Report ID: SQMIG45D2152

Report ID: SQMIG45D2152

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG45D2152 |

Region:

Global |

Published Date: December, 2025

Pages:

175

|Tables:

272

|Figures:

82

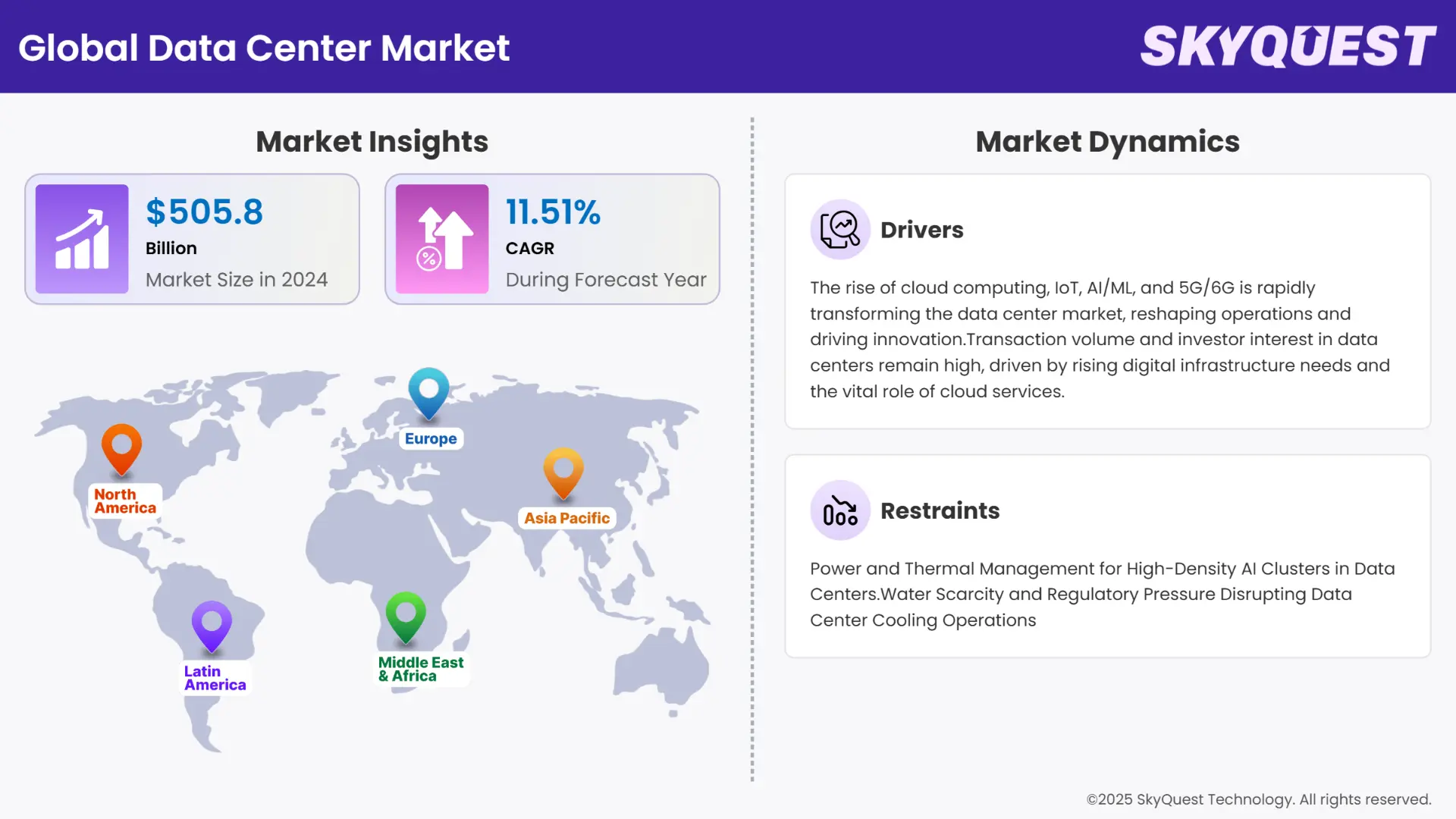

Global Data Center market size was valued at USD 505.8 Billion in 2024 and is poised to grow from USD 564.02 Billion in 2025 to USD 1348.35 Billion by 2033, growing at a CAGR of 11.51% in the forecast period (2026–2033).

Increased demand for data usage is a key contributor to market growth, driven by the spread of digitalization applications to different industries. Smart services, social media platforms, online payment solutions, and home automation are becoming part of daily routines, causing an explosion in the use of data. These applications place significant dependence on strong data infrastructure, which propels the demand for cutting-edge technologies and solutions to process, store, and handle the massive flow of data in an efficient manner. Moreover, the rise in adoption of IoT devices, cloud computing, and edge computing technologies further contributes to this trend, thereby developing a dynamic ecosystem of digital applications. Smart home control, for instance, relies on networked devices that transmit information in real time, while cashless payments demand secure and hassle-free data processing. In combination, these innovations factor in the expansion of the market by driving demands for more advanced data solutions to accommodate the growing digital environment.

How AI is Optimizing the Data Center Market?

AI is revolutionizing the data center industry by improving operational performance, lowering downtime, and optimizing power consumption. With predictive analytics AI solutions can predict equipment breakdowns. which can be addressed with preventive maintenance and prevented from causing interruptions. Machine learning algorithms process real-time information to adjust cooling systems, power consumption, and workload allocation dynamically, leading to considerable cost reductions and better sustainability. Artificial intelligence also simplifies data center infrastructure management (DCIM), reducing mundane tasks and recognizing inefficiencies more quickly than with manual monitoring. Industry players such as Google & Microsoft are using AI to lower energy consumption by as much as 40% in cooling processes. As data requirements increase AI's capacity to oversee intricate environments efficiently places it at the forefront of innovation in next-generation high-performance data centers.

Is Growing Cloud Adoption Driving Data Center Demand?

Cloud adoption is gaining pace globally, transforming the data center world. Over 60% of companies now rely on cloud platforms to deploy applications representing a large paradigm shift in IT infrastructure strategies. Approximately 94% of leading business organizations worldwide have adopted cloud computing. In the EU, 45.2% of businesses utilized cloud services in 2023 for hosting email, storing files, and office applications. In addition, 75.3% of them used sophisticated cloud solutions for database hosting, cybersecurity, and application development. Cloud adoption increased by 4.2 percentage points from 2021. Today, 60% of corporate data is in the cloud, due to growing confidence in its security and performance. This increase in cloud use is propelling demand for high-performing, scalable data centers for hybrid and multi-cloud infrastructures.

To get more insights on this market click here to Request a Free Sample Report

The global Data Center market is segmented into Offering, type, Size, Data Centre Redundancy, End User industry and region. By Offering, the market is classified into Hardware, Software and services. Depending on type, it is divided into Enterprise (On-Premises) Data Centers, Public Cloud Data Centers and Hyperscale Data Centers, Managed Data Centers and Colocation Data Center. According to Size, the market is categorized into Micro Data Center <10 MW, Small Data Center 10 MW–30 MW, Medium Data Centre 30–50 MW, Large Data Centre 50–80 MW, and Hyperscale/Very Large Data Centre >80 MW. By Data Centre Redundancy, the market is classified into N, N+1, N+2, 2N. By End User Industry, the market is classified into Cloud, Technology, Telecom, Healthcare, Banking & Financial Services, Retail & E-commerce, Entertainment & Media, Energy, Others. Regionally, the market is analyzed across North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

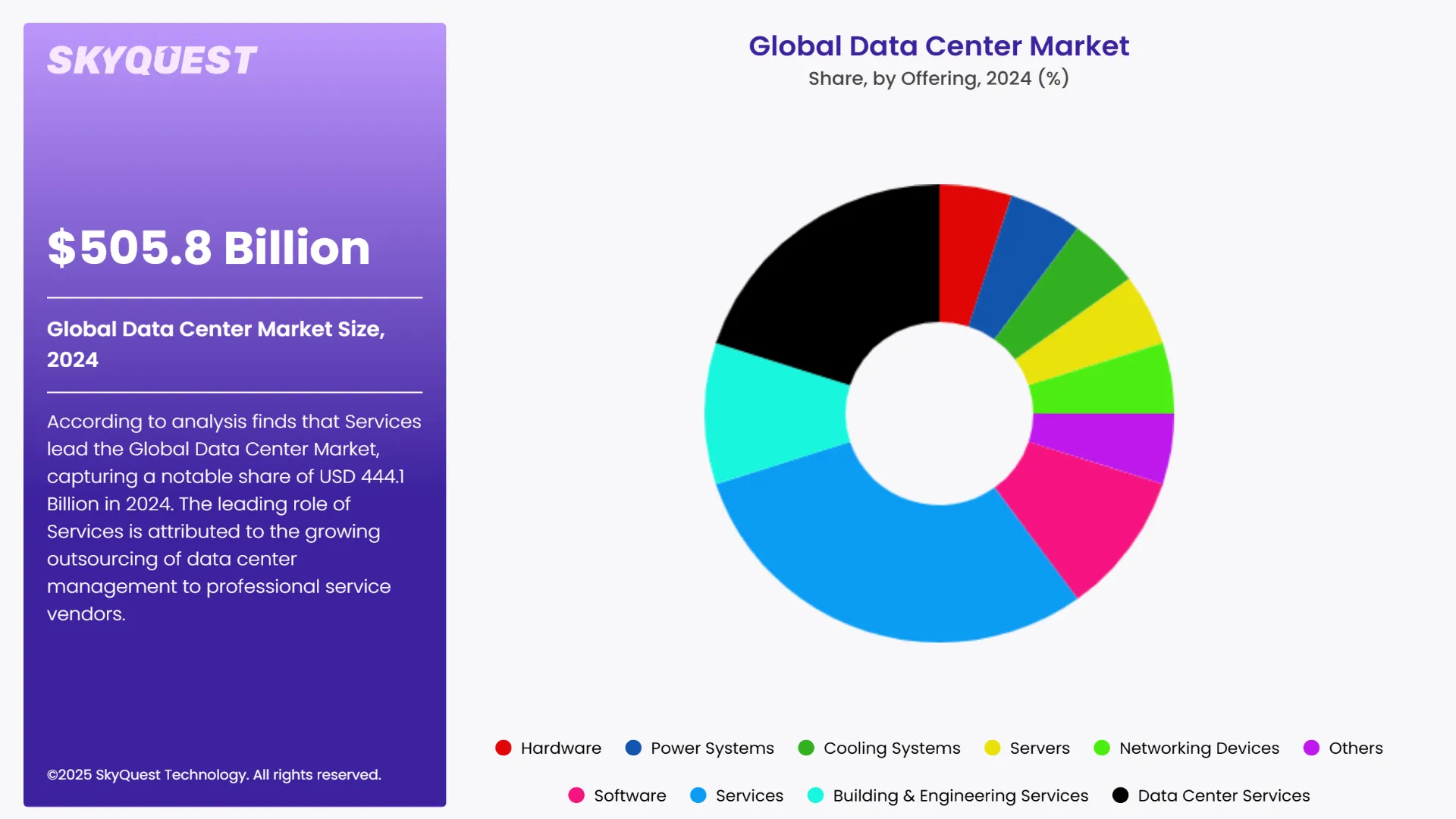

According to analysis finds that Services lead the Global Data Center Market, capturing a notable share of USD 444.1 Billion in 2024. The leading role of Services is attributed to the growing outsourcing of data center management to professional service vendors. Companies, right from hyperscalers to enterprises, are seeking cost- and trust-worthy data center upgrades, maintenance, and management solutions, fueling managed services, co-location services, and consultancy demand. Scalability and flexibility offered by service-based solutions match the needs of businesses across verticals. In addition, increasing demand for cloud-based solutions and edge computing prowess supports this segment as organizations are focusing more on smooth integration and ease of operations.

Hardware is the second-largest data center market segment globally, expanding at a constant CAGR of 10.7%. This is fueled by growing demand for efficient, high-performance servers, advanced cooling infrastructure, and high-performance networking equipment. With the volumes of data increasing and workloads getting more complex, enterprises are focusing on next-generation hardware to host scalable, high-speed, and low-latency infrastructure. Additionally, the use of modular and prefabricated hardware increases deployment efficiency and flexibility, supporting the changing needs of contemporary data centers. All these developments play a critical role in addressing the performance and sustainability requirements of future-ready facilities.

To get detailed segments analysis, Request a Free Sample Report

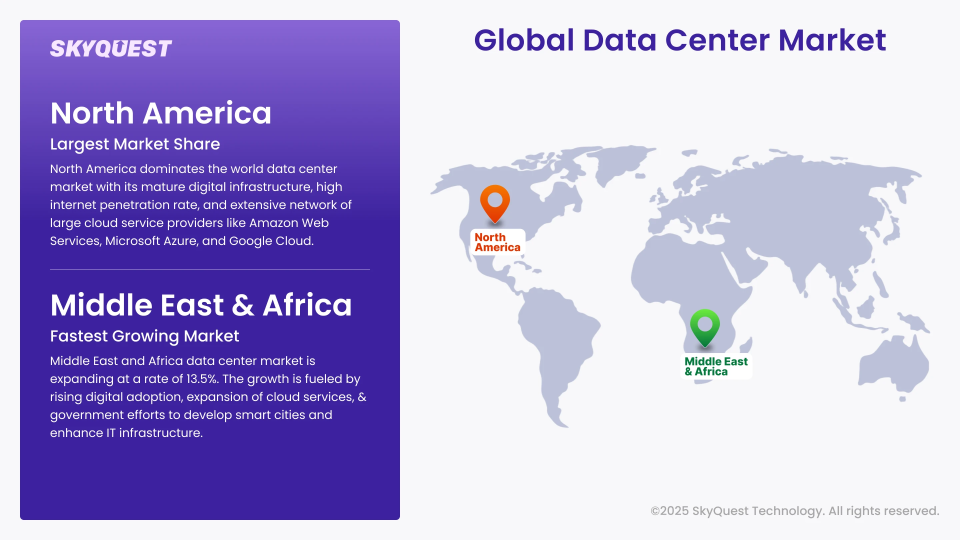

North America dominates the world data center market with its mature digital infrastructure, high internet penetration rate, and extensive network of large cloud service providers like Amazon Web Services, Microsoft Azure, and Google Cloud. Early adoption of new technologies like AI, IoT, and big data analytics in the region also propels the demand for data storage and processing capacity. Moreover, massive investments in hyperscale and edge data centers, especially in the United States, combined with encouraging regulatory policies and strong energy availability, increase the competitiveness of the region. Increased enterprise cloud migration and demand for colocation services also ensure North America's leadership position.

The United States is at the forefront of the world data center market with the presence of hyperscale players in the form of Amazon Web Services, Microsoft Azure, and Google Cloud. The government has launched policies to encourage renewable energy consumption in data centers to boost sustainability efforts. Virginia (Ashburn) and Texas are key locations because of the tax incentives, stable power infrastructure, and proximity to cloud users. Moreover, the increasing use of AI, edge computing, and IoT among businesses is also driving demand for sophisticated data center solutions. Large investments from domestic as well as global players, including Equinix and Digital Realty, also increase market growth further.

Canada's data center market is growing due to heightened demand for cloud services and green energy projects supported by the government.

Quebec and Ontario provinces are now top destinations with access to cheap hydroelectric energy and cold climate advantages for natural cooling. Government initiatives in favor of adoption of clean energy and incentives for renewable-fueled data centers encourage investments from international players such as Microsoft, Google, and AWS.

Europe is growing rapidly in the data center market with growing demand for cloud services and digital transformation across industries. Stringent data privacy regulations like GDPR push companies to keep and process data locally, accelerating the need for data centers in Europe. Major cloud players are scaling hyperscale data centers in the region to meet the surge in demand. Europe's strong focus on sustainability encourages the use of energy efficient, renewables powered data centers to attract green businesses. The continent's favorable geographical location and developed connectivity networks ensure high-performance reliability for global users. Incentives & investments from governments add to marketplace expansion. The growing use of edge computing to underpin IoT & 5G use cases is fueling the deployment of smaller regional data centers throughout Europe, propelling the industry growth.

Germany is a leading data center market in Europe, with its geographical centrality, superior connectivity, and strong economy.

The nation's stringent GDPR compliance regulations and green energy programs are propelling investments into green data centers. Frankfurt, being a member of the FLAP (Frankfurt, London, Amsterdam, Paris) markets, is the largest colocation and hyperscale data center hub. Renewable energy is encouraged by the German government, and green data centers are also incentivized through tax benefits. Equinix, NTT, and Digital Realty are increasing the size of their facilities to accommodate the surging demand for cloud and edge solutions in the nation. The use of AI, IoT, and 5G technologies is also driving the market further.

The UK data center market is driven by high demand for cloud services and colocation space due to London's reputation as a global financial hub.

Brexit has not been able to deter the UK from attracting investments from global players due to its well-developed digital infrastructure and closeness to global markets. The green agenda of the government for green energy has led to green data center alliances, with sustainability becoming a universal market driver. Greater utilization of AI, big data, and edge computing is in progress, with Amazon, Microsoft, &Google leading hyperscale developments. Furthermore, the UK government's focus on cybersecurity and data protection supports market growth.

Middle East and Africa data center market is expanding at a rate of 13.5%. The growth is fueled by rising digital adoption, expansion of cloud services, & government efforts to develop smart cities and enhance IT infrastructure. Urbanization is increasing in a swift manner, internet penetration is rising, and there is increasing demand for data processing and storage, which are the key drivers of growth. Regions such as the UAE, Saudi Arabia, South Africa, and Nigeria are driving hyperscale and edge data center investments. Strategic investment in connectivity in the form of subsea cables and 5G networks is also enhancing the MEA region. Governments are also prioritizing data sovereignty and cybersecurity, driving local data center development. Sustainability is also gaining importance, and there is an attempt to utilize renewable energy and enhance energy efficiency in data centers. In total, MEA's market has good potential for growth and technology uptake.

The data center market in Brazil has experienced tremendous growth due to growing digital transformation across industries, growing internet penetration, and cloud adoption. The government of Brazil has played a major role in driving data center investments through the implementation of initiatives like the "Digital Transformation Strategy" (E-Digital) as well as ICT infrastructure enhancement policies to improve the country's ICT infrastructure. The government has also given importance to energy-efficient data centers through tax incentives on the adoption of green energy. Key players such as Equinix, Ascenty, and ODATA have taken advantage of Brazil's growing cloud industry by opening hyper-scale facilities in Sao Paulo and Rio de Janeiro, which are major nodes in the LATAM region.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

The rise of cloud computing, IoT, AI/ML, and 5G/6G is rapidly transforming the data center market, reshaping operations and driving innovation.

Transaction volume and investor interest in data centers remain high, driven by rising digital infrastructure needs and the vital role of cloud services.

Power and Thermal Management for High-Density AI Clusters in Data Centers

Water Scarcity and Regulatory Pressure Disrupting Data Center Cooling Operations

Request Free Customization of this report to help us to meet your business objectives.

The Global Data Center Market competitive landscape is defined by innovation-led strategic activities, capacity addition, and sustainability. Market leaders such as Equinix and Digital Realty are pushing aggressively into new markets through acquisitions—Equinix's $10 billion buyout of CoreSite in 2021 being a case in point, increasing its coverage in important US markets.

At the same time, businesses are pouring large sums into green data centers to address ESG objectives; Google's commitment to running solely on carbon-free energy by 2030 is indicative of this move toward sustainability as a competitive advantage.

Further, collaborations with cloud providers are critical—Microsoft Azure and AWS partnerships with data center operators extend service integration and edge computing capabilities. Tailoring of colocation products and sophisticated cooling technologies also distinguish market leaders. Scalability, energy efficiency, and customer-oriented services are guaranteed through these focused approaches, allowing major players to retain their leadership in the face of increasing demand and changing technological needs.

Emerging Trends Shaping the Future of Data Center

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected using Primary Exploratory Research backed by robust Secondary Desk research.

According to SkyQuest analysis, The Global Data Center Market is poised to experience tremendous growth.

This growth is boosted by the mass introduction of cloud computing, edge technologies, and IoT devices, propelling need for scalable and effective data storage. BFSI, healthcare, and e-commerce industries are investing hugely in data centers to enable their digital transformation, and this justifies the resilience and critical presence of the market within the world economy. Cloud adoption is still a leading influence, with 60% of business firms utilizing cloud applications and 94% of big companies globally utilizing cloud platforms for enhanced scalability and cost savings. Edge computing is also transforming the data center ecosystem by providing quicker data processing and lower latency, particularly for IoT, autonomous systems, and smart city uses. Asia-Pacific, Latin America, and Middle East emerging markets present huge growth potential with increasing internet penetration, urbanization, and favorable government policies. Water consumption limitations, scalability constraints, and intensifying cybersecurity risks necessitate continuous innovation and co-operation to provide sustainable market growth.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 505.8 Billion |

| Market size value in 2033 | USD 1348.35 Billion |

| Growth Rate | 11.51% |

| Base year | 2024 |

| Forecast period | 2026-2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Data Center Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Data Center Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Data Center Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Data Center Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Global Data Center market size was valued at USD 505.8 Billion in 2024 and is poised to grow from USD 564.02 Billion in 2025 to USD 1348.35 Billion by 2033, growing at a CAGR of 11.51% in the forecast period (2026–2033).

The Global Data Center Market competitive landscape is defined by innovation-led strategic activities, capacity addition, and sustainability. Market leaders such as Equinix and Digital Realty are pushing aggressively into new markets through acquisitions—Equinix's $10 billion buyout of CoreSite in 2021 being a case in point, increasing its coverage in important US markets. 'Microsoft Corp. (US)', 'Amazon.com, Inc. (AWS) (US)', 'Alphabet Inc. (Google) (US)', 'Equinix, Inc. (US)', 'Digital Realty (US)', 'NTT DATA Corp (Japan)', 'IBM Corp. (US)', 'Oracle Corporation (US)', 'American Tower (CoreSite) (US)', 'KDDI Corporation (Japan)', 'CyrusOne (US)', 'China Telecom (China)', 'Web Werks (India)', 'e& (UAE)', 'NEXTDC (Australia)', 'Cologix (US)', 'DataBank (US)', 'Vocus Group (Australia)', 'Netrality Data Centers (US)', 'Sify Technologies Limited (India)'

The data center market worldwide is transforming very quickly due to the fast-growing adoption of cloud computing, Internet of Things (IoT), artificial intelligence (AI), machine learning (ML), and the use of advanced wireless technologies such as 5G and upcoming 6G networks. These technology advancements are transforming the data center ecosystem, changing the very core of business operations, supporting innovation, and catalyzing unprecedented market growth. Perhaps the most powerful driver of this change is increasing demand for AI functionality, which is redefining the power consumption patterns of data centers. Our research indicates AI-related power demand will grow around 200 TWh during the period from 2024 to 2030, with AI contributing around 20% of all data center power usage by the end of the decade. Transaction numbers and investor appetite for data centers continue to be strong, fueled by increasing digital infrastructure demands and the critical significance of cloud services.

Rising Adoption of Prefabricated and Modular (PFM) Data Centers Amidst Supply Chain Constraints: Growing Use of Prefabricated and Modular (PFM) Data Centers in the Face of Supply Chain Restrictions: With the increasing trend of building prefabricated and modular (PFM) data centers, one of the prominent supply side trend for the Global Data Center Market. This strategy is fueled by the increasing need for new data centers, which generates substantial investment prospects in the highly fragmented PFM market. In 2024, hyperscalers alone spent about $10 billion to increase capacity, with the investment growing more than 4% a year until 2032. These plans are, however, threatened by a constrained labor market, unstable commodity prices, high inflation, and tight supply chains, and so far, a 7-8% rise in overall costs of capital for building projects since 2022. Nonetheless, the PFM segment is a potential sector for investment and innovation in the data center space.

North America dominates the world data center market with its mature digital infrastructure, high internet penetration rate, and extensive network of large cloud service providers like Amazon Web Services, Microsoft Azure, and Google Cloud. Early adoption of new technologies like AI, IoT, and big data analytics in the region also propels the demand for data storage and processing capacity. Moreover, massive investments in hyperscale and edge data centers, especially in the United States, combined with encouraging regulatory policies and strong energy availability, increase the competitiveness of the region. Increased enterprise cloud migration and demand for colocation services also ensure North America's leadership position.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients