Report ID: SQMIG35H2341

Report ID: SQMIG35H2341

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG35H2341 |

Region:

Global |

Published Date: May, 2025

Pages:

193

|Tables:

106

|Figures:

76

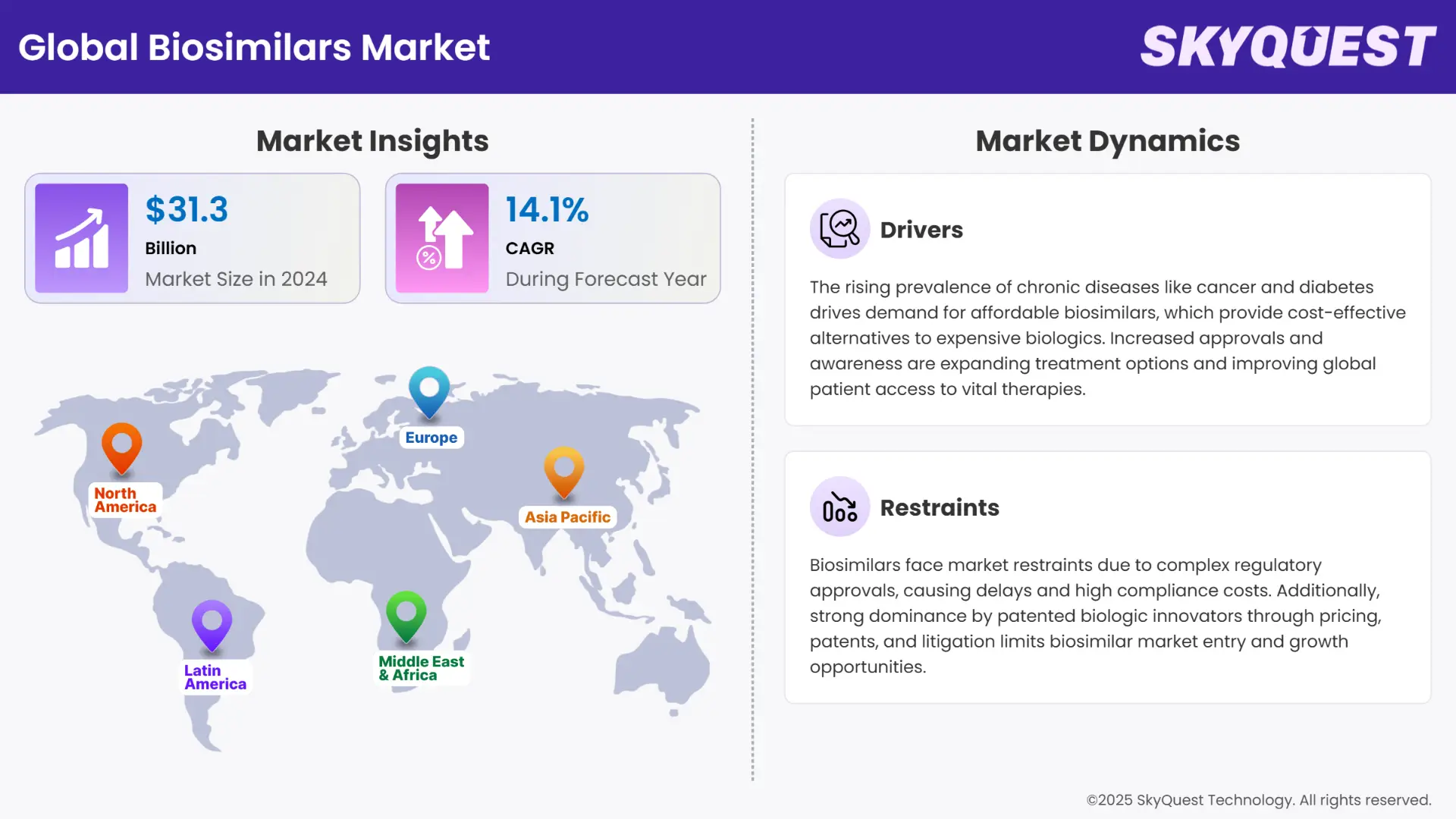

Biosimilars Market size was valued at USD 31.3 Billion in 2024 and is poised to grow from USD 35.71 Billion in 2025 to USD 102.59 Billion by 2033, growing at a CAGR of 14.1% during the forecast period (2026–2033).

The global biosimilars market growth is mainly driven by the patent loss of biologic drugs as more affordable versions of the drug come up. For example, patent expiration of popular biologics such as Humira (adalimumab), Remicade (infliximab), and Herceptin (trastuzumab) has triggered the lift-off of biosimilar approvals and launches globally. This is translated to huge cost savings for patients and healthcare systems, as these are normally priced 15-30% cheaper than their reference biologics. Lower cost promotes increased adoption levels, particularly in markets that could not afford biologics prior to the present.

One of the driving factors for biosimilars industry is support from regulatory agencies and streamlined approval procedures such as Biologics Price Competition and Innovation Act (BPCIA) and 351(k) Biologics License Application (BLA). As a response to increasing demand for affordable biologic substitutes, agencies such as the U.S. FDA, European Medicines Agency (EMA), and the WHO have created regulatory frameworks to make biosimilar approval quicker and more efficient.

For instance, the FDA's Biologics Price Competition and Innovation Act (BPCIA) offers biosimilars an abbreviated licensure pathway, lowering the cost of development and time-to-market. In the same vein, the EMA's customized guidelines enable them to skip some of the preclinical trials if they show equivalence to the reference biologics. This means, instead of conducting all standard preclinical tests from scratch, they only need to provide sufficient evidence that they match the reference biologic in terms of safety, efficacy, and quality.

This simplified regulatory process reduces barriers to entry for manufacturers, promotes competition, and speeds up biosimilar launches, further entrenching the global biosimilars market's growth path.

What Impact Does AI have on Biosimilar Approval Timelines and R&D costs?

AI is revolutionizing biosimilar development by enhancing biologic characterization, process optimization, and predictive analytics. Artificial intelligence-based machine learning models scrutinize intricate biologic structures, enhancing bio similarity evaluations and minimizing comparability study time. This results in accelerated biosimilar approval times and reduced R&D expenses, while promoting market competitiveness.

A January 2022 collaboration between Biogen and Insilico Medicine is a significant example. Global biotech giant Biogen has incorporated machine learning models and Insilico Medicine's AI-powered predictive analytics to speed up biologic characterization and automate the biosimilar development process. R&D costs fall by 50% and the time taken to receive regulatory approvals shortens when AI systems determine complex protein structures, optimize comparison studies and enhance manufacturing procedures. AI-based protein modeling platforms analyze molecular structures to predict the stability and efficacy of biosimilars, enabling more efficient manufacturing processes by reducing trial-and-error experiments and optimizing formulation development.

Moreover, AI enhances pharmacovigilance and regulatory compliance through automation of adverse event detection with the use of real-time analysis from electronic health records and social media. The regulatory authorities, such as the FDA and EMA, are implementing AI to monitor post-markets, and the biosimilars have to meet standards for safety and efficacy, enhancing confidence and adoption.

In January 2024, AION Labs, an Israeli firm that applies AI and machine learning to enhance drug discovery, launched a new firm named TenAces Biosciences. The new company is aimed at the discovery of molecular glues—small molecules that enable protein-protein interactions and enables therapeutic effects and facilitates the treatment for those diseases which were considered untreatable previously. With the application of ML, the company focuses on identifying those molecular glues which can help bind with E3 ubiquitin ligases systematically.

To get more insights on this market click here to Request a Free Sample Report

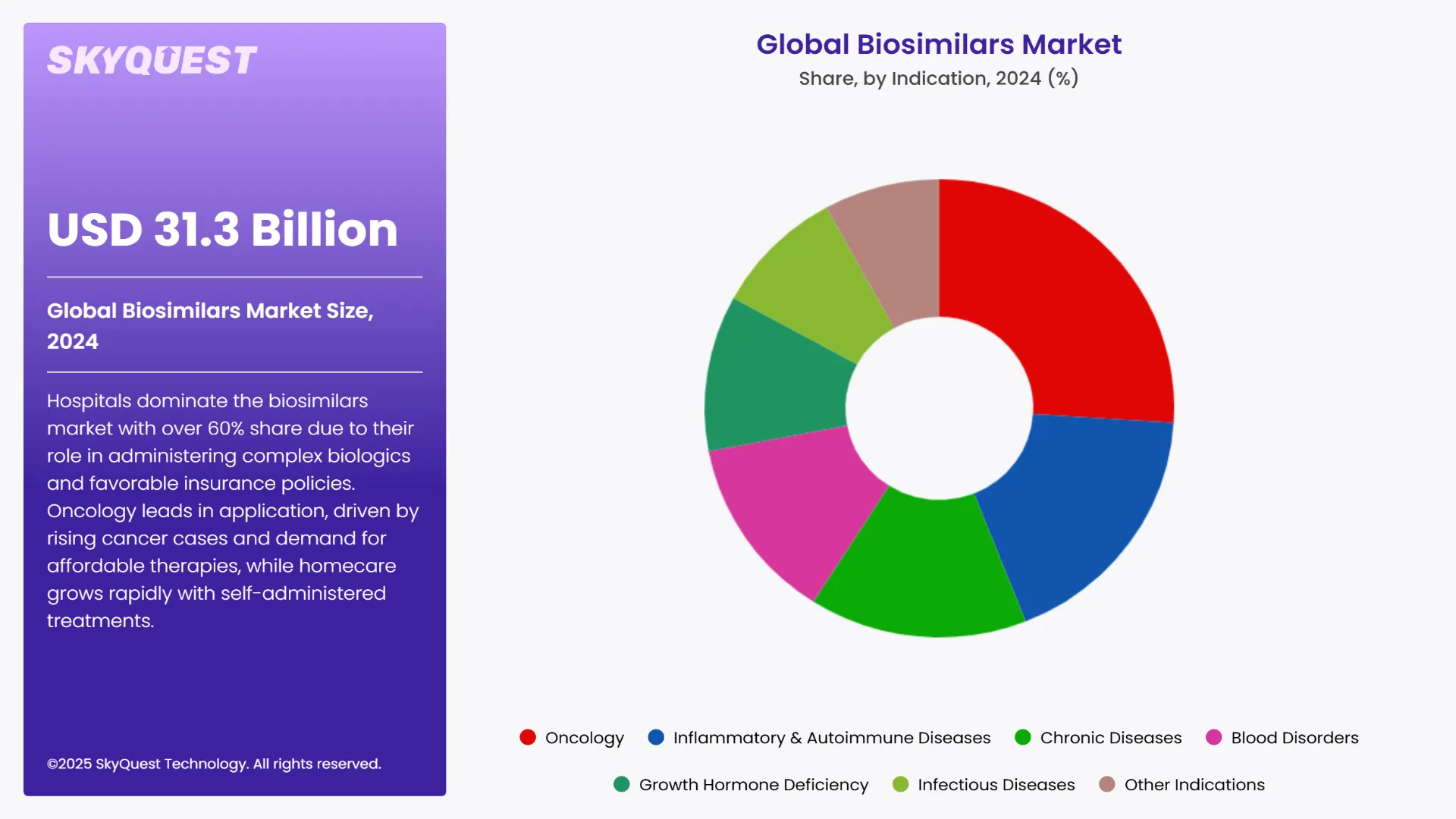

The global biosimilars market is segmented by Drug Class, Indication, Distribution Channel and region. Based on Drug Class, the market is segmented into Monoclonal Antibodies, Granulocyte Colony-Stimulating Factor, Insulin, Erythropoietin, Recombinant Human Growth Hormone, Etanercept, Follitropin, Teriparatide, Interferons, Anticoagulants and Other Drug Classes. Based on Indication, the market is segmented into Oncology, Inflammatory & Autoimmune Diseases, Chronic Diseases, Blood Disorders, Growth Hormone Deficiency, Infectious Diseases and Other Indications. Based on Distribution Channel, the market is segmented into Online Pharmacies, Hospital Pharmacies and Retail Pharmacies. Based on region, the biosimilars market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

According to the global biosimilars market report, hospitals play a crucial role in the prescribing of complex biologic drugs, especially for chronic diseases such as diabetes, autoimmune disease, and cancer. Thus, the segment dominated the market. Cost savings and incorporation of biosimilars into treatment regimens are among the aspects driving hospital adoption.

Hospitals were responsible for more than 60% of the global biosimilar use, since most biosimilar therapies, such as monoclonal antibodies (such as Rituximab and Trastuzumab), must be given intravenously and under close supervision, which is optimally achieved in a hospital. Moreover, hospital control in this market is reinforced by government and commercial insurance policies that prefer biosimilars in hospital formularies because they are cheaper than original biologics.

Whereas, with patient requests for simplicity, remote monitoring, and self-administered biologics, the homecare category is expanding rapidly. In-home treatments for chronic diseases such as diabetes and autoimmune diseases are being selected by patients as telemedicine and wearable injectors increase in popularity. Self-injected monoclonal antibody therapy and insulin pens, for instance, are increasing and lowering hospitalization rates.

Oncology is the largest segment of Biosimilars market since biosimilars are available at a lower cost than innovative biologics and there are vast numbers of cancer patients. Prices have been reduced, and cancer treatment has been made affordable and accessible with the introduction of them in the oncology market. Additionally, since cancer exhibits high incidence and prevalence globally, the health care systems across the world are making cutting the burden of cancer through use of cost-effective therapeutic regimens a top priority.

According to the International Agency for Research on Cancer (IARC) estimates, by the year 2040, the cancer burden is anticipated to rise to 27.5 million new cases of cancer and 16.3 million cancer-related deaths worldwide. Growing numbers of cancer cases are poised to drive demand for advanced cancer drugs for treating patients successfully.

However, diabetes is an emerging field of application which is increasingly common in aging, ill diets, and unhealthy living patterns. Continuous glucose monitoring systems (CGMSs) and smart insulin pens are transforming the field of diabetes. For maximizing patient improvement and minimizing risk from diabetes-related complications, the digital insulin pen offered by Eli Lilly, for instance, synchronizes with CGMSs in real-time glucose displays.

To get detailed segments analysis, Request a Free Sample Report

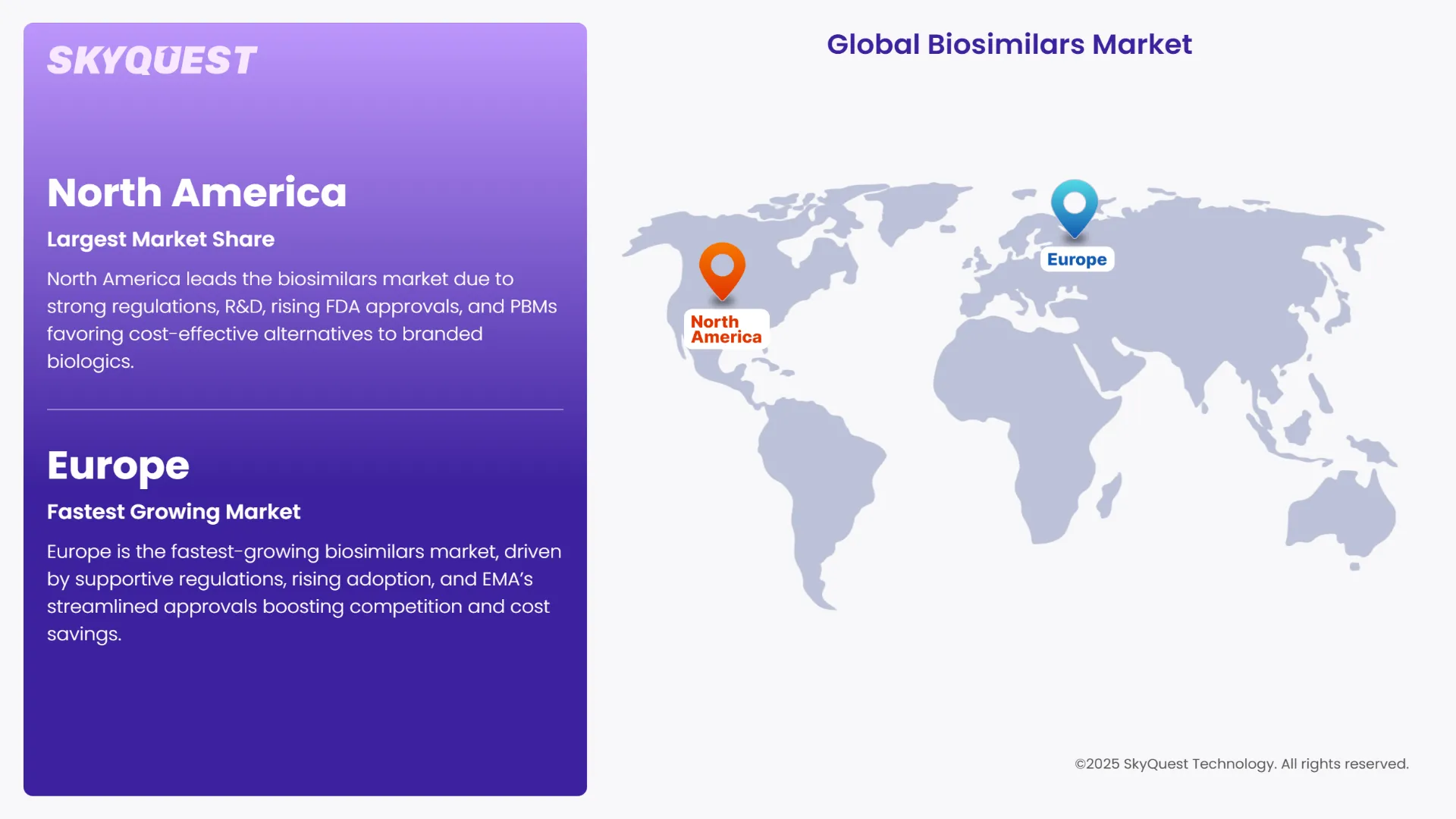

North America continues to lead the global biosimilars market share, driven by a robust regulatory framework, significant R&D investments, and a surge in biosimilar approvals. In 2024, the U.S. Food and Drug Administration (FDA) approved 18 new biosimilars, reflecting the region's dynamic landscape for biosimilar therapies. The market is further bolstered by strategic shifts from major pharmacy benefit managers (PBMs) like UnitedHealth and CVS Health, which are increasingly favoring cost-effective biosimilars over branded biologics. This transition is expected to enhance patient access and drive substantial healthcare savings.

U.S. Biosimilars Market

The U.S. biosimilars market is experiencing unprecedented growth, underpinned by regulatory support and market dynamics. In 2024, the FDA approved 19 biosimilars, including first-time approvals for drugs like Prolia and Xgeva (denosumab), and Eylea (aflibercept). Major PBMs, such as UnitedHealth and CVS Health, have announced plans to replace high-cost biologics like Humira with more affordable biosimilars in their formularies starting in 2025. These strategic moves are anticipated to significantly increase biosimilar adoption, reduce healthcare expenditures, and improve patient access to essential therapies.

Canada Biosimilars Market

Biosimilars market in Canada is advancing steadily, supported by Health Canada's proactive regulatory stance. As of March 2024, Health Canada had approved 59 biosimilars, reflecting the country's commitment to expanding treatment options. Provincial policies promoting biosimilar substitution have further accelerated market penetration. The combination of regulatory support and policy initiatives positions Canada as a significant player in the North American biosimilars landscape.

Europe is emerging as the fastest-growing region in the biosimilars market, propelled by favorable regulatory frameworks, increasing biosimilar adoption, and a strong presence of key market players. The European Medicines Agency's (EMA) streamlined approval processes have facilitated the entry of numerous biosimilars, enhancing competition and driving down healthcare costs. The region's commitment to biosimilar integration is evident in its robust market growth projections.

Germany Biosimilars Market

Germany stands at the forefront of Europe's biosimilars market, characterized by high adoption rates and supportive healthcare policies. In January 2024, Sandoz launched Tyruko® (natalizumab), the first biosimilar approved for treating relapsing-remitting multiple sclerosis (RRMS), marking a significant milestone in the country's biosimilar landscape. Germany's emphasis on cost-effective therapies and its well-established healthcare infrastructure continue to foster biosimilar growth.

France Biosimilars Market

France's biosimilars market is gaining momentum, driven by governmental initiatives and increasing healthcare provider acceptance. The French National Agency for Medicines and Health Products Safety (ANSM) has implemented policies encouraging biosimilar use, resulting in higher prescription rates. Collaborations between domestic pharmaceutical companies and international biosimilar manufacturers are further enhancing market expansion.

UK Biosimilars Market

The United Kingdom (UK) is witnessing a significant uptick in biosimilar adoption, supported by the National Health Service's (NHS) cost-containment strategies. The NHS has actively promoted biosimilar integration to achieve substantial savings, leading to increased utilization across various therapeutic areas. The UK's proactive approach and commitment to biosimilar education among healthcare professionals are key drivers of market growth.

The Asia Pacific region is poised for remarkable growth in the biosimilars market, fueled by rising healthcare expenditures, increasing prevalence of chronic diseases, and supportive government policies. Countries like Japan and South Korea are leading the charge, leveraging their advanced technological capabilities and robust pharmaceutical industries to capitalize on biosimilar opportunities.

Japan Biosimilars Market

Japan's biosimilars market size is expanding steadily, underpinned by the Ministry of Health, Labour and Welfare's (MHLW) initiatives to promote biosimilar use. The country's aging population and escalating healthcare costs have necessitated the adoption of cost-effective alternatives, positioning biosimilars as a viable solution. Collaborations between Japanese pharmaceutical firms and global biosimilar manufacturers are further propelling market growth.

South Korea Biosimilars Market

South Korea has established itself as a global hub for biosimilar development and manufacturing. Companies like Samsung Biologics and Celltrion are at the forefront, with Samsung Biologics operating multiple large-scale manufacturing facilities and engaging in partnerships with international pharmaceutical giants. The government's support through favorable policies and investment in biopharmaceutical infrastructure has been instrumental in the country's biosimilar market expansion.

India Biosimilars Market

The governments and healthcare systems are saving costs while advocating for biosimilar uptake with their reimbursement policies and substitution frameworks. For instance, finance minister of India, Nirmala Sitharaman, on 1 February 2025, widened the list of life-saving medicines exempted from Basic Customs Duty (BCD) to add advanced medicines for cancer, orphan diseases, and immune disorders with an aim to reducing the burden on patients and widening the availability of critical drugs Thus, boosting the biosimilars market growth at an accelerated pace.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Rising Prevalence of Chronic Diseases

Rising Demand for Cost-Effective Biologics

Complex and Stringent Regulatory Approval Processes

Strong Market Dominance of Biologic Innovators

Request Free Customization of this report to help us to meet your business objectives.

Biosimilars market is highly competitive globally, with major pharmaceutical and biotech companies actively expanding their portfolios. The leading biosimilar companies invest in R&D, strategic alliances, and regulatory clearance to capture market share. Some of the notable contributors include Pfizer, Novartis (Sandoz), Amgen, Biocon Biologics, Samsung Bioepis, and Celltrion. These players use cutting-edge manufacturing, biosimilar interchangeability strategies, and competitive pricing to battle in the market. Some of the upcoming players such as Alvotech, Coherus BioSciences, and Polpharma Biologics are also emerging, making a difference through innovation and affordability. As biosimilar adoption increases, competition intensifies, fostering market growth and affordability of biologic treatments globally.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected using Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, the global biosimilars market research is highlighting its revolutionary transformation, fueled by patent expiration, regulatory encouragement, AI innovation, and the emergence of innovative startups. As biosimilars become increasingly accepted around the world, they offer affordable substitutes for costly biologics, driving greater accessibility for patients and minimizing healthcare costs. AI-driven drug development and biomanufacturing improvements are streamlining approvals, reducing R&D expense, and improving biosimilar quality.

In addition, startups are also leading the way in market growth, bringing new technologies and promoting competitive product development. In the future, next-generation biologics and personalized medicine will drive biosimilar development, creating long-term sustainability. With continuous innovation and wider uptake, biosimilars will transform healthcare worldwide by providing affordability, innovation, and better patient outcomes.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 31.3 Billion |

| Market size value in 2033 | USD 102.59 Billion |

| Growth Rate | 14.1% |

| Base year | 2024 |

| Forecast period | 2026-2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Biosimilars Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Biosimilars Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Biosimilars Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Biosimilars Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients