Report ID: SQMIG35H2249

Report ID: SQMIG35H2249

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG35H2249 |

Region:

Global |

Published Date: July, 2025

Pages:

198

|Tables:

128

|Figures:

77

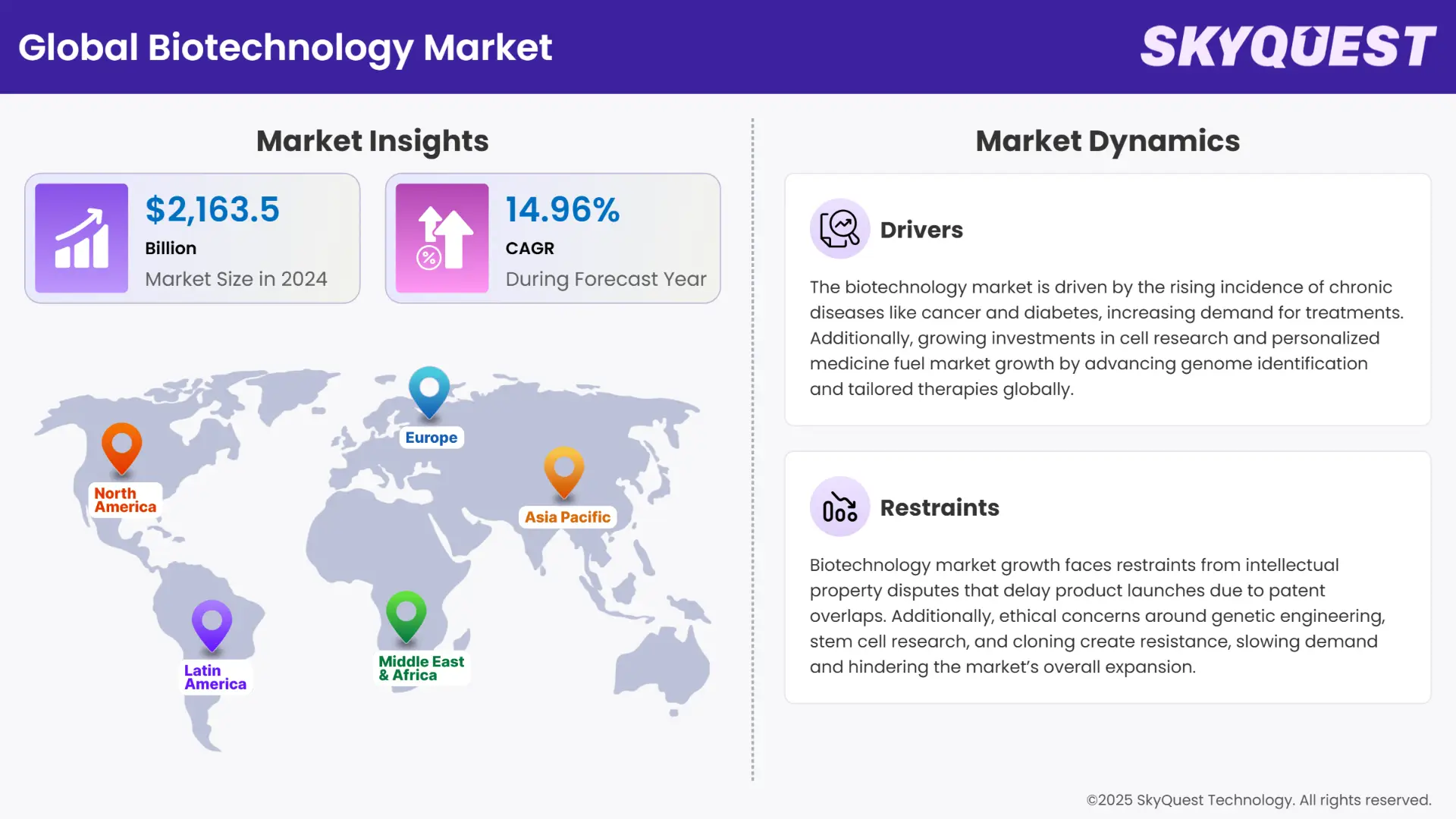

Global Biotechnology Market size was valued at USD 2171.48 billion in 2024 and is poised to grow from USD 2496.33 billion in 2025 to USD 7615.12 billion by 2033, growing at a CAGR of 14.96% during the forecast period (2026-2033).

The global biotech market is growing rapidly, driven by an increase in R&D investment, more demand for personalized medicine, and innovation in fields like genetic engineering and synthetic biology. A major driver of market growth is the growing use of biotechnology in healthcare, especially in biopharmaceuticals and the development of vaccines. The successful large-scale implementation of mRNA vaccines that happened during the COVID-19 pandemic revealed the potential of biotech innovation. Public and private funding for genomics and cell & gene therapy is increasing. For example, we see this in the U.S. with the government ARPA-H initiative and the Horizon Europe program in the EU, which has aimed to encourage biotech R&D.

Another driver is the convergence of biotechnology with artificial intelligence and big data, to enhance drug discovery and crop biotechnology. With the growth in demand for sustainable agricultural and food production, we have seen the introduction and growing use of genetically modified (GM) crops to achieve more sustainable agriculture; and biofertilizers are also becoming an industry. According to the USDA, biotech crops accounted for more than 90 percent of the corn, cotton, and soybeans planted in the U.S. in 2023. Biotechnology is also starting to grow rapidly in importance in some environmental solutions, such as bio-remediation and waste treatment, which is expanding its prospect of market use. The growth of industrial biotechnology is also occurring including biofuels and bioplastics, is also gaining traction due to the global push toward decarbonization and circular economy goals.

In regards to the downside, the market faces challenges such as expensive development costs, regulatory challenge, and ethics. The time-consuming and uncertain process of regulatory approval for biotech products--especially in the EU where GM organisms are heavily legislated--and challenges associated with IP and patent expirations, act as barriers to innovation. In addition to these factors, the public debate around the use of gene editing technologies like CRISPR and synthetic biology contributes to resistance of use in food and agriculture. These factors combine to create barriers to expedited scalable applications of biotech in sectors.

How AI is Transforming Biotechnology Market?

AI is quickly changing the biotechnology market by transforming foundational processes such as drug discovery, protein engineering, and genomics. Examples are machine learning models to predict molecular interactions, generative AI for the design of novel drug candidates, and predictive tools that optimize clinical trial designs and biomarker discovery. This type of AI technology can speed up R&D, reduce costs, and drastically improve success rates—just look at the recent news where AI designed therapeutics move from bench to bedside in about one-third of the time that a conventional therapeutic design process might take.

One opportunity released within the past year which further supports this notion was SandboxAQ’s launch of an enormous synthetic 3D molecular dataset. This dataset is composed of 5.2 million computer generated molecular structures, in order to train and improve existing AI drug–protein binding prediction models. This dataset is available in the public domain and can significantly improve the accuracy and efficiency of virtual screening and to help eliminate lab-heavy experimentation at the early stages of drug discovery.

To get more insights on this market click here to Request a Free Sample Report

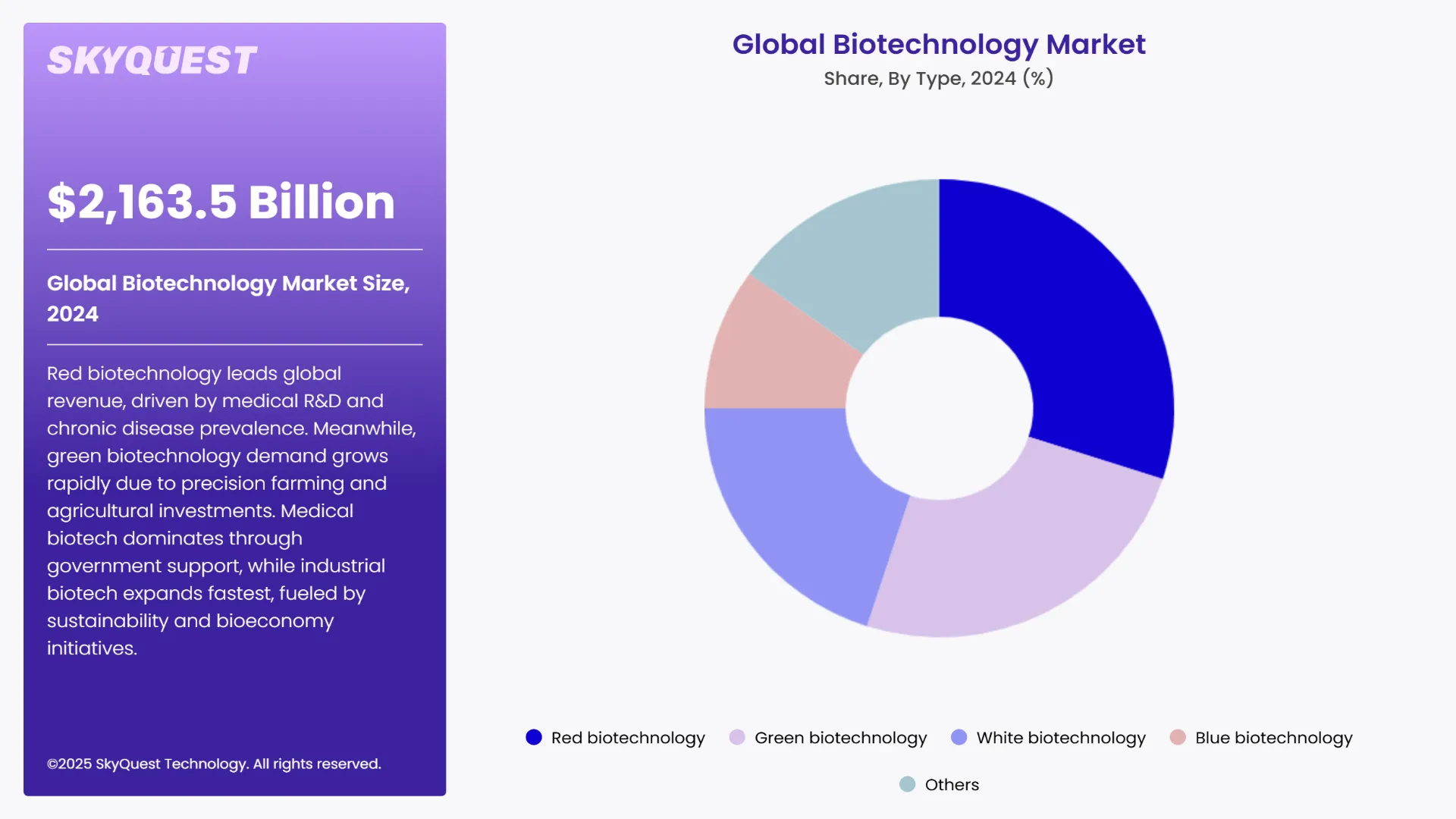

Global Biotechnology Market is segmented by Type, Technology, Application, End User and region. Based on Type, the market is segmented into Red biotechnology, Green biotechnology, White biotechnology, Blue biotechnology and Others. Based on Technology, the market is segmented into Nano Biotechnology, PCR Technology, DNA Sequencing, Chromatography, Tissue Engineering & Regeneration, Cell-Based Assays, Fermentation and Others. Based on Application, the market is segmented into Medical Biotechnology, Agricultural Biotechnology, Industrial Biotechnology, Environmental, Biotechnology, Marine Biotechnology, Bioinformatics and Others. Based on End User, the market is segmented into Pharmaceutical & Biotechnology Companies, Contract Research Organizations, Academic & Research Institutes and Others. Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

Why Is Red Biotechnology Dominating Revenue While Green Biotechnology Emerges as the Fastest Growing Segment?

Red biotechnology holds sway in terms of revenue generation for the global biotechnology market. Red biotechnology refers to any kind of research and development of biotechnology that is aimed at the healthcare and life sciences industry. High investments in medical R&D and rising prevalence of chronic diseases are majorly contributing to the dominance of this segment.

Meanwhile, the demand for green biotechnology is projected to surge at an impressive pace going forward. The adoption of precision and smart farming practices is estimated to bolster the demand for green biotechnology. Growing investments in improving agricultural yield and improve livestock health will also favor biotechnology demand outlook.

Why Does Medical Biotechnology Dominate While Industrial Biotechnology Grows the Fastest?

Medical biotechnology is the engine of the biotechnology market due to growing government investment in biopharmaceutical R&D, gene therapies and vaccine innovation. The U.S. National Institutes of Health (NIH) invested over $49 billion in 2024 in biomedical research. The EU from its Horizon Europe Programme is investing €8.3 billion in health innovation. This highlights that medical biotechnology contends continues to lead in biotechnology clearly as the sustained support of the public sector has driven the success of medical biotechnology.

Industrial biotechnology is the fastest growing area of biotechnology as a result of government support and awareness from growing bioeconomy strategies but also in the marketplace given that industrial customers now increasingly demand sustainable, bio-based products. The European Commission also noted industrial biotechnology contributes to GDP with €31 billion of GDP and has supported over 200,000 direct jobs, which is also growing rapidly in Europe with committed funding from targeted EU funding programmes.

To get detailed segments analysis, Request a Free Sample Report

How is North America being Dominating in Biotechnology Industry?

North America is expected to remain a clear global leader in the biotechnology sector, comprising around 41–42% of the biotechnology market share in 2023. The state of U.S. biotechnology is significant with government support at massive levels, with the National Institutes of Health (NIH) allocating $45.3 billion in 2023 for biomedical research, and the FDA's expedited pathways that provided breakthrough therapy designations for 31 biological products with expedited access to market or innovation in that year.

U.S. Biotechnology Market

The U.S. is in first place in North American biotech, with companies like Regeneron and government sector support from agencies like the Biomedical Advanced Research and Development Authority (BARDA) and the NIH. For example, Regeneron was awarded a $450 million federal contract under Operation Warp Speed to support scaling manufacturing of its COVID-19 monoclonal antibody cocktail.

Canada Biotechnology Market

Canada is consolidating significant government investment towards biotechnology and is making rapid advancements. For example, AbCellera recently received $225 million federal support to build a antibody research and development campus in Vancouver. In Edmonton, Entos has also received federal funding and $62 million from the Strategic Innovation Fund to build a 103,000 ft² biomanufacturing facility to manufacture genetic medicine in March 2025 following an approved contract.

Why Asia Pacific Fastest Growing Biotechnology Market in 2024?

As the highest growth in APAC at a projected CAGR of ~14–14.7% in each of the next foreseeable years starting in 2024, biotech is a significant national priority with governments in China, India, Japan, and South Korea – China’s “Made in China 2025” and FiveYear Plan - pledged $150 billion for biopharma; India’s DBT more than US $3.5 Billion as its biotechnology strategy; Japan earmarked ¥126 Billion (~US$850 M) in 2023 for regenerative medicine and precision health.

China Biotechnology Market

China is the place to be in APAC biotechnology, with leadership across biomanufacturing, and biologics. WuXi AppTec and WuXi Biologics expanded their facilities in 2021 in Shanghai and Chengdu capable of multitens of thousands of liter GMP production capacity, backed by the guided focus of the 14th FiveYear Plan - taking advantage of government licensing reforms, cluster incentives, low R&D costs, and low startup costs.

India Biotechnology Market

India’s biotechnology breakthrough is growing under the Department of Biotechnology and the Bio Pharma Mission policies. Bharat Biotech under its Genome Valley headquarters in Hyderbad delivered over nine billion vaccines by May 2025, and completed Phase III testing of its oral cholera vaccine showing helpful scale-up, largely backed by the government.

South Korea Biotechnology Market

South Korea’s biotech strength lies in biosimilars and CGT. Companies like Samsung Bioepis lead globally in biosimilar monoclonal antibodies, while SK Bioscience develops scalable genetherapy manufacturing. Government supports include tax incentives and publicprivate partnerships, boosting export and clinical innovation capabilities.

Why Europe is second-largest share in Biotechnology Market?

Europe holds ~27–29% share and has the €95.5 billion R&D spend with Horizon Europe and the EMA recent approval of 17 advanced therapies in 2020–2023.

Germany Biotechnology Market

Germany is leading in biotech with the federal strategy on gene and cell therapies with the Federal Education Ministry, which has a timely action plan to develop clinical and regulatory frameworks by the end of 2024. Wacker Biotech also opened a mRNA competence centre in Halle, funded by €100 million to enhance national pandemic preparedness and allow more flexibility for manufacturing.

Italy Biotechnology Market

Italy is gaining traction in biotech manufacturing with a government facilitated investment from Novo Nordisk of €2.34 billion to expand diabetes and obesity drug production in Anagni. This project is considered a Strategic National Project, will deliver ~800 jobs and approvals will be simplified with a special commissioner role.

UK Biotechnology Market

The UK is leading with BioNTech's £1 billion investment into the R&D centres and AI hub in the UK, along with £129 million worth of government grants to turbocharge mRNA-based cancer treatments and genomics innovations. The NHS has also undertaken a large-scale trial with Scancell's DNA vaccine for melanoma, as part of a wider UK strategy to reduce trial timelines and centralise health records access (£600 million investment).

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Biotechnology Market Drivers

High Incidence of Chronic Diseases:

Rising Investments Cell Research:

Biotechnology Market Restraints

Intellectual Property Claim Disputes:

Ethical Concerns and Challenges:

Request Free Customization of this report to help us to meet your business objectives.

All over the world, governments are integrating biotechnology where it fits into their national economic and security priorities. The Upsilon government is developing legislation in the form of the National Biotechnology Initiative Act which proposes the establishment of a National Biotechnology Coordination Office to consolidate national policy and legislative enhancement with just under ~$15 billion potential regulatory enhancements, legislative improvements and streamlining to promote economic stimulation and innovation. In contrast the OECD and EU have identified biomanufacturing as a strategic area of national investment including ~ $12 billion in EU investment from 2021-2027 equally and have recommended regulatory innovation advances as a sub-sector of biomanufacturing in order to enhance scale across the food, health, and industrial biotechnology sectors. South Korea's new Presidential Bio Committee established January 2025, is facilitating cross ministry collaboration and coordination of policy, as well as enhancing contract development and manufacturing organization (CDMO) capacity, by 2032, and planning to train 110 000 bio-specialist workforce talent.

Top Player’s Company Profiles

Recent Developments in Biotechnology Market

Is public funding boosting biomanufacturing infrastructure?

Governments across the U.S., EU, China, and South Korea are expanding national investment in biomanufacturing facilities—viewed as strategic infrastructure. The U.S. now has a multi‑billion dollar biomanufacturing strategy; the EU is streamlining regulation via a proposed “Biotech Act”; South Korea’s Presidential Bio Committee set targets to scale cluster and CDMO capacity nationwide.

Is synthetic biology fueling sustainable bioeconomies?

Governments and global bodies are supporting synthetic biology (synbio) as a green innovation pathway. In 2025, state grants in the U.S., EU, and China targeted synbio capacity and enzyme-driven bio‑industrial scaling. Synbio is projected to grow, enabling sustainable bioplastics and biofuels.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected using Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, high prevalence of chronic diseases, growing investments in medical R&D, and high demand for personalized medicine are slated to boost biotechnology market growth. However, ethical concerns, complexity in biomanufacturing, and regulatory compliance are estimated to be the top restraints for biotechnology companies. High investments in medical R&D and quick adoption of novel technologies are key prospects that help North America maintain a dominance stance. Demand for red biotechnology is slated to bring in the most revenue across the study period. Developing synthetic biology products via biotechnology will pay off big time for biotechnology companies in the long run.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 2171.48 billion |

| Market size value in 2033 | USD 7615.12 billion |

| Growth Rate | 14.96% |

| Base year | 2024 |

| Forecast period | 2026-2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Biotechnology Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Biotechnology Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Biotechnology Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Biotechnology Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Global Biotechnology Market size was valued at USD 2171.48 Billion in 2024 and is poised to grow from USD 2,163.5 billion in 2024 to USD 6,644.2 billion by 2032, growing at a CAGR of USD 2496.33 Billion in 2025 during the forecast period USD 7615.12 Billion by 2033.

All over the world, governments are integrating biotechnology where it fits into their national economic and security priorities. The Upsilon government is developing legislation in the form of the National Biotechnology Initiative Act which proposes the establishment of a National Biotechnology Coordination Office to consolidate national policy and legislative enhancement with just under ~$15 billion potential regulatory enhancements, legislative improvements and streamlining to promote economic stimulation and innovation. In contrast the OECD and EU have identified biomanufacturing as a strategic area of national investment including ~ $12 billion in EU investment from 2021-2027 equally and have recommended regulatory innovation advances as a sub-sector of biomanufacturing in order to enhance scale across the food, health, and industrial biotechnology sectors. South Korea's new Presidential Bio Committee established January 2025, is facilitating cross ministry collaboration and coordination of policy, as well as enhancing contract development and manufacturing organization (CDMO) capacity, by 2032, and planning to train 110 000 bio-specialist workforce talent. 'Novo Noridisk', 'Amgen', 'Johnson & Johnson', 'Gilead Sciences', 'Bristol Myers Squibb', 'Vertex Pharm', 'Roche', 'Regeneron', 'Moderna Inc.', 'Biogen Inc', 'Thermo Fisher Scientific Inc.', 'Pfizer Inc.', 'Corteva Agriscience', 'Sanofi', 'Bayer AG', 'Merck KGAA', 'Bluebird Bio Inc.', 'Abbvie Inc', 'Syngenta Group', 'CSL Limited'

Incidence of chronic diseases such as cancer and diabetes has increased on a global level. Subsequently the demand for treatment of these diseases is also increasing at a rapid pace and fueling the global biotechnology market growth all over the world.

Public funding boosting biomanufacturing infrastructure.

Synthetic biology fueling sustainable bioeconomies.

How is North America being Dominating in Biotechnology Industry?

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients