Report ID: SQMIG30I2497

Report ID: SQMIG30I2497

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG30I2497 |

Region:

Global |

Published Date: May, 2025

Pages:

199

|Tables:

95

|Figures:

76

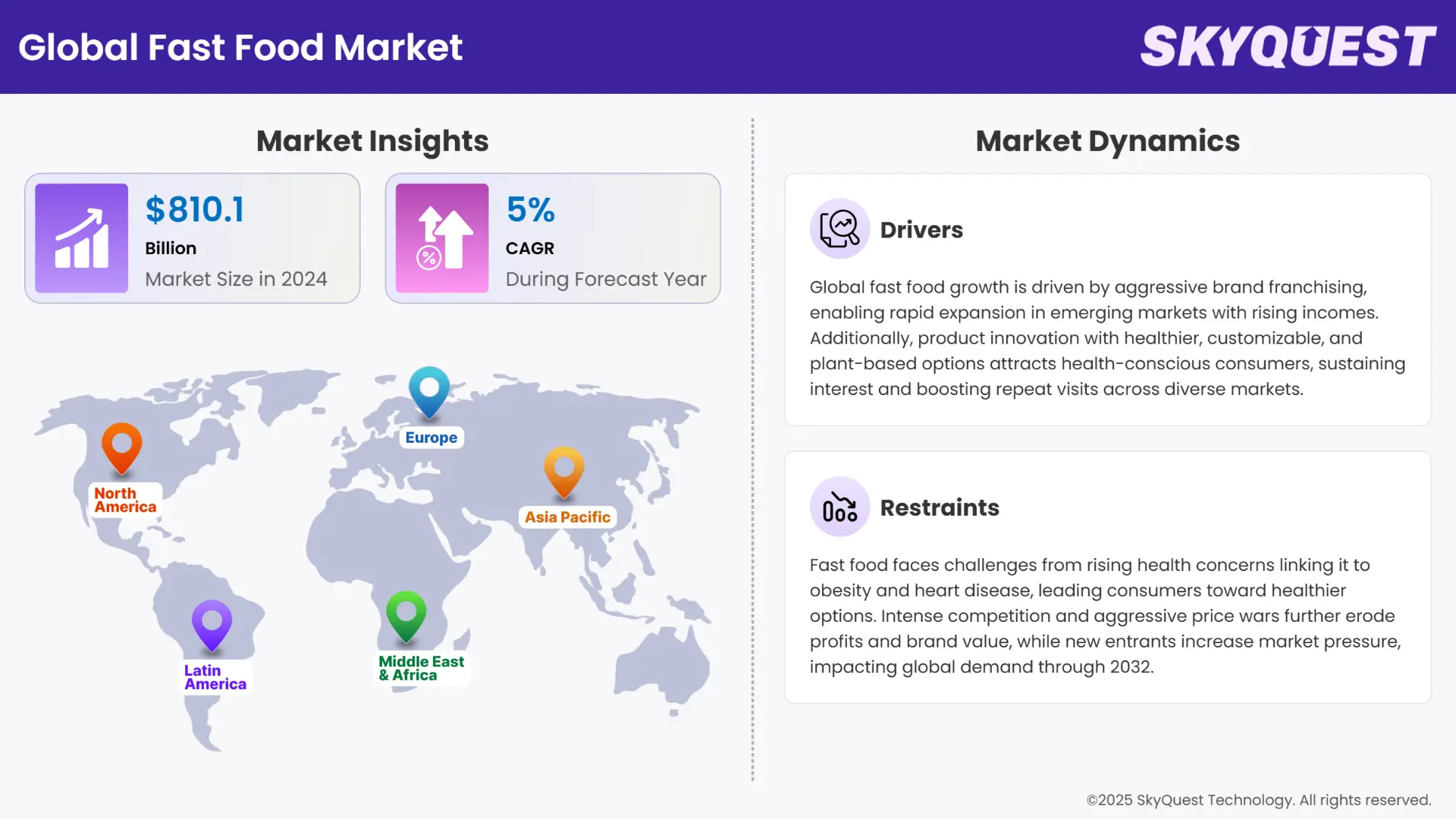

Global Fast Food Market Size was valued at USD 810.1 Billion in 2024 and is poised to grow from USD 850.61 Billion in 2025 to USD 1256.73 Billion by 2033, growing at a CAGR of 5% in the forecast period (2026–2033).

Rapid urbanization, changing consumer lifestyles, expansion of online ordering and delivery platforms, growing youth population, expansion of global fast-food franchises, and product innovation are driving up the demand for fast food through 2032.

The fast food market growth is majorly driven by increasing urbanization and busier consumer lifestyles, as urban dwellers often seek quick, affordable, and convenient meal options. Food delivery apps and digital ordering platforms have improved consumer accessibility to fast food. Expansion of global fast food brands through franchising and product innovation are also helping keep people hooked on fast food. The integration of technology in operations such as self-service kiosks, mobile apps, AI-powered drive-thrus, and kitchen automation is helping improve customer experience and efficiency for fast food brands. Younger generations are key consumers in the fast food space due to their demand for convenience, affordability, and variety.

On the contrary, negative perception and health concerns associated with fast food consumption, intense market competition, price wars, regulatory compliance challenges, and environmental concerns are anticipated to slow down fast food market penetration across the study period and beyond.

How are AI and Automation Impacting the Fast food Industry?

Fast food brands are leveraging artificial intelligence (AI) and automation to streamline operations, enhance customer experience, and reduce labor dependency. AI powers chatbots for online orders, predictive analytics for inventory management, and voice-activated drive-thrus. Automation is used in food preparation, self-service kiosks, and robotic kitchens. These technologies improve order accuracy, speed, and operational efficiency while reducing overhead costs.

As labor shortages and demand for contactless service rise, AI and automation are transforming how fast food is produced, ordered, and delivered, reshaping the future of quick-service dining.

To get more insights on this market click here to Request a Free Sample Report

Global Fast Food Market is segmented by By Product Type, By Service Type, By Age Group, By Cuisine, By Ingredient Type, By Price Range, By Distribution Channel and region. Based on By Product Type, the market is segmented into Burgers & Sandwiches, Pizza & Pasta, Chicken & Seafood, Bakery & Confectionery, Beverages and Others. Based on By Service Type, the market is segmented into Quick Service Restaurants (QSRs), Fast Casual Restaurants, Cafés & Bakey Chains, Street Vendors & Food Trucks and Others. Based on By Age Group, the market is segmented into Below 18 Years, 18–35 Years, 36–50 Years and Above 50 Years. Based on By Cuisine, the market is segmented into American, Italian, Chinese, Indian, Mexican, Middle Eastern and Others. Based on By Ingredient Type, the market is segmented into Vegetarian, Non-Vegetarian, Vegan/Plant-Based Alternatives and Gluten-Free Options. Based on By Price Range, the market is segmented into Low-Cost, Mid-Range and Premium. Based on By Distribution Channel, the market is segmented into Dine-In, Takeaway, Online Food Delivery Platforms and Drive-Thru. Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

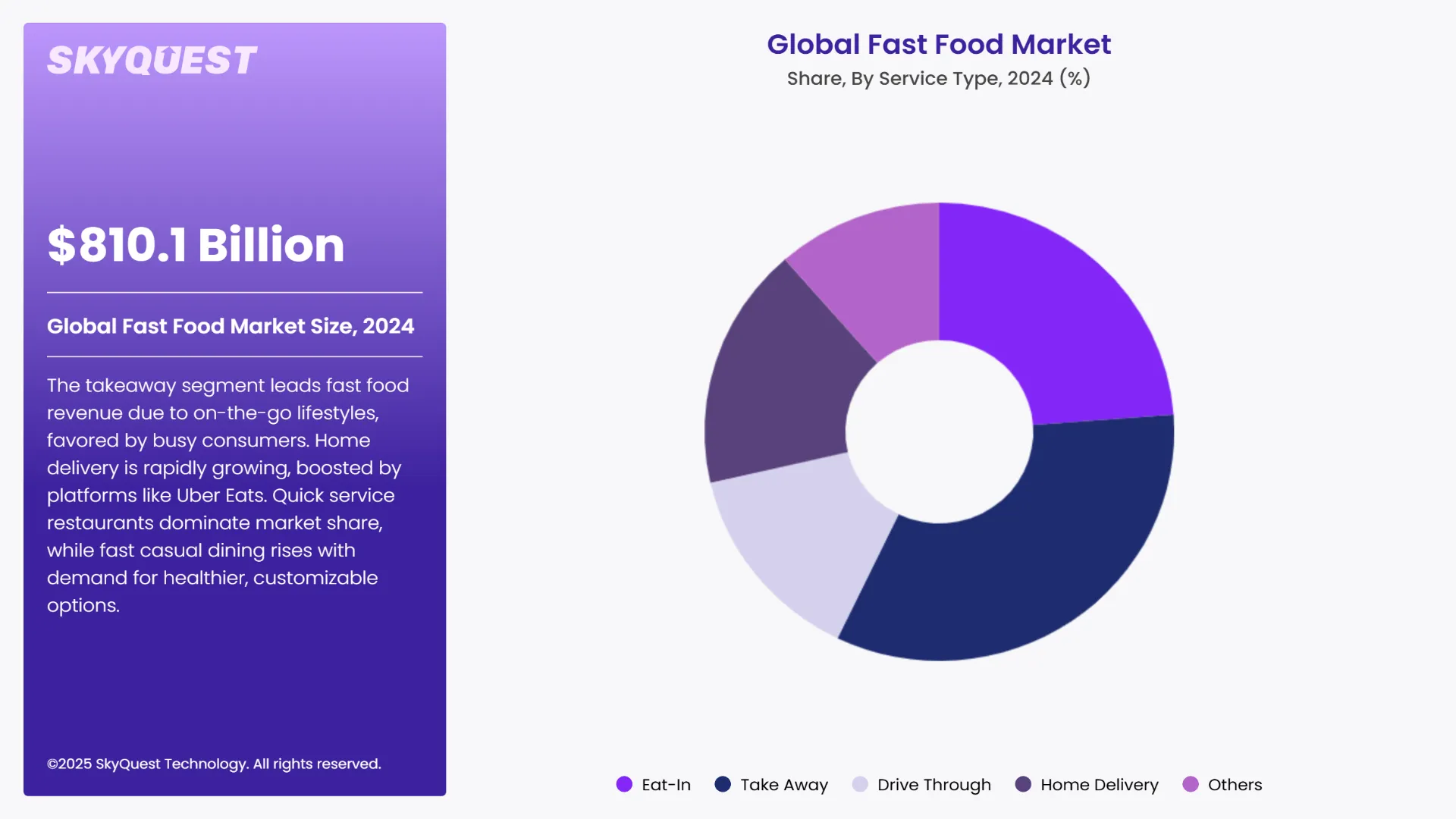

The takeaway segment is slated to spearhead the global fast food market revenue generation potential in the future. Growing adoption of on-the-go lifestyle and alignment of take away with these preferences are helping this segment hold sway over others. Working professionals, students, and busy consumers seeking quick meals are more likely to opt for fast food takeaways around the world.

Meanwhile, the demand for the home delivery segment is slated to rise at a robust pace across the study period. Growing availability of food delivery platforms like Uber Eats, DoorDash, and in-house delivery systems are helping this segment generate new opportunities.

The quick service restaurants (QSR) segment is forecasted to hold a major chunk of the global fast food market share going forward. Efficient service models, global presence, and standardized menus are helping this segment emerge as a key distributor of fast food. QSRs benefit from strong brand recognition, franchising, and widespread availability across urban and suburban regions.

On the other hand, the demand for fast food from fast casual restaurants is slated to rise at a notable pace as per this fast food market analysis. Growing consumer demand for healthier, customizable, and higher-quality dining experiences is helping generate new business scope via this segment.

To get detailed segments analysis, Request a Free Sample Report

High consumer spending potential and deep-rooted fast food culture in North America makes it the largest fast food market share in the world. High brand loyalty, widespread franchise networks, and extensive drive-thru services are further supporting the consumption of fast food in this region. Quick adoption of app-based ordering, loyalty programs, and AI-powered services by fast food brands in the region has also helped them maximize their sales potential in North America. Strong disposable income supported by robust economy and eating-out habits help keep North America at the top of global fast food market demand.

United States Fast Food Market

Presence of a long-established culture of convenience dining and innovation has positioned the United States as a global leader in fast food consumption. Home to major fast food brands such as McDonald’s, Burger King, and Wendy’s, the country has a deep-rooted connection with fast food. Availability of multiple drive-thrus, 24-hour service, and loyalty apps further boost the sales of fast food in the United States. A thriving and expanding quick-service franchise network further cements the dominance of the country in not just this region but on a global level as well.

Canada Fast Food Market

The demand for fast food in Canada is backed by strong brand loyalty, diverse cuisines, and high urban concentration. Tim Hortons, McDonald’s, and A&W are the top fast food companies in the country with growing interest among other international fast food chains. Canada’s high disposable income, tech-savvy population, and cultural openness make it a lucrative market for both domestic and international fast food chains targeting health-conscious and time-strapped consumers.

The Asia Pacific region emerges as the fastest growing fast food market on the back of rising urbanization, growing middle-class populations, and Western lifestyle adoption. Rapid franchise expansion of local as well as global fast food brands in Asian countries is also creating new opportunities going forward. Consumers, particularly the youth, seek affordable, trendy, and convenient dining options. Localization of menus with regional flavors is an indispensable trend for all fast food companies operating in the Asia Pacific. Changing work-life dynamics and expansion of middle class population fuel dining-out habits, which in turn boost fast food consumption.

Japan Fast Food Market

Blending Western chains with local giants like MOS Burger and Sukiya is the definition of fast food industry in Japan. High service standards, unique menu localization, and efficiency are forecasted to be key factors shaping the demand for fast food in the country. Vending machines, contactless payments, and automation are defining features of fast food joints operating in Japan. The country’s fast food market emphasizes presentation, speed, and quality, while maintaining strong brand loyalty.

South Korea Fast Food Market

Digital culture plays a pivotal role in augmenting the fast food market demand in South Korea. Local fast food brands such as Lotteria and Mom’s Touch coexist with international brands such as McDonald’s, thereby offering multiple opportunities for all companies. The youth population drives demand for trendy, shareable meals and fusion menus. Social media and influencers heavily impact consumption patterns. Adoption of AI-powered kiosks and robotic kitchens is highly popular in the country owing to its tech-forward consumer base.

Rise of digital food delivery platforms and demand for quick and affordable dining are helping bolster the consumption of fast food in Europe. Demand for plant-based fast-food alternatives and adoption of sustainable packaging are expected to be highly popular trends among fast food brands operating in this region. Regulatory frameworks ensure food quality and labeling standards. Despite saturation in some areas, innovation and evolving dietary preferences are driving consistent growth.

Germany Fast Food Market

The fast food industry of Germany can be characterized as mature but growing. Health-conscious consumers drive demand for organic, vegetarian, and eco-friendly menu options. Regulatory frameworks influence nutritional transparency and sustainability practices. Sausages, kebabs, burgers, and sandwiches are some of the sought-after fast food items among German consumers. While traditional values persist, consumer openness to innovation ensures continued growth and modernization of the fast food space in the country.

United Kingdom Fast Food Market

Urbanization, multicultural influences, and digital adoption are influencing the fast food market in the United Kingdom. Greggs, McDonald’s, and Pret A Manger are the top fast food providers in the country. British consumers favor affordability, speed, and variety when it comes to fast food. Vegan options, international street food, and British staples are expected to be highly popular among fast food brands operating in the country. Growing vegan population also plays a crucial role in changing fast food consumption patterns of the United Kingdom.

France Fast Food Market

Demand for fast food items such as burgers, sandwiches, and bakery items is high in France. The fast food market of the country focuses on balancing traditional culinary pride with rising fast food demand. McDonald’s, Quick, and Brioche Dorée are key brands leading sales of fast food in the country. Consumers expect quality ingredients, ethical sourcing, and elegant presentation, even in fast food. France’s culinary expectations have pushed fast food chains to elevate menu offerings, blending speed with sophistication in a market increasingly open to convenience.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Global Brand Expansion and Franchising

Product Innovation and Healthier Menu Options

Rising Health Concerns and Negative Perceptions

Intense Market Competition and Price Wars

Request Free Customization of this report to help us to meet your business objectives.

Fast food providers should invest in product innovation and launch healthier menus to attract more customers. Localization of menus and use of regional ingredients and flavors can help companies improve their global expansion efforts as per this fast food market analysis.

Product innovation remains central for new companies looking to compete with established brands. Startups should focus on offering unique fast food combinations and leverage technologies to stay competitive. Here are a few startups that could change the trajectory of fast food industry growth in the long run.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected by means of Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, rapidly increasing urbanization and global expansion of fast food franchises are slated to primarily drive the demand for fast food going forward. However, price wars, health concerns associated with fast food consumption, and intense market competition are expected to slow down the adoption of fast food in the future. North America is forecasted to emerge as the leading market for fast food providers owing to high consumer spending potential for convenience and an established fast food culture. Incorporation of sustainability and introduction of plant-based and flexitarian menus are key trends driving the fast food sector in the long run.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 810.1 Billion |

| Market size value in 2033 | USD 1256.73 Billion |

| Growth Rate | 5% |

| Base year | 2024 |

| Forecast period | 2026–2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Fast Food Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Fast Food Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Fast Food Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Fast Food Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Global Fast Food Market Size was valued at USD 810.1 Billion in 2024 and is poised to grow from USD 850.61 Billion in 2025 to USD 1256.73 Billion by 2033, growing at a CAGR of 5% in the forecast period (2026–2033).

McDonald's Corporation, The Wendy’s Company, Starbucks Corporation, Chipotle Mexican Grill, Inc., Papa John’s International, Inc., Jack in the Box Inc., Yum! Brands, Inc., Restaurant Brands International (RBI), Inspire Brands, Subway, Chick-fil-A, In-N-Out Burger, Five Guys Enterprises, LLC, Company, Mixue (Mixue Bingcheng), Domino’s Pizza, Panda Express, Luckin Coffee, Jollibee, Herfy

The key driver of the fast food market is the rising demand for convenient, quick, and affordable meal options, fueled by busy lifestyles, urbanization, increasing disposable incomes, and the growing popularity of online food delivery services.

A key market trend in the fast food market is the increasing focus on healthier and customized menu options, including plant-based, low-calorie, and organic offerings, driven by rising health awareness and changing consumer preferences.

North America accounted for the largest share in the fast food market, driven by high consumer spending, busy lifestyles, widespread presence of global fast food chains, and strong adoption of online ordering and delivery services.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients