Report ID: UCMIG40D2023

Report ID:

UCMIG40D2023 |

Region:

Global |

Published Date: Upcoming |

Pages:

165

| Tables: 55 | Figures: 60

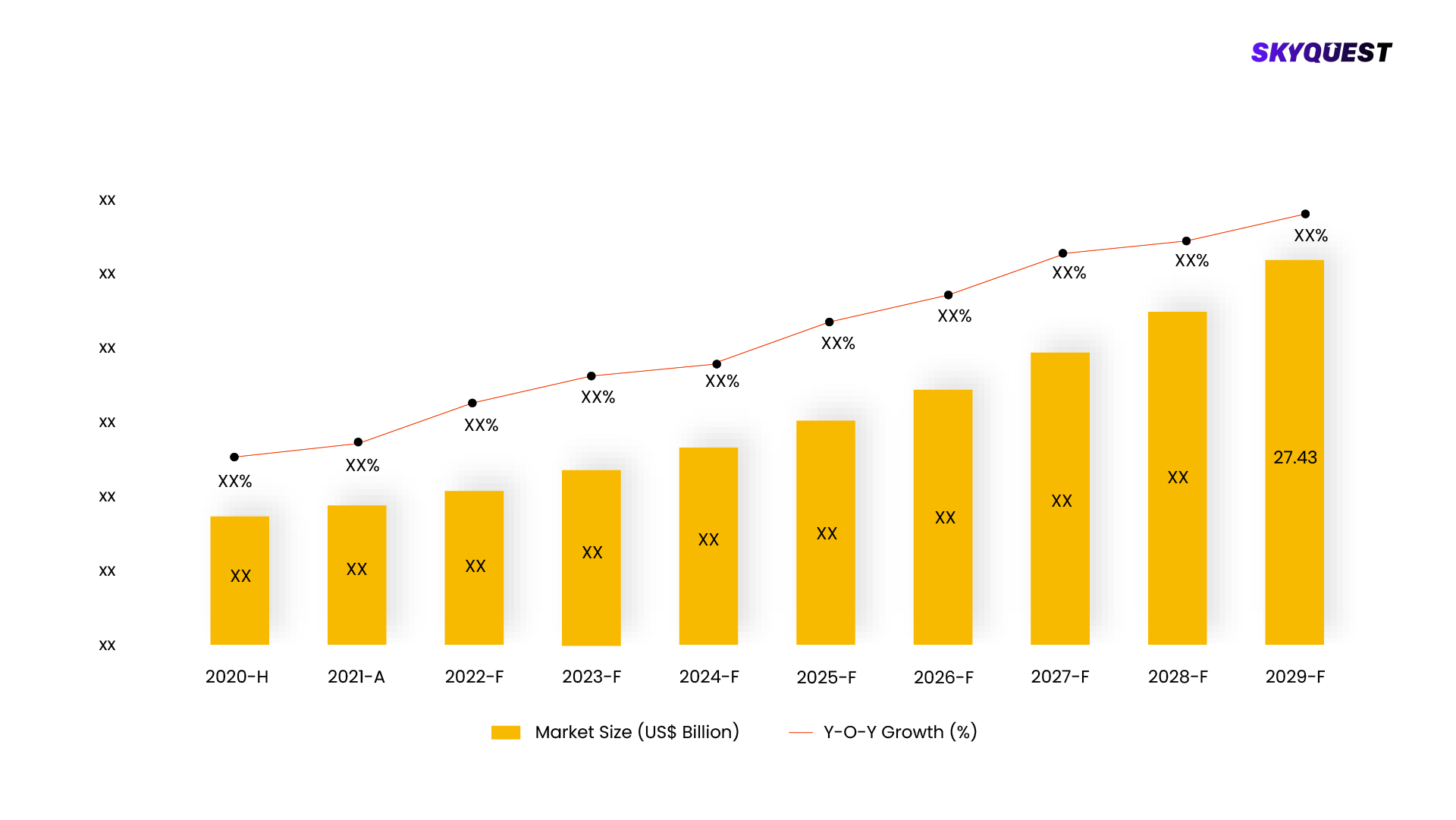

The global on-demand insurance market reached a significant valuation of USD 955.3 million in 2022. Projections indicate that this market is poised for substantial growth in the coming years, with a projected compound annual growth rate (CAGR) of 21.2% from 2023 to 2030. This growth trajectory suggests a promising future for on-demand insurance, highlighting the increasing demand and adoption of flexible insurance solutions worldwide.

This report is being written to illustrate the market opportunity by region and by segments, indicating opportunity areas for the vendors to tap upon. To estimate the opportunity, it was very important to understand the current market scenario and the way it will grow in future.

Production and consumption patterns are being carefully compared to forecast the market. Other factors considered to forecast the market are the growth of the adjacent market, revenue growth of the key market vendors, scenario-based analysis, and market segment growth.

The market size was determined by estimating the market through a top-down and bottom-up approach, which was further validated with industry interviews. Considering the nature of the market we derived the Other Diversified Financial Services by segment aggregation, the contribution of the Other Diversified Financial Services in Diversified Financials and vendor share.

To determine the growth of the market factors such as drivers, trends, restraints, and opportunities were identified, and the impact of these factors was analyzed to determine the market growth. To understand the market growth in detail, we have analyzed the year-on-year growth of the market. Also, historic growth rates were compared to determine growth patterns.

Our industry expert will work with you to provide you with customized data in a short amount of time.

REQUEST FREE CUSTOMIZATIONWant to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Report ID: UCMIG40D2023