Report ID: SQMIG45I2295

Report ID: SQMIG45I2295

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG45I2295 |

Region:

Global |

Published Date: January, 2026

Pages:

191

|Tables:

116

|Figures:

77

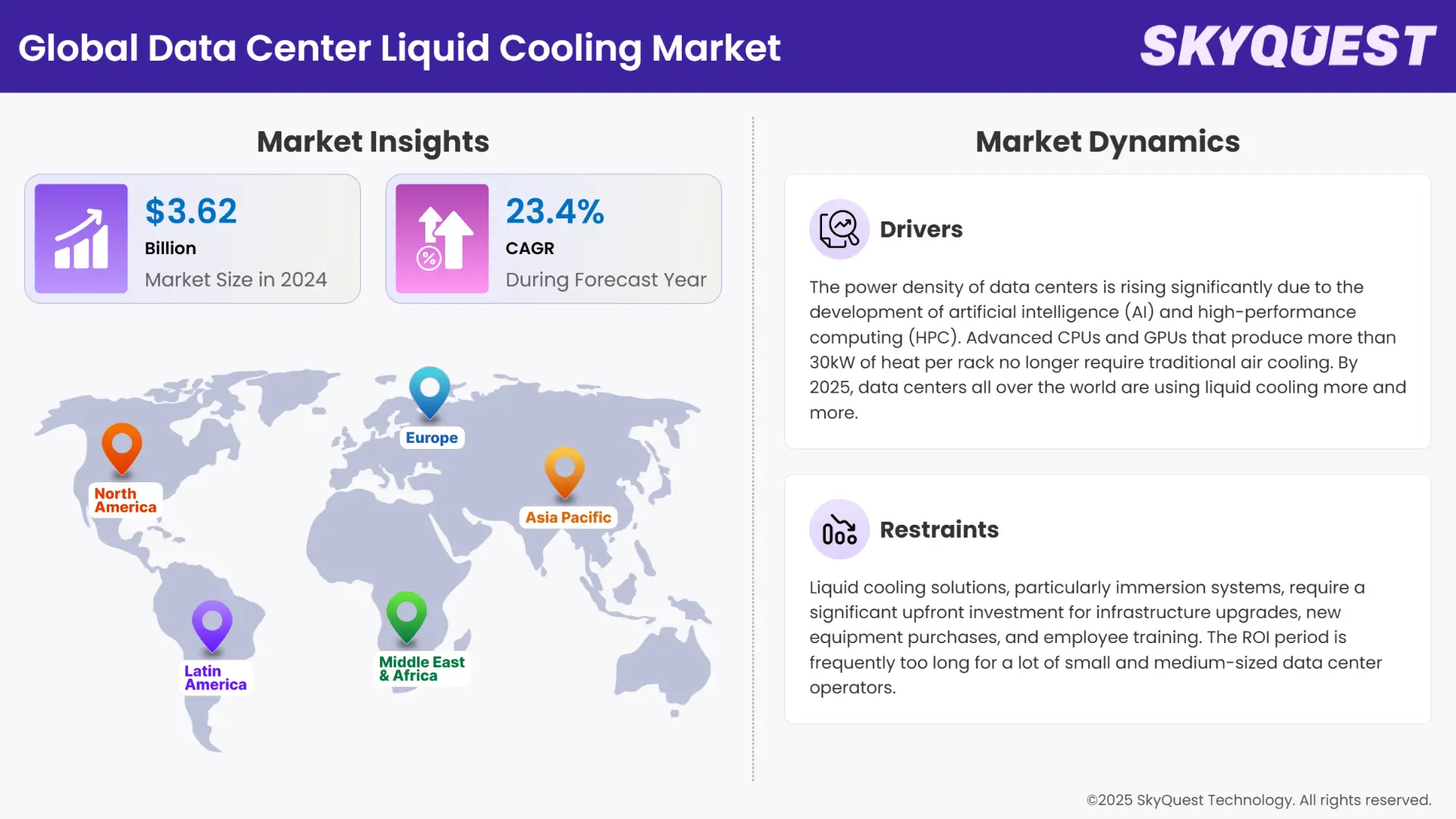

Global Data Center Liquid Cooling Market size was valued at USD 3.62 billion in 2024 and is poised to grow from USD 4.47 billion in 2025 to USD 24.02 billion by 2033, growing at a CAGR of 23.4% during the forecast period (2026-2033).

The increasing energy consumption of data center facilities has prompted businesses to explore and adopt advanced liquid cooling solutions. As data centers expand and operate at higher densities, conventional cooling methods become less efficient and more costly. To solve these problems, companies are using state-of-the-art liquid cooling technologies, which offer improved thermal management and energy efficiency.

Additionally, the growing cloud computing market is presenting numerous opportunities for data center providers. As more businesses use cloud-based solutions to benefit from their scalability, flexibility, and affordability, end users' demand for data center infrastructure to support these services has been growing. This expansion, which necessitates the building of new data centers and the renovation of existing facilities, will lead to innovation and the data center liquid cooling market growth.

What Role Does AI Play in Optimizing Data Center Cooling Efficiency?

By making it simpler to control heat and use energy more effectively, artificial intelligence is transforming the global data center liquid cooling market outlook. Since traditional air cooling is insufficient for AI applications that require more processing power, liquid cooling techniques are employed. Artificial intelligence (AI) algorithms are being used to forecast heat trends and make real-time adjustments to cooling systems to increase efficiency and reduce operating expenses. For demanding AI workloads, Hewlett Packard Enterprise (HPE) unveiled a fully fanless direct liquid cooling solution in October 2024. 90% less energy is used to cool this system. Similarly, in 2025, the neocloud company Crusoe announced that it would construct liquid-cooled AI servers in the US using over 13,000 AMD MI355X processors. This demonstrates the growing significance of AI and liquid cooling in the architecture of data centers of the future.

To get more insights on this market click here to Request a Free Sample Report

Global Data Center Liquid Cooling Market is segmented by Offering, Data Center Type, Data Center Size, Cooling Model, Infrastructure, Coolant Type, Deployment Mode, Application, Distribution Channel, Verticals and region. Based on Offering, the market is segmented into Solution and Services. Based on Data Center Type, the market is segmented into Edge Data Center, Enterprise (On-Premises) Data Centers, Public Cloud Data Centers and Hyperscale Data Centers, Managed Data Centers and Colocation Data Center and High-Performance Computing (HPC) Data Center. Based on Data Center Size, the market is segmented into Micro Data Center <10 MW, Small Data Center 10 MW-30 MW, Medium Data Centre 30-50 MW, Large Data Centre 50-80 MW and Hyperscale/Very large Data Centre > 80 MW. Based on Cooling Model, the market is segmented into Rack/Row Based and Room Based. Based on Infrastructure, the market is segmented into Raised Floor Environment and Non-Raised Floor Environment. Based on Coolant Type, the market is segmented into Purified Water, Deionized Water, Glycol-Water Mixtures, Synthetic Mineral Oils, Dielectric Fluids and Others. Based on Deployment Mode, the market is segmented into Retrofit Deployments and New Build Deployments. Based on Application, the market is segmented into Server Cooling, Storage Cooling, Networking Cooling and Others. Based on Distribution Channel, the market is segmented into Direct and Indirect. Based on Verticals, the market is segmented into Enterprises and Cloud Service Provider. Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

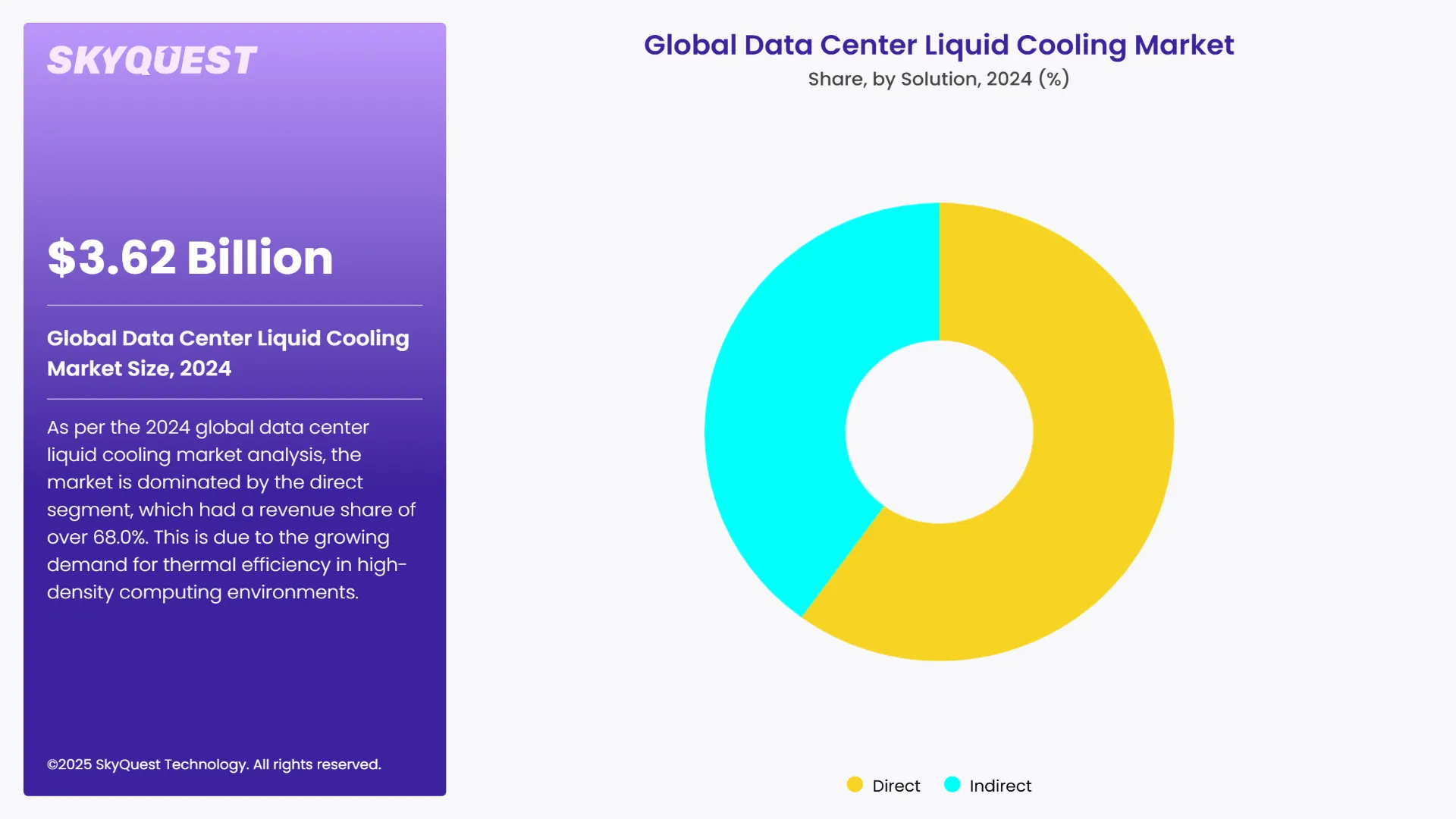

As per the 2024 global data center liquid cooling market analysis, the market is dominated by the direct segment, which had a revenue share of over 68.0%. This is due to the growing demand for thermal efficiency in high-density computing environments. As AI, machine learning, big data analytics, and blockchain technologies are developing so quickly, servers are becoming more powerful and heat intensive. DLC solutions, which employ a liquid coolant to directly cool the processor and other components, offer a far greater capacity for heat removal than traditional air cooling.

The indirect segment is expected to grow at a significant compound annual growth rate (CAGR) over the forecast period because of its ability to give data centers switching from traditional air cooling to a more balanced and low-risk alternative. In indirect liquid cooling systems, heat is absorbed by liquid at the rack or row level, typically via rear-door heat exchangers or in-row cooling units, without coming into direct contact with electronic components. As it allows data centers to greatly improve thermal management without requiring extensive redesigns of the current server architecture, this technique is appealing to operators seeking small-scale improvements rather than complete system overhauls.

Based on the 2024 global data center liquid cooling market forecast, the cold plate segment dominated the market with a revenue share of over 48.0%. Traditional air-cooling solutions face physical limitations when trying to cool increasingly dense server environments. Cold plate cooling allows operators to pack more computer power into the same or smaller physical footprint, maximizing return on investment for expensive data center real estate. This data center liquid cooling industry trend is particularly important as companies seek to grow their digital operations while keeping infrastructure expansion costs under control.

The immersion category is anticipated to have the largest data center liquid cooling market share during the forecast period. Improvements in tank design and dielectric fluid chemistry have made immersion cooling systems more reliable, secure, and cost-effective. Customized solutions for a range of maintenance and performance requirements are offered by contemporary single-phase and two-phase immersion techniques. This is accelerating widespread adoption and reducing integration barriers, particularly when combined with growing OEM and hardware vendor support.

To get detailed segments analysis, Request a Free Sample Report

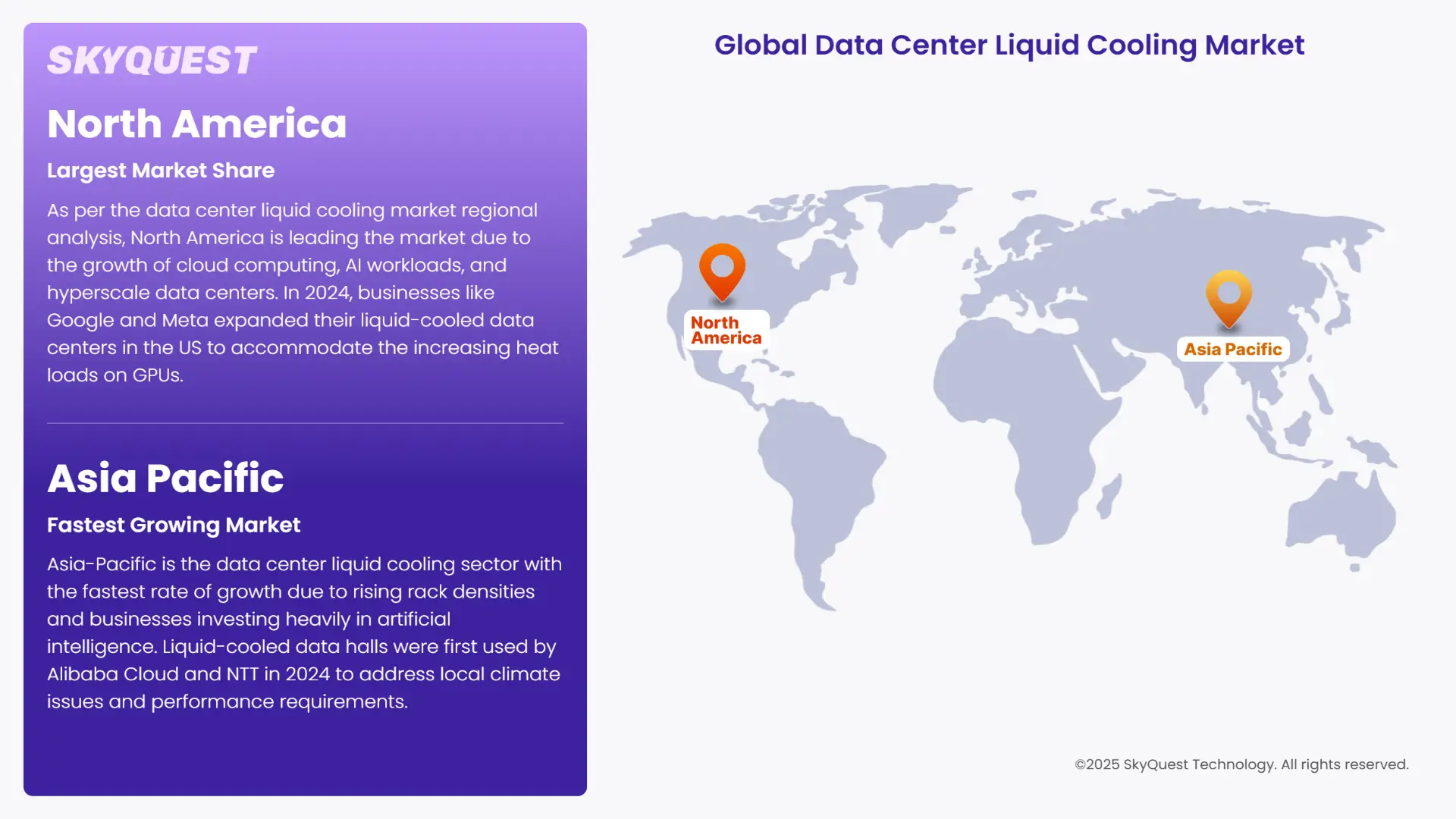

As per the data center liquid cooling market regional analysis, North America is leading the market due to the growth of cloud computing, AI workloads, and hyperscale data centers. In 2024, businesses like Google and Meta expanded their liquid-cooled data centers in the US to accommodate the increasing heat loads on GPUs. Adoption is being pushed by the region's emphasis on energy efficiency and sustainability. Advanced thermal management systems are also being promoted by the US Department of Energy.

The US is the largest market in the region due to the expansion of AI infrastructure. Microsoft started using two-phase immersion cooling for its AI computers in 2025 at its Quincy data center in Washington. Energy use was reduced by 10% to 15% as a result. The company is becoming increasingly concerned about thermal constraints and power density in conventional air-cooling systems, particularly in cloud and colocation environments. Thus, want to quickly transition to liquid cooling because of this.

The most common option has been air-cooled centers due to Canada's colder climate. However, the move to liquid cooling is being driven by the demands of high-performance computing (HPC). In 2024, liquid-cooled edge data centers for 5G applications were tested by CENGN (Centre of Excellence in Next Generation Networks). Adoption of green data infrastructure is accelerating due to regional hyperscale installations and government support.

The data center liquid cooling market in Europe is expanding as energy costs rise, and businesses seek to be more ecologically conscious. Large corporations were impacted by the EU's 2024 "Green Deal," which promoted the use of energy-efficient technologies. One of the world's greenest integrated direct-to-chip cooling systems for AI workloads in 2025 is the EcoDataCenter in Sweden. This demonstrates Europe's dedication to developing high-performing, environmentally responsible data centers.

High-density workloads and sustainability are becoming more prevalent in UK data centers. In 2025, Telehouse London installed liquid-cooled racks to accommodate AI clients with workloads exceeding 40 kW per rack. Suppliers are adopting energy-efficient thermal management technology in response to the nation's environmental goals and growing electricity costs.

The goal of France's digital infrastructure construction is to achieve carbon neutrality. In 2024, OVHcloud expanded its Bordeaux location and employed water-based cooling to maintain server performance and reduce pollution. In both new and renovated data centers, the government and the EU are promoting the use of sustainable cooling solutions.

Germany is investing heavily in liquid cooling technology and is renowned for its engineering leadership. DE-CIX In order to handle more network traffic and data, Frankfurt, one of the biggest internet exchange hubs in the world, upgraded its infrastructure in 2025 with immersion cooling. Demand is being driven by regulatory emphasis on sustainability and PUE (Power Usage Effectiveness).

Asia-Pacific is the data center liquid cooling sector with the fastest rate of growth due to rising rack densities and businesses investing heavily in artificial intelligence. Liquid-cooled data halls were first used by Alibaba Cloud and NTT in 2024 to address local climate issues and performance requirements. One of the main causes of this increase is that nations like South Korea and Japan are facilitating the growth of green data centers.

The need for liquid cooling is increasing as a result of South Korea's investments in AI and metaverse infrastructure. In 2025, SK Telecom upgraded its hyperscale data center in Pangyo by collaborating with a liquid cooling company based in the United States. Government-funded smart city and digital twin initiatives are also increasing demand for high-performance, thermally efficient data centers.

Thermal efficiency is crucial in Japan because of the country's densely populated cities and limited land supply. In order to address the issues of heat and space, NTT Communications constructed a data center in Tokyo in 2024 using direct liquid cooling. Japan is anticipated to employ immersion cooling and modular liquid systems in high-density environments more frequently as AI deployments increase.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

More AI and HPC Work Needed

Increasing Awareness of Energy Conservation

High Initial Investment Cost

Issues with Compatibility and Maintenance

Request Free Customization of this report to help us to meet your business objectives.

Rittal GmbH & Co. KG, 3M Company, and Schneider Electric hold a significant market share of over 20% in the data center liquid cooling industry. The main players are focusing on developing and deploying a range of liquid cooling solutions, including direct-to-chip and immersion cooling systems, to enhance thermal management and increase energy efficiency. These technologies reduce the need for traditional air-cooling methods by addressing the increasing heat loads generated by modern servers and other high-performance computing devices.

Incorporating sustainability into these solutions is also highly regarded. Businesses like Schneider and Vertiv are making progress in creating cooling systems that not only optimize performance but also support environmental goals by reducing energy consumption and carbon footprints. As the demand for data centers increases and regulatory pressures increase, these advancements in liquid cooling are becoming crucial for maintaining operational effectiveness and achieving sustainability goals.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected by means of Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, as workloads related to artificial intelligence (AI), high-performance computing (HPC), and cloud computing are growing exponentially, the data center liquid cooling market is expanding rapidly. As heat and power continue to present issues to data centers, liquid cooling will become criteria to improve performance and optimize power consumption. With modular and immersion systems, deployment is becoming more viable, but challenges still remain in terms of cost and integration. While large companies are pursuing aggressive agreements with cloud providers and hyperscalers to complicate their reliance on liquid cooling, edge data centers and sustainable practices will help to propel the industry forward. Government support and the rise of the global digital economy will help transition liquid cooling and become standard technology in next-generation data centers across North America, Europe, and Asia Pacific by 2032.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 3.62 billion |

| Market size value in 2033 | USD 24.02 billion |

| Growth Rate | 23.4% |

| Base year | 2024 |

| Forecast period | 2026-2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Data Center Liquid Cooling Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Data Center Liquid Cooling Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Data Center Liquid Cooling Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Data Center Liquid Cooling Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Global Data Center Liquid Cooling Market size was valued at USD 3.62 Billion in 2024 and is poised to grow from USD 4.46 Billion in 2025 to USD 23.99 Billion by 2033, growing at a CAGR of 23.4% in the forecast period (2026–2033).

Rittal GmbH & Co. KG, 3M Company, and Schneider Electric hold a significant market share of over 20% in the data center liquid cooling industry. The main players are focusing on developing and deploying a range of liquid cooling solutions, including direct-to-chip and immersion cooling systems, to enhance thermal management and increase energy efficiency. These technologies reduce the need for traditional air-cooling methods by addressing the increasing heat loads generated by modern servers and other high-performance computing devices. 'ExxonMobil', 'Fujitsu', 'Aligned Data Centers', 'ABB Ltd', 'Rotork plc', 'SMC Corporation', 'Festo AG & Co. KG', 'Moog Inc.', 'Curtiss-Wright Corporation', 'IMI plc', 'AUMA Riester GmbH & Co. KG', 'Barksdale Inc.', 'Flowserve Corporation', 'Johnson Controls'

The power density of data centers is rising significantly due to the development of artificial intelligence (AI) and high-performance computing (HPC). Advanced CPUs and GPUs that produce more than 30kW of heat per rack no longer require traditional air cooling. By 2025, data centers all over the world are using liquid cooling more and more. This is due to the fact that hyperscalers such as Microsoft and Meta are handling demanding AI/ML workloads by utilizing immersion and direct-to-chip liquid cooling systems.

Growth of Edge Data Centers with Liquid Cooling: Compact edge data centers are growing in popularity as AI and IoT drive data processing closer to the edge. To maintain performance in constrained areas, Canada, India, and Southeast Asia implemented liquid cooling in edge installations in 2025. As edge facilities require high-density, quiet, and efficient computing, countries are increasingly choosing hybrid systems with modular immersion cooling.

As per the data center liquid cooling market regional analysis, North America is leading the market due to the growth of cloud computing, AI workloads, and hyperscale data centers. In 2024, businesses like Google and Meta expanded their liquid-cooled data centers in the US to accommodate the increasing heat loads on GPUs. Adoption is being pushed by the region's emphasis on energy efficiency and sustainability. Advanced thermal management systems are also being promoted by the US Department of Energy.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients