Report ID: SQMIG35H2342

Report ID: SQMIG35H2342

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG35H2342 |

Region:

Global |

Published Date: June, 2025

Pages:

196

|Tables:

92

|Figures:

76

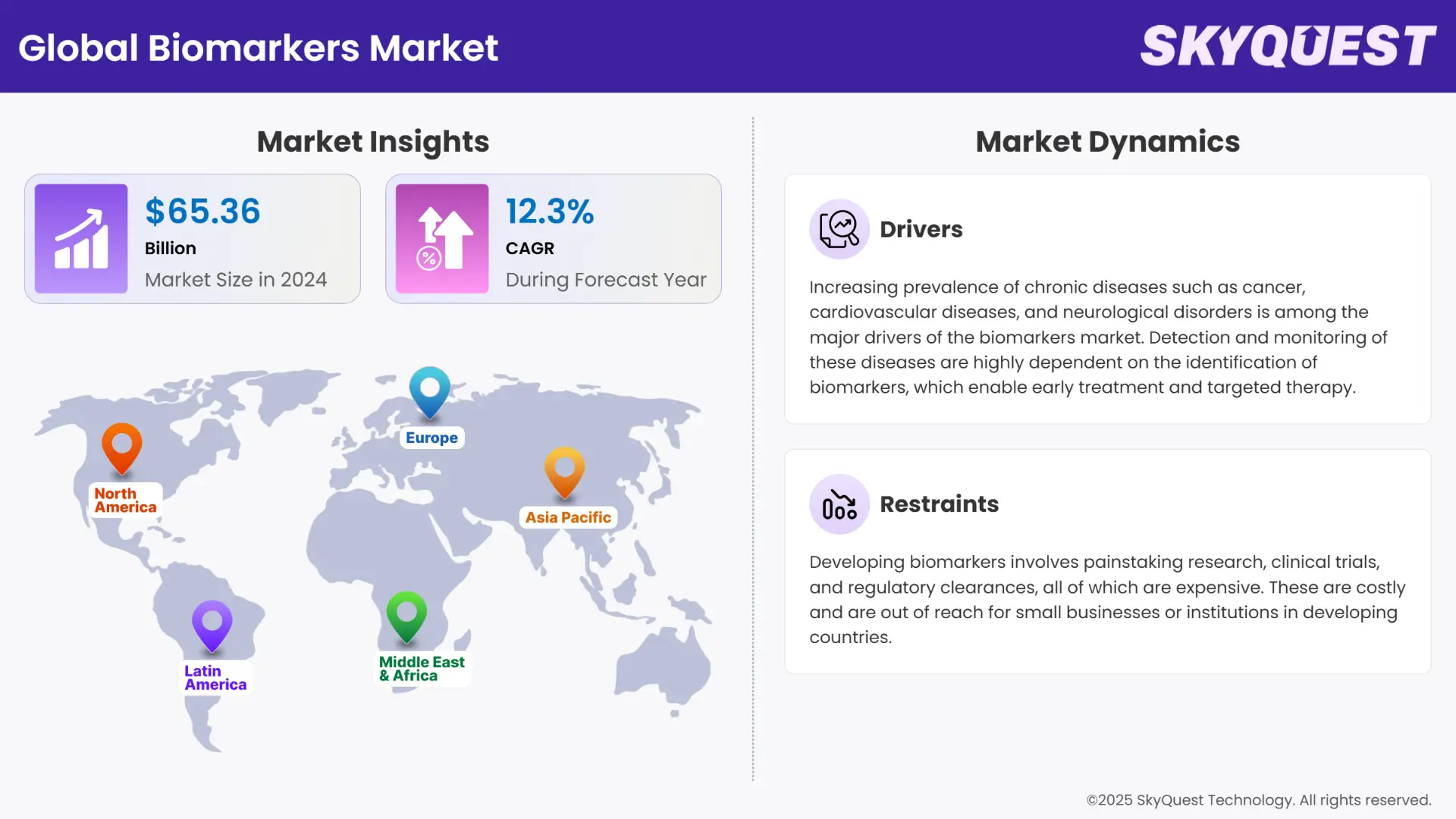

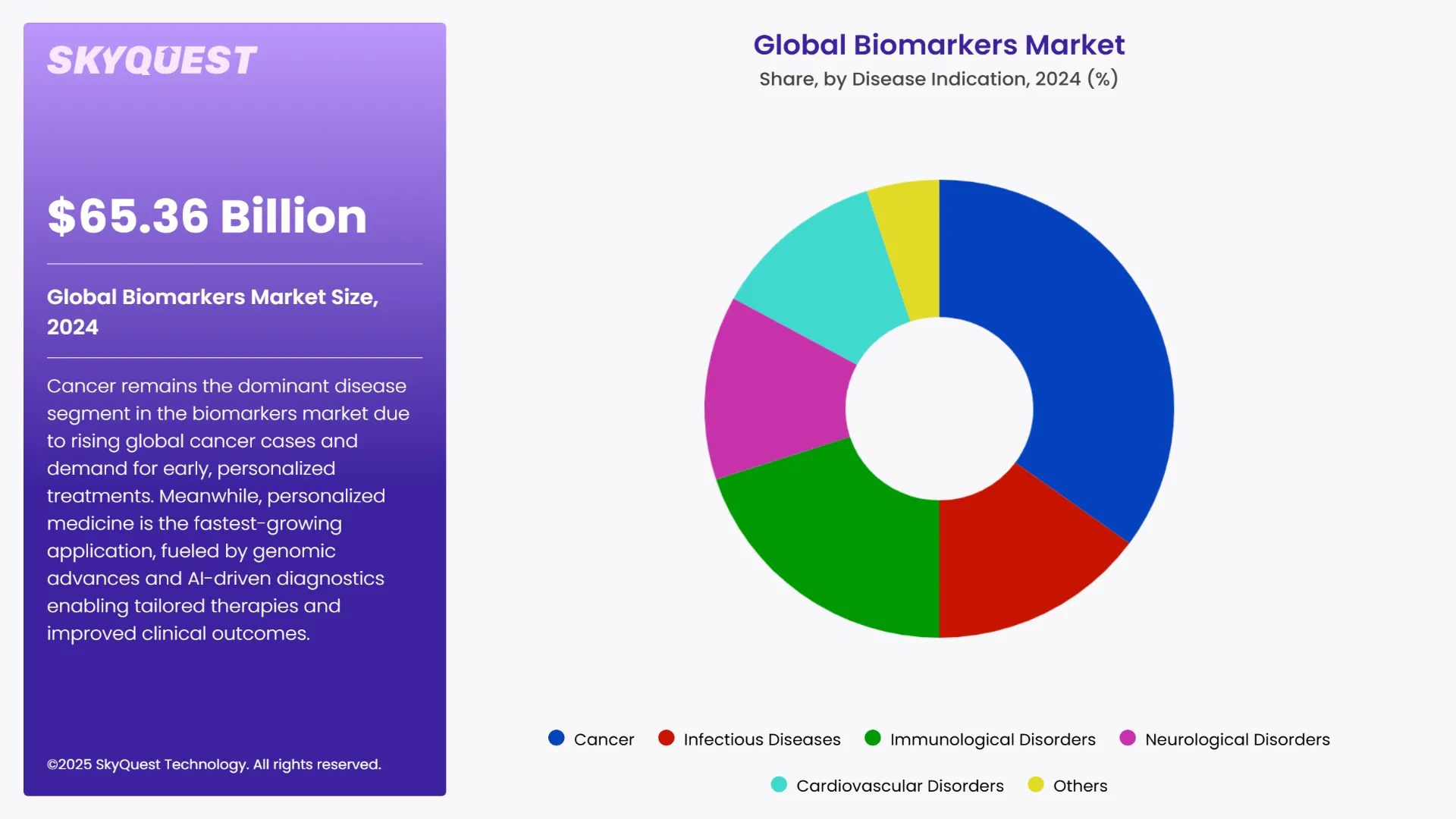

Global Biomarkers Market size was valued at USD 65.36 Billion in 2024 and is poised to grow from USD 73.4 Billion in 2025 to USD 185.66 Billion by 2033, growing at a CAGR of 12.3% during the forecast period (2026–2033).

The biomarker market is expanding strongly with expanding uses in diagnostics, drug development, and targeted treatment. Biomarkers also play a crucial role in the early diagnosis of disease, disease prognosis, and monitoring of treatment response and are valuable assets in many therapeutic fields like oncology, neurology, and cardiology. Advancements in genomics, proteomics, and bioinformatics technology are assisting in the identification and validation of biomarkers and thus their prospect for application in the clinic. Pharmaceutical and biotech organizations are to a great degree enabled by biomarker-based research to find drugs and attain regulatory approval.

Furthermore, increased adoption of companion diagnostics and biomarkers for clinical trials is also driving Biomarkers Market growth. As the health care sector is gearing up for precision medicine, global demand for precise, non-invasive, and predictive biomarkers is increasing. Biomarkers market drivers are increasing incidence rates for chronic diseases like cancer, diabetes, and cardiovascular disease. Unmet needs for early and precise diagnosis are stimulating demand, which is driving biomarker-based diagnostics. Incentives from the government and research grants, especially in genomics and translational medicine, are driving biomarker development. Increasing use of biomarkers in clinical trials for patient stratification and monitoring of therapy is fueling innovation.

Development of next-generation sequencing, digital pathology, and bioinformatics tools is enabling quicker and more affordable discovery of biomarkers. Moreover, growing reliance of the pharmaceutical sector on biomarkers in determining the safety and efficacy of drugs also fuels the biomarkers market growth. Growing demand for personalized treatment regimens also highlights the position of biomarkers in patient treatment and better patient outcomes. Despite the promising growth opportunities, the biomarker marketplace is beset by several challenges.

Skyrocketing costs of biomarker discovery, validation, and regulatory approval can render them less accessible and universally accepted in limited-resource environments. Biotechnological issues of assigning specificity, reproducibility, and clinical utility to biomarkers are considerable hurdles. Data confidentiality and decentralized healthcare models could constrain biomarker adoption into general practice. In addition, the absence of standard guidance on biomarker development and inconsistent reimbursement policies geographically restrict market expansion. Academia, industry, and regulators need to communicate with each other in order to overcome these constraints. Regulatory path heterogeneity between countries also deters market entry worldwide and results in delays in product launches. These hindrances need to be addressed so that the potential of biomarkers can be best achieved in enhancing healthcare provision and therapy outcomes.

Artificial Intelligence (AI) is transforming the biomarker space by expediting the speed and accuracy of biomarker discovery, qualification, and use cases. Machine learning techniques are able to scan large databases in genomics, proteomics, and digital health to identify new biomarkers and forecast patient response to therapy. The approach accelerates the product development cycle of personalized medicine, allowing clinicians to tailor treatment from single biomarker signatures. Moreover, AI platforms enable multi-omics data integration, where researchers are able to have a general overview of disease mechanisms and development. Uses of AI technologies not only improve the accuracy of diagnostics but also accelerate clinical trial designs, lower the cost, and decrease time to biomarkers market for novel pharmaceuticals.

For example, Imagene and Tempus AI collaboration, initiated in February 2025, is a remarkable AI-powered biomarker discovery pipeline. The collaboration can potentially create an AI-based biomarker prediction panel in NSCLC. The new platform analyzes biopsy samples using machine learning algorithms and detects actionable biomarkers like EGFR, ALK, MET, BRAF, HER2, RET, and ROS1.

To get more insights on this market click here to Request a Free Sample Report

The global biomarkers market is segmented by Product, Type, Research Area, Technology, Disease Indication, Application, End User and region. Based on Product, the market is segmented into Consumables, Services and Software. Based on Type, the market is segmented into Safety Biomarkers, Efficacy Biomarkers and Validation Biomarkers. Based on Research Area, the market is segmented into Genomics, Proteomics, Metabolomics and Others. Based on Technology, the market is segmented into Immunoassays, Ngs, Pcr, Mass Spectrometry, Chromatography and Others. Based on Disease Indication, the market is segmented into Cancer, Infectious Diseases, Immunological Disorders, Neurological Disorders, Cardiovascular Disorders and Others. Based on Application, the market is segmented into Clinical Diagnostics, Drug Discovery & Development, Personalized Medicine, Clinical Research and Others. Based on End User, the market is segmented into Pharmaceutical & Biotechnology Companies, Hospitals & Diagnostic Laboratories, Academic & Research Institutes and Others. Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

The cancer segment was the largest percentage in the disease indication category in the 2024 global biomarkers market report. The cancer segment dominated the market with the largest percentage in the disease indication category, as can be seen from the 2024 cancer biomarkers market. The expansion of this segment is primarily driven by the expansion of global cases of cancer and the growing requirement for early detection, precise diagnosis, and individualized therapy. Biomarkers have become a flagship modality in oncology primarily for disease staging evaluation, prediction of therapeutic outcome, and monitoring of recurrence in follow-up.

In 2024, the industry saw a sudden growth when research for oncology was continued to be supported and funded by regulations all around the world. Oncology biomarker pipelines are being looked for by key pharmaceutical industries to drive drug efficiency and patient outcomes. For example, in March 2024, Roche introduced a new FDA-approved biomarker panel for the diagnosis of early breast cancer. The diagnostic solution is complemented by companion therapies, allowing for personalized treatment regimens and improved survival of the patient.

On the other hand, neurologic disease biomarkers are increasing at a sustainable CAGR of 10.4%. Recent clinical trials confirm that these biomarkers have been found to be extremely valuable in identifying Alzheimer's and Parkinson's disease even before symptoms arise. Due to aging populations and an increase in neurological disorders, this segment will pick up pace in the future years.

The fastest-growing application area, according to the 2024 global biomarker market report, was personalized medicine. It is propelled mainly by the advances in genomics and artificial intelligence technologies that facilitate highly individualized treatment regimens from patient-specific biomarker profiles. Biomarkers are at the core of patient stratification, forecasting drug response, and limiting side effects, a trend redefining clinical decision-making. High growth for precision medicine programs was experienced in 2024 as governments and private investors committed to biomarker-driven diagnostic platforms. This has been revolutionizing the treatment of disease, particularly oncology, immunology, and rare genetic diseases.

For example, Illumina introduced a new AI-powered multi-omics biomarker discovery platform in April 2024 aimed at making oncology and autoimmune disease therapy more personalized. The platform reduced the time to detect clinically relevant biomarkers by months, accelerating R&D productivity in collaborator pharmaceutical companies.

To get detailed segments analysis, Request a Free Sample Report

North America dominates the world biomarkers market with strong healthcare infrastructure, high R&D spending, and rampant incidence of chronic diseases. The U.S. market alone would be valued at USD 124.49 billion by 2034 with a CAGR of 15.22%. The drivers on their list are genomics, proteomics, and bioinformatics advances, which would facilitate the discovery of new biomarkers. Government programs such as the Cancer Moonshot and Precision Medicine Initiative propel market growth by investing in biomarker R&D. The presence of large-scale biotech companies and favorable regulative frameworks also support biomarker-based therapeutics and diagnostics commercialization.

The United States Biomarkers Market

The United States is at the forefront of biomarker innovation, and the market value is at USD 124.49 billion in 2034. Some of the major recent developments include the approval of Foundation One CDx as a companion diagnostic for Keytruda to further aid in customized treatment approaches. The integration of artificial intelligence within biomarker discovery and innovation within liquid biopsy technologies also aids in its prominence. Cooperation with industry, academic, and government organizations enhances the discovery of new biomarkers, which keeps the U.S. at the forefront of biomarker discovery and utilization.

Canada Biomarkers Market

Canada biomarker market is growing with sufficient healthcare and government support. Canadian Institutes of Health Research (CIHR) initiatives fund biomarker research that leads to innovation. Biotechnology companies and Canadian universities drive the expansion of personalized medicine through collaboration. Sharing and integration of data enable large-scale biomarker studies in Canada, which could be a future global leader in the biomarkers market.

The Asia Pacific region is also witnessing high growth in the biomarkers market due to the growing investments in healthcare, aging populations, and advances in biotechnology. The Japanese market will hold USD 18.1 billion by 2030 at a rate of 14.6% CAGR. South Korea is also expanding heavily, and market value is projected to become USD 193.4 million by 2030. Public-private partnerships and government initiatives are driving innovation and driving the growth of biomarker-based diagnostics and therapeutics in the region.

Japan Biomarkers Market

The Japanese biomarkers market will expand, with market size projections anticipating it to be worth USD 18.1 billion by 2030. New developments involved the launch of the TMC Japan BioBridge with the Texas Medical Center and the National Cancer Center to further develop cancer care and provide Japanese entrepreneurs with the chance to scale into the U.S. market. Besides, Tempus and SoftBank Group's joint venture is also slated to apply artificial intelligence to single patient medical data analysis and recommend treatment in Japan, Tempus' first overseas expansion beyond the United States for its genomic testing and AI clinical recommendations business.

South Korea Biomarkers Market

South Korean biomarker market is in a phase of fast growth, with projected market size of USD 193.4 million by 2030. The country's focus on biotechnology and innovation and government support offer favorable conditions for biomarker R&D. The partnership of South Korean biotech companies with overseas counterparts is adding to the improvement in growth and commercialization of biomarker-based treatments and diagnostics and helping to make South Korea a major player in the Asia Pacific biomarkers market.

Europe maintains a large share of the total biomarkers market, seconded by Germany, France, and the United Kingdom. Germany will have a CAGR of 14.6% to reach USD 18.1 billion by 2030. The UK will also grow steadily backed by improved precision medicine, increasing spending in healthcare, and attention to personalized treatments. There is proper healthcare infrastructure, favorable regulatory rules, and active participation in global research bodies to support and promote the adoption of biomarker-based solutions.

Germany Biomarkers Market

Germany's biomarkers market is developing solidly and the market size is projected at USD 18.1 billion in 2030. New highlights are the establishment of the German Cancer Consortium (DKTK), the collaboration as a national research network for the translation of scientific results to the clinic. The university-industry partnerships accelerate the trajectory of establishment of new biomarkers and personalized therapies to the patient, solidifying Germany's position as Europe's lead in biomarker studies and implementation.

France Biomarkers Market

The French biomarkers market is expanding on the shoulders of increasing research and healthcare investment. Biomarker research is funded by the French National Cancer Institute (INCa) and encouraged by biomarker innovation for cancer therapy and diagnosis. Research institutes, French universities, and biotech firms finance biomarker marketing and development. Personalized medicine and precision oncology also attract prominence for France, and these propel the French biomarkers market to expand.

United Kingdom Biomarkers Market

United Kingdom biomarkers market is growing consistently with the growth in genomics and precision medicine. The UK Biobank, a large biomedical database, has high-density information available for biomarker discovery and research. Biomarker therapy design and deployment and diagnostics are facilitated by collaboration between UK centers and global partners. Government funding and support facilitate biomarker deployment into practice, and the United Kingdom dominates the European biomarkers market.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Rising Prevalence of Chronic Diseases.

Advancements in Genomics and Bioinformatics

High Costs of Biomarker Development

Regulatory Challenges and Lack of Standardization

Request Free Customization of this report to help us to meet your business objectives.

The biomarker market is highly competitive, and the leading players are employing strategic alliances, mergers, and acquisitions in order to strengthen pipelines and achieve geographical presence. Roche and Thermo Fisher are investing heavily in artificial intelligence platform-based biomarker discovery and companion diagnostics to create capabilities for personalized medicine. Firms are also looking to focus on the integration of multi-omics data and real-world evidence to achieve higher biomarker accuracy. This constantly evolving landscape is driving perpetual innovation to enable quick adaptation to evolving regulatory requirements and market conditions.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected using Primary Exploratory Research backed by robust Secondary Desk research.

SkyQuest’s study suggests that the market for biomarkers is led by the rising prevalence of chronic diseases, driving demand for early detection and personalized treatment options. Advances in genomics and bioinformatics technologies also propel biomarker discovery, aiming to enhance diagnostic precision and therapeutic specificity. High development costs and regulatory complexity, though, constrain market expansion by inhibiting mass adoption and reducing product approvals. The North American region dominates the market because of strong healthcare infrastructure, high R&D spending, and favorable government policy. Market-wise, oncology biomarkers are leading the front in the aftermath of the urgent need for early cancer diagnosis and personalized therapies. Together, they set out a rapidly evolving scene with a focus on innovation and precision medicine.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 65.36 Billion |

| Market size value in 2033 | USD 185.66 Billion |

| Growth Rate | 12.3% |

| Base year | 2024 |

| Forecast period | 2026-2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Biomarkers Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Biomarkers Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Biomarkers Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Biomarkers Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients