Report ID: SQMIG35H2173

Report ID: SQMIG35H2173

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG35H2173 |

Region:

Global |

Published Date: August, 2025

Pages:

194

|Tables:

123

|Figures:

71

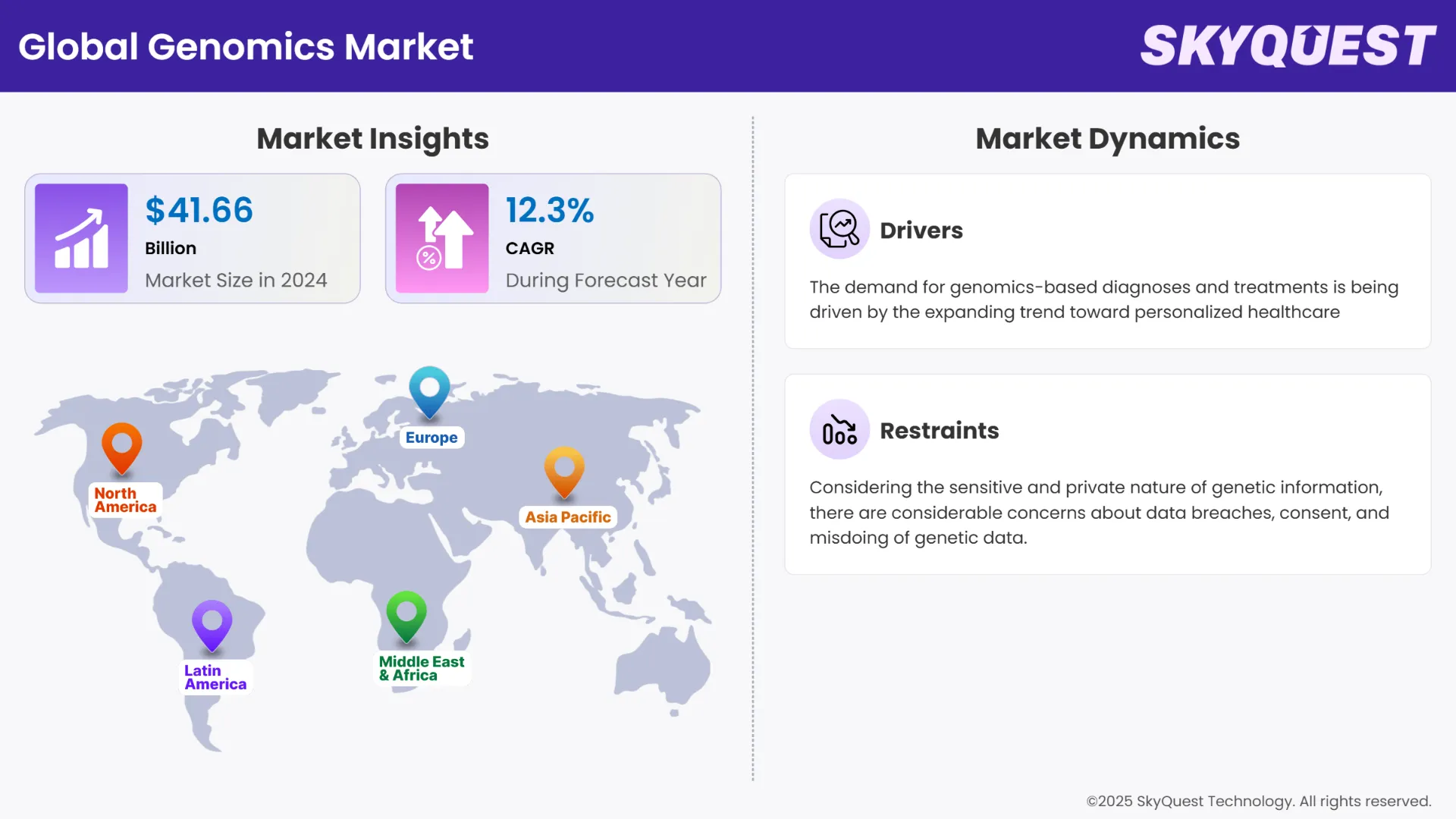

Global Genomics Market size was valued at USD 41.66 Billion in 2024 and is poised to grow from USD 46.78 Billion in 2025 to USD 118.34 Billion by 2033, growing at a CAGR of 12.3% in the forecast period (2026–2033).

The increasing incidence of viral and genetic disorders that require genomic sequencing, along with the expanding application of next-generation sequencing (NGS) in chronic diseases like cancer to detect genetic abnormalities, are the main factors propelling the global genomics market growth. Additionally, the advancement of cutting-edge genomics technologies is enhancing both research and applications. The need for genomically-based customized treatment plans is also being fueled by the improved patient outcomes brought about by the growing use of personalized medicine.

The integration of artificial intelligence and machine learning transforming the global genomics market outlook is essential due to the intricacy of data sets and the expanding number of biological techniques, such as DNA sequencing. Using computational devices with AL/ML, important information is simpler to manage, extract, and analyze. Researchers are using this integration to organize projects to help with the source of the disease, tracking the state of cancer, and inheritance to accurately diagnose genetic disorders, classification of potential primary causes of cancer, and develop competencies with gene editing. AI and ML help develop predictions and identify latent patterns in genetic data. Scientists are also making recommendations to prepare for the future evolution of various diseases to improve public health.

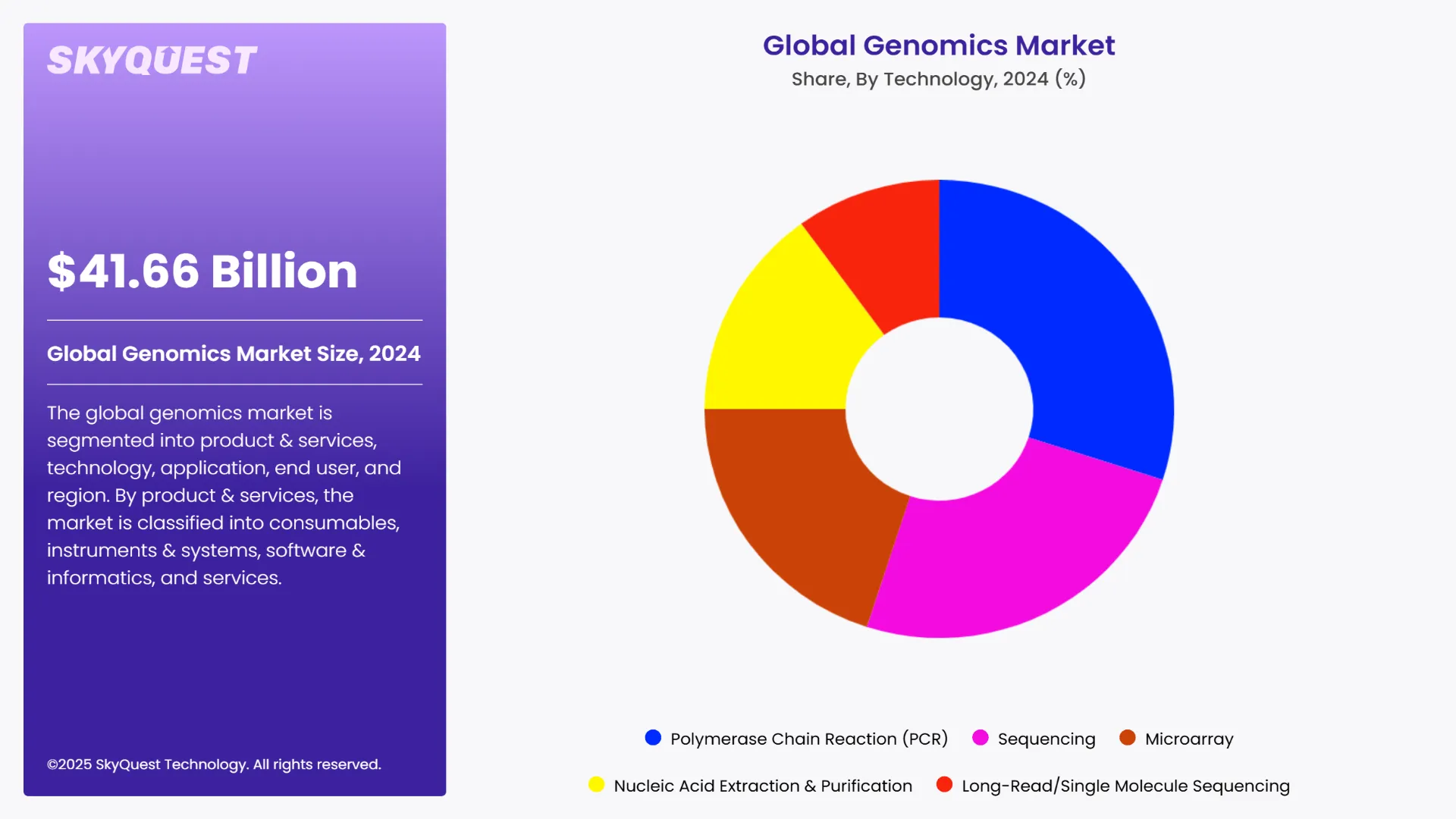

To get more insights on this market click here to Request a Free Sample Report

The global genomics market is segmented into product & services, technology, application, end user, and region. By product & services, the market is classified into consumables, instruments & systems, software & informatics, and services. Depending on technology, it is divided into polymerase chain reaction (PCR), sequencing, long-read/single molecule sequencing, microarray, and nucleic acid extraction & purification. According to the application, the market is categorized into diagnostics, drug discovery & development, precision/personalized medicine, agriculture & animal genomics, and forensics & ancestry. As per end user, it is segregated into hospitals & clinics, diagnostic & reference laboratories, research institutes & centers, and pharmaceutical & biotechnology companies. Regionally, it is analyzed across North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

As per the 2024 genomics market analysis, the most popular method in the market is still polymerase chain reaction (PCR), which will generate 35.2% of global sales. It is essential for pathogen identification and targeted diagnostics due to its low cost and quick results. For example, the U.S. CDC strengthened its vital role in public health surveillance in 2024 by increasing its use of PCR for real-time tracking of new infectious illnesses.

There is significant and rapid compound annual growth (CAGR) of 17.5% between 2025 to 2032 associated with the rapidly growing implementation of sequencing platforms in routine clinical care. In 2025, hospitals across Germany, started using Illumina's whole genome sequencing (WGS) technology for comprehensive cancer profiling, it is an example that highlights the growing use of sequencing technology in individualized treatment planning within the realm of precision medicine.

As per the 2024 genomics market forecast, the diagnostics had a 38.1% share of the market revenues due to its widespread use in diagnosing infectious hierarchies, genetic carrier screening, and oncology. For example, in 2024, Roche promoted lung cancer and breast cancer screening to patients across Europe using its diagnostic utility validated by next generation sequencing-based technologies. Hospitals operate and implement genomics-based pathogen panels globally as a response to increased incidence of antibiotic-resistant infections, with some panels allowing real-time tracking.

The precision/personalized medicine segment is growing at a 20.1% CAGR as hospitals increasingly use genetics to tailor treatments for patients. The Mayo Clinic and NHS England expanded their genomic-guided therapy (GGT) programs in cardiology and oncology to support treatment effectiveness and patient outcomes by allowing physicians to customize prescriptions according to genetic markers.

To get detailed segments analysis, Request a Free Sample Report

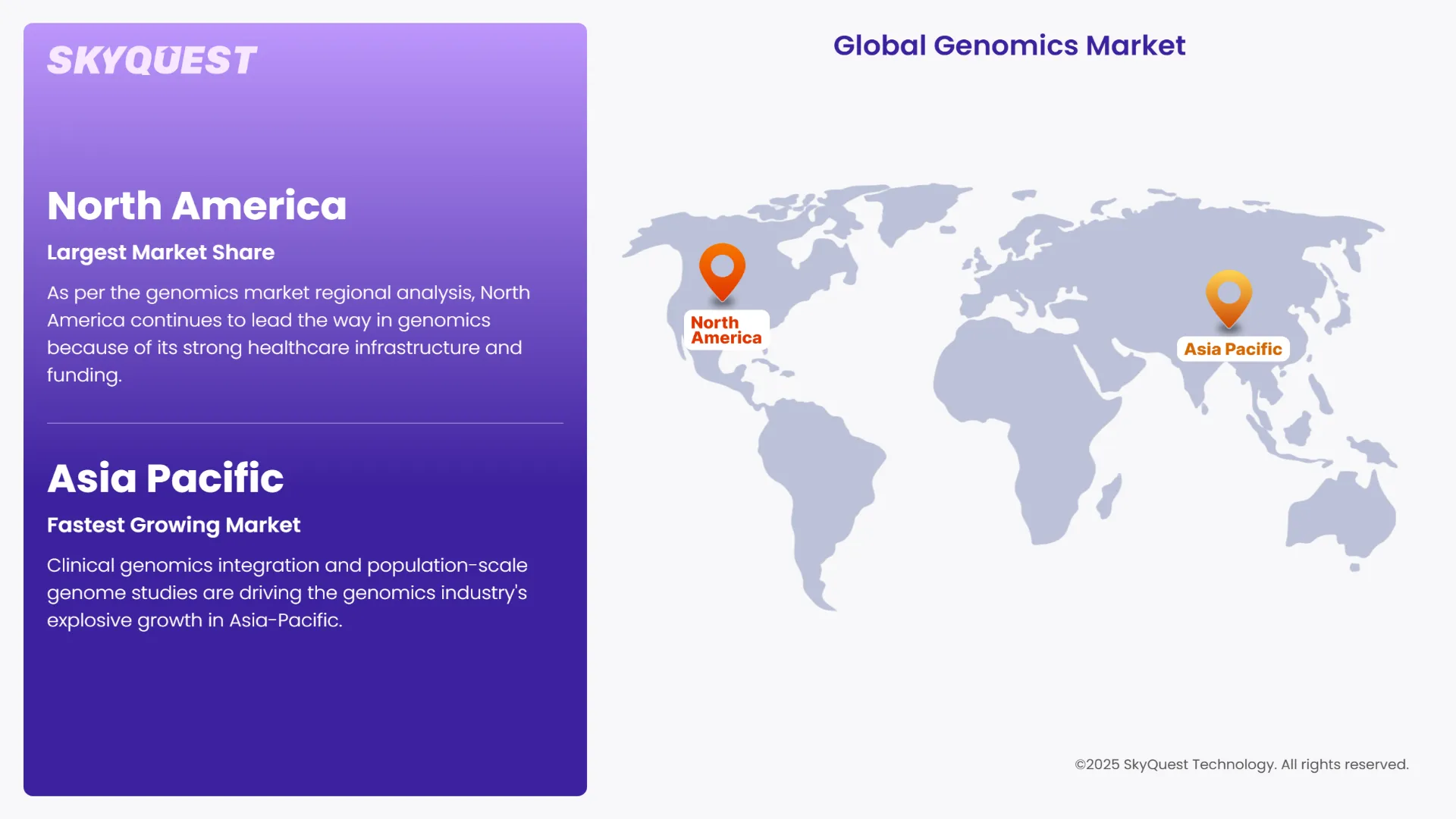

As per the genomics market regional analysis, North America continues to lead the way in genomics because of its strong healthcare infrastructure and funding. About USD 500 million was set aside for genomic medicine research by the U.S. National Human Genome Research Institute in 2024. Through 2025, strategic partnerships will persist, such as Illumina's clinical whole-genome sequencing partnership with top U.S. hospitals. Innovation and commercial adoption are fueled by the region's robust biotech ecosystem and quick adoption of precision medicine.

U.S. Genomics Market

The integration of personalized medicine and diagnostics is critical to the success of the genomics sector in the United States. GRAIL's multi-cancer early detection test was introduced in more than 50 hospital systems in 2024. Whole-genome sequencing for rare disorders was first covered by major insurance companies. NIH's All of Us initiative, which promotes data-driven precision health, will reach over 1.3 million people by 2025. Commercial adoption has also accelerated due to the FDA's quick approval process for genetic tests.

Canada Genomics Market

The genomics market share in Canada is expanding because of substantial public funding. In 2024, Genome Canada allocated USD 91 million to fund research in fields such as Indigenous health, cancer, and climate change. To increase accessibility and AI integration, the nation started a national genomics data strategy in 2025. These programs are making Canada a regional center for innovation by creating demand in the healthcare and agricultural industries.

Clinical genomics integration and population-scale genome studies are driving the genomics industry's explosive growth in Asia-Pacific. Precision healthcare was improved in 2024 by regional programs such as China's Genomics Plan and GenomeAsia100K. A CAGR of more than 17% is a result of increased infrastructure, growing private investment, and an increase in the burden of chronic diseases. The number of genomics tests is expected to rise faster in Asia than in Europe.

China Genomics Market

The Chinese genomics industry is being driven by an aggressive industrial policy and state support. To provide rare disease and neonatal screening, BGI Genomics extended its sequencing operations to more than 200 hospitals in 2024. The goal of China's 14th Five-Year Plan was to incorporate genetics into the nation's healthcare system. Two significant factors improving healthcare outcomes are the quick development of AI-based diagnostics and expanding biodata banks.

India Genomics Market

India is making strides in genomics through government initiatives and innovative startup projects. To create a national genetic database, the Indian Genome Project sequenced more than 20,000 people in 2024. Tata-backed 1MG introduced reasonably priced genomics testing for hereditary illnesses and cancer in 2025. India is now positioned to become a global center for affordable genomic services due to the rise in chronic illnesses and the integration of digital health.

Through public-private partnerships and cross-border healthcare initiatives, Europe promotes genomics. Countries joined the 1+ Million Genomes campaign, which aims to share genetic data for research and therapeutic applications. The European Health Data Space seeks to make genomic data more accessible for precision medicine by 2025. Horizon Europe funding is driving market expansion in the pharmaceutical and diagnostics industries.

UK Genomics Market

The growth of Genomics England has kept the UK at the forefront. The NHS started incorporating whole-genome sequencing into routine cancer and rare disease patient care in 2024. The government set aside Euro 175 million for infrastructure and additional research. The UK's position as a national genomics policy model will be further cemented in 2025 with new collaborations with AI companies aiming to enhance sequencing interpretation.

France Genomics Market

The genomics industry is continuing to grow with the support of the French government's Plan France Médecine Génomique 2025. A significant breakthrough was made in 2024 when the Paris and Marseille sequencing centers processed over 30,000 patients. The SeqOIA collaboration enhanced the integration of rare diseases and cancer in the real world. Clinical genomics adoption in public hospitals and research facilities will have further accelerated by 2025 as a result of regulatory changes that promote AI and data sharing.

Germany Genomics Market

AI is driving the German genomics market increasingly, particularly in oncology diagnosis. Siemens Healthineers and BioNTech collaborated in 2024 to create AI-powered tools for detecting cancer mutations. Euro 150 million was given for genetic medicine research by the German Federal Ministry of Education and Research. By 2025, it is anticipated that the growing use of data-centric medications and legal frameworks for managing genetic data will increase market potential.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Growing Need for Customized Care

Genome Sequencing is Becoming Less Expensive

Ethics and Data Privacy Issues

Intricacy of Interpreting Data

Request Free Customization of this report to help us to meet your business objectives.

Strategic alliances, mergers and acquisitions, and innovation are prized by major competitors within the highly competitive genomics industry. While Thermo Fisher offers complete lab solutions, Illumina is the leader in sequencing platforms. Companies like Qiagen and Roche utilize companion diagnostics and use NGS to generate value. To tap into new revenue streams, leading genomics market strategies within the market include partnerships with large pharmaceutical companies, cloud-based data analytics, and expanding into consumer and clinical genetics.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected by means of Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, as genomics tools are gaining more traction in population health, personalized medicine, and disease diagnosis, the field seems to be expanding rapidly. More recently, the decreased costs of sequencing, increases in AI applications, and increased consumer interest in genetic knowledge and accessibility through direct-to-consumer genomics and population genomics projects are also driving genomics innovation. However, hurdles remain including the complexity of genomic interpretation and data privacy, and start-ups such as Helix and Verge Genomics are employing AI with exploration and discovery delivered on scalable genomic health platforms. Large corporations are continuing to invest in R&D, cloud and partnerships, around their genomic offerings. As health progresses towards data-centricity, genomics is poised to transform the ways in which public health, therapies, and diagnostics are practiced.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 41.66 Billion |

| Market size value in 2033 | USD 118.34 Billion |

| Growth Rate | 12.3% |

| Base year | 2024 |

| Forecast period | 2026-2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Genomics Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Genomics Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Genomics Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Genomics Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Global Genomics Market size was valued at USD 41.66 Billion in 2024 and is poised to grow from USD 46.78 Billion in 2025 to USD 118.34 Billion by 2033, growing at a CAGR of 12.3% in the forecast period (2026–2033).

Strategic alliances, mergers and acquisitions, and innovation are prized by major competitors within the highly competitive genomics industry. While Thermo Fisher offers complete lab solutions, Illumina is the leader in sequencing platforms. Companies like Qiagen and Roche utilize companion diagnostics and use NGS to generate value. To tap into new revenue streams, leading genomics market strategies within the market include partnerships with large pharmaceutical companies, cloud-based data analytics, and expanding into consumer and clinical genetics. 'SeqOne', 'Thermo Fisher Scientific, Inc.', 'F. Hoffmann-La Roche Ltd.', 'Ultima Genomics, Inc.', 'QIAGEN N.V.', 'Fabric Genomics', 'Bio-Rad Laboratories, Inc.', 'Oxford Nanopore Technologies', 'Pacific Biosciences of California, Inc.', 'GE Healthcare', 'BGI Genomics Co., Ltd.', '23andMe, Inc.', 'Genomic Health (Exact Sciences)', 'Myriad Genetics, Inc.'

The demand for genomics-based diagnoses and treatments is being driven by the expanding trend toward personalized healthcare. By using genomic data to customize medications based on a patient's genetic composition, doctors can improve outcomes in pharmacogenomics, rare diseases, and cancer. The use of genetics in precision medicine is expanding due to initiatives like the NIH's All of Us program and pharmaceutical collaborations with genomic companies.

Artificial intelligence (AI) and machine learning are disrupting genomics by speeding up variant classification, finding patterns, and interpreting data. Companies are not only applying algorithms to find pathogenic mutations, but they are also developing more useful gene-editing techniques and refining predictive modelling. These efforts are opening large scale analyses of genetic data that can be used in a wide range of areas including oncology, diagnosing rare disease, and drug discovery.

As per the genomics market regional analysis, North America continues to lead the way in genomics because of its strong healthcare infrastructure and funding. About USD 500 million was set aside for genomic medicine research by the U.S. National Human Genome Research Institute in 2024. Through 2025, strategic partnerships will persist, such as Illumina's clinical whole-genome sequencing partnership with top U.S. hospitals. Innovation and commercial adoption are fueled by the region's robust biotech ecosystem and quick adoption of precision medicine.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients