Report ID: SQMIG35D2315

Report ID: SQMIG35D2315

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG35D2315 |

Region:

Global |

Published Date: May, 2025

Pages:

196

|Tables:

232

|Figures:

76

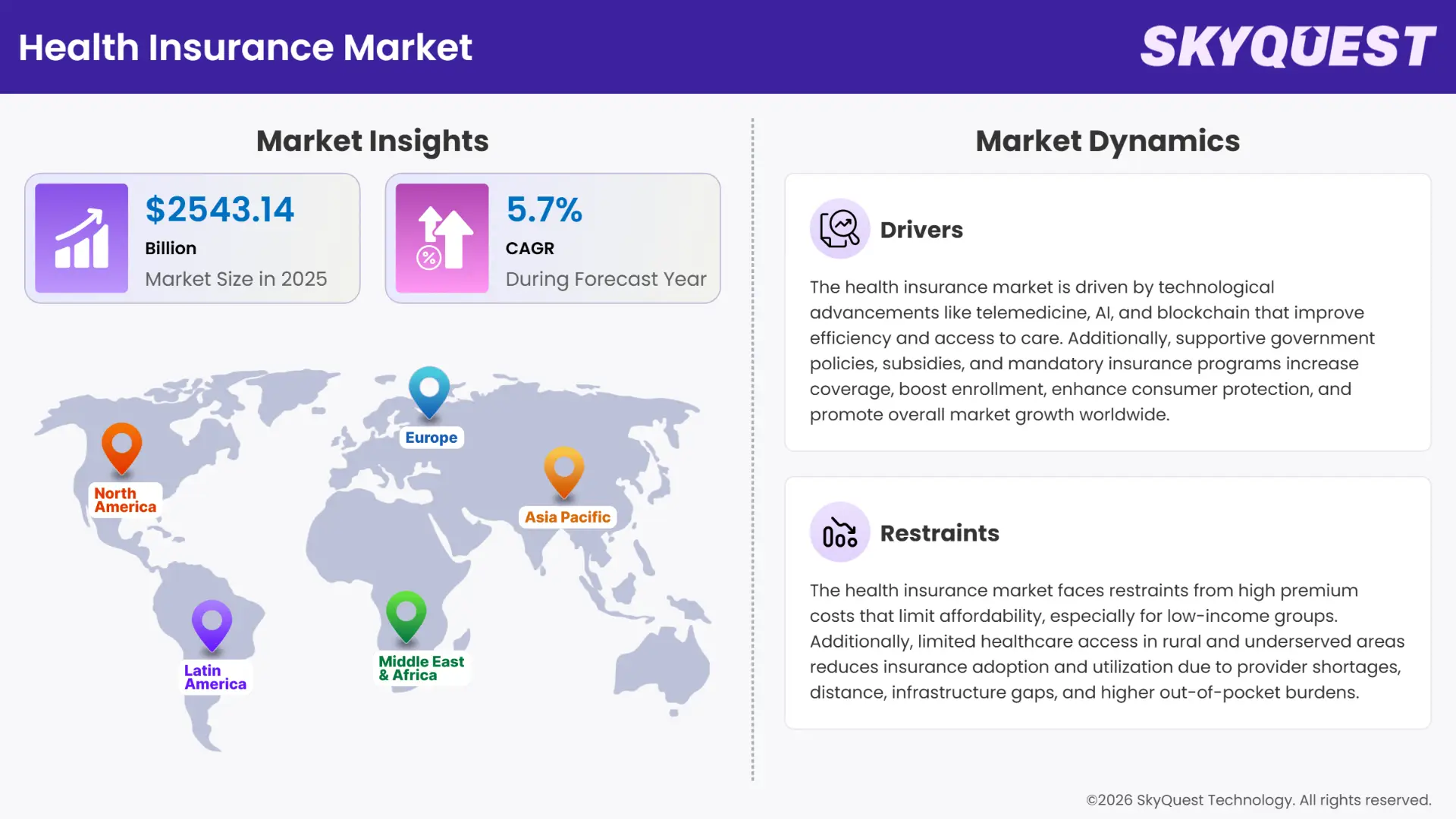

Health Insurance Market size was valued at USD 2406 Billion in 2024 and is poised to grow from USD 2543.14 Billion in 2025 to USD 3962.51 Billion by 2033, growing at a CAGR of 5.7% during the forecast period (2026–2033).

The global healthcare insurance market is growing progressively, fueled by escalating healthcare expenses, growing consciousness of medical cover, and regulations encouraging the uptake of insurance. The industry is shifting towards digitalization, with AI-powered underwriting and telemedicine-enabled plans picking up momentum. Private insurers and government-sponsored programs continue to increase their penetration, with developing economies offering promising growth prospects. The ageing population and incidence of chronic diseases are further fueling demand. Challenges like premium rates being high and claim processing complicating are still prevalent. The healthcare insurance market participants are looking to new-age policy structures, value-based health models, and customer-centric offerings to improve affordability and accessibility.

The global health insurance market is a combination of both public and private systems, where private insurance is supplementary to most nations. Private insurance is supplemental to public health insurance in advanced markets, where public health coverage provides the majority, and additional services are covered by private insurance. Germany, France, the UK, Italy, and Spain have well-established public healthcare, which covers more than 90% of their citizens, with a secondary choice of private insurance. 60-70% of Canadians and Japanese have private insurance for the purpose of paying for non-public services. In the U.S, 65.6% are covered by private health insurance as the main coverage. Lower levels of adoption of private insurance exist in emerging economies such as China, Mexico, and Brazil, whose best placement is Mexico at approximately 2%. South Korea and Chile are dominated by both public and private systems.

Health insurance fraud poses a major constraint on the expansion of the world health insurance market. Misrepresentations, fraudulent claims, and dishonest activities not only result in insurer losses but also affect premiums, market stability as a whole, and consumer confidence. It has emerged as a growing concern for insurers and consumers, necessitating rigorous measures to prevent and counter. For instance, In India, in 2023, it was found that 60% of Indian insurers have experienced a major increase in fraud, especially in life and health insurance. Factors that have contributed are greater digitization (34%), work-from-home (22%), and compromised controls (22%). Types of fraud are data theft, third-party collusion, and mis-selling. Data quality concerns and data protection and privacy challenges are significant. Fraud prevention is a top priority for 40% of insurers, with budgets also being boosted by many to combat these issues.

In addition, survey by the Coalition Against Insurance Fraud (CAIF) in 2021, estimated that Health insurance fraud in the U.S. costs $105 billion each year, with Medicare and Medicaid fraud losses totaling USD 68.7 billion. Some of the popular forms of fraud include providers billing for services that were not rendered or upcoding procedures, and patients' medical identity theft. Covid-19 pandemic saw fraudulent claims on the rise, with reported fraud cases of more than 292,000 and losses of USD 674 million. Anti-fraud efforts have been seen through advanced technology enabling early detection and prevention, with insurers incorporating auto-fraud detection systems to curb financial losses.

How Technology is Transforming the Health Insurance Market?

Artificial Intelligence (AI) and technological innovation are radically changing the health insurance industry by optimizing operational efficiency, risk analysis, and customer satisfaction. Insurers are using AI to leverage predictive analytics to accurately evaluate health risks, allowing for tailored policy pricing and predictive care management. Automation via AI-enabled chatbots and claims processing saves administrative expenses and turnaround times. The latest move is UnitedHealth Group's use of AI solutions to automate processing of medical claims with an eye towards reducing errors and simplifying operations. Such developments are transforming the insurance value chain, saving costs while enhancing delivery of services and health outcomes for policyholders.

To get more insights on this market click here to Request a Free Sample Report

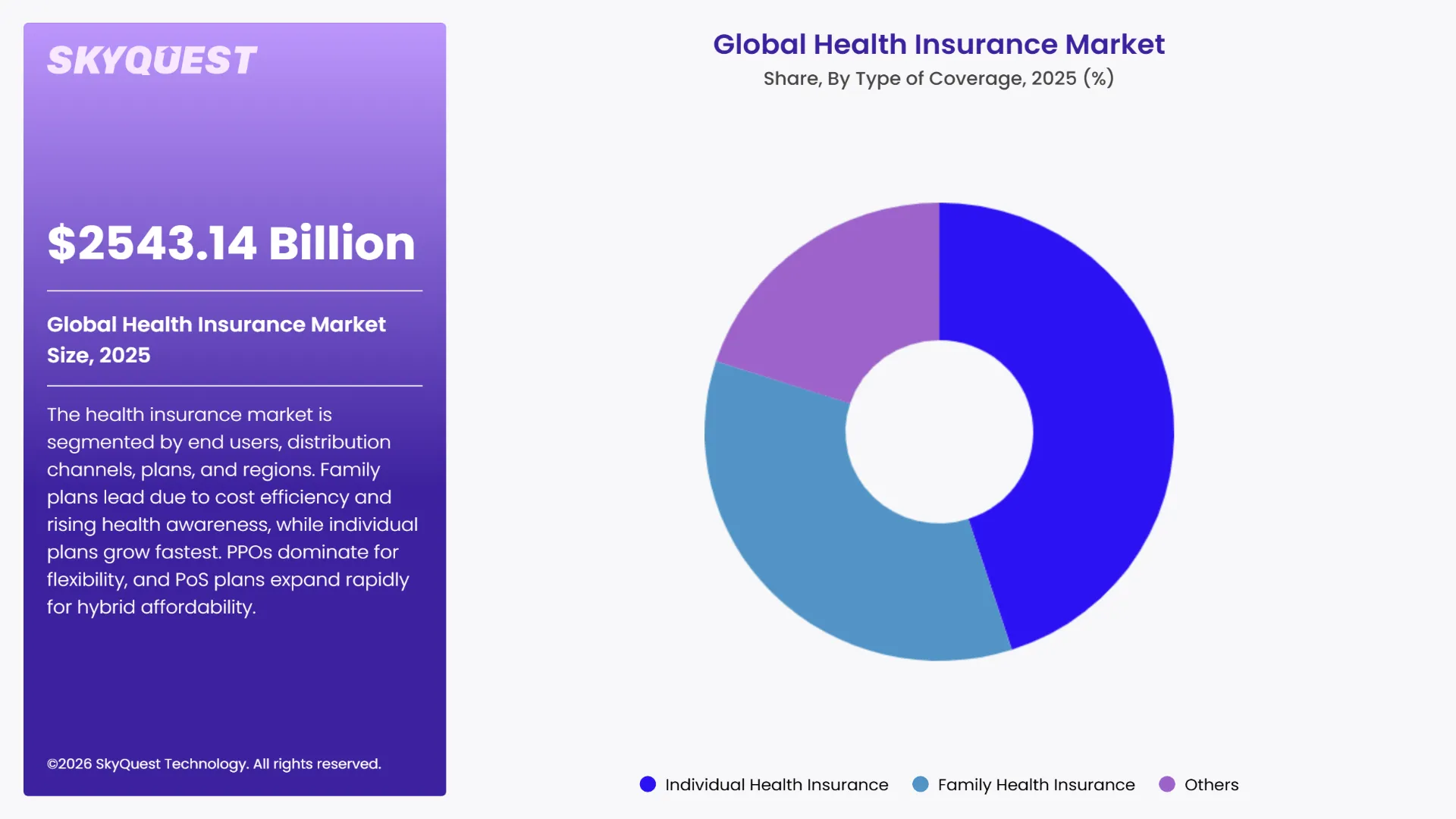

The global health insurance market is segmented by type of coverage, service provider, age group, policy duration, insurance service provider, end user, distribution channel, plans, and geography. The market is categorized by type of coverage on the basis of Individual Health Insurance (platinum, gold, silver, and others), Family Health Insurance (platinum, gold, silver, and others), and Others. On the basis of service provider, the market is categorized by Private Providers, Public Providers, and Others. Based on age group, the market is categorized by Child Health Insurance, and Adults (Young Adults (13-30 Years), Adults (31-60 Years), and Seniors/Elderly (65+ Years)). By policy duration, the health insurance market is segmented into term insurance, and lifetime coverage. On the basis of insurance service provider Medical Insurance, and Critical Illness Insurance.

By end user the market is segmented into Corporates, Individuals, and Others. Based on distribution channel the market is segmented into Direct Sales, Brokers & Agents, Banks, and Others. By plans the market is segmented into Health maintenance organizations (HMOs) Plans, Preferred provider organizations (PPOs) Plans, Exclusive provider organizations (EPOs) Plans, and Point-of-service (POS) Plans. On the basis of geography, the health insurance market is categorized by North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The family health insurance market is leading due to many major reasons such as the growth in the prevalence of chronic diseases, rising healthcare expenditure, and improving disposable income. Family Health Insurance is highly sought after because it offers complete protection to the whole family under one plan, thereby reducing the cost and being convenient. The exhaustive analysis finds that the need for this segment is also propelled by the increased awareness of medical protection against financial emergencies, especially following the COVID-19 pandemic. The pandemic has hugely influenced consumer behavior, with a 50.0% rise in health policy inquiries as individuals understood the requirement of strong health coverage to protect themselves against unexpected medical costs.

The individual health insurance market segment is the fastest growing, driven by rising cost of healthcare and growing incidence of chronic diseases, which have increased the desire for customized health coverage. Individual Health Insurance differs from Family Health Insurance in that it provides customized policies that suit the individual needs of lone policyholders, thus proving to be a popular choice among those with no dependents or those who want more customized cover.

The Preferred Provider Organizations (PPOs) segment dominates the global health insurance market due to the convenience provided by PPOs, enabling the insured party to utilize a vast network of health providers without the necessity for referrals and thereby increasing consumer convenience. The second reason for the preference for PPOs is the low paperwork involved compared to other health plans, leading them to be the preferred option of consumers.

The Point-of-Service (PoS) Plans segment is growing the fastest, led by increasing demand for hybrid products combining the attributes of HMOs and PPOs. Growing awareness in emerging markets, and middle-class populations that are increasingly on the lookout for both affordability and flexibility, is driving PoS plan uptake. Policy support and online enrollment platforms are also driving the health insurance market growth.

To get detailed segments analysis, Request a Free Sample Report

North America dominates the global health insurance market share with strong government support, high healthcare spending, and an established private health insurance industry. The U.S. has seen substantial expansion under the Affordable Care Act (ACA) through public exchanges and Medicaid expansion, and employer plans continue to be a significant source of coverage. The region also enjoys increasing utilization of digital health platforms and telemedicine services, which are being increasingly incorporated into the insurers' portfolio. In Canada, universal care is complemented by private insurance of uncovered services, increasing market depth. In addition, regulatory systems promote competition and innovation, which maximize consumer choice and fuel market growth throughout North America.

US Health Insurance Market

The U.S. health insurance market growth is fueled by the ongoing increase in healthcare expenses, making insurance a necessary financial resource for patients and families. With medical inflation always ahead of general inflation, surgeries, extended treatments, and chronic disease care are no longer affordable without insurance. In addition, the Affordable Care Act (ACA) still takes the center stage in promoting greater insurance penetration by requiring coverage and broadening Medicaid in many states. Employer-sponsored coverage is still a dominating sector, but private insurance marketplaces' expansion has enabled greater competition and innovation, which resulted in personalized plans targeting different income levels. Furthermore, the growing aging population, especially Baby Boomers moving into Medicare, has fueled demand for Medicare Advantage plans, a fast-growing part of private health coverage.

Canada Health Insurance Market

The Canada health insurance market growth is largely driven by gaps in public healthcare coverage, creating strong demand for supplementary private health insurance. Although the nation has a universal healthcare system, not all services are universally covered, such as prescription medication, dental procedures, and vision needs, hence creating a vibrant private insurance market. Employers and individuals turn increasingly to private coverage to fill these gaps, and supplementary health insurance is a key business. In addition, population trends, most notably an aging society, have increased demands for long-term care insurance and critical illness policies. The government's efforts to drive pharmacare reforms will change the dynamics of the health insurance market, likely boosting demand for niche insurance products. Digital innovation in policy issuance and claims processing has also increased access, and insurance offerings have become more appealing to young generations.

The European expansion in the health insurance market is powered by strong regulatory mechanisms, aging populations, and increasing healthcare spending. Progs such as the European Health Union and the EU4Health programme, which provide more than USD 5 billion to reinforce health systems after COVID-19, are accelerating insurance demand. The region's transition towards digital health solutions, such as e-prescriptions and cross-border patient data exchange, has further increased the breadth of coverage and reach. Germany and France are requiring health insurance of all residents, while public-private partnerships and broader coverage for chronic and mental illness are further driving health insurance market penetration and insurer involvement.

Germany Health Insurance Market

The Germany's health insurance market enjoys a well-developed dual system of statutory and private health insurance, promoting competition and innovation. Statutory health insurance (Gesetzliche Krankenversicherung or GKV) is compulsory for the vast majority of the population, but high-income earners and the self-employed increasingly choose private health insurance (Private Krankenversicherung or PKV) because of its better cover, including quicker medical appointments and specialist treatments.

The growth of digital health programs, such as electronic health records (EHR) and telemedicine adoption, has contributed even further to health insurance market growth. Moreover, government-supported reforms, like an increase in coverage for digital therapeutics and mental health therapies, have boosted consumer dependence on insurance. Insurance demand for long-term care is also on the increase due to the very fast aging of the German population, opening up new business opportunities for insurers.

France Health Insurance Market

The France health insurance market is rising because of the development of complementary insurance (mutuelles) complementing the universal healthcare system in the country. Although the public system provides an abundance of healthcare coverage, out-of-pocket payments for specialized treatments, co-payments, and non-reimbursed medication have triggered the need for private insurance. Recent regulatory reforms, including the 100% Santé reform, designed to enhance access to dental, optical, and hearing services, have amplified the complementors' role. Corporate-sponsored health insurance for employees has also been enforced, adding to the market size. The rising incidence of chronic diseases, combined with growing government incentives for private health plans to include alternative treatments and telemedicine services, has fueled innovation in the industry.

UK Health Insurance Market

The UK health insurance market is expanding as a result of mounting pressure on the National Health Service (NHS), making most people and employers go for private insurance for quicker access to treatment. The NHS treatment backlog, fueled by the COVID-19 pandemic, has encouraged people to opt for private insurance for quicker access to specialist appointments and elective procedures. In addition, corporate medical coverage has become more popular as companies focus on employee health to minimize absence and enhance productivity. Increased digital healthcare offerings and AI-based diagnostics have also encouraged the introduction of novel policies by insurers that incorporate virtual care, thus making private medical insurance more attractive. With Brexit changing healthcare workforce, there is also greater pressure on public services, which justifies alternative insurance options.

Asia Pacific is set for forward-looking the health insurance market growth, spurred by accelerating healthcare spending, growing middle-class populations, and accelerating awareness of health protection. Governments in the region, most notably China, India, and Southeast Asia, are introducing regulation reforms and public health insurance programs to increase cover. Examples include India's Ayushman Bharat and China's universal health insurance extension, which are transforming access to care. In addition, innovation in digital health through telemedicine and insurtech platforms is facilitating affordable distribution and customized products, drawing insurers and consumers alike. This collaboration between policy initiatives and technological integration drives strong market growth in the region.

China Health Insurance Market

China is set to experience dramatic growth in the global health insurance market demand due to government-initiated plans like the "Healthy China 2030" master plan and growth of the Basic Medical Insurance (BMI) programs that cover more than 95% of the population. Urbanization, population aging, and the increasing prevalence of chronic diseases are driving demand for both private and public insurance. The China Banking and Insurance Regulatory Commission (CBIRC) is promoting foreign investment and digital health innovation actively, building a favorable regulatory environment. In addition, collaborations between insurers and technology firms are speeding up take-up of AI-based underwriting and telemedicine, improving market penetration.

Japan Health Insurance Market

Japan's health insurance industry is expanding based on its fast-aging population, which raised the demand for long-term care and specialist medical coverage. Although Japan's population has a universal healthcare system, private insurance is increasingly being opted for covering extra services like advanced care and outpatient treatment. Private health plans are being encouraged by the government to aid in the financial stability of the public system. Further, the increasing trend of AI-based diagnostics and digital healthcare is also seeing more customized insurance policies, according to the demographic needs.

South Korea Health Insurance Market

South Korea is expected for strong growth in the global health insurance market demand, influenced by its fast-aging population, high rates of healthcare consumption, and government efforts to increase the take-up of private insurance. The National Health Insurance Service (NHIS) provides coverage to the entire population but increasing out-of-pocket expenses have spurred demand for add-on private insurance. Regulatory changes like the liberalization of insurance product authorization and bonuses for digitization integration are leading to market growth. The Health Insurance Review and Assessment Service (HIRA) of South Korea is also improving transparency and efficiency of claims handling, inviting foreign insurers and investors to enter the market with innovative solutions.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Technological Advancements in Healthcare

Increasing Government Policies, Subsidies, and Public Healthcare Systems

High Premium Costs & Affordability Issues

Limited Healthcare Access in Rural & Underserved Areas

Request Free Customization of this report to help us to meet your business objectives.

The global health insurance market is expanding increasingly as a result of new product introduction. The insurers are focusing on efficient strategies with the introduction of new products that are designed to address changing consumer needs. New product introductions not only expand the scope of insurance companies but also allow them to tackle some of the salient issues in the healthcare system, including cost saving, increased accessibility, and enhanced health outcomes. For example, Aetna's launch of SimplePay Health in October 2024. The new health plan is tailored for self-insured clients and specifically seeks to simplify healthcare coverage while dramatically reducing costs.

Level.Health

Founded in 2024, their core mission is to enhance competition within the Irish health insurance sector by delivering innovative and affordable health coverage. Founded by Oliver Tattan and Jim Dowdall, Level.Health raised around USD 14 million from Aviva to fund its vision. Its mission is to offer consumers greater choice and value in health insurance to break the stranglehold of the traditional insurers in Ireland. Through the power of technology and customer-friendliness, Level.Health is poised to make health insurance simpler and more attainable for more people.

CrowdHealth

Founded in 2021, their central mission is to make available a peer-to-peer model of crowdfunding as a substitute for conventional health insurance. Started by Andy Schoonover, CrowdHealth enables members to pool monthly subscriptions to pay for one another's medical bills, circumventing conventional insurance frameworks. This peer-to-peer alternative appeals to people frustrated with the complexities and denials of the American insurance system. Although providing cost savings and a sense of community, CrowdHealth's approach is unregulated and highly selective about coverage and may not appeal to all, particularly in times of serious health crises.

Ditto Insurance

Founded in 2021, their central goal is to make insurance simpler for India with an advisory-first model. Based in Bengaluru, Ditto Insurance is a corporate insurance agent that offers health and term insurance products. It is backed by Indian stockbroker Zerodha and seeks to make insurance more accessible and simpler for Indian consumers to understand. The strategy of Ditto is tailored guidance and clear information to assist customers in making the right choices for insurance. Customer education and assistance is its core area, with Ditto revolutionizing the Indian insurance experience.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected using Primary Exploratory Research backed by robust Secondary Desk research.

The global health insurance market is undergoing a transformative evolution, propelled by rising healthcare costs, technological advancements, and growing public awareness of medical coverage. The convergence of AI, telemedicine, and digital platforms is reshaping the industry, enhancing efficiency, affordability, and customer-centricity. Government initiatives, particularly in emerging markets like India and China, alongside aging populations in developed economies, are expanding coverage and stimulating demand. Despite challenges such as high premium costs, fraud, and limited access in rural areas, the market continues to thrive, with innovative policy structures and hybrid plans gaining traction. North America and Europe maintain leadership through robust regulatory frameworks and mature systems, while Asia Pacific emerges as a dynamic growth frontier. Segmental preferences, such as the dominance of PPO plans and the rise in family insurance demand, reflect evolving consumer behavior. Overall, the industry is poised for sustained expansion, underpinned by digital innovation, regulatory support, and shifting demographic needs.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 2406 Billion |

| Market size value in 2033 | USD 3962.51 Billion |

| Growth Rate | 5.7% |

| Base year | 2024 |

| Forecast period | 2026–2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Health Insurance Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Health Insurance Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Health Insurance Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Health Insurance Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Health Insurance Market size was valued at USD 2276.25 Billion in 2024 and is poised to grow from USD 2406 Billion in 2025 to USD 3748.82 Billion by 2032, growing at a CAGR of 5.7% during the forecast period (2026-2033).

UnitedHealth Group, Elevance Health, Aetna CVS Health, Cigna Corporation, Humana Inc., Allianz SE, AXA Group, Prudential Financial, MetLife, Inc., Bupa Group, Swiss Life Holding AG, Sampo Group, Aviva plc, Generali Group, China Life Insurance

The key driver of the health insurance market is the rising healthcare costs and increasing awareness of financial protection against medical expenses, which drive individuals, employers, and governments to adopt comprehensive health insurance plans for better access to quality healthcare.

A key market trend in the health insurance market is the growing adoption of digital health platforms and telemedicine, which enhance customer engagement, streamline claims processing, offer personalized plans, and improve access to healthcare services.

North America accounted for the largest share in the health insurance market, driven by high healthcare expenditure, well-established insurance infrastructure, widespread adoption of private and employer-sponsored plans, and strong regulatory frameworks supporting comprehensive coverage.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients