Report ID: SQMIG45D2060

Report ID: SQMIG45D2060

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG45D2060 |

Region:

Global |

Published Date: July, 2025

Pages:

171

|Tables:

119

|Figures:

69

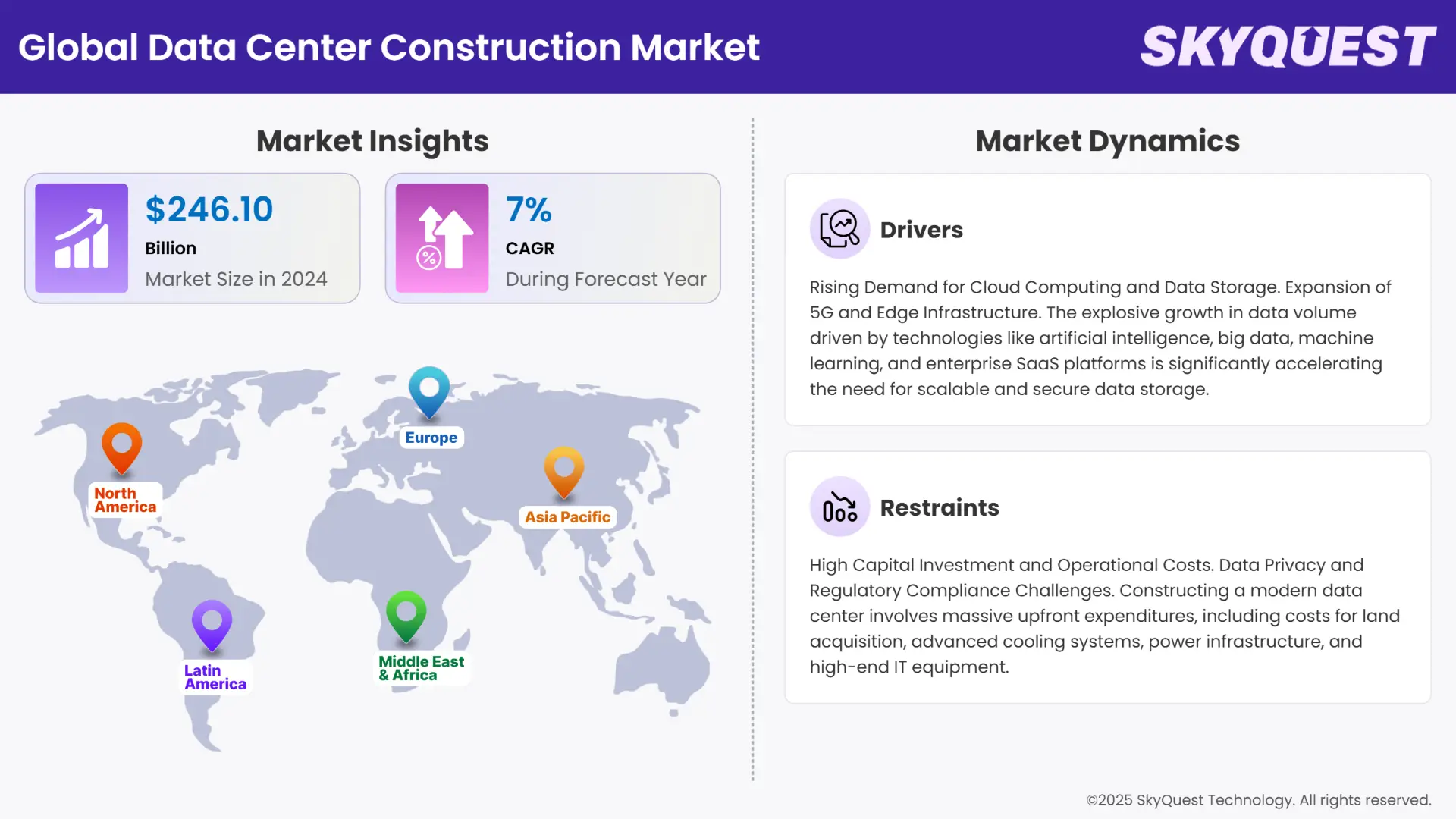

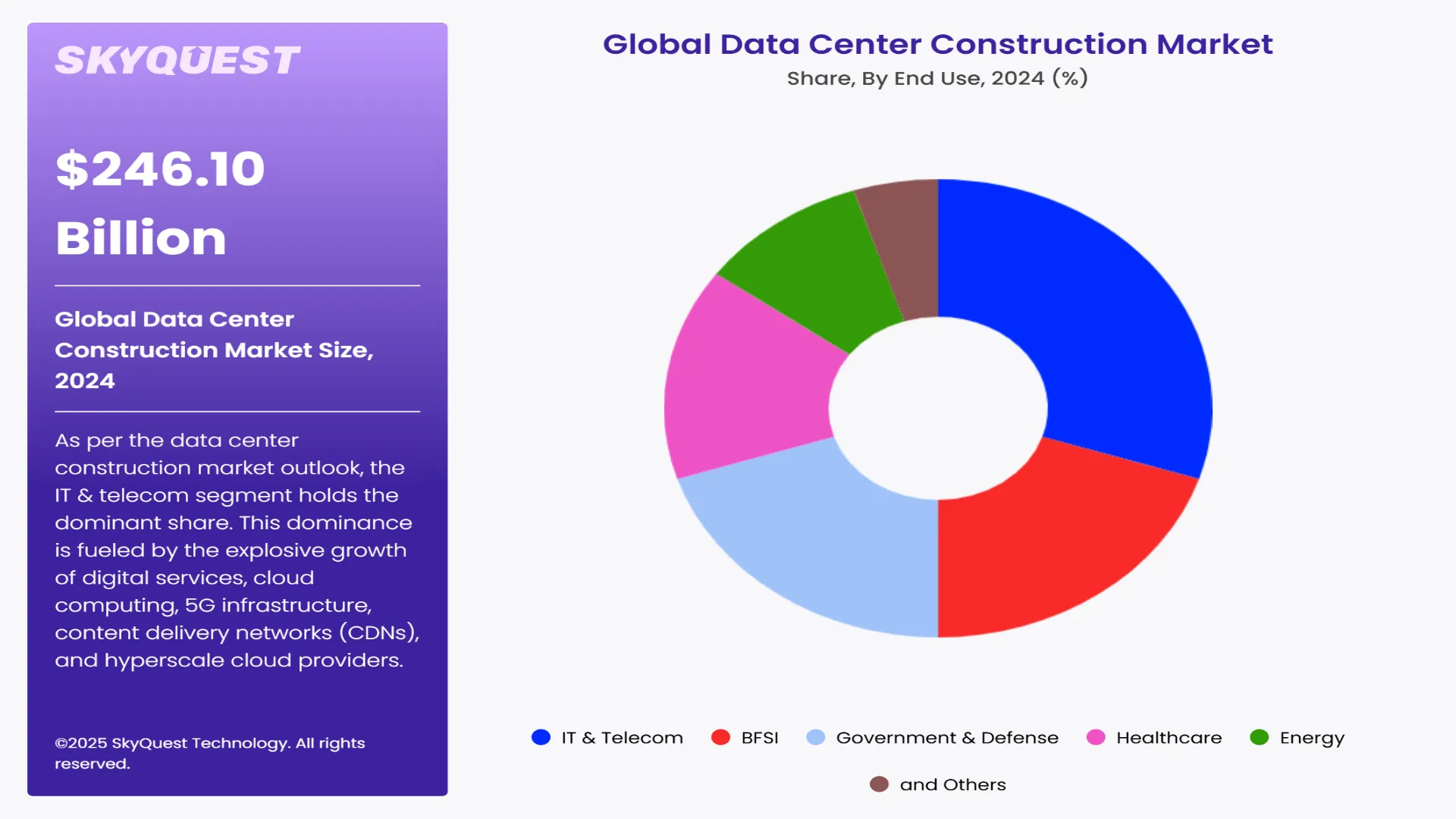

Global Data Center Construction Market size was valued at USD 246.10 Billion in 2024 and is poised to grow from USD 263.33 Billion in 2025 to USD 452.44 Billion by 2033, growing at a CAGR of 7% in the forecast period 7%.

The global data center construction market is witnessing significant growth due to the rapid rise in digital transformation, cloud computing adoption, and the exponential increase in data generation. The increasing investments from hyperscale data center operators such as Amazon Web Vertical (AWS), Microsoft Azure, and Google Cloud are also driving the data center construction industry’s growth.

Enterprises increasingly rely on cloud service providers (CSPs) and colocation data centers to manage large volumes of data, necessitating the construction of new, high-capacity facilities. In addition, the rise of edge computing is encouraging the establishment of smaller, localized data centers to reduce latency and support real-time data processing.

Another significant growth factor is the global increase in data consumption, fueled by rising internet usage and the proliferation of connected devices across different verticals. This exponential growth in data requires substantial data storage and processing capabilities, making the construction of new data centers essential.

Leading firms are investing significantly in building new data centers or upgrading existing ones to meet the growing demand for storage, processing power, and connectivity. This expansion is fueled by the need for greater scalability, reliability, and efficiency in managing vast amounts of data. As a result, the market is experiencing robust growth as companies recognize the strategic importance of a robust and resilient data infrastructure in today's digital economy.

While the data center construction industry is experiencing significant growth, it also faces several challenges. One major restraint is the high upfront cost associated with building data centers. Constructing a data center requires substantial investment in land, infrastructure, equipment, and skilled labor, making it a capital-intensive endeavor. Additionally, regulatory hurdles and permitting processes can further delay construction projects, increase costs, and affect the market. Another restraint is the limited availability of suitable locations for data center construction, especially in densely populated urban areas where land is scarce and expensive.

How is AI Driving Investment in Data Center Construction?

The explosive growth of AI applications in 2024, particularly generative AI, large language models, and real-time analytics, has led to record-breaking investments in data center infrastructure. Globally, companies poured billions into expanding their capacity to support AI workloads, with the U.S. contributing a substantial share of new builds. Hyperscalers such as Microsoft, Google, and Amazon accelerated their construction of pipelines, fueling demand for large-scale, energy-efficient facilities capable of handling AI training and inference operations. This trend is reshaping global digital infrastructure to meet the unprecedented computing needs of the AI era.

In 2024, many new projects integrated on-site renewable energy sources such as wind and solar farms alongside battery storage and backup systems. AI is used to forecast energy demand, balance loads, and optimize power distribution across facilities. In Scotland, for example, a £3.9 billion AI data center project is being built with full green energy integration, reflecting the broader push for environmentally responsible construction amid rising regulatory and ESG pressures.

To get more insights on this market click here to Request a Free Sample Report

The global data center construction market is segmented into infrastructure, tier type, size, end use, and region. Based on infrastructure, the market is segmented into IT infrastructure, PD & cooling infrastructure, and miscellaneous infrastructure. Based on tier type, the market is segmented into tier 1, tier 2, and tier 3. Based on size, the market is segmented into small and medium-scale data centers, and large-scale data centers. Based on end use, the market is segmented into IT & telecom, BFSI, government & defense, healthcare, energy, and others. Based on region, the market is segmented into North America, Asia-Pacific, Europe, Latin America, and Middle East & Africa.

As per the data center construction market outlook, tier 3 segment holds the dominant share in the market. These facilities offer a balance between cost, performance, and redundancy, making them the preferred choice for large enterprises and colocation providers. Tier 3 centers provide N+1 redundancy, ensuring that maintenance can occur without downtime, an essential feature for businesses that require high availability but not the extreme uptime of Tier 4. Their dominance is driven by strong demand from sectors like BFSI, healthcare, and cloud services, especially in regions like North America, Europe, and Asia Pacific.

As per data center construction market forecast, tier 2 segments are currently witnessing faster growth, especially in emerging markets where digital transformation is accelerating. These facilities offer limited redundancy (N), making them more cost-effective to build and operate. They are increasingly being deployed by small and medium-sized enterprises (SMEs), local cloud providers, and government agencies looking to digitize operations while keeping costs low. Countries in Latin America, Southeast Asia, and parts of Africa are seeing a surge in Tier 2 construction as part of regional data localization and infrastructure expansion efforts.

As per the data center construction market outlook, the IT & telecom segment holds the dominant share. This dominance is fueled by the explosive growth of digital services, cloud computing, 5G infrastructure, content delivery networks (CDNs), and hyperscale cloud providers. Global technology giants such as Amazon, Microsoft, Google, and Meta are continuously investing in large-scale data centers to support increasing demands for data storage, AI workloads, and latency-sensitive applications. Additionally, telecom companies are expanding their infrastructure to support growing mobile data traffic and low latency 5G services, making IT & telecom the backbone of global data center deployment.

As per data center construction market analysis, the healthcare segment is emerging as the fastest growing in the market. The rapid digitization of healthcare services, widespread adoption of electronic health records (EHRs), telemedicine, AI-driven diagnostics, and real-time patient monitoring are significantly increasing data generation in this sector. The need for secure, scalable, and compliant infrastructure to store and process this data is prompting hospitals, research institutions, and healthcare providers to invest in modern data center facilities.

To get detailed segments analysis, Request a Free Sample Report

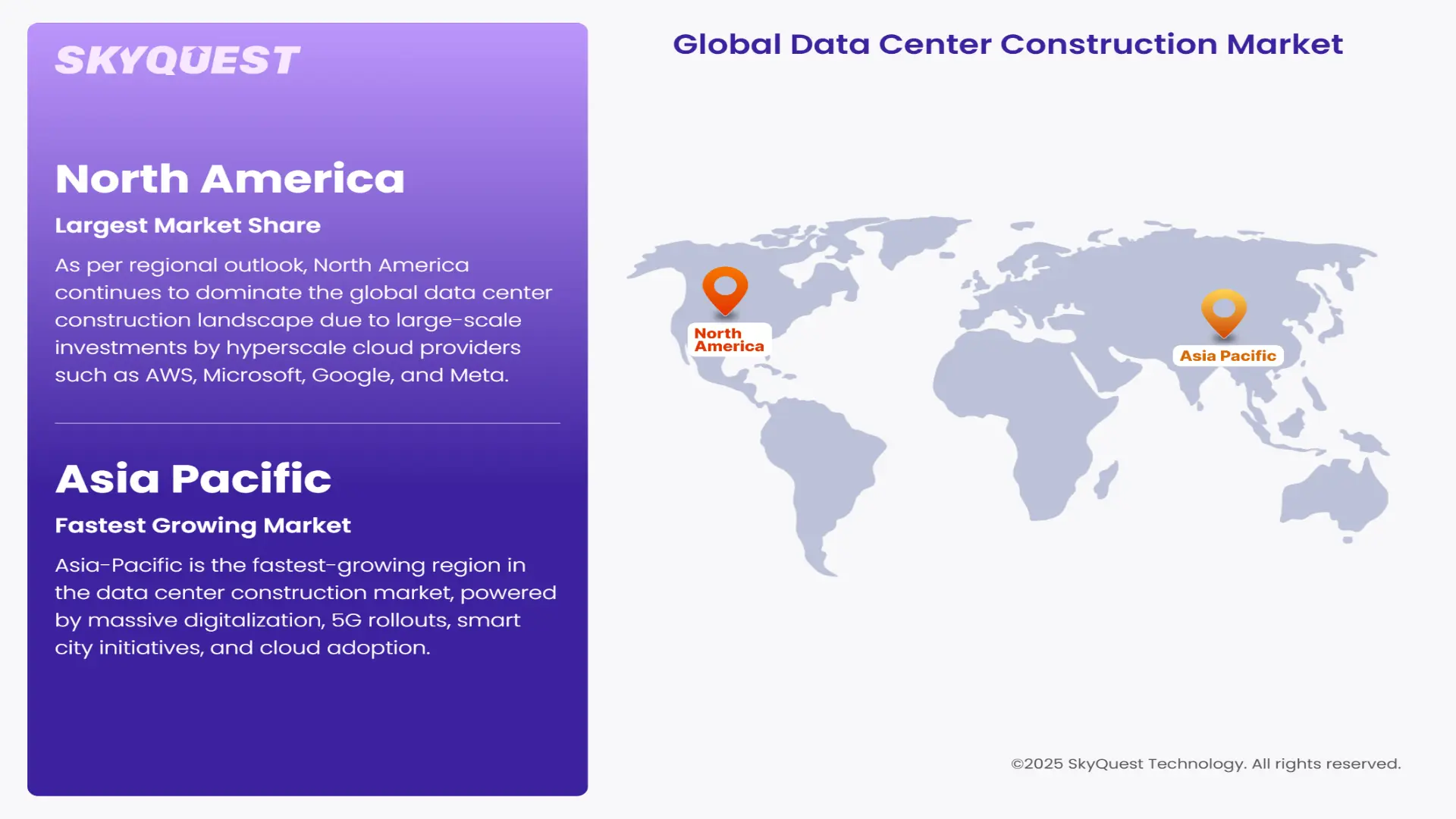

As per regional outlook, North America continues to dominate the global data center construction landscape due to large-scale investments by hyperscale cloud providers such as AWS, Microsoft, Google, and Meta. The U.S. remains the key market, with data centers concentrated in Virginia, Texas, and Iowa, where favorable tax policies, robust power infrastructure, and access to fiber networks support high-capacity builds. Canada also contributes significantly, offering a sustainable environment through access to renewable energy and a cool climate ideal for energy-efficient operations.

The United States holds the largest data center construction market share. Major hyperscale cloud providers like Amazon, Microsoft, Google, and Meta continue to invest in massive facilities across regions such as Northern Virginia, Texas, and Arizona. The key driver is the surge in demand for cloud services, AI workloads, and content delivery, supported by tax incentives and robust power infrastructure. However, rising power grid constraints, land scarcity in major hubs, and long permitting timelines are emerging as critical restraints that could hinder new deployments.

Canada is experiencing steady market growth in data center construction, with Toronto, Montreal, and Vancouver leading the way. The country's cool climate and access to renewable energy, especially hydroelectric power, are major drivers that support energy-efficient and sustainable data center development. Additionally, its proximity to U.S. markets and data sovereignty policies attract foreign investments. However, high real estate and construction costs, along with stricter zoning regulations, can delay project execution and increase capital requirements.

Asia-Pacific is the fastest-growing region in the data center construction market, powered by massive digitalization, 5G rollouts, smart city initiatives, and cloud adoption. Countries like Japan and South Korea are leading in innovation-driven demand, while Southeast Asian markets like Singapore and Indonesia are becoming colocation and hyperscale hotspots.

As per industry analysis, Japan is rapidly expanding its data center infrastructure, driven by its national digital transformation strategy and smart city initiatives. Cities like Tokyo and Osaka are major hubs, supported by strong enterprise demand and government-backed innovation programs. The main drivers include the rise of IoT, AI, and the country’s 5.0 vision. On the downside, limited land availability, high construction costs, and the need for earthquake-resilient designs serve as key restraints for large-scale expansions.

South Korea is emerging as a dynamic market for data center construction, particularly in Seoul and surrounding tech zones. Key drivers include rapid 5G deployment, the expansion of smart manufacturing, and increasing demand for edge computing and low-latency services. The government’s push for digital innovation also plays a significant role. However, limited buildable land, high urban density, and regulatory constraints pose challenges for developers seeking to expand in core urban locations.

Europe is positioning itself as a global leader in green and energy-efficient data center construction. With strict regulations on emissions and data privacy (e.g., GDPR), countries like Germany, the UK, and the Nordics are prioritizing low-PUE designs, renewable energy usage, and modular builds. Frankfurt and London are major connectivity hubs, while EU funding is helping newer markets like Italy and Spain develop modern digital infrastructure. However, slow permitting processes, high utility costs, and rigid environmental compliance requirements can hamper the pace of expansion.

Germany is a leading data center construction market in Europe, with Frankfurt serving as one of the continent’s largest interconnection hubs. The key driver is strong demand for colocation and cloud services from enterprises and cloud providers, coupled with a reliable power grid and focus on sustainability. Germany also benefits from its central location and data privacy regulations that encourage local hosting. However, stringent environmental policies and complex permitting procedures often extend construction timelines and increase compliance costs.

The UK continues to be a vital European hub for data center construction, especially in London and Manchester. The growing adoption of AI, digital transformation in finance and healthcare, and strong connectivity infrastructure are key market drivers. Post-Brexit investments and government-backed tech initiatives are further encouraging domestic development. On the restraint side, rising electricity prices and the push for net-zero emissions are putting pressure on operators to adopt costly sustainable practices.

Italy is a developing market in the European data center space, with growing activity in Milan and Rome. Key drivers include increasing digital infrastructure investments backed by EU recovery funds, rising enterprise cloud usage, and demand for localized storage due to data protection laws. The government’s focus on digitization is also stimulating the sector. However, regional disparities in infrastructure, bureaucratic delays, and slower economic growth act as major restraints in accelerating nationwide data center deployment.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Rising Demand for Cloud Computing and Data Storage

Expansion of 5G and Edge Infrastructure

High Capital Investment and Operational Costs

Data Privacy and Regulatory Compliance Challenges

Request Free Customization of this report to help us to meet your business objectives.

The competitive landscape of the global data center construction industry is characterized by a mix of construction giants, technology solution providers, infrastructure specialists, and cloud service enablers who collaborate to deliver scalable, energy-efficient, and high-uptime data center facilities. Companies like Turner Construction, DPR Construction, and Holder Construction dominate the general contracting and design-build space, especially for hyperscale and colocation projects.

As per market strategies, in 2024, collaboration between Siemens and Compass Datacenters, Siemens agreed to supply modular medium-voltage electrical skids over several years to support Compass’s large-scale construction pipeline. This strategic deal highlights the industry’s shift toward modular and prefabricated engineering to speed up deployment and reduce costs.

In recent years, several innovative startups have entered the fleet management space, leveraging cutting-edge technologies to challenge established players and address niche market needs. These startups are focusing on AI, sustainability, electric vehicle (EV) integration, and data analytics to offer agile, cost-effective, and scalable solutions for diverse fleet operations.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected by means of Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, key drivers for market growth include the surge in cloud adoption across enterprises. The data center construction market is witnessing significant growth, which is driven by the growing demand for data processing and storage solutions. This growth is largely responsible for the proliferation of cloud computing, Big Data Analytics and the expansion of the Internet of Things (IoT) app. One of the most important restrictions in the market is the high upfront cost associated with establishing these facilities. The trend towards hyperscale data centers presents a substantial opportunity within the data center construction market. These large-scale facilities support extensive cloud platforms and big data analytics, providing the infrastructure needed for high-volume, high-velocity data.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 246.10 Billion |

| Market size value in 2033 | USD 452.44 Billion |

| Growth Rate | 7% |

| Base year | 2024 |

| Forecast period | 7% |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Data Center Construction Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Data Center Construction Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Data Center Construction Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Data Center Construction Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Global Data Center Construction Market size was valued at USD 246.10 Billion in 2024 and is poised to grow from USD 263.33 Billion in 2025 to USD 452.44 Billion by 2033, growing at a CAGR of 7% in the forecast period 7%.

The competitive landscape of the global data center construction industry is characterized by a mix of construction giants, technology solution providers, infrastructure specialists, and cloud service enablers who collaborate to deliver scalable, energy-efficient, and high-uptime data center facilities. Companies like Turner Construction, DPR Construction, and Holder Construction dominate the general contracting and design-build space, especially for hyperscale and colocation projects. 'Turner Construction Company', 'Holder Construction', 'DPR Construction', 'AECOM', 'Jacobs Engineering Group', 'IBM Corporation', 'Schneider Electric', 'ABB Ltd.', 'Equinix, Inc.', 'NTT Ltd.', 'Vertiv Group Corp.', 'Eaton Corporation'

The explosive growth in data volume driven by technologies like artificial intelligence, big data, machine learning, and enterprise SaaS platforms is significantly accelerating the need for scalable and secure data storage. As businesses migrate their infrastructure to the cloud, global hyperscale providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are rapidly expanding their data center footprints. This is leading to a steady rise in data center construction, particularly in Tier 3 and Tier 4 facilities that support massive computing workloads and guarantee uptime.

Shift Toward Sustainable and Green Data Centers: Environmental sustainability has become a top priority in data center construction. There is a strong shift toward eco-friendly building materials, renewable energy sources (like wind and solar), and energy-efficient designs such as liquid cooling and AI-optimized HVAC systems. Companies are also targeting green certifications like LEED and BREEAM as part of their ESG commitments, signaling a long-term trend toward net-zero and carbon-neutral data centers.

As per regional outlook, North America continues to dominate the global data center construction landscape due to large-scale investments by hyperscale cloud providers such as AWS, Microsoft, Google, and Meta. The U.S. remains the key market, with data centers concentrated in Virginia, Texas, and Iowa, where favorable tax policies, robust power infrastructure, and access to fiber networks support high-capacity builds. Canada also contributes significantly, offering a sustainable environment through access to renewable energy and a cool climate ideal for energy-efficient operations.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients