Report ID: SQMIG35H2061

Report ID: SQMIG35H2061

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG35H2061 |

Region:

Global |

Published Date: May, 2025

Pages:

177

|Tables:

132

|Figures:

77

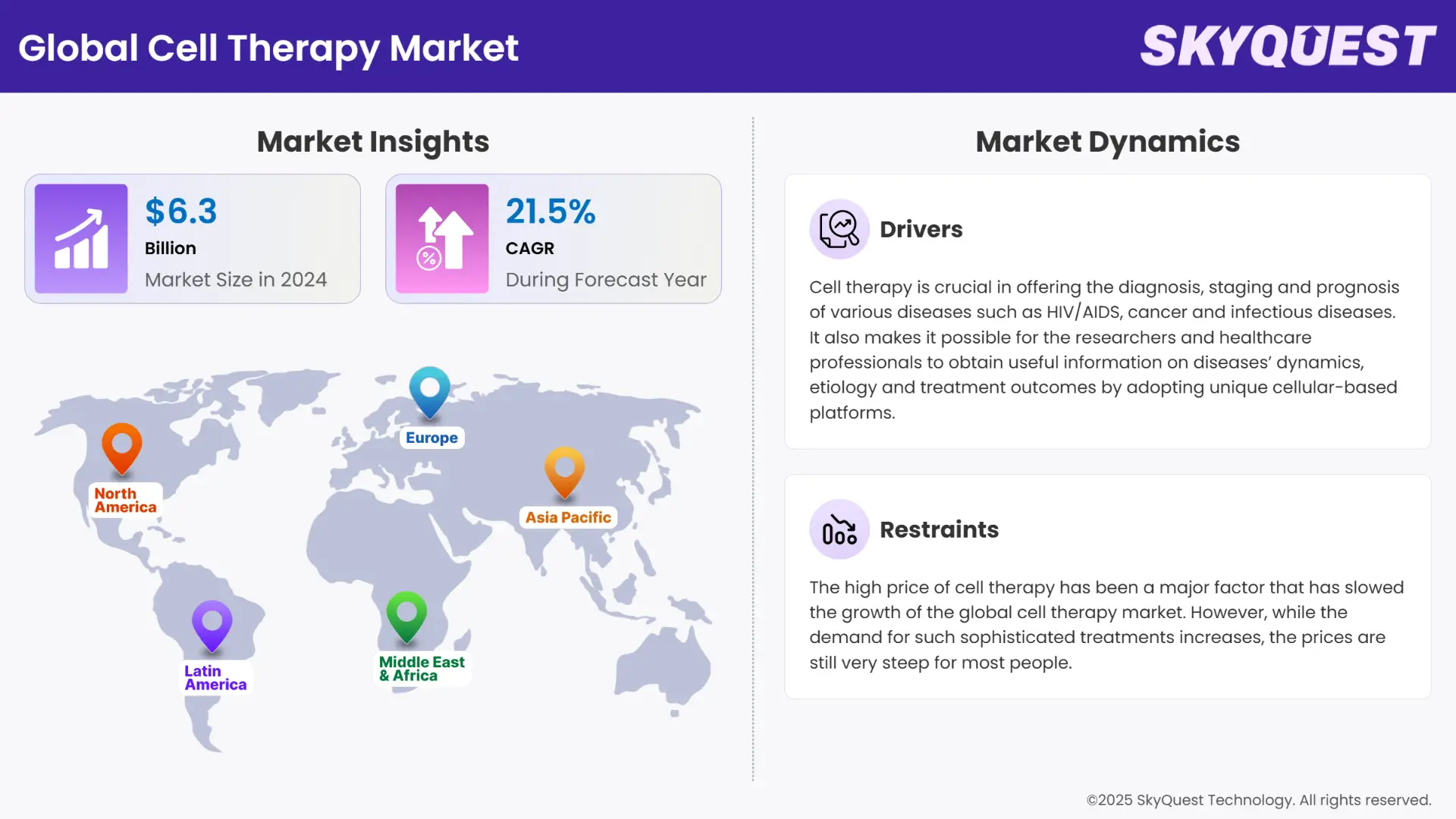

Cell Therapy Market size was valued at USD 6.3 Billion in 2024 and is poised to grow from USD 7.65 Billion in 2025 to USD 36.35 Billion by 2033, growing at a CAGR of 21.5% during the forecast period (2026–2033).

The cell therapy market is anticipated to expand rapidly due to the rising incidence of chronic diseases, the shifting preference toward regenerative medicine, and the surging number of clinical trials related to cell-based therapies. More people are now suffering from chronic diseases and conditions worldwide. The International Diabetes Federation’s Diabetes Atlas shows that 573 million adults globally were living with diabetes in 2021. This number is expected to rise to 643 million in 2030 and 783 million in 2045.

The increase in funding for cell therapy clinical trials, the adoption of good practices for cell therapy manufacturing, and the success of cell therapy products have become key trends that are expanding firms in this cell therapy market. The advancement in cell banking facilities along with the subsequent advancement in cell manufacturing, storage, and characterization has strengthened the market’s capability to handle large volumes across the world. Moreover, several organizations provide cell therapy characterization research and analysis services, and hence, contribute to enhancing the manufacturing of cell-based therapeutics. This has led to an enhancement of market revenues recently.

The growth of clinical trials can be attributed to the number of funding agencies that have continuously given their approval and funding to projects at different stages of clinical trial phases. In Europe, most of the late phase projects are financed through European Union grants. For Instance, in July 2022, Achilles Therapeutics announced it had been awarded USD 4 million in grant funding for further development of ImmTAC technology. €2 million through Horizon Europe, which is the European Union’s primary research and innovation funding program to support the development of personalized therapy production.

The concept of modified medicine has greatly increased the number of clinical trials. Autologous cell therapies, especially with genetically modified cells, have the advantage of individual treatment with targeted genetic characteristics of patients. It improves the efficacy of treatment plans and reduces side effects, which is a dramatic change in the healthcare model. Cell therapy is a field with high levels of innovation. Cell-based therapy today is rendered highly effective and safe due to recent research and technological advancements. These developments address a number of key areas, including new cell sources, enhanced manufacturing processes, and effective delivery systems.

Some of the significant factors that have led to the rise of businesses include more funding for clinical research, implementation of manufacturing best practices, and high sales of new products. Also, threats include a low cost of stem cell treatments that has made consumers interested in them. The advancements made in cell banking facilities have helped to add more capacity to the market to produce, store and characterize cells so that large volumes of cells can be handled effectively. The above infrastructure has in one way or the other boosted the market to better revenue inflows in the recent past.

The increase in the number of clinical studies can be because of the backing from both public and private funding agencies that continue to offer approval and funding across phases of clinical trials. most of the advanced projects in Europe get grants from the EU, for instance; the USD 4. This project is implemented within the framework of the “Horizon Europe” program, and under its auspices, Achilles Therapeutics received a grant of 2 million dollars. This funding is crucial in the progress of personalized therapy delivery. Moreover, the expanded usage of stem cell treatments in autoimmune and metabolic diseases demonstrates the role of stem cells in therapeutic applications.

To get more insights on this market click here to Request a Free Sample Report

The Global Cell Therapy Market is segmented by Technology, Cell Type, Therapy Type, Therapeutic Area, End user and region. Based on Technology, the market is segmented into Somatic Cell Technology, Cell Immortalization Technology, Viral Vector Technology, Genome Editing Technology, Cell Plasticity Technology and Three-Dimensional Technology. Based on Type, the market is segmented into Autologous and Allogeneic. Based on Cell Type, the market is segmented into Stem Cell (Bone Marrow, Blood, Umbilical Cord-Derived, Adipose-Derived Stem Cell, and Others (placenta, and nonspecific cells)), and Non-stem Cell.

Based on Therapy Type, the market is segmented into Allogeneic Therapies (Stem Cell Therapies (Hematopoietic Stem Cell Therapies, Mesenchymal Stem Cell Therapies) Non-Stem Cell Therapies (Keratinocytes & Fibroblast-based Therapies, Others), and Autologous Therapies (Stem Cell Therapies (BM, Blood, & Umbilical Cord-derived Stem Cells, Adipose Derived Cells, Others) Non-Stem Cell Therapies (T-Cell Therapies, CAR T Cell Therapy, T Cell Receptor (TCR)-based, Others) and Others). Based on the Therapeutic Area, the market is segmented into Oncology, Cardiovascular Disease (CVD), Musculoskeletal Disorders, Dermatology, and Others. Based on End User, the market is segmented into Hospitals & Clinics, Academic & Research Institutes, and Others. Based on region, the market is segmented into North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

The autologous therapy segment held the largest share in the market in 2023 with 91%. This growth is due to the increasing use of different CAR-T therapies that have demonstrated positive results in managing various types of cancer and genetic diseases. Some of these therapies have been approved by the FDA, and the expansion of their use is in progress. For instance, in February 2022 the U. S. FDA approved ciltacabtagene autoleucel (Carvykti) for the treatment of adult patients suffering from multiple myeloma that is unresponsive to other treatment or has relapsed after treatment.

The allogeneic cell therapy segment is expected to grow rapidly from the year 2024 to 2031. This growth is due to its use in creating new therapeutic regimes for treating diseases. At present, there are 542 allogeneic CAR-T products in the development phase worldwide, and many of them are demonstrating favorable outcomes. For instance, Adapt immune Ltd. partnered with Genentech to develop allogeneic therapies from iPSCs; the company wants to develop T-cells with more division capabilities than mature T-cells.

The oncology segment was also the largest revenue generating segment in the market in 2023. Anti-CD19 CAR T-cells have shown high and durable response rates in patients with acute lymphocytic leukemia (ALL). Furthermore, there has been a rising trend in the number of FDA approvals for novel therapies, which is expected to foster development in the cell therapy market. For instance, in October 2021, the U. S. FDA approved brexucabtagene autoleucel (Tecartus) as a CAR T cell therapy for B-cell precursor ALL for patients who did not respond to the initial treatment or have a relapse. This approval made brexucabtagene the first CAR T therapy for adults with ALL.

The musculoskeletal disorders segment is expected to witness high cell therapy market growth in the next few years. There is significant interest in technologies that seek to repair or replace damaged musculoskeletal tissues. Scientists are focusing on clinically relevant cell sources for therapies targeting musculoskeletal tissue degeneration. They are also investigating the careful and targeted use of engineered or native skeletal progenitor cells to promote tissue healing and activate musculoskeletal tissues. These efforts are expected to drive the growth of this segment. This segment is expected to be driven by these efforts.

To get detailed segments analysis, Request a Free Sample Report

North America emerged as the largest cell therapy market revenue in 2023, with a share of approximately 58%, and the joint research activities between the research institution and the large pharmaceutical firm. Many developments are being witnessed in the region through these partnerships. For instance, in June 2022, Immatics entered into a collaboration with Bristol Myers Squibb to work on the development of Gamma Delta Allogeneic Cell Therapy Programs. Government funding is also essential for cell therapy market growth in the United States. For instance, in January 2022, Cellino Biotech revealed that it had raised about $80 million in a Series A funding round from 8VC, Felicis Ventures, among others. The company plans to use these funds to increase stem cell-derived therapy supply and build the world's first stand-alone human cell foundry by 2025.

The Asia Pacific region is expected to witness a high growth rate during the forecast period owing to the growing demand for cell therapy. Some of these drivers include increased knowledge of new treatments, increased funding, and expected positive changes in government policies. For instance, in June 2022, Tessa Therapeutics Ltd. disclosed that it has closed series funding rounds worth USD 126 million for enhancing the research of the following generation cancer treatments. Likewise, the cell therapy market in South Korea is poised to offer good growth prospects owing to the various strategies adopted by domestic and global players.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Could Cell Therapy Be the Key to Tackling Global Health Challenges and Emerging Diseases?

Is Rising R&D Investment and Chronic Disease Prevalence Fueling the Stem Cell Therapy Market Surge?

Is the High Cost of Cell Therapy Hindering Its Global Market Expansion?

Are Ethical Concerns Over Embryonic Stem Cells Slowing the Progress of Stem Cell Therapy?

Request Free Customization of this report to help us to meet your business objectives.

The cell therapy market is highly competitive with lots of large players competing with each other in developing their technology and securing bigger chunks of the market space. The major players are spearheading the revolution with their strong R&D capacities and strong pipelines to create new therapies. Startups and small biotech companies such as Adapt immune Therapeutics and Bluebird Bio are also making notable progresses, typically targeting specialized areas and strategic alliances in order to augment their pipelines. The market also experiences considerable action in mergers and acquisitions as firms try to merge strength, reach geographically, and maximize product development. It is also impacted by collaborative ventures between drug giants and research centers with an intent to leverage next-generation technologies and expedite the commercialization of new cell therapies.

Advances in cell engineering, cryopreservation, and scalability of manufacturing are increasing the effectiveness and affordability of cell therapies. Automation, artificial intelligence, and single-use bioprocessing technologies optimize production efficiency and reduce the risk of contamination. Next-generation sequencing and CRISPR gene editing are also enabling precision medicine strategies by enabling therapy to be made consonant with the profile of a patient. Not just do these technologies increase therapeutic efficacy, but they also reduce production cost and treatment time, thereby increasing market access. As a result of this, there are increasingly more biotech firms and research institutions entering the market, which causes innovation and raising possibilities of treatment for formerly incurable diseases.

The global rise in chronic diseases like cancer, diabetes, and cardiovascular diseases is highly augmenting demand for cell therapy. As conventional treatment tends to be insufficient or palliative, patients and clinicians are resorting to sophisticated regenerative therapies with curative potential. Cell therapies like CAR-T in oncology and stem cell therapies for cardiac and neurological diseases are finding traction. This is accompanied by rising ageing populations and physical inactivity, which continue to keep chronic disease burdens on an upward trend. Hence, the healthcare systems are spending more on advanced treatments, driving the growth of cell therapy by clinical segments.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyzes the Data collected by means of Primary Exploratory Research backed by robust Secondary Desk research.

According to our analysis, the cell therapy market is expanding considerably assisted by the advances in the area of biotechnology, research and clinical trial financing, and increasing prevalence of autoimmune and chronic diseases. Cell therapy technologies such as CAR-T and stem cell therapies are producing better therapeutic results and rising therapeutic use. The market is also supported by pharmaceutical, biotech, and research firm partnerships and research collaborations which are accelerating the discovery and commercialization of new medications. Though high medication prices are preventing these efforts, efforts to simplify in manufacture and approval processes are expected to make these medications affordable, driving the market further.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 6.3 Billion |

| Market size value in 2033 | USD 36.35 Billion |

| Growth Rate | 21.5% |

| Base year | 2024 |

| Forecast period | 2026-2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Cell Therapy Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Cell Therapy Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Cell Therapy Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Cell Therapy Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Currently, there are autologous and allogeneic cell therapy types along with sub categories such as stem cell therapies (e.g., hematopoietic, mesenchymal) and non-stem cell therapies (e.g., CAR-T, T-cell receptor-based therapies) variable precision targeted regenerative therapies.

Cell therapy is being used throughout medicine including cancer, cardiovascular disease, musculoskeletal conditions, dermatological conditions, and emerging infectious diseases, with better outcomes in when regenerative and personalized treatment is used for chronic and life-threatening illness.

CAR-T therapy is revolutionary in oncology, because it provides highly effective individualized treatments for tumors of hematologic origin predominantly in the time since the high profile use for acute lymphocytic leukemia and commonly for multiple myeloma, as supported by the increasing number of FDA approvals and success in clinical trials.

The emerging gene editing technologies such as CRISPR, are promoting precision in cell therapy through the ability to target genetic modification, which increases the therapeutic effect and reduces side effects, which enriches the potential planning of patient specific therapies in regenerative medicine and cancer.

Regulatory organizations, such as the U.S. FDA and the Horizon Europe program in the European Union, helps approve and fund cell therapy projects that demonstrate safety, efficacy, and assurance that ethical safeguards are being given for the progression of personalized and regenerative medicine.

COVID-19 revealed the power of cell therapy in research to understand and treat emerging disease situations, providing a burst of research and development investment and value appropriating advanced diagnostics and therapeutic platforms for the purpose of responding to infectious threats and improving health outcomes.

Investment opportunities in cell therapy are driven by growth in clinical trial funding, improved manufacturing infrastructure, and strength in strategic partnerships. The increase in investment for next-generation therapies, principally from companies and governments, have established cell therapy as a viable high-growth sector with a competitive and profitable market potential.

Progress in cell therapy research consists of improved cell engineering; more pathways using CAR-T therapies; allogeneic therapies from iPCS; advancements in delivery methods; greater advances to pervasive regenerative treatments that are safer, scalable, and have the potential for delivery.

AI is shaking up cell therapy development by unifying and optimizing various manufacturing features, minimizing contamination concerns, speeding up the drug discovery process, enhancing the speed of therapy development while consistently optimizing the process to produce greater efficiency and support quick scale of cell-based treatment platforms.

The increasing push towards regenerative medicine created three things: demand for cell therapies accelerated by the growing prevalence of chronic disease and aging population and for curative potential that is often absent in available conventional treatments.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients