Report ID: SQMIG35A3050

Report ID: SQMIG35A3050

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG35A3050 |

Region:

Global |

Published Date: June, 2025

Pages:

193

|Tables:

59

|Figures:

75

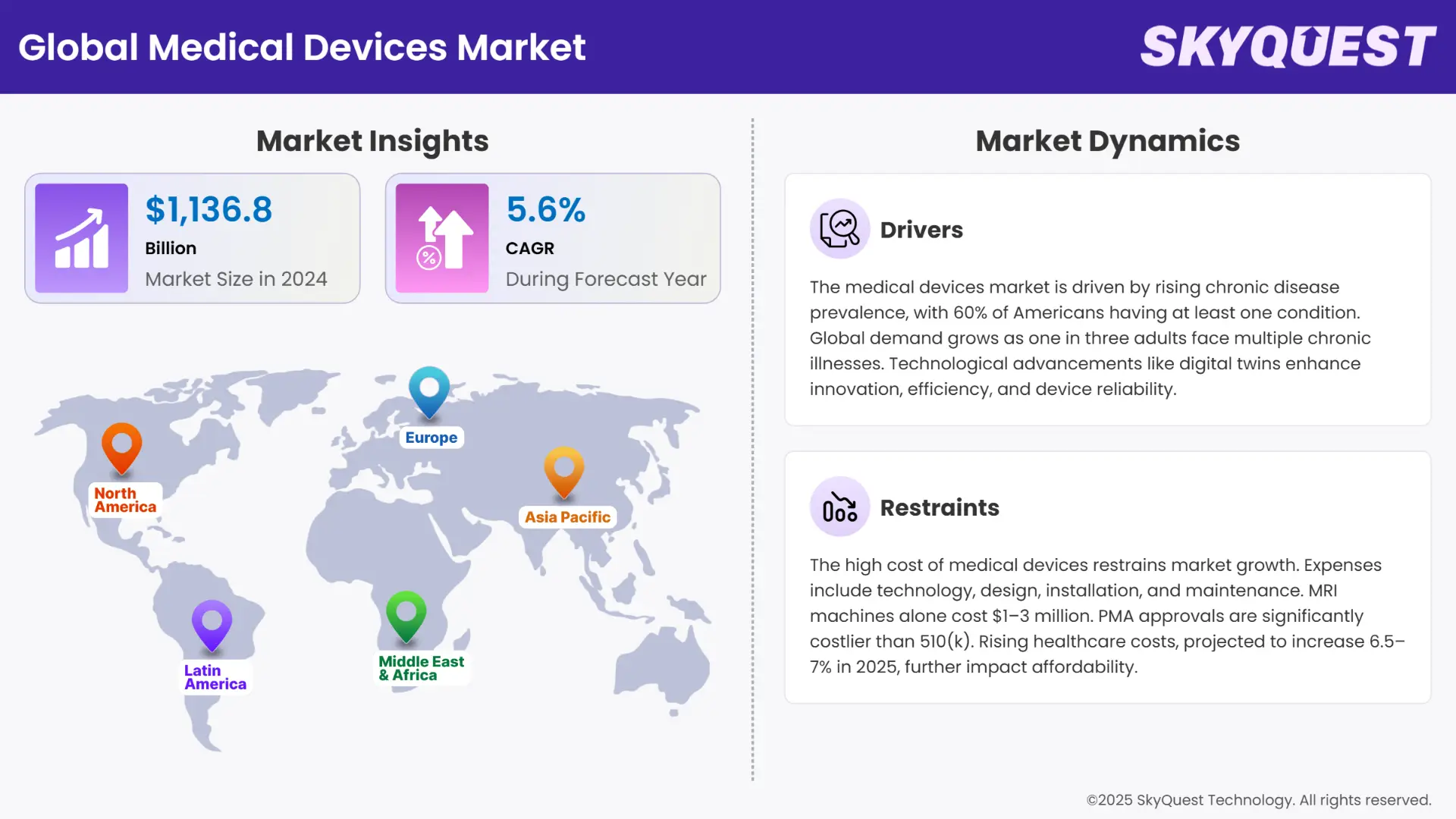

Global Medical Devices Market size was valued at USD 1136 Billion in 2024 and is poised to grow from USD 1199.62 Billion in 2025 to USD 1855.04 Billion by 2033, growing at a CAGR of 5.6% during the forecast period (2026–2033).

The rise in prevalence of chronic and infectious disease, advancement in technologies and increase in healthcare awareness are the major factor for the growth of the medical device market. As conditions such as cardiovascular disease, diabetes, and respiratory disorders become more widespread, there is a growing demand for advanced monitoring, diagnostic and therapeutics devices.

The technological innovations such as wearable health monitors, AI integration, and minimal invasive tools enhance the patient care. Further, WHO has launched an online platform named Medical Devices Information System (MeDevIS). This is the first global open access clearing house for information on medical devices, covering around 2301 type of medical devices for different application. This platform is designed to support the regulation, government and the user in decision making on procurement, and selection of medical devices for testing, treatment and diagnostics.

The integration of technologies such as robotics, artificial intelligence, wearable sensors, and 3D printing in medical devices further propelling market growth. The innovation in medical device is one of the major factors for the growth of the market. According to World Health Organization, it was reported that around 10% of U.S population are living with implanted medical devices. This widespread adoption reflects increased patient acceptance and clinical trust in implantable solutions for conditions such as orthopedic injuries, cardiac disorders, and neurological issues. This increases the device sales but also accelerates research and development, further driving the medical devices market growth.

The increase in demand for remote monitoring devices and wearable devices further surge the medical devices market. According to one of the research study, conducted in September 2024, it was reported that nearly 81.7% of cardiovascular patient are willing to use remote monitoring for their follow up. Further, the adoption of 3D printing technology allows for the customization of prosthetics and implants, which enhance surgical outcome and patient comfort.

The high cost of medical cost and stringent regulation act as a major restrain for the growth of the market. The price of medical equipment prices ranges from USD 2,000 to USD 100,000. After the use of medical device, it cost nearly 30% to 40% less than the new devices. The price range depend mostly on its brand and technology. The high price limits the accessibility of medical device in developing regions.

Furthermore, complex and evolving regulations can delay product approvals and hinder the Market entry.

How is AI Advancing in Medical devices industry?

The U.S Food & Drug Administration (FDA) aims to develop safe, innovative and effective medical devices including devices which incorporate machine learning and artificial intelligence. In 2024, the U.S FDA approve around 169 AI integrated medical device.

The FDA approved AI/ML integrated medical devices focused mostly on cardiovascular disease, cancer, and stroke. Aidoc Medical Ltd. receive approvals for multiple AI tools by targeting acute conditions such as pulmonary embolism (PE), intracranial hemorrhage (ICH), cervical spine trauma, and stroke assessment using CT scans. These trends highlight the growing role of AI in enhancing clinical outcomes, accelerating diagnosis, and driving next-generation healthcare solutions.

To get more insights on this market click here to Request a Free Sample Report

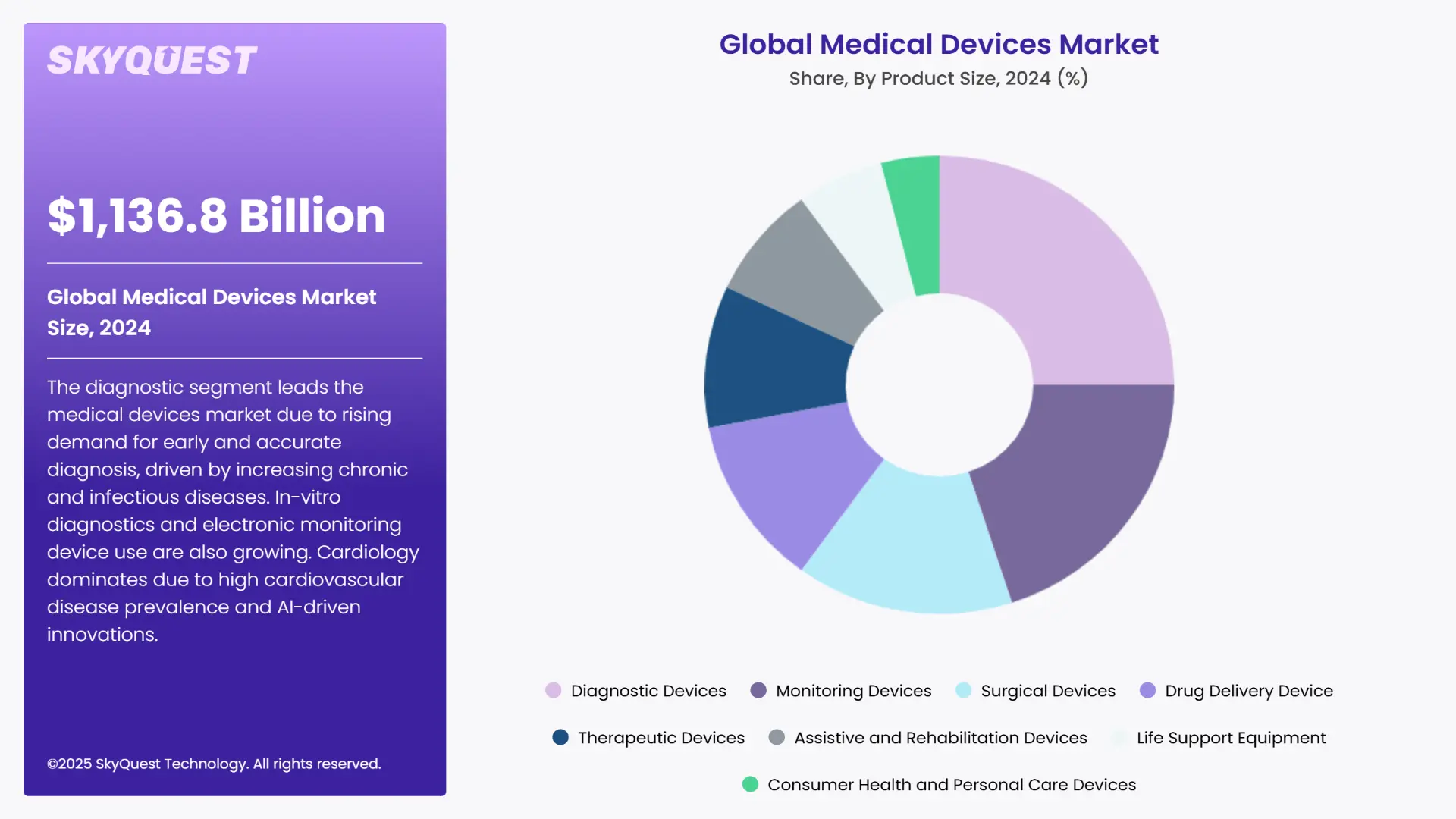

The global medical devices market is segmented By Product, By Class, By Application, By End User and region. Based on By Product, the market is segmented into Diagnostic Devices, Monitoring Devices, Surgical Devices, Drug Delivery Devices, Therapeutic Devices, Assistive and Rehabilitation Devices, Life Support Equipment, Consumer Health and Personal Care Devices. Based on By Class, the market is segmented into Class I, Class II, Class III and Class IV. Based on By Application, the market is segmented into Cardiology, Orthopedics, Neurology, Respiratory Care, Diabetes Care, Ophthalmology, General Surgery, Gynecology & Urology, Oncology and Others. Based on By End User, the market is segmented into Hospitals & Clinics, Ambulatory Surgical Centers (ASCs), Diagnostic Laboratories, Homecare Settings and Research Institutes & Universities. Based on region, the medical devices market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

The diagnostic segment dominates the medical devices market due to rising demand for early diagnosis, and increase in awareness among consumer. In addition, the rise in prevalence of infectious and chronic disease surges the demand for rapid, accurate and early diagnosis and boost the sale of medical diagnostic device.

In addition, the surge in demand for in-vitro diagnostic test further propel the growth of the market. Around 3.3 billion invitro test are performed in the U.S every year. Further, According to Gov.UK, it was reported that the total number of people with electronic monitoring device increase by 13% from 2022 to 2023. Thus, surge in demand of monitoring devices among consumer also drive the growth of diagnostic medical devices market.

Based on the 2024 cardiology segment dominates the market due to increase in prevalence of cardiovascular disease. According to World Health Federation, it was reported that more than half a billion population get diagnosed with cardiovascular disease. The rising incidence of indication such as arrhymias, heart failure, coronary artery disease and hypertension surge the need for advanced therapeutic and diagnostic devices.

The advancement in AI/ML integrated medical device for cardiovascular disease propel the growth of the market. In 2024, nearly 60% of the U.S FDA device are for cardiovascular disease. Further, increase in research & development and advancement in technology drive the market growth.

To get detailed segments analysis, Request a Free Sample Report

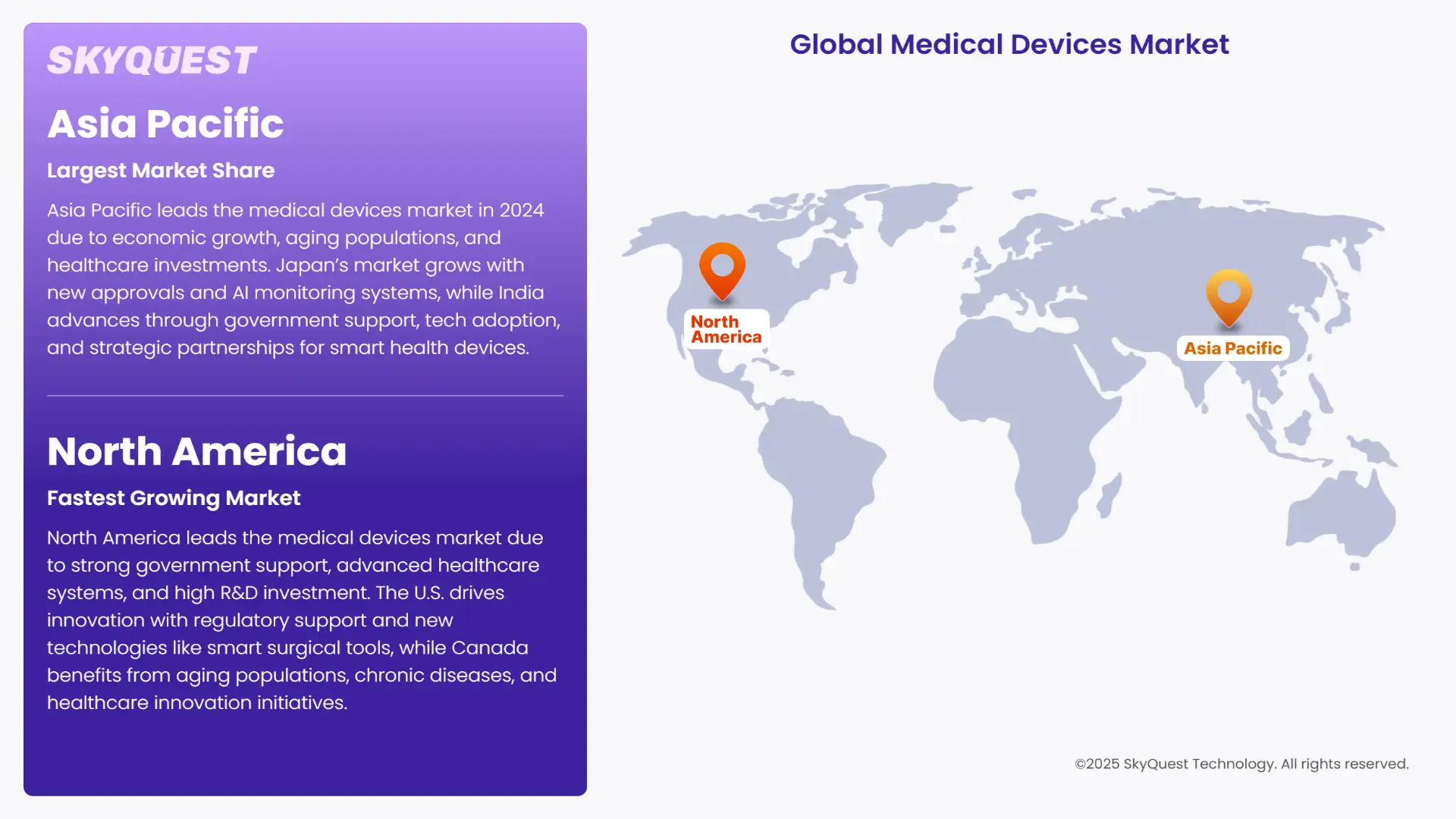

Asia Pacific is leading the medical devices market share in 2024 due to rapid economic growth, increasing healthcare investments, and rising demand from large and aging populations. Countries like China, India, and Japan are expanding healthcare infrastructure and improving access to advanced medical technologies. Growing middle-class income and increasing awareness of health issues drive higher consumption of medical devices. Additionally, government initiatives supporting domestic manufacturing, innovation hubs, and favorable regulatory reforms accelerate medical devices market growth.

The increasing geriatric population in Japan, rise in government initiative and surge in demand for monitoring device drive the Japan medical device market growth. In 2023, 956 medical devices were newly approved by the Pharmaceuticals and Medical Devices Agency (PMDA) in Japan, of which 685 were generic medical devices.

In addition, Japan launches several medical monitoring systems covering AI-powered arrythmia detection and long-term continuous monitoring. These systems aim to enhance patient care, mostly in an aging population. For example, iRhythm has launched its Zio ECG Recording and Analysis System, which provides continuous, uninterrupted ECG monitoring for up to 14 days

The rising healthcare demand, increasing government support, and rapid adoption of advanced technologies drive the India Medical device market demand. In April 2025, Philips, one of the leading health technologies, announced the launch of new AI-enabled Elevate Platform upgrade on the EPIQ Elite ultrasound imaging platform, at UltraFest 2025 in India.

Further in February 2025, MediBuddy, India's largest digital healthcare company, has announced a strategic partnership with ELECOM, a leading Japanese electronics company, to jointly develop and introduce cutting-edge smart health IoT devices to the Indian market.

North America maintains its dominance in the medical devices industry through strong government support, high investment in research, and advanced healthcare systems. The U.S. Food and Drug Administration (FDA) plays a key role by offering clear approval processes and special programs that speed up access to new technologies. Leading companies such as Medtronic, Abbott, and Boston Scientific drive innovation, supported by major universities and research centers. High healthcare spending and early use of new technologies like robotics and smart devices also support growth.

The U.S medical devices market growth is driven by innovative technologies, regulatory support, growing demand for minimally invasive procedures, and strong collaborations between companies advancing patient care and diagnostic solutions. In February 2025, SpineGuard and its US partner Omnia Medical launched the PsiFGuard, a new smart drilling device for sacroiliac joint fusion, at the NANS convention in Orlando, Florida. The device uses SpineGuard’s DSG® (Dynamic Surgical Guidance) technology, which improves the accuracy and safety of bone implant placement. This launch represents a major advancement in surgical tools, aiming to enhance outcomes and streamline procedures in spine surgery through innovative local conductivity sensing technology.

The Canada medical devices market share is driven by a growing aging population, increasing prevalence of chronic diseases, and rising healthcare expenditure. Government initiatives promoting healthcare innovation and digital health adoption further boost the market. Canada's strong focus on research and development, combined with collaborations between healthcare providers and medical device companies, accelerates the introduction of advanced technologies.

The Europe medical devices market share is driven by increasing R&D activities, strong regulatory framework and well-established healthcare infrastructure. Country such as UK, & Germany lead innovation with advanced manufacturing capabilities.

In October 2024, GE Healthcare announced the collaboration with University Medicine Essen (UME) to establish a new Theragnostic Centre of Excellence in Germany. This center increases the precision care and expands access to personalized cancer treatment. This center uses the latest technology and solution for supporting the clinical practices and advance research in the country. The center boosts Germany’s medical device market by advancing precision oncology, fostering innovation, research, and global competitiveness in healthcare.

The UK IVD market is driven by increasing research & development activities and launch of advanced medical devices. In March 2025, the Abbott, announced the launch of portable whole blood test in UK for the diagnosis of suspected mild traumatic brain injuries.

In March 2025, the researcher from the UK university of Birmingham have launched a new 4D medical device manufacturing project. This project aims to use of materials which promote faster healing and combine this ethos with advanced manufacturing process.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Increase in prevalence of chronic disease

Advancement in Technology

High cost of medical Device

Request Free Customization of this report to help us to meet your business objectives.

To stay ahead in the global medical devices market, key player focuses on innovation, AI integration and rapid diagnostics solutions. The market is moderately fragmented, with a major multinational key players dominating in the core product such as diagnostic, monitoring and therapeutics devices. Medtronic dominate the medical device market followed by Johnson & Johnson and Abbott.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected using Primary Exploratory Research backed by robust Secondary Desk research.

According to SkyQuest’s analysis, the global medical devices market is poised for sustained growth, driven by the rising prevalence of chronic and infectious diseases, increasing healthcare awareness, and continuous technological advancements. The integration of AI and machine learning is improving diagnostic precision and enabling more personalized and efficient treatments. Wearable devices and remote patient monitoring are gaining traction, especially in underserved and remote regions, due to their convenience and real-time health tracking capabilities.

Additionally, there is a growing emphasis on minimally invasive and home-based healthcare solutions, reflecting consumer demand for accessibility and faster results. Cardiology and diagnostic devices remain key market segments, supported by high demand for early detection and management of diseases. Asia-Pacific is emerging as a high-growth region owing to expanding healthcare infrastructure, economic development, and supportive government policies. Despite challenges such as high costs and regulatory complexities, innovation, digitalization, and strategic collaborations are expected to fuel continued market expansion.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 1136 Billion |

| Market size value in 2033 | USD 1855.04 Billion |

| Growth Rate | 5.6% |

| Base year | 2024 |

| Forecast period | 2026–2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Medical Devices Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Medical Devices Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Medical Devices Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Medical Devices Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Global Medical Devices Market size was valued at USD 1136 Billion in 2024 and is poised to grow from USD 1199.62 Billion in 2025 to USD 1855.04 Billion by 2033, growing at a CAGR of 5.6% during the forecast period (2026–2033).

Medtronic plc, Johnson & Johnson, Abbott Laboratories, Koninklijke Philips N.V. (Philips), F. Hoffmann-La Roche AG, OMRON Corporation, DexCom, Inc., Medline Industries, LP, Stryker Corporation, Siemens Healthineers AG, Becton, Dickinson and Company, Withings S.A.S., Beurer GmbH, Nihon Kohden Corporation, Qardio, Inc., ICU Medical, Inc., Terumo Corporation, iHealth Labs Inc., Contec Medical Systems Co., Ltd., A&D Company, Limited

The key driver of the medical devices market is the increasing demand for advanced healthcare solutions, fueled by the rising prevalence of chronic and lifestyle diseases, aging populations, technological innovations, and growing investments in healthcare infrastructure globally.

A key market trend in the medical devices market is the growing adoption of digital health technologies, including wearable devices, remote monitoring, and AI-driven diagnostic tools, which enhance patient care, enable real-time data analysis, and support personalized healthcare solutions.

North America accounted for the largest share in the medical devices market, driven by advanced healthcare infrastructure, high adoption of innovative medical technologies, strong R&D investments, and the presence of leading global medical device manufacturers.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients