Report ID: SQMIG50I2010

Report ID: SQMIG50I2010

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG50I2010 |

Region:

Global |

Published Date: December, 2025

Pages:

192

|Tables:

236

|Figures:

82

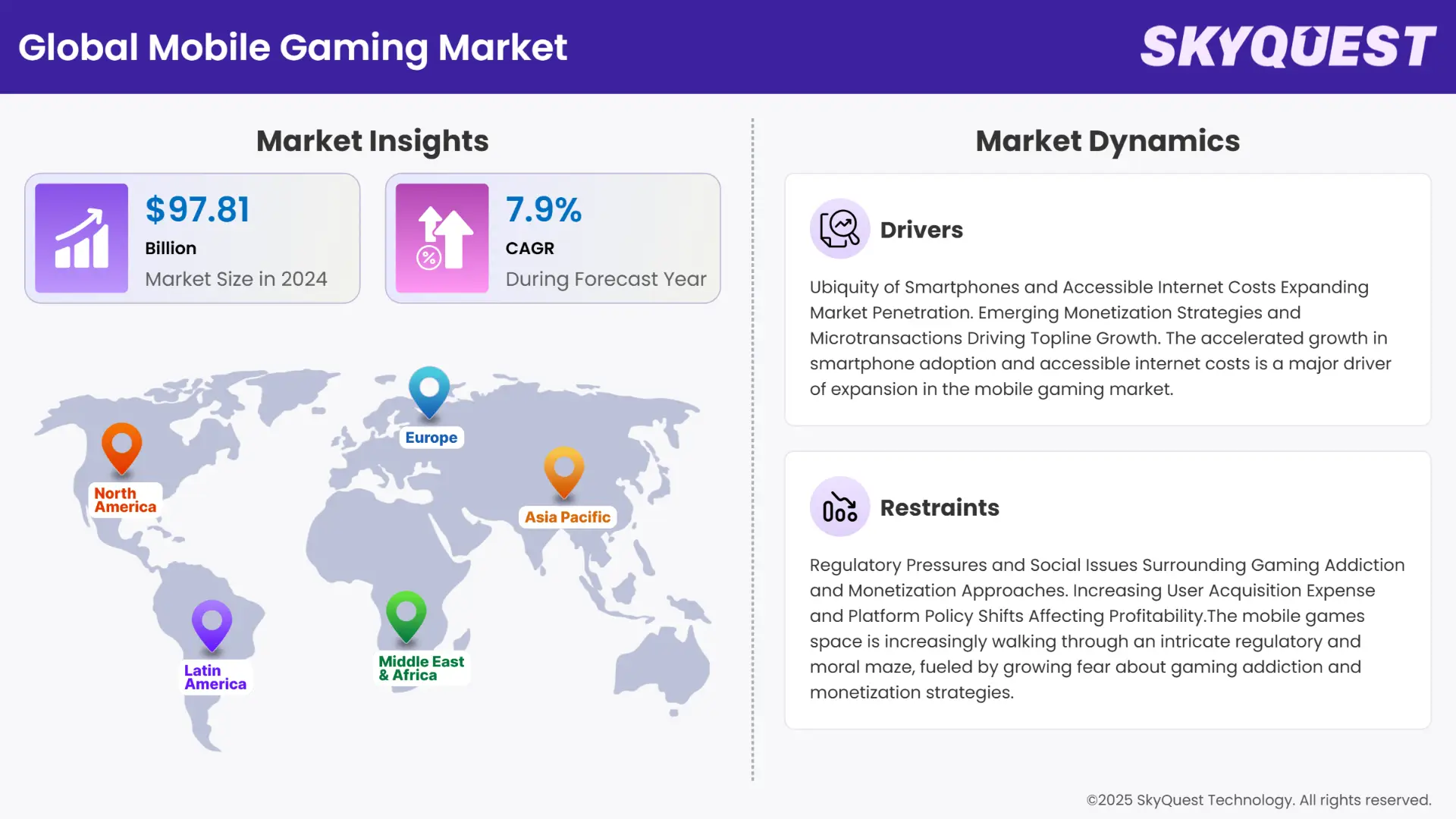

Global Mobile Gaming market size was valued at USD 97.81 Billion in 2024 and is poised to grow from USD 105.54 Billion in 2025 to USD 193.9 Billion by 2033, growing at a CAGR of 7.9% in the forecast period (2026–2033).

The mobile gaming industry continues to boom as one of the most vibrant and lucrative industries in the overall digital entertainment market, fueled by expanding smartphone penetration, enhanced availability of high-speed internet, and the rollout of 5G networks. Mobile games in 2024 generated more than 50% of the global gaming revenue, surpassing console and PC game revenues combined. The market is undergoing a transformation in monetization techniques, with in-app purchases, ad-supported models, and subscription services like Apple Arcade and Google Play Pass becoming progressively sophisticated. Hyper-casuals remain prevalent in download charts based on their low barriers to entry, but mid-core and hardcore games, particularly multiplayer battle arenas and strategy titles, are delivering engagement and revenue, with higher crossover between mobile and PC/console franchises (e.g., "Call of Duty: Mobile," "Genshin Impact"). The mobile eSports ecosystem is growing, with games such as PUBG Mobile and Free Fire supporting competitive play and tournament sponsorships in markets with historically constrained console infrastructure. At the same time, AI and machine learning are streamlining user retention, ad targeting, and content personalization, driving both user lifetime value and developer ROI. Cloud gaming has the potential to eliminate device reliance and facilitate high-definition quality gaming on lesser hardware supported by alliances between game companies and mobile operators.

How Is AI Powering Innovation Across Mobile Gaming Platforms?

Artificial Intelligence (AI) is revolutionizing the mobile gaming space in its core by improving the user experience, monetization maximization, and development simplification.

AI analytics enable game developers to personalize gameplay, customize difficulty, and suggest in-app purchases based on player actions, enhancing engagement and retention. AI-powered procedural content generation enables games to provide dynamic levels and stories, minimizing development time while maintaining novelty in gameplay. AI is also applied in real-time fraud detection, balanced matchmaking in multiplayer settings along with more intelligent non-player characters (NPCs) that respond to user tactics. Additionally, AI enhances ad targeting as it examines user data to present more targeted ads, boosting click-through rates and revenue.

How Are Cloud & 5G Networks Powering the Future of Mobile Gaming?

The global deployment of cloud infrastructure and the adoption of 5G networks at speed are fueling mobile gaming by removing the hindrance of traditional hardware, with high-speed connectivity and ultra-low latency, 5G facilitates smooth multiplayer experiences and real-time interactions even within bandwidth-hungry titles. cloud gaming services such as NVIDIA GeForce NOW and Xbox Cloud Gaming shift processing to far-off servers, making graphically demanding games playable on low-budget smartphones without impacting performance. This shift frees up developers to create more detailed, more immersive experiences like open-world worlds, real-time events and AR capabilities. It opens up possibilities for new monetization models like game streaming subscriptions and real-time in-game purchases. Together cloud and 5G are changing mobile gaming availability, performance, and revenue potential in markets around the world.

To get more insights on this market click here to Request a Free Sample Report

The global Mobile Gaming market is segmented into Game Genre, meat type, processing type, and region. By Game Genre, the market is classified into Action, Adventure, Casino, Sports, Puzzle, Role Playing, and Others. Depending on platform, it is divided into Android, iOS, Progressive Web Apps (PWAs), and Hybrid, Others. By Revenue Model, the market is classified into Premium (Paid) Games, Subscription-Based, Advertising-Based, and Freemium. According to Device, the market is categorized into Smartphone, Handheld Gaming Consoles, Tablets, and Others. By Age Group, the market is classified into Children (Under 12), Teenagers (13–19), Young Adults (20–35), and Adults (36+). By Technology, the market is classified into AR (Augmented Reality) Games, VR (Virtual Reality) Games, Cloud Gaming, and Others. According to Connectivity, the market is categorized into Online Multiplayer Games, and Offline Games. By Distribution Channel, the market is classified into App Stores (Google Play Store, Apple App Store, & Third-Party App Stores), Direct Downloads, and Others. Regionally, the market is analyzed across North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

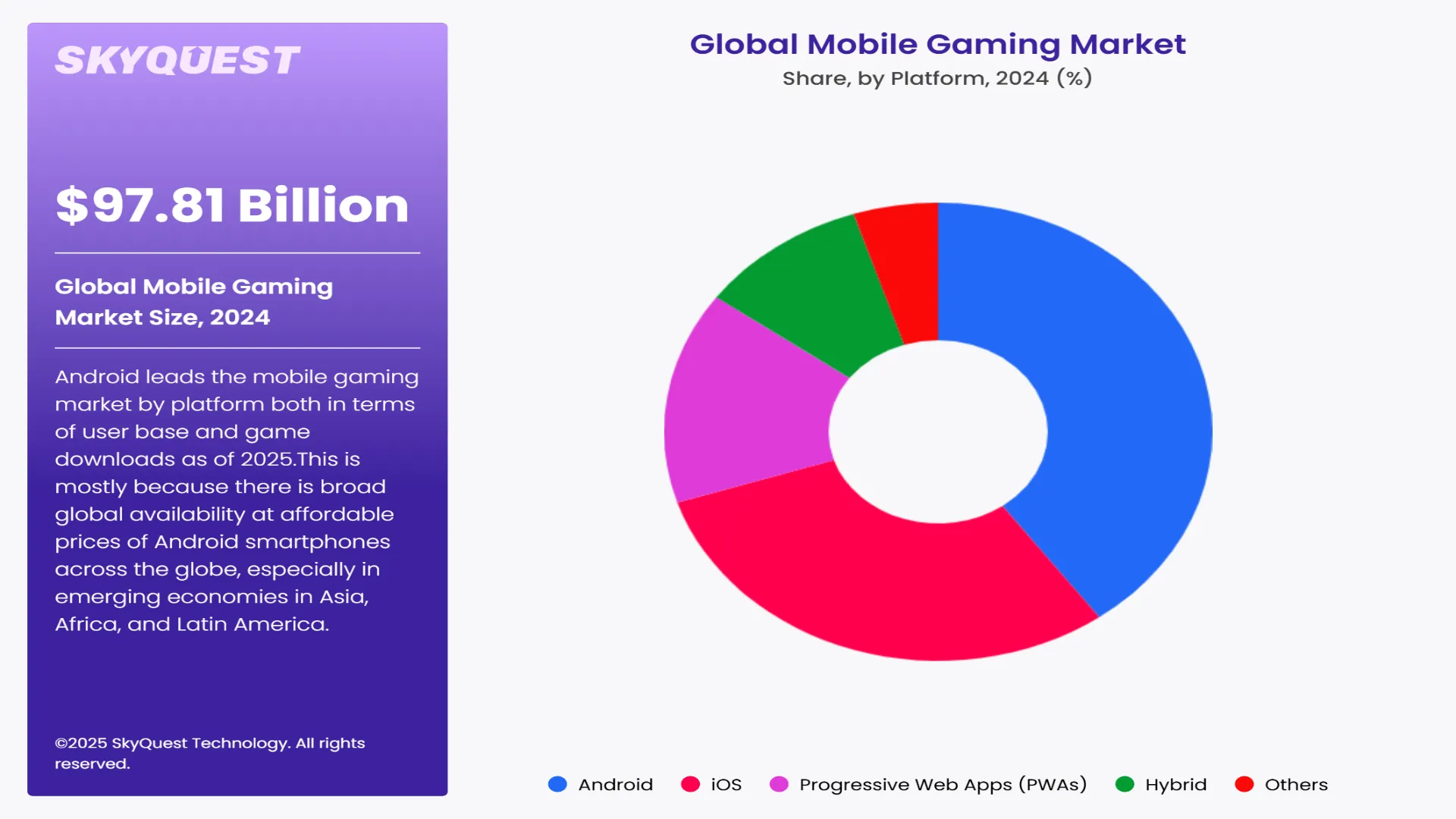

Android leads the mobile gaming market by platform both in terms of user base and game downloads as of 2025. This is mostly because there is broad global availability at affordable prices of Android smartphones across the globe, especially in emerging economies in Asia, Africa, and Latin America. According to Statista and Sensor Tower, Android accounts for over 70% of global mobile gaming downloads, driven by its open ecosystem and the presence of numerous app stores beyond Google Play, including region-specific stores like Samsung Galaxy Store and third-party platforms in China. Android’s flexible device pricing from entry-level to flagship makes gaming accessible to a vast audience, while game developers often prioritize Android to reach scale quickly. Furthermore, nations such as India and Brazil, with more than 90% market share of Android, have witnessed runaway growth in casual and hyper-casual mobile gaming consumption, solidifying Android's position as the most popular mobile gaming platform in the world.

iOS is presently the fastest-growing platform in the mobile gaming market especially when it comes to revenue generation. Even with fewer global users than Android, iOS users normally spend much more on in-app expenditure. Sensor Tower and Data.ai said that in 2024 iOS generated almost 65 percent of global mobile game revenue driven by healthy markets in the united states, Japan, and Western Europe. Premium games and deep-spending users are drawn to the platform's closely curated App Store, secure payment system, and better device capability. iOS is also riding high on subscription-based offerings such as Apple Arcade, which gained popularity because it offers an ad-free, handpicked gaming experience. Additionally, monetization is more effective on iOS, with greater ARPU (Average Revenue Per User), which makes it the most appealing platform for developers who cater to well-off and active gamers, particularly in mature markets.

To get detailed segments analysis, Request a Free Sample Report

Asia-Pacific is currently leading the world in the mobile gaming sector, fueled mainly by enormous user bases in China, India, Japan, and South Korea. China alone generates more than 40% of the world's mobile game revenue due to its strong gaming culture and homegrown major developers such as Tencent and NetEase. High smartphone penetration, vast adoption of 5G technology, and an expanding middle class with rising disposable income support the region. Also, market dominance is further driven by the popularity of social gaming and mobile eSports in markets such as South Korea. Tech innovation supported by governments and app ecosystems established also play a role in leading Asia-Pacific to become the biggest and most significant region in mobile gaming.

China is the leading force in the Asia-Pacific mobile gaming industry, with the highest proportion of revenue and player base. The large population of the country over 1.4 billion people combined with deep smartphone penetration and mature internet infrastructure, makes the market for mobile gaming huge. Giant players like Tencent & NetEase have spearheaded innovation and localization churning out worldwide hits like Honor of Kings and PUBG Mobile. The government has controlled the market with strict regulations, but the companies remain nimble, shifting focus to quality and compliance. Moreover, China's deep culture of social gaming and mobile eSports raises user interaction. The nation's ongoing investment in 5G networks and AI technologies further solidifies its dominance in the mobile gaming market.

India is Asia-Pacific's fastest emerging mobile gaming market fueled by quick smartphone penetration and growing internet connectivity. With more than 750 million smartphone users to date in 2024. Cheap budget phones and low data plans have made access to gaming universal in urban and rural India. Local content and games written in regional languages along with the immense popularity of casual and hyper-casual games, have driven user growth. The surge in mobile payment facilities and digital wallets has made in-game purchases much simpler, increasing monetization. Government efforts toward enhancing digital infrastructure and the extensive rollout of 4G & 5G will help maintain this growth tempo, making India a key growth driver of the mobile gaming sector.

Latin America is the fastest growing region in the mobile gaming market fueled by fast smartphone adoption and enhancing internet infrastructure. Markets such as Brazil, Mexico, & Argentina are seeing doubling or tripling in mobile game download and revenue growth, fueled by increasing youth populations seeking to play games. Cheap mobile handsets and data plans have reduced barriers to entry, and developers more and more localize content to local languages and cultural norms. The increasing popularity of casual and social games, along with growing mobile payment opportunities, is driving monetization. Also, higher investments in digital infrastructure and the widening of 4G/5G networks are likely to support this huge growth path in the next few years.

Brazil dominates the Latin American mobile gaming market with the largest player base and highest revenues in the region. With over 210 million inhabitants and accelerating smartphone penetration, Brazil offers a vibrant gaming market fueled by mass-market adoption of inexpensive mobile phones and improved internet penetration. A few of the most widely accepted genres of games in Brazil are casual games, battle royale games, and football-based games that perform well with Brazilian gamers. Growth of social gaming and live streaming platforms like Twitch has also encouraged an active community of gamers. local companies and global publishers are investing in Brazil, localizing content so it resonates with local tastes and cultural. Ongoing build-out of 4G & 5G networks is improving the user experience putting Brazil in position to become the leading and most economically significant mobile gaming market in Latin America.

Mexico is the fastest developing mobile gaming market in Latin America, fueled by swift urbanization and growing smartphone adoption. The countries young population coupled with growing internet penetration and cheap data plans, drives robust demand for mobile games. Casual, puzzle, and multiplayer games are especially favored by Mexican consumers, who demonstrate growing interest in in-app purchases as well as ad-based monetization. Localization strategies, such as Spanish language support and regionally appropriate game themes, have increased user adoption. The increasing visibility of mobile esports events and influencer marketing campaigns are also adding to the speed of growth. Investment in digital infrastructure and the implementation of 5G networks are also likely to further spur market growth positioning Mexico as a major emerging market in the Latin American mobile gaming market.

North America is a mature high-value mobile gaming market with high smartphone availability & robust consumer expenditure. The region has a strong gaming culture developed technology infrastructure, and extensive 5G penetration. Revenue from mobile gaming continues to expand on the back of varied game genres such as action, strategy, and casual games. The concentration of leading international publishers and technology innovators facilitates continued innovation with monetization models including subscriptions, in-app purchases, and ad-supported gaming continuing to be favored. Growing regulatory attention to data privacy along with user protection influences market forces. North America overall is of great strategic value to developers who are looking for stable revenues and access to an informed & tech-enabled user base.

The United States is the biggest gaming market for mobile in North America, fueled by high disposable incomes, smartphone penetration of over 85%, and high consumer spend propensity towards games. Hit titles like Call of Duty, Mobile and Among Us identify the U.S. demand for competitive multiplayer and social gaming. The U.S. market also takes the lead in embracing sophisticated monetization models such as battle passes, microtransactions, and subscription models like Apple Arcade. Regulatory policies those regarding privacy and loot boxes, increasingly shape game design and advertising. The mature app ecosystem and dynamic influencer culture support continuous user engagement and revenue growth.

Canada mobile gaming market is expanding steadily with backing from high smartphone penetration and technology-embracing population. Canadian players like combination of casual, puzzle, and strategy games with high uptake of freemium models. Canada is aided by its geographical location near the United States having similar gaming interest & regulatory frameworks. Domestic developers and studios are finding common grounds with global publishers creating more varied content. Investment in 5G infrastructure and favorable government support to the technology industry also increases market potential. Although smaller than in the U.S., Canada's mobile gaming market is characterized by high user engagement and innovation and is therefore a key player in the North American ecosystem.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Ubiquity of Smartphones and Accessible Internet Costs Expanding Market Penetration

Emerging Monetization Strategies and Microtransactions Driving Topline Growth

Regulatory Pressures and Social Issues Surrounding Gaming Addiction and Monetization Approaches

Increasing User Acquisition Expense and Platform Policy Shifts Affecting Profitability

Request Free Customization of this report to help us to meet your business objectives.

The global mobile game market competitive landscape is intensely dynamic with major players using multi-faceted strategies to maintain dominance.

Tencent one of the companies uses its massive portfolio such as Honor of Kings and PUBG Mobile to continue market dominance with aggressive user growth and localized content specific to developing markets such as India and Southeast Asia. Activision Blizzard, on the other hand, takes advantage of cross-platform synergy by porting successful franchises such as Call of Duty to mobile platforms, driving engagement through live events and eSports partnerships. Niantic, the AR gaming leader with Pokémon GO, innovates consistently by regularly updating content and making strategic alliances (e.g., with Nintendo) to drive user retention. Further, firms such as Zynga aggressively pursue mergers and acquisitions, as seen through its buying of Peak Games, to add to its casual gaming catalog and utilize data analytics for precision monetization. They invest significantly in AI-based personalization and cloud gaming to maximize user experience and scale, highlighting the role of technology-led differentiation in this highly competitive market.

Emergence of Hyper-Casual and Social Gaming

Integration of Augmented Reality (AR)

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected using Primary Exploratory Research backed by robust Secondary Desk research.

According to SkyQuest analysis the mobile gaming industry is a developing and fast-growing segment in the global entertainment ecosystem. Spurred by mass adoption of smartphones, cost-effective internet connections and technology improvements in 5G and cloud computing, mobile games are now the favorite among a wide and global array of gamers. Disruptive monetization strategies opened up huge revenue pockets while addressing diverse user needs. The market also encounters some challenges such as increasing costs of acquiring users, regulatory pressures over addictive features, and policy shifts on the platforms affecting profitability. Dominance is preserved among major players via strategic collaborations, ongoing innovation, and localization that responds to the distinctive needs of regional markets.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 97.81 Billion |

| Market size value in 2033 | USD 193.9 Billion |

| Growth Rate | 7.9% |

| Base year | 2024 |

| Forecast period | 2026-2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Mobile Gaming Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Mobile Gaming Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Mobile Gaming Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Mobile Gaming Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients