc., Lululemon Athletica Inc., VF Corporation, ASICS Corporation, New Balance Athletics, Inc., Columbia Sportswear Company, Skechers USA, Inc., Fila Holdings Corp., Anta Sports Products Ltd., Gymshark Ltd., Reebok International Ltd.

The key driver of the athleisure market is the rising consumer preference for comfortable, versatile, and stylish clothing that can be worn for both fitness activities and casual everyday wear, fueled by increasing health consciousness, active lifestyles, and fashion trends.

A key market trend in the athleisure market is the growing adoption of sustainable and high-performance fabrics, such as recycled materials, moisture-wicking textiles, and stretchable, breathable fabrics, which combine comfort, functionality, and eco-friendly appeal for fashion-conscious consumers.

North America accounted for the largest share in the athleisure market, driven by high consumer awareness of fitness and wellness, strong adoption of activewear as everyday fashion, established retail and e-commerce channels, and the presence of leading global athleisure brands.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients