Report ID: UCMIG40N2008

Report ID:

UCMIG40N2008 |

Region:

Global |

Published Date: Upcoming |

Pages:

165

| Tables: 55 | Figures: 60

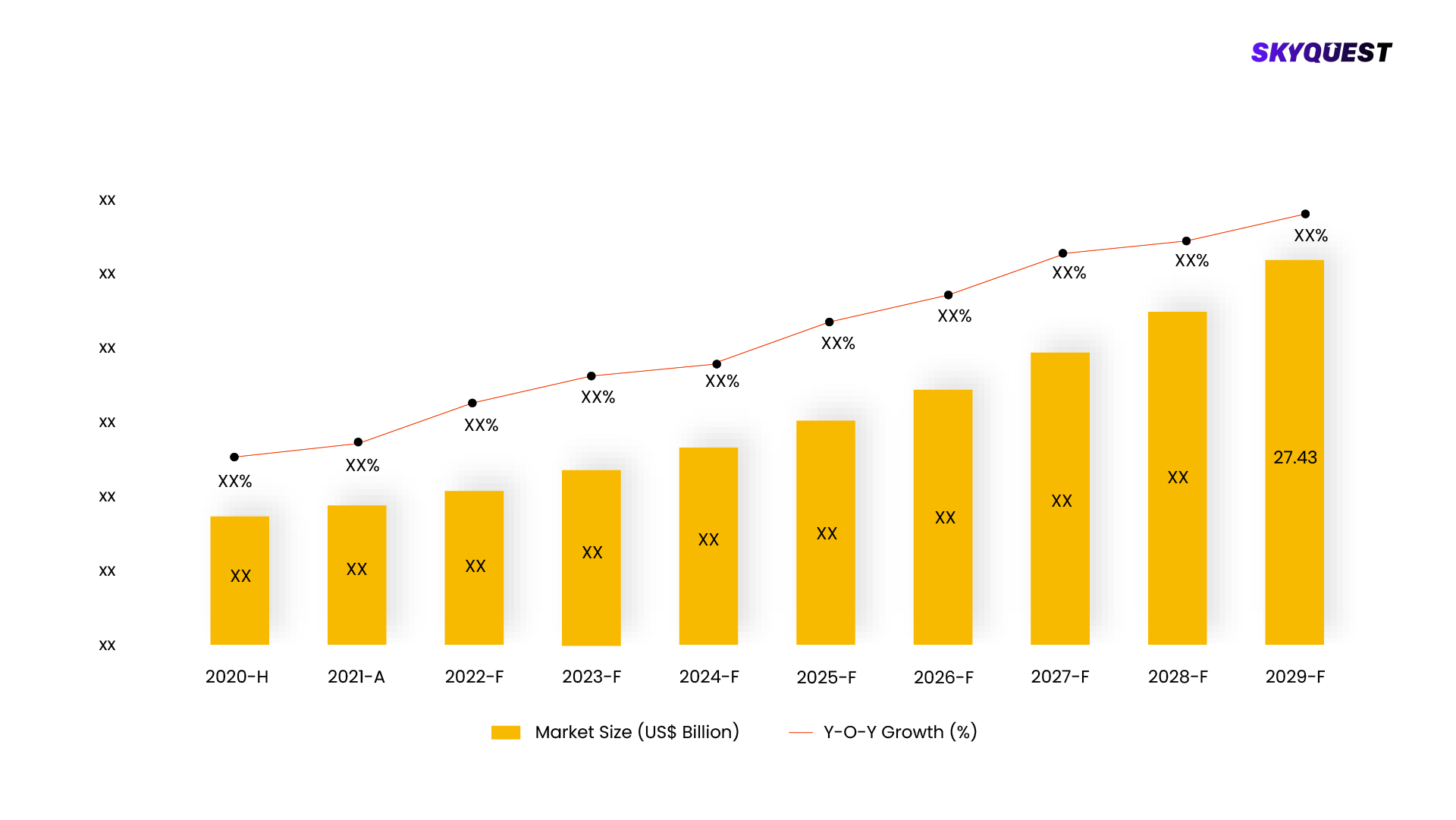

The global critical illness insurance market experienced significant growth in recent years, with a value of USD 350.02 billion in 2022. Moving forward, the market is expected to maintain a steady expansion, exhibiting a compound annual growth rate (CAGR) of 7.0% from 2023 to 2030. This growth can be attributed to various factors, including increasing awareness among individuals about the financial risks associated with critical illnesses and the need for comprehensive coverage. Additionally, advancements in medical technology and the rising prevalence of chronic diseases contribute to the market's growth. As the demand for financial protection against critical illnesses continues to rise, the critical illness insurance market is poised for substantial expansion in the coming years.

This report is being written to illustrate the market opportunity by region and by segments, indicating opportunity areas for the vendors to tap upon. To estimate the opportunity, it was very important to understand the current market scenario and the way it will grow in future.

Production and consumption patterns are being carefully compared to forecast the market. Other factors considered to forecast the market are the growth of the adjacent market, revenue growth of the key market vendors, scenario-based analysis, and market segment growth.

The market size was determined by estimating the market through a top-down and bottom-up approach, which was further validated with industry interviews. Considering the nature of the market we derived the Life & Health Insurance by segment aggregation, the contribution of the Life & Health Insurance in Insurance and vendor share.

To determine the growth of the market factors such as drivers, trends, restraints, and opportunities were identified, and the impact of these factors was analyzed to determine the market growth. To understand the market growth in detail, we have analyzed the year-on-year growth of the market. Also, historic growth rates were compared to determine growth patterns.

Our industry expert will work with you to provide you with customized data in a short amount of time.

REQUEST FREE CUSTOMIZATIONWant to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Report ID: UCMIG40N2008