Report ID: SQMIG35D2331

Report ID: SQMIG35D2331

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG35D2331 |

Region:

Global |

Published Date: July, 2025

Pages:

157

|Tables:

91

|Figures:

71

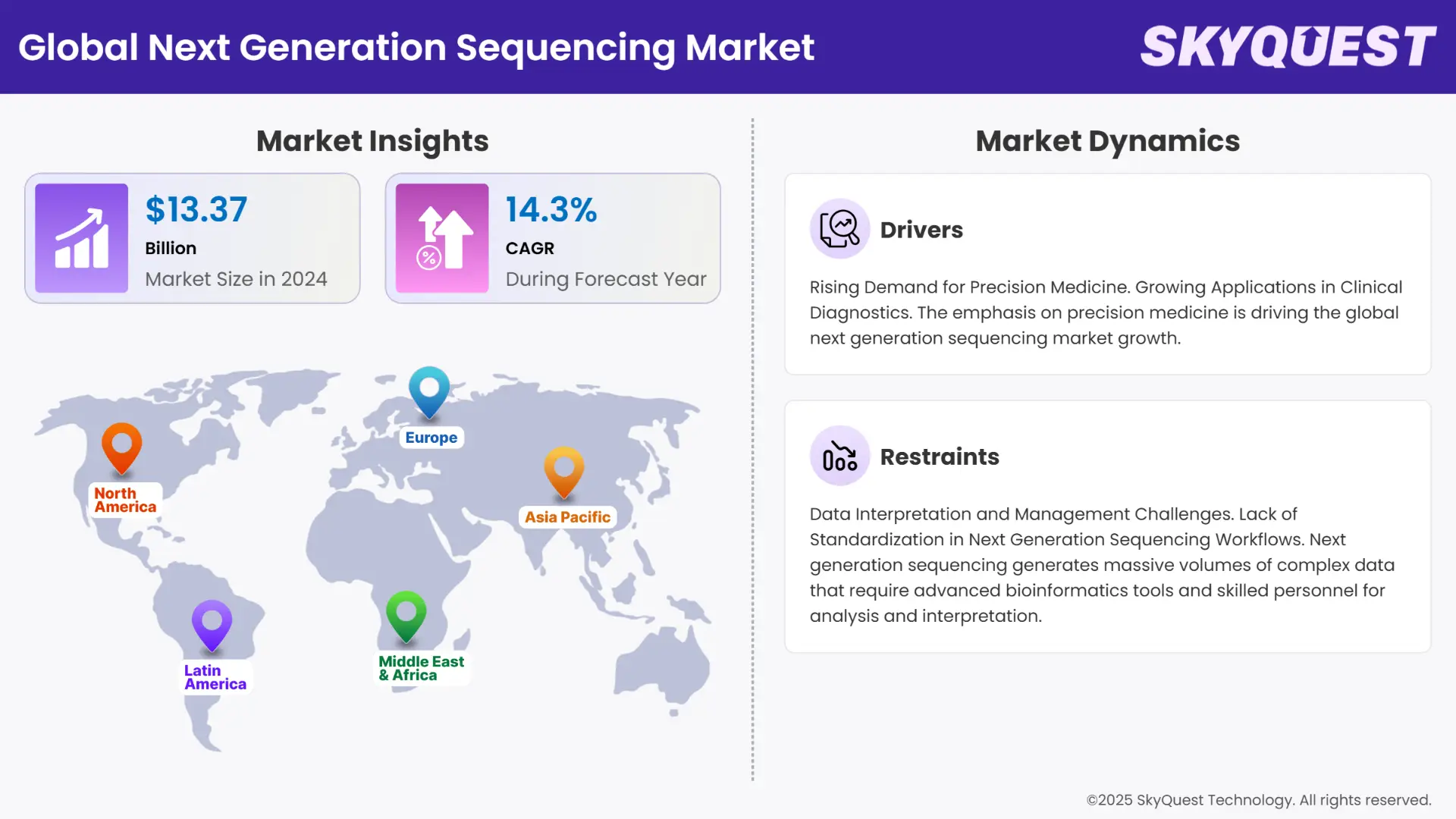

Global Next Generation Sequencing Market size was valued at USD 13.37 Billion in 2024 poised to grow between USD 15.28 Billion in 2025 to USD 44.52 Billion by 2033, growing at a CAGR of 14.3% in the forecast period (2026–2033).

The global rise in genomic research, particularly in fields such as oncology, rare diseases, and infectious diseases, is a major driver of the next generation sequencing market. Researchers are increasingly relying on next generation sequencing to analyze large volumes of genetic data quickly and accurately. This demand is fueled by the need to understand genetic variations, identify disease markers, and develop targeted therapies. next generation sequencing enables high-throughput sequencing, allowing simultaneous analysis of multiple genes, which dramatically accelerates the pace of discovery. As a result, academic institutions, biotech firms, and pharmaceutical companies are investing heavily in next generation sequencing platforms, propelling market growth.

The steady reduction in sequencing costs over the past decade has been a key trend driving the global next generation sequencing sector. Initially a prohibitively expensive process, whole genome sequencing can now be performed at a fraction of its earlier cost due to technological innovation and competition. This affordability has made next generation sequencing viable for clinical diagnostics, population genomics, and precision medicine. As a result, healthcare providers and research organizations in both developed and emerging economies are integrating next generation sequencing into routine workflows. The cost-effectiveness is not only democratizing access but also encouraging large-scale initiatives like national genome mapping projects, thereby fuelling market expansion.

How does AI Reduce Error Rates and Analysis Time in Next Generation Sequencing Workflows?

Artificial Intelligence (AI) is significantly transforming the next generation sequencing landscape by streamlining the interpretation of complex genomic data. Next generation sequencing generates vast datasets that require advanced analytics to extract clinically relevant insights. AI algorithms, particularly in machine learning and deep learning, automate variant calling, gene annotation, and pattern recognition, reducing analysis time and error rates. This has made sequencing faster, more accurate, and accessible for clinical applications like oncology and rare disease diagnosis. A key development is DeepMind’s AlphaGenome (2025), which uses AI to decode non-coding DNA regions, enhancing understanding of gene regulation and further expanding next generation sequencing’s utility in personalized medicine.

In July 2024, NVIDIA upgraded its GPU-accelerated genomics suite, Parabricks (version 4.3.1), adding support for the Grace Hopper Superchip. By harnessing this advanced AI-optimized hardware, Parabricks slashes whole-genome sequencing analysis time dramatically transforming multi-day workflows into hours. This speed boost not only accelerates clinical and research applications but also reduces costs, directly enhancing the next generation sequencing scalability and adoption worldwide.

To get more insights on this market click here to Request a Free Sample Report

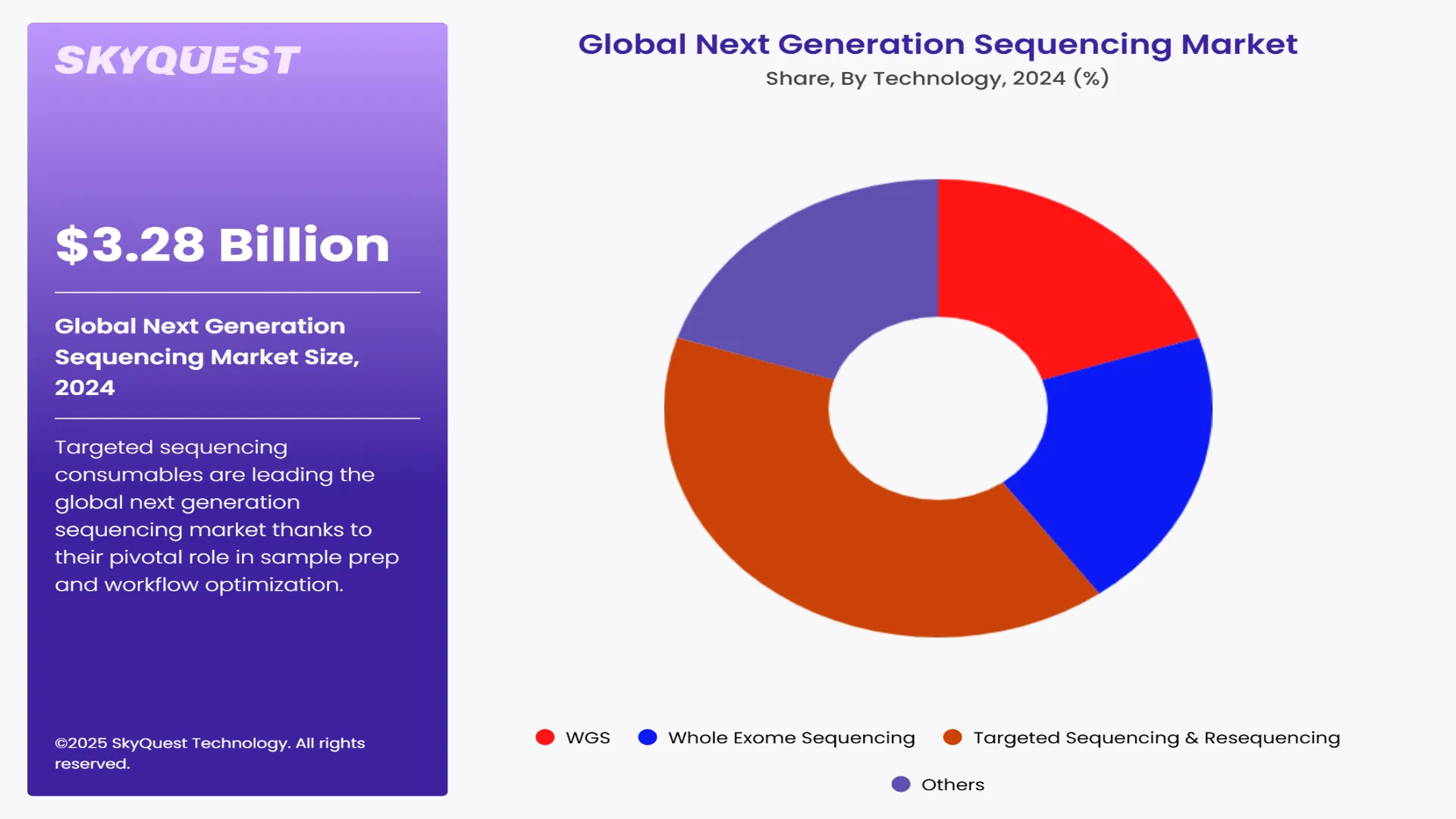

The global next generation sequencing market is segmented based on technology, product, end-use, and region. In terms of technology, the market is segmented into WGS, whole exome sequencing, targeted sequencing & resequencing, and others. Based on product, the market is divided into platform and consumables. Based on end-use, the market is segmented into academic research, clinical research, hospitals & clinics, pharma & biotech entities, and other users. Based on region, the market is segmented into North America, Europe, Asia-Pacific, Central & South America and the Middle East & Africa.

Which Clinical Fields Benefit from Targeted Sequencing Techniques?

Based on the global next generation sequencing market forecast, targeted sequencing and resequencing technologies are at the forefront of the industry due to their precision, cost-efficiency, and clinical relevance. By focusing on specific genes or genomic regions, these methods reduce data complexity and enable faster, more actionable insights—especially in oncology, inherited diseases, and pharmacogenomics. Their ability to deliver high coverage and accuracy at lower costs makes them the dominant choice for diagnostic and clinical applications.

Whole genome sequencing is poised to be the fastest-growing technology in the global next generation sequencing market due to its comprehensive genomic coverage, declining costs, and expanding clinical utility. WGS enables complete variant detection, supporting breakthroughs in personalized medicine, rare disease diagnosis, and population genomics, thereby accelerating its global adoption across research and healthcare sectors.

Why do Targeted Sequencing Consumables Support a Diverse Range of Applications?

Targeted sequencing consumables are leading the global next generation sequencing market thanks to their pivotal role in sample prep and workflow optimization. These include pre‑optimized kits and reagents—like library prep, target enrichment, and purification kits—that labs continuously consume. Innovations such as microfluidic‑based, pre‑spotted reagent cards and automation-compatible consumables boost efficiency, reduce errors, and ensure data quality. Because consumables are indispensable for every run, they generate ongoing revenue and support diverse applications—making them dominant in the next generation sequencing product ecosystem.

Platform products are expected to be the fastest growing segment in the global next generation sequencing market due to continuous technological advancements, higher throughput capabilities, and integration of AI-powered analytics. Their ability to support diverse sequencing applications on a single system is driving increased adoption across clinical and research settings.

To get detailed segments analysis, Request a Free Sample Report

Why is Early Adoption of Genomic Technologies Significant for North America?

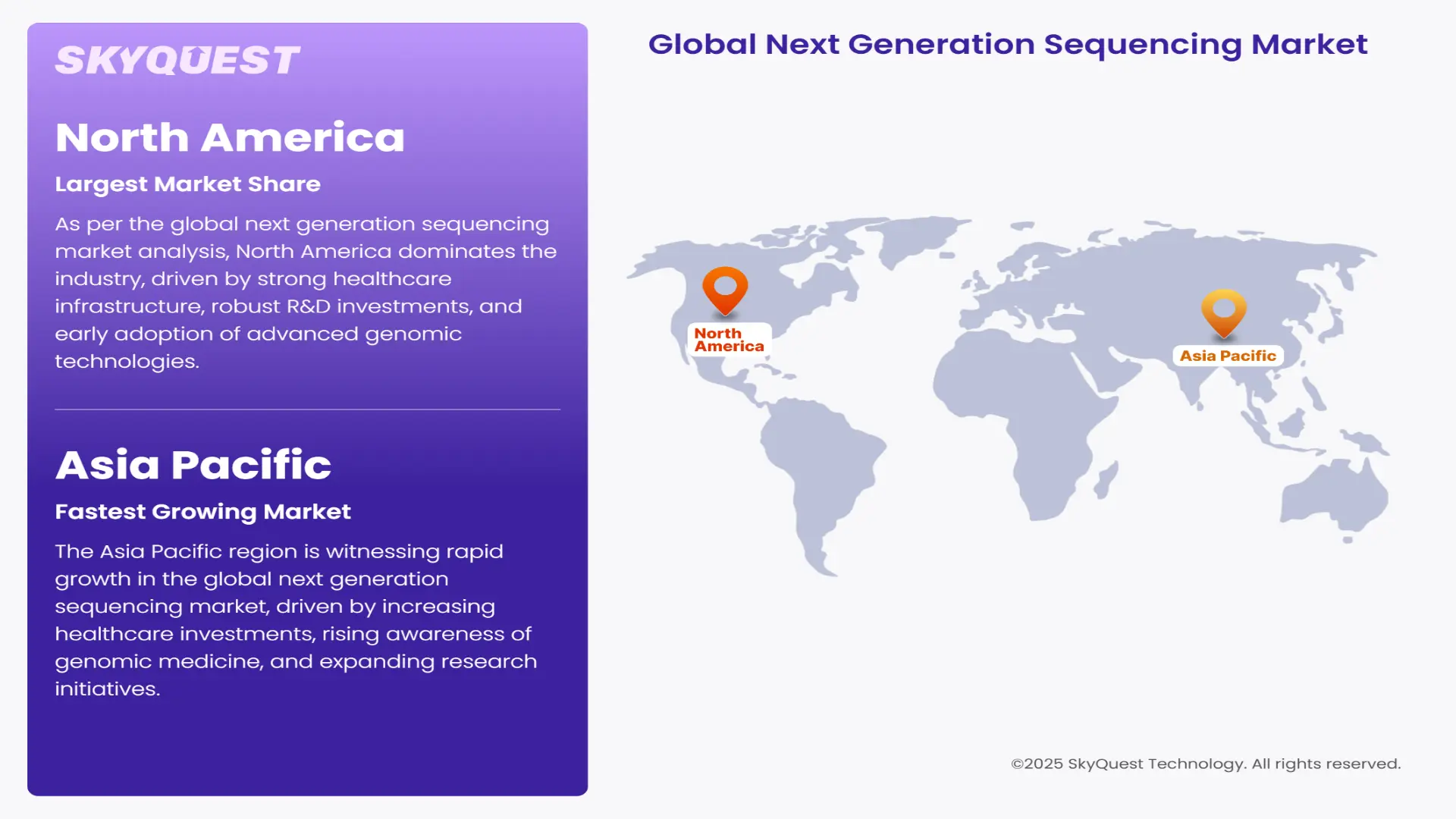

As per the global next generation sequencing market analysis, North America dominates the industry, driven by strong healthcare infrastructure, robust R&D investments, and early adoption of advanced genomic technologies. The presence of key market players, increasing demand for personalized medicine, and favorable regulatory support fuel regional growth. Additionally, widespread use of next generation sequencing in oncology, rare disease diagnostics, and academic research continues to reinforce North America’s leadership in the global next generation sequencing landscape.

US Next Generation Sequencing Market

The United States is the largest contributor to North America’s next generation sequencing market, driven by significant investments in genomic research, strong federal funding through agencies like the NIH, and the presence of major next generation sequencing companies. Clinical adoption is high due to advanced healthcare infrastructure and precision medicine initiatives. Next generation sequencing is widely applied in oncology, genetic disease diagnosis, and drug development, positioning the U.S. as a global leader in sequencing innovation.

Canada Next Generation Sequencing Market

Canada plays a growing role in North America’s next generation sequencing market, supported by government initiatives like Genome Canada and strong academic research centers. The country emphasizes next generation sequencing in public health, rare disease identification, and oncology diagnostics. Increasing partnerships between healthcare institutions and biotech firms, alongside rising adoption of genomic medicine, are enhancing Canada’s market presence and contributing to regional advancements in sequencing technologies and personalized healthcare solutions.

Which Sectors are Adopting Next Generation Sequencing more Rapidly in Asia Pacific?

The Asia Pacific region is witnessing rapid growth in the global next generation sequencing market, driven by increasing healthcare investments, rising awareness of genomic medicine, and expanding research initiatives. Countries like China, Japan, and India are leading advancements through national genomics programs and precision medicine efforts. Growing partnerships between local biotech firms and global players, along with supportive government policies, are accelerating next generation sequencing adoption across clinical and academic sectors.

Japan Next Generation Sequencing Market

Japan is a major contributor to the Asia Pacific next generation sequencing market, driven by strong government support, advanced healthcare infrastructure, and leading-edge research. The country emphasizes next generation sequencing in oncology, rare disease diagnostics, and prenatal screening. Technological innovations such as microfluidic automation and partnerships between academic institutions and global biotech firms strengthen its position. Japan’s national precision medicine strategies and early adoption of clinical genomics continue to accelerate its role in global next generation sequencing advancements.

South Korea Next Generation Sequencing Market

South Korea is rapidly expanding its presence in the Asia Pacific next generation sequencing market through strong government-backed genomic initiatives and the growth of key players like Macrogen. The country invests in clinical genomics, cancer screening, and personalized medicine. Robust infrastructure, high data analysis capabilities, and a thriving biotech sector support widespread adoption. With ongoing R&D efforts and strategic collaborations, South Korea is becoming a vital contributor to Asia-Pacific and global sequencing innovation.

What are the Key Drivers Behind Europe’s Strong Position in the Next Generation Sequencing Market?

Europe holds a significant share in the global next generation sequencing market, fueled by strong government support, rising genomics research funding, and expanding use of next generation sequencing in clinical diagnostics. Countries like the UK, Germany, and France lead advancements in precision medicine and cancer genomics. Collaborative projects such as the 1+ Million Genomes Initiative are accelerating next generation sequencing adoption, positioning Europe as a key hub for innovation and population-scale sequencing efforts.

Germany Next Generation Sequencing Market

Germany is a leading contributor to the Europe next generation sequencing market, driven by its strong biotechnology sector, government funding, and academic research institutions. The country emphasizes next generation sequencing applications in oncology, rare diseases, and infectious disease surveillance. Major companies like Qiagen and Roche operate extensively in Germany, boosting innovation. With a well-developed healthcare infrastructure and a focus on precision medicine, Germany is a central hub for clinical and research-based next generation sequencing advancements in Europe.

France Next Generation Sequencing Market

France plays a significant role in the Europe next generation sequencing market through national initiatives like the Genomic Medicine Plan 2025, which integrates next generation sequencing into routine clinical care. The country has advanced public genomics infrastructure, supported by institutions like Inserm and Genoscope. France prioritizes next generation sequencing in cancer and rare disease diagnostics, contributing to market growth with robust investments in consumables and sequencing platforms, making it a rising leader in European genomics research and healthcare innovation.

Italy Next Generation Sequencing Market

Italy is rapidly emerging in the Europe next generation sequencing market, supported by increased government funding, academic research, and public health initiatives. Italian institutions are leveraging next generation sequencing in oncology, infectious disease research, and genetic disorder diagnostics. With growing investments in targeted sequencing and collaborations between universities and biotech firms, Italy is expanding its role in Europe’s genomic landscape and contributing steadily to the global adoption of next-generation sequencing technologies.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Next Generation Sequencing Market Drivers

Rising Demand for Precision Medicine

Growing Applications in Clinical Diagnostics

Next Generation Sequencing Market Restraints

Data Interpretation and Management Challenges

Lack of Standardization in Next Generation Sequencing Workflows

Request Free Customization of this report to help us to meet your business objectives.

The global next generation sequencing market outlook is highly competitive, with key players including Illumina, Thermo Fisher Scientific, BGI Genomics, and Oxford Nanopore Technologies. Illumina focuses on expanding its sequencing platforms and acquiring bioinformatics firms. Thermo Fisher leverages strategic collaborations to enhance clinical applications. BGI Genomics emphasizes affordable sequencing services globally, while Oxford Nanopore advances portable, real-time sequencing technologies. Continuous innovation, partnerships, and geographic expansion are core strategies shaping the competitive landscape.

As per the global next generation sequencing industry analysis, the startup landscape is flourishing, with new companies focusing on AI-driven analytics, rapid diagnostics, and portable sequencing technologies. These startups often fill gaps left by larger firms, offering agile solutions for clinical and research challenges. Backed by venture capital and public health demand, they are accelerating innovation in sample preparation, bioinformatics, and sequencing efficiency, contributing significantly to the expansion and diversification of the global next generation sequencing ecosystem.

Top Player’s Company Profiles

Recent Developments

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected by means of Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, the global next generation sequencing industry is experiencing accelerated growth, driven by increasing demand for precision medicine, advances in sequencing technologies, and the integration of AI into genomic data analysis. Falling costs have made next generation sequencing more accessible, enabling its expansion across clinical diagnostics, population health, and research sectors.

Targeted sequencing remains dominant due to its efficiency and clinical relevance, while whole genome sequencing is rapidly gaining traction. Regional leaders like North America, Asia-Pacific, and Europe continue to invest heavily in infrastructure, research, and policy support. With rising competition, continuous innovation, and expanding clinical applications, the global next generation sequencing market strategies is set to transform healthcare by enabling faster, more accurate, and personalized medical solutions on a global scale.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 13.37 Billion |

| Market size value in 2033 | USD 44.52 Billion |

| Growth Rate | 14.3% |

| Base year | 2024 |

| Forecast period | 2026-2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Next Generation Sequencing Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Next Generation Sequencing Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Next Generation Sequencing Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Next Generation Sequencing Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients