Report ID: SQMIG20G2067

Report ID: SQMIG20G2067

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG20G2067 |

Region:

Global |

Published Date: May, 2025

Pages:

186

|Tables:

211

|Figures:

80

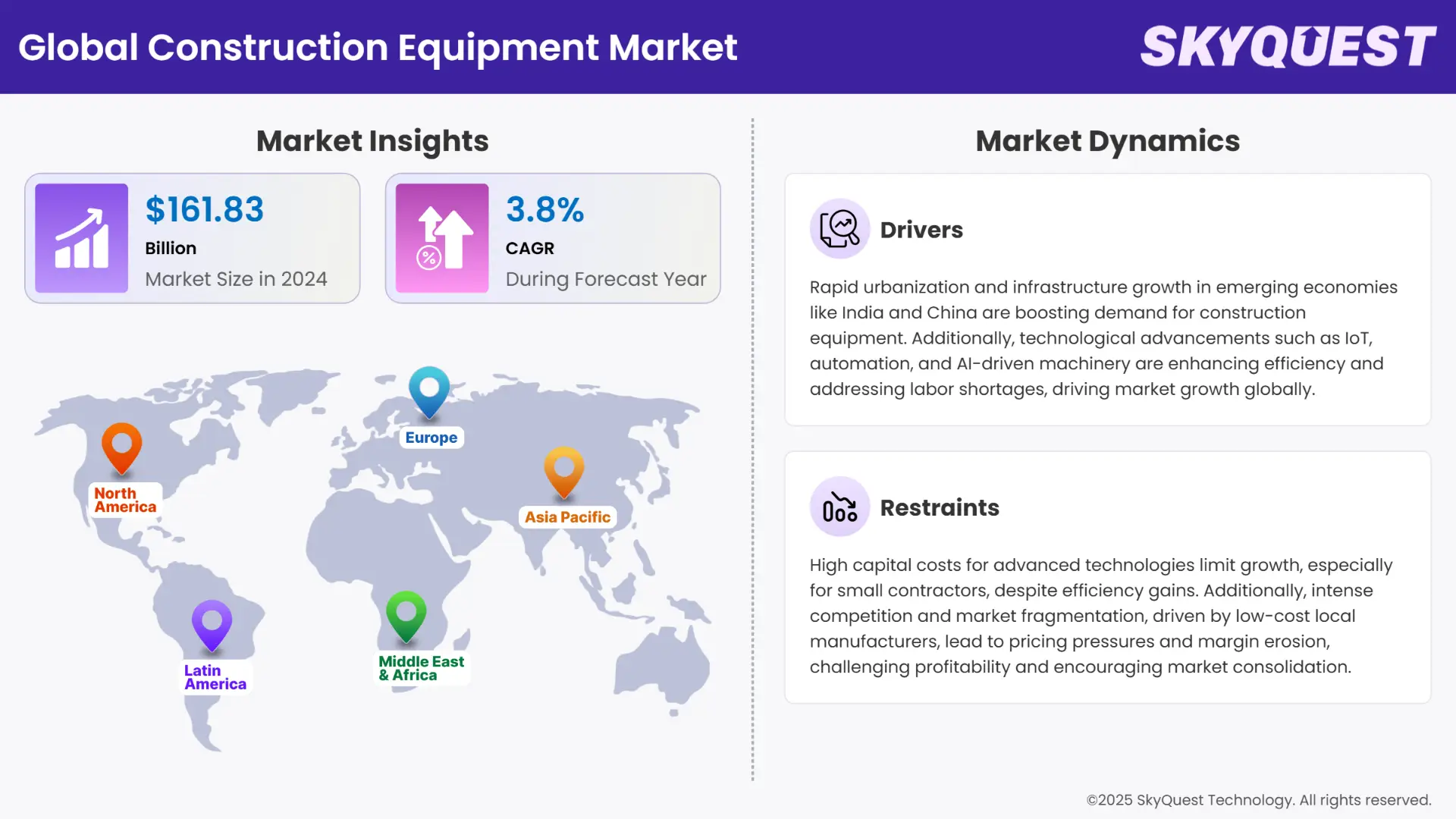

Construction Equipment Market size was valued at USD 161.83 Billion in 2024 and is poised to grow from USD 167.98 Billion in 2025 to USD 226.38 Billion by 2033, growing at a CAGR of 3.8% during the forecast period (2026–2033).

The factors influencing this growth include rapid urbanization in many parts of the developing world and increased focus by governments on improving existing structures. This surge is calling for the construction machinery referred to as excavators, loaders, and dump trucks among others. Therefore, it can be predicted that the global construction equipment market is going to grow much faster due to the increased development activities of infrastructure across the world which in turn would require earthmoving and material handling equipment. Higher expenditure by the government in improving current structures is fostering construction activities in emerging nations.

Recent instances clarify the demand for construction equipment will rise in the coming years. Instances like, In May 2024, Ferrovial, a global infrastructure company, announced, through its construction subsidiary Webber, that it has been granted nine new contracts totaling USD 1.2 billion. This construction contract includes bridge construction, expansion of water treatment plants, and road maintenance in the US and Canada. Such instances are coming from different parts of the world which shows how government awarded projects can enhance the demand for construction equipment demand across the world.

Technological integration with the construction equipment market is anticipated to see significant growth during the forecasted period. OEMs are eyeing this opportunity to enter the market with new products by diversifying their customer base in the construction equipment market. For instance, Caterpillar launched a new Cat® 789D Autonomous Water Truck (AWT) In March 2025 and a fully autonomous Cat® 777 off-highway truck. Such steps toward the autonomous construction and mining economy significantly boost the demand for autonomous construction equipment which creates opportunities for the manufacturers of construction equipment.

How Could Autonomous Construction Equipment Benefit Manufacturers in gaining a Larger Market Share?

There are many aspects that propel the demand for the autonomous construction equipment across the construction projects as they provide manufacturers with several competitive advantages. Some of these advantages are it can increase operational efficiency, reduce the dependency on labor, ensuring the safer work progress. Through the capabilities of AI and IoT, these machines provide higher precision and 24/7 productivity, directly addressing contractors looking for cost-effective, scalable solutions. With several real-world instances, manufacturers who are using autonomous technology can differentiate their portfolios and secure major deals. In addition, early adoption allows access to untapped markets and strategic partnerships with technology providers.

To get more insights on this market click here to Request a Free Sample Report

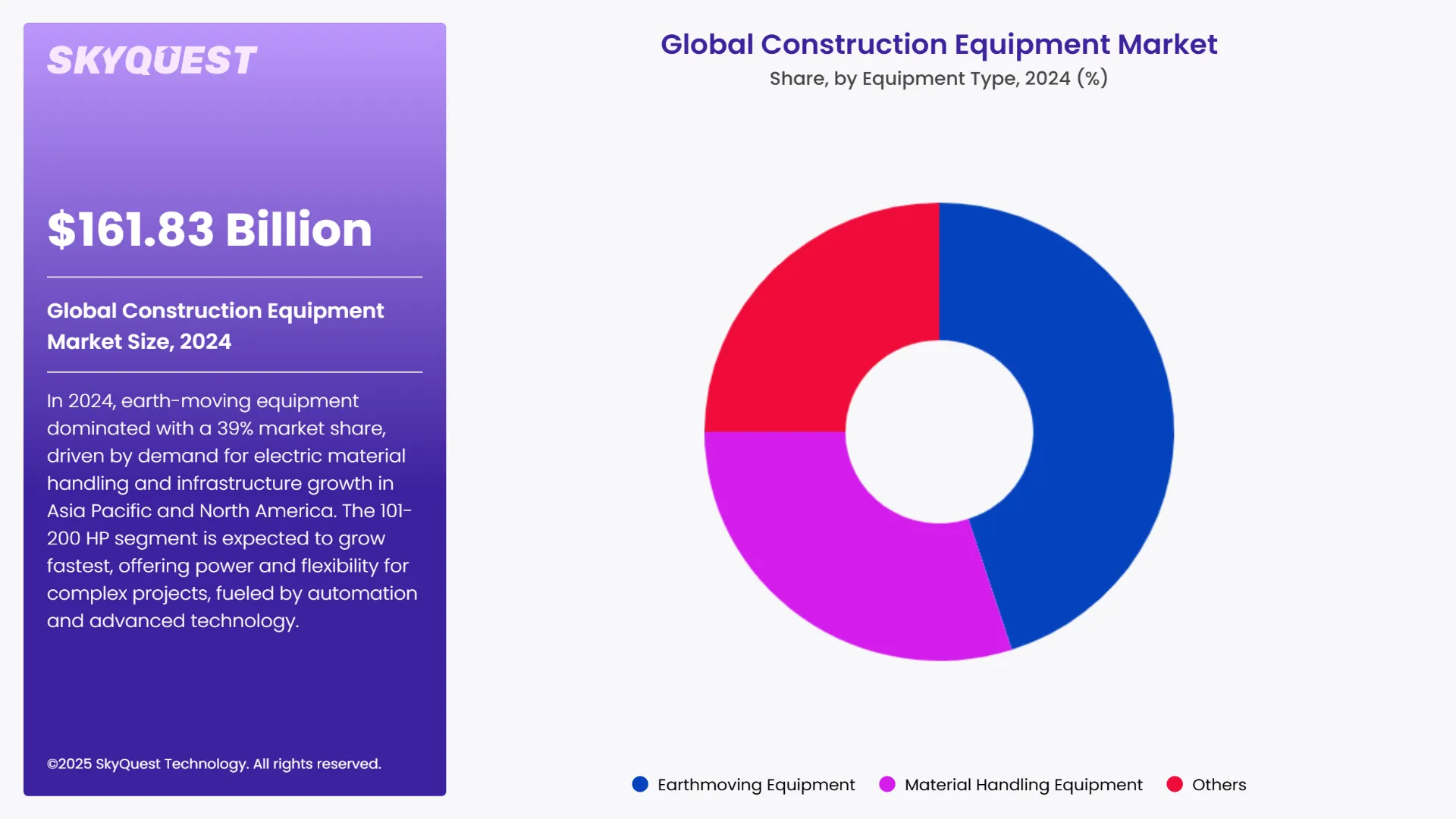

The global construction equipment market is segmented into equipment type, category, power output, propulsion type, drive type, application and region. By equipment type, the market is earthmoving equipment, material handling equipment and others. By category, the market is segmented into autonomous & semi-autonomous and human operated. By power output, the market is segmented into <100 HP, 101-200 HP, 201-400 HP and >400 HP. By propulsion type, the market is segmented into internal combustion engine (ICE), electric and others. By driver type, the market is segmented into hydraulic and electric & hybrid. By Application, the market is segmented into infrastructure, commercial and residential. By region, the construction equipment market is analyzed across North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

SkyQuest study found the dominance of Earthmoving Equipment in 2024, holding a market share of 39% in 2024. The segment is mostly driven by the huge demand for electric material handling equipment, which has driven this segment's growth, with the highest sales among all categories. The rising trend toward electrification in building construction, increasing investment in smart cities, and consistent infrastructure development in the Asia Pacific and North America are the dominant trends fueling this dominance.

Material Handling Equipment is the fastest-growing sub-segment in the market by application. The demand surge is largely driven by autonomous capabilities combined with AI and IoT technologies, which are revolutionizing conventional construction processes. These intelligent machines improve operations by providing real-time monitoring without dependency on labor. Moreover, escalating labor shortages and the impetus for productivity and safety gains are hastening the adoption of automation in this equipment segment.

The <100 HP segment was the largest in the market in 2024. This segment is comprised of mini-excavators, compact wheeled loaders, skid steers, and compact track vehicles which are highly maneuverable machines. The growing popularity of compact construction equipment for infrastructure and construction projects in the Asia Pacific, Latin America, and African region will spur the market in the future period. Increase of infrastructure development, expansion of urban construction, and construction of small and medium-sized buildings have increased the demand for efficient, portable, and multifunctional equipment. Technology factors include: the increasing comfort of the operator, better power train technologies, and increasing automation which also increases the growth of the segment.

The 101-200 HP segment is expected to hold the maximum growth rate during the forecast period. The need for 101-200 HP construction machines over <100 HP arises due to the requirements of higher power, flexibility, and efficiency on big, complex projects. The equipment is capable of undertaking more difficult tasks, like heavy lifting and excavation, and is able to suit different job needs with different attachments. They are fuel-efficient, rugged, and incorporate leading technologies, enhancing productivity and lessening operating costs. In addition, they have improved performance on rough terrain and meet more stringent environmental standards.

To get detailed segments analysis, Request a Free Sample Report

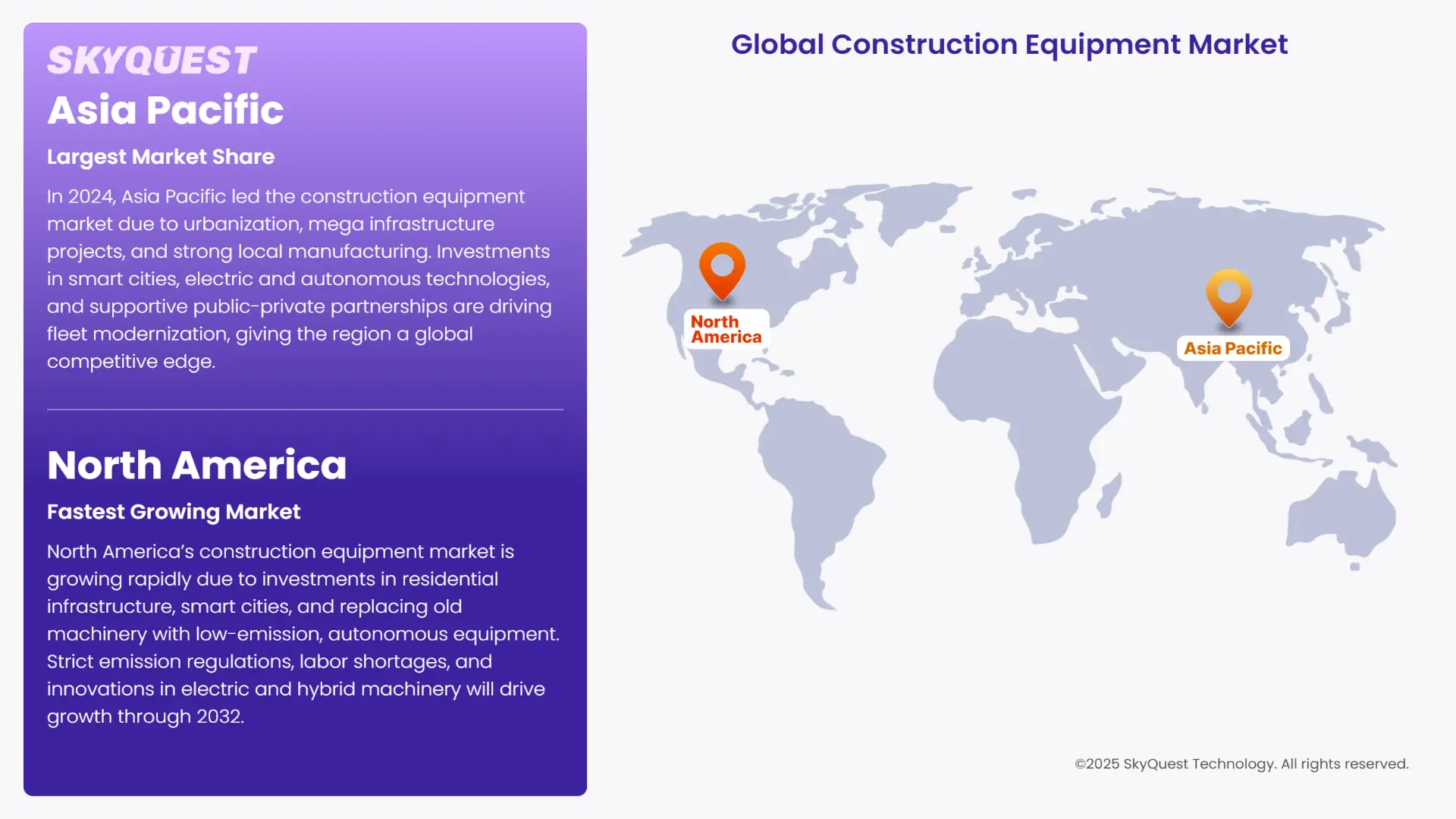

Asia Pacific became the leading construction equipment market in 2024, fueled by increasing urbanization, growing mega infrastructure programs, and robust local manufacturing capacity. Our insights show that regional governments are investing aggressively in smart cities, transportation corridors, and green infrastructure, resulting in sustained demand for sophisticated machinery. Further, the region has the advantage of having global and local producers who are incorporating electric and autonomous technologies. Strategic public-private collaborations and enabling regulatory systems are also driving the modernization of construction fleets, providing Asia Pacific with a competitive advantage in the global construction equipment market.

China Construction Equipment Market

China's market is also seeing significant growth, driven by outbound investment strategy and regional infrastructure plans. In February 2025, Chinese OEM LiuGong unveiled a new assembly facility in Kenya to cater to multibillion-dollar East African projects, showcasing China's position in global infrastructure export and equipment distribution. This action emphasizes China's double advantage—high domestic demand and strategic overseas expansion. The robust state support for manufacturing innovation, particularly in electric and intelligent machinery, is also assisting Chinese players in dominating both domestically and internationally.

India Construction Equipment Market

In India, the market for construction equipment is picking up pace due to rising infrastructure needs and strategic regional collaborations. Volvo CE partnered with Time Equipment Pvt. Ltd in April 2025, to cater to the North India market, an indicator of increased OEM interest in India's changing scenario. With the government speeding up infra development under PM Gati Shakti and Bharatmala, construction equipment demand will witness a growth. Additionally, expanding urban housing developments, road networks, and industrial corridors are spurring domestic production and foreign investment in construction equipment.

Japan Construction Equipment Market

Japan's market is undergoing a shift with the adoption of electrification and precision technology. In May 2024, Volvo CE launched the EC230 Electric, Asia's first 20-ton mid-size electric excavator, in Japan—a nation where this tonnage class leads demand. The transition marks Japan's move toward low-emission construction equipment in line with its carbon neutrality agenda. The focus of the country on automation, compact urban building solutions, and eco-friendly machinery is driving electric and smart equipment demand, setting Japan at the forefront of sustainable construction innovation across Asia.

North America is experiencing a strong growth in the construction equipment market share due to significant investments in residential infrastructure, smart city development, and replacement of old machinery with low-emission and autonomous equipment. Regional trends reflect growing use of electric and hybrid construction equipment, especially due to strict emission controls and growing labor shortages. Innovations of construction equipment, coupled with robust public and private infrastructure investment, are likely to drive tremendous growth in the region through 2032.

US Construction Equipment Market

The United States construction industry is supported by a combined yearly expenditure/gross output of USD 2.2 trillion in 2024, accounting for 4.5% of the national GDP. With around 1.6 million new residential buildings constructed every year, residential construction remains a prime growth driver. The American market is also helped by big-ticket federal infrastructure initiatives and city renewal projects. Additionally, contractors are increasingly adopting digitalized and autonomous equipment to address labor productivity objectives. Consequently, the U.S. construction equipment market is anticipated to grow at a CAGR of 3.8% during the forecast period.

Canada Construction Equipment Market

In Canada, the construction equipment market growth is picking up pace because of continuous capital investments and growing urbanization. Up to February 2025, investment in building construction stood at USD 22.4 billion, a 1.5% monthly growth. Additionally, capital spending on non-residential construction grew by 5.6% against last year, indicating heavy demand in industrial and commercial projects. The Canadian government's emphasis on renewal of infrastructure, residential expansion, and carbon-neutral construction practices is promoting the uptake of contemporary, low-emission equipment. These trends indicate a positive growth pattern for Canadian construction equipment manufacturers.

Europe offers selective but significant opportunities for construction equipment market growth, most specifically in civil infrastructure, green building retrofits, and equipment electrification. The EU's initiative towards carbon neutrality and the Renovation Wave strategy are propelling demand for low-emission, electric, and hybrid construction equipment. Furthermore, cross-border energy and transport infrastructure projects within the Connecting Europe Facility (CEF) and the EU Recovery Fund are driving public sector investment, specifically in renewable installations, road, and rail—building high momentum for the adoption of specialized and compact construction equipment.

UK Construction Equipment Market

The UK construction equipment market is experiencing short-term stagnation, as overall construction output registered minimalist growth during Q1 2025 against the last quarter. The rise in new work by 0.9% was counterbalanced by a 1.2% decline in repair and maintenance, an indication of a sectoral imbalance. Slower infrastructure expenditure and uncertainty have curbed equipment demand.

Germany Construction Equipment Market

Germany's construction equipment market share is experiencing a mixed performance forecast in 2024. While building construction is expected to fall by 3.5%, civil engineering indicates a promising growth of 2.5% due to continued investment in digital and green infrastructure. Nevertheless, 68% of companies identified energy and raw material costs as major risks, which are likely to limit the purchase of equipment. The transition towards electrified and efficient construction equipment is still a promising niche within Germany's green transformation agenda in progress.

France Construction Equipment Market

France continues to present targeted opportunities for construction equipment market demand, particularly for urban regeneration, railway development, and energy-efficient retrofitting initiatives. State-backed initiatives like the France Relance stimulus package are directing investments towards transport infrastructure and environmental modernization. The building industry is also reaping demand for smaller and electric machinery appropriate for high-density urban environments such as Paris and Lyon.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Rapid Urbanization and Infrastructure Development Across Emerging Economies

Technological Advancements and the Rise of Automation in Construction Machinery

High Capital Investment on Tech-advancements

Market Fragmentation and Intense Competitive Pressure

Request Free Customization of this report to help us to meet your business objectives.

The construction equipment market is competitive to new entrants due to the strong presence of the top five companies such as Caterpillar, Komatsu, Volvo CE, Hitachi Construction Machinery, and Liebherr, who account for more than 40% share of the market. These established players have strong brand equity, extensive distribution channels, and regular technological advancements. New entrants are faced with difficulty penetrating the market because of high capital needs, secured customer loyalty, and rigorous regulatory requirements. Some of the key strengths that drive market share are after-sales service capabilities, localized production, robust dealer networks, and innovation in automation and electrification, all of which build brand dependability and customer loyalty.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected using Primary Exploratory Research backed by robust Secondary Desk research.

SkyQuest's study concludes that the global construction equipment market is highly dependent on spending on construction projects worldwide. This growth is also boosted by fast-paced urbanization, infrastructure development, and growing government investments in emerging economies. Demand for earthmoving and material handling equipment keeps growing in reaction to widespread development projects. Advances in technology, especially automation and electrification, are transforming the industry by increasing efficiency and productivity. OEMs are using innovation to address changing project requirements and regulatory requirements. While incumbent players dominate the competitive market, the dynamic development of the market provides room for investors in autonomous solutions and intelligent technologies. Overall, the market is poised for continued momentum and change.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 161.83 Billion |

| Market size value in 2033 | USD 226.38 Billion |

| Growth Rate | 3.8% |

| Base year | 2024 |

| Forecast period | 2026–2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Construction Equipment Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Construction Equipment Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Construction Equipment Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Construction Equipment Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Expanding urban areas are increasing demand for advanced construction machinery to build housing, transportation, and utilities. This trend drives consistent investment in earthmoving and material handling equipment, particularly in rapidly developing countries.

Technological advancements such as AI-powered automation, IoT telematics, and autonomous systems improve operational efficiency, safety, and precision. They also reduce labor dependency, enabling contractors to meet tight deadlines and optimize costs in complex projects.

Stringent emission norms are accelerating the shift toward electric, hybrid, and low-noise machinery. Manufacturers are investing in cleaner propulsion technologies and compliance-driven product upgrades to meet global sustainability targets and market requirements.

Material handling equipment is the fastest-growing segment, driven by autonomous capabilities, AI integration, and real-time monitoring. Demand is fueled by labor shortages, safety priorities, and efficiency gains in commercial, residential, and infrastructure projects.

Economic booms and increased infrastructure spending drive higher construction equipment demand, while downturns slow adoption. Large-scale government investments and stimulus packages significantly shape market momentum and equipment replacement cycles.

Challenges include high capital costs for advanced technologies and intense price competition from local manufacturers. Opportunities lie in infrastructure expansion, adoption of autonomous equipment, and partnerships that open access to untapped, high-growth regions.

Construction Equipment Market size was valued at USD 161.83 Billion in 2024 and is poised to grow from USD 167.98 Billion in 2025 to USD 226.38 Billion by 2033, growing at a CAGR of 3.8% during the forecast period (2026–2033).

Liebherr-International AG (Switzerland), Caterpillar Inc. (United States), AB Volvo (Sweden), HD Hyundai Construction Equipment Co Ltd (South Korea), Hitachi (Japan), Deere & Company (United States), J C Bamford Excavators Ltd. (JCB) (United Kingdom), Komatsu Ltd. (Japan), CNH Industrial NV (United Kingdom), XCMG Construction Machinery Co Ltd (China), KUBOTA Corporation (Japan), SANY Group (China), Terex Corporation (United States), Manitou BF SA (France), Wacker Neuson SE (Germany)

The key driver of the construction equipment market is the increasing global infrastructure development and urbanization, which fuels demand for machinery such as excavators, loaders, and cranes, alongside government investments in residential, commercial, and industrial construction projects.

A key market trend in the construction equipment market is the adoption of smart and automated machinery, including telematics, AI, and electric-powered equipment, which enhances operational efficiency, reduces emissions, and lowers overall maintenance and operational costs.

Asia-Pacific accounted for the largest share in the construction equipment market, driven by rapid urbanization, large-scale infrastructure projects, government investments in transportation and housing, and strong demand from countries like China and India.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients