Report ID: SQMIG15F2238

Report ID: SQMIG15F2238

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG15F2238 |

Region:

Global |

Published Date: June, 2025

Pages:

195

|Tables:

120

|Figures:

77

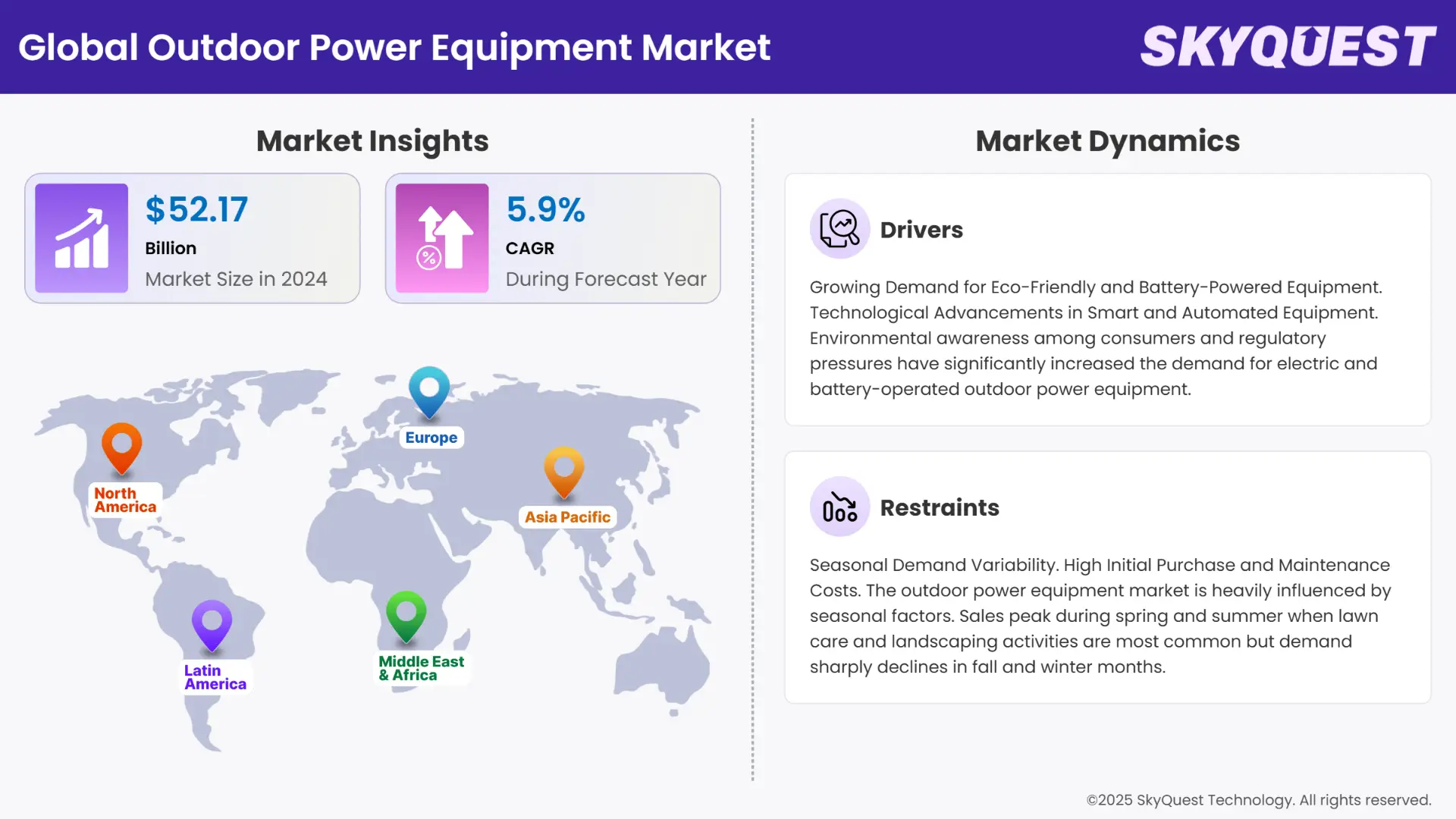

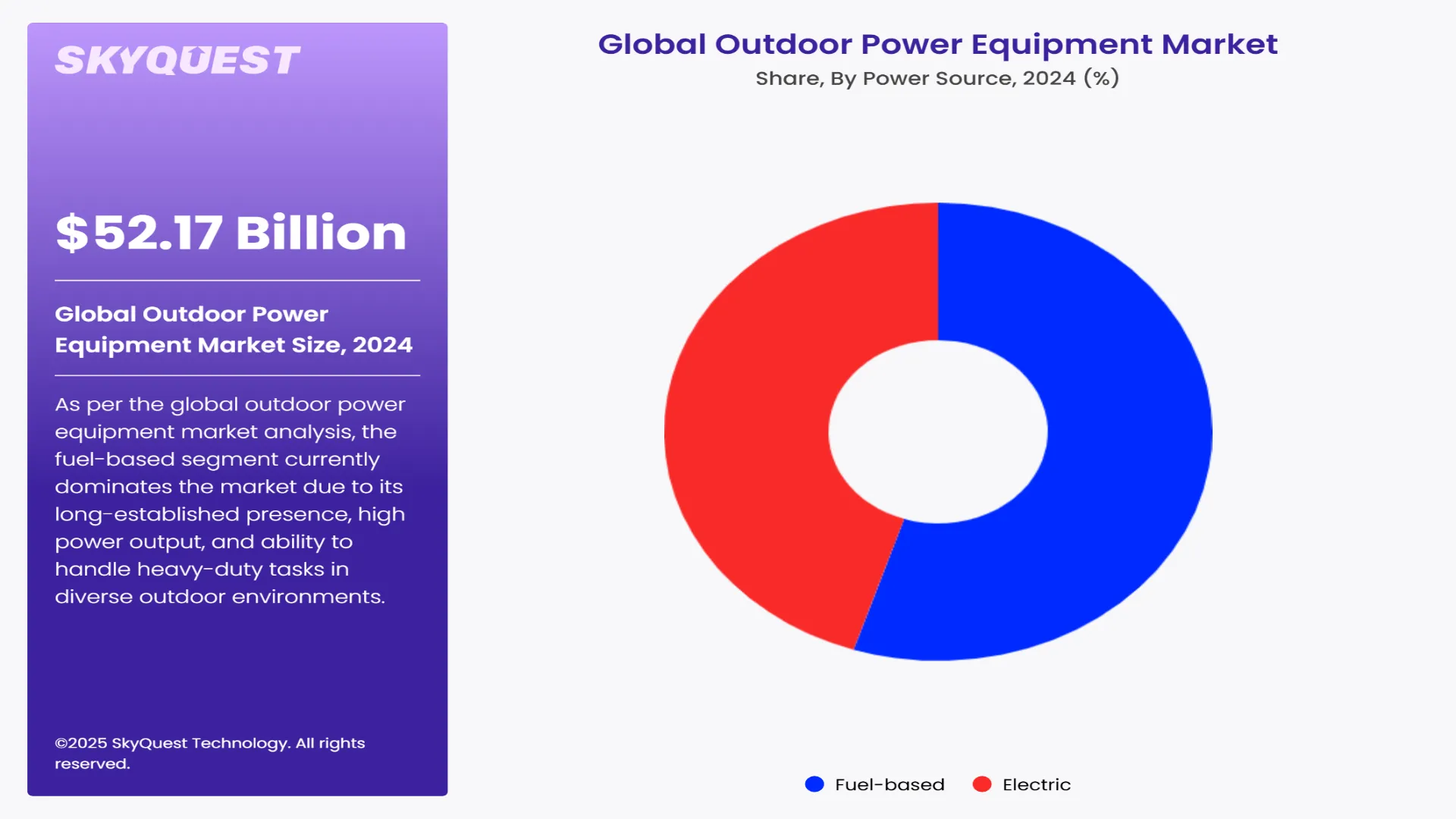

Global Outdoor Power Equipment Market size was valued at USD 52.17 Billion in 2024 and is poised to grow from USD 55.24 Billion in 2025 to USD 87.39 Billion by 2033, growing at a CAGR of 5.9% in the forecast period (2026–2033).

The outdoor power equipment market is evolving rapidly, fueled by several significant factors that contribute to its steady expansion. Increasing urbanization and the growth of residential and commercial landscaping activities have substantially raised the demand for efficient and reliable outdoor power tools. Consumers and businesses alike are seeking equipment that not only delivers high performance but also aligns with environmental sustainability goals. This shift has accelerated innovation in battery-powered, and electric OPE, which reduces harmful emissions and noise pollution, addressing growing regulatory and consumer pressures for greener solutions.

Technological progress is another key driver, with manufacturers integrating smart features such as IoT connectivity, app-based controls, and enhanced ergonomics to improve usability and maintenance. These advancements make equipment easier to operate and maintain, attracting a wider customer base, including homeowners and professional landscapers. Despite these positive trends, the market is contending with certain obstacles. Seasonal demand creates variability in sales, with peak periods mainly during warmer months, which can challenge consistent revenue streams for manufacturers and retailers. Additionally, the costs associated with upkeep and repairs remain a concern for many users, potentially limiting market penetration in some segments.

The outlook for the market remains optimistic. The continuous push towards innovation, combined with increasing environmental regulations and consumer awareness, is expected to drive the adoption of electric and hybrid outdoor power equipment.

How is AI Revolutionizing the Outdoor Power Equipment Market in 2024?

Artificial Intelligence (AI) is playing an increasingly transformative role in the outdoor power equipment market by enabling smarter, more efficient, and user-friendly products. In 2024, AI-powered features such as predictive maintenance, autonomous operation, and real-time performance optimization will become standard in advanced OPE models. For example, Husqvarna introduced AI-driven robotic lawn mowers that use machine learning algorithms to adapt mowing patterns based on terrain and weather conditions, maximizing efficiency while minimizing energy use. This integration of AI not only improves the overall performance and durability of the equipment but also enhances user convenience by reducing manual intervention and maintenance needs. As AI continues to evolve, it is expected to drive innovation in OPE (outdoor power equipment market), making products safer, more reliable, and environmentally friendly, thereby accelerating market growth and reshaping consumer expectations.

To get more insights on this market click here to Request a Free Sample Report

The outdoor power equipment market is segmented into equipment type, power source, functionality, application, and region. Based on equipment type, the market is segmented into lawn mowers, saws, trimmers & edgers, blowers, tillers & cultivators, snow throwers and others. Based on power source, the market is segmented into fuel-based and electric. Based on functionality, the market is segmented into conventional products and connected/smart products. Based on application, the market is segmented into commercial and residential/DIY. Based on region, the market is segmented into North America, Asia-Pacific, Europe, Latin America, and Middle East & Africa.

What Makes Battery-Powered and Robotic Lawn Mowers a Game-Changer?

As per the global outdoor power equipment market outlook, lawn mowers hold a dominant position in the market due to their essential role in lawn and garden maintenance across residential, commercial, and municipal sectors. They are a fundamental tool for creating and preserving green spaces, which drives consistent demand. Recent technological advancements have significantly boosted the appeal of lawn mowers, especially the rise of battery-powered and robotic models. These innovations offer quieter operation, zero emissions, and increased convenience through automation, making lawn mowers more attractive to eco-conscious consumers and busy homeowners. Additionally, urbanization and increased awareness about outdoor aesthetics have further fueled the demand for efficient lawn care solutions.

As per global outdoor power equipment market forecast, the trimmers & edgers segment is experiencing rapid growth, driven by their versatility in maintaining clean and precise lawn edges and hard-to-reach areas that lawn mowers cannot efficiently cover. Both homeowners and professional landscapers favor these tools for their ease of use, maneuverability, and ability to deliver detailed landscaping results. The growing shift toward cordless, battery-operated trimmers and edgers has expanded their market potential by addressing concerns about noise pollution, fuel emissions, and maintenance associated with gas-powered devices.

What Makes Fuel-Powered Equipment the Preferred Choice for Heavy-Duty Tasks?

As per the global outdoor power equipment market analysis, the fuel-based segment currently dominates the market due to its long-established presence, high power output, and ability to handle heavy-duty tasks in diverse outdoor environments. Fuel-powered equipment, especially gasoline-operated machines, is preferred for their reliability and longer running times, making them a go-to choice for commercial landscapers and large-scale operations.

As per global outdoor power equipment market forecast, the electric segment is the fastest-growing segment, driven by rising environmental concerns, stricter emission regulations, and advancements in battery technology. Electric outdoor power equipment offers benefits such as low noise, zero emissions, and minimal maintenance, making it increasingly popular among residential users and eco-conscious consumers. The increasing availability of cordless and battery-powered models further accelerates the adoption of electric equipment in both urban and suburban markets.

To get detailed segments analysis, Request a Free Sample Report

Why is North America Charging Ahead of Outdoor Power Equipment?

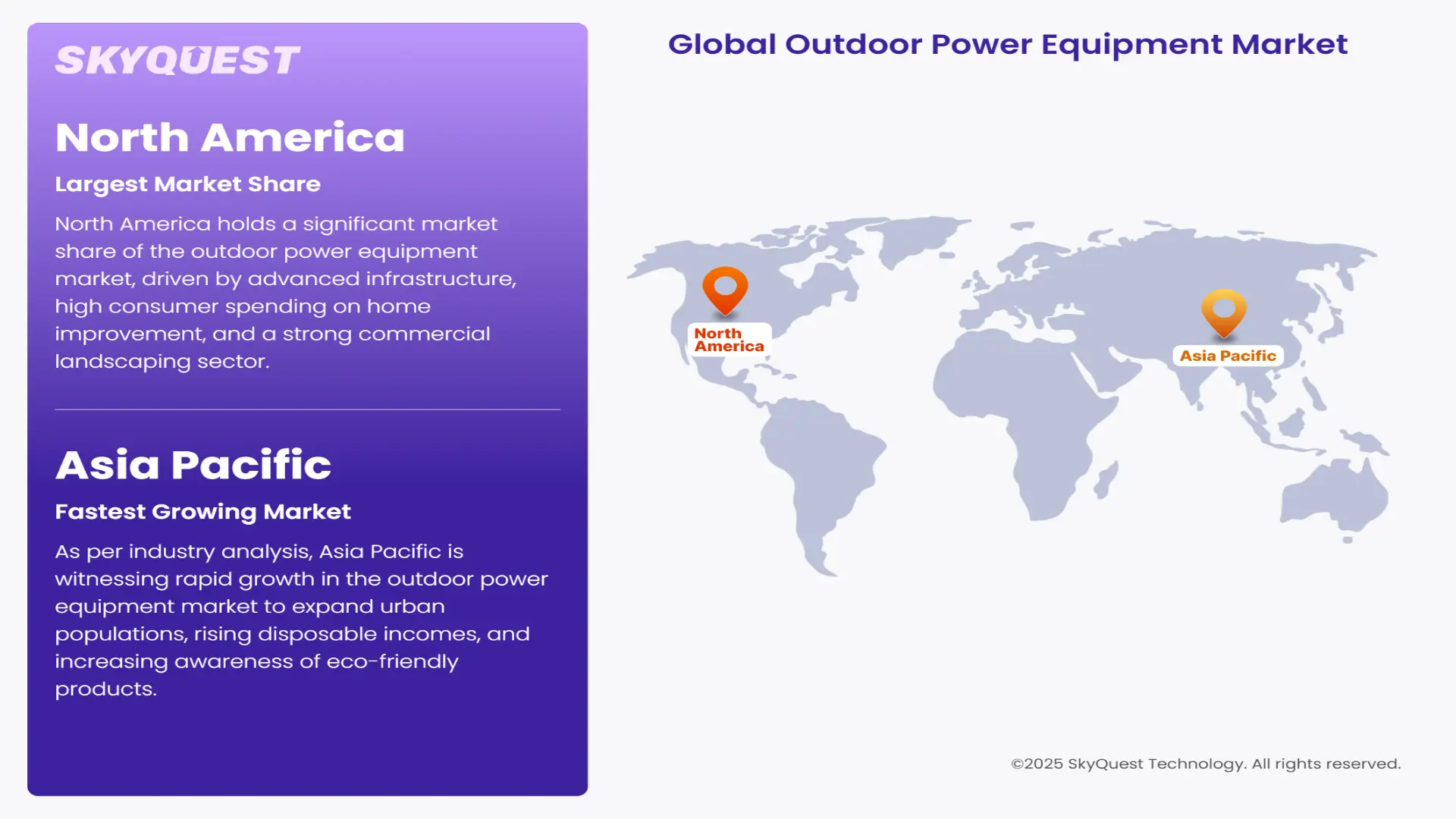

North America holds a significant market share of the outdoor power equipment market, driven by advanced infrastructure, high consumer spending on home improvement, and a strong commercial landscaping sector. The growing adoption of eco-friendly battery-powered equipment and government initiatives promoting green technologies further bolster the market. Additionally, the region’s well-established retail and distribution channels make it easier for manufacturers to reach end-users effectively.

Outdoor Power Equipment Market in United States

As per regional forecast, the United States is a key contributor to North America’s dominance in the outdoor power equipment market. High consumer awareness about environmental issues and increased investment in smart and electric equipment drive market growth. Manufacturers are focusing on launching innovative products such as robotic mowers and IoT-enabled tools. Government regulations aimed at reducing emissions also encourage the shift from gas-powered to electric equipment.

Outdoor Power Equipment Market in Canada

As per regional outlook, Canada’s market growth is supported by rising demand for residential landscaping tools and government subsidies promoting sustainable energy solutions. The country’s harsh winters and vast landscapes create demand for durable and reliable equipment, fostering innovation in cold-weather operational capabilities. Increasing urbanization and landscaping investments further contribute to market expansion.

Could Asia Pacific Become the Global Hub for Next-Gen Outdoor Tools?

As per industry analysis, Asia Pacific is witnessing rapid growth in the outdoor power equipment market to expand urban populations, rising disposable incomes, and increasing awareness of eco-friendly products. The growing construction and commercial landscaping sectors in developing economies also support market demand. Technological adoption is accelerating, particularly in countries like Japan and South Korea.

Outdoor Power Equipment Market in Japan

Japan’s outdoor power equipment market benefits from the country’s strong technological innovation culture. The demand for highly efficient, compact, and robotic equipment is growing among both commercial and residential users. Japan’s aging population also drives demand for easy-to-use, ergonomic tools, encouraging manufacturers to prioritize user-friendly designs.

Outdoor Power Equipment Market in South Korea

South Korea’s market growth is fueled by increased government support for green technology and rising consumer preference for electric-powered outdoor tools. The country’s robust manufacturing base also enables the production of advanced outdoor equipment, while urban landscaping projects boost demand from commercial sectors.

What’s Driving Europe’s Push for Eco-Friendly Outdoor Equipment?

Europe remains a vital market for outdoor power equipment, driven by stringent environmental regulations, high adoption of electric equipment, and strong demand from commercial landscaping and agricultural sectors. The region emphasizes sustainability, pushing manufacturers to innovate with cleaner and quieter technology solutions.

Outdoor Power Equipment Market in Germany

Germany leads Europe in the outdoor power equipment market due to its strong industrial base and focus on precision engineering. The country’s strict environmental laws accelerate the shift to electric and battery-powered devices, while a growing DIY culture supports residential market growth.

Outdoor Power Equipment Market in United Kingdom

The UK market benefits from increasing government initiatives promoting low-emission technologies and expanding public green spaces. Consumer interest in gardening and home improvement remains strong, driving demand for user-friendly and efficient outdoor equipment.

Outdoor Power Equipment Market in Italy

Italy’s outdoor power equipment market is shaped by the country’s large agricultural sector and growing urban landscaping projects. The demand for compact and versatile tools is increasing, along with a focus on sustainable equipment that meets European environmental standards.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Outdoor Power Equipment Market Drivers

Growing Demand for Eco-Friendly and Battery-Powered Equipment

Technological Advancements in Smart and Automated Equipment

Outdoor Power Equipment Market Restraints

Seasonal Demand Variability

High Initial Purchase and Maintenance Costs

Request Free Customization of this report to help us to meet your business objectives.

The competitive landscape of the global outdoor power equipment industry in 2024 is characterized by intense rivalry among well-established global players focusing on innovation, sustainability, and strategic partnerships to maintain and expand their market shares. Leading companies such as Husqvarna Group, Stihl, and Deere & Company are investing heavily in electric and battery-powered equipment to cater to the growing demand for eco-friendly and noise-reduced solutions.

As per market strategies, in 2024, Husqvarna launched a new line of battery-operated lawn mowers and trimmers aimed at residential users seeking greener alternatives. Additionally, many players are forming collaborations with technology firms to integrate IoT and AI capabilities for smart equipment management. The push towards electrification, digitalization, and enhanced user experience is driving competition and reshaping market dynamics, with companies leveraging R&D and strategic acquisitions to stay ahead.

In recent years, the outdoor power equipment market has seen a surge in innovative startups that are redefining how consumers and professionals approach landscaping and maintenance tasks. These startups focus heavily on sustainability, smart technology integration, and user-friendly designs. Many are developing electric and battery-powered tools that reduce environmental impact while maintaining high performance. Others are leveraging AI and IoT to create connected devices that offer predictive maintenance, remote control, and enhanced safety features.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected by means of Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, key drivers of market growth include rising demand for eco-friendly equipment. Market growth can be ascribed to the increasing demand for cordless outdoor power equipment as people are more inclined toward greater flexibility and portability. Furthermore, several companies’ technological advancements in outdoor power equipment are also expected to drive market growth. The rising urbanization, disposable income, and infrastructure activities coupled with rising demand for landscaping services are expected to augment the growth of the outdoor power equipment industry. Key restraints limiting the growth of the outdoor power equipment market include the high upfront cost of advanced electric and robotic equipment, which can deter price-sensitive customers. Furthermore, growing awareness of environmental issues leads to increasing adoption of outdoor power equipment using lithium-ion batteries as they are environmentally friendly and maximize energy output.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 52.17 Billion |

| Market size value in 2033 | USD 87.39 Billion |

| Growth Rate | 5.9% |

| Base year | 2024 |

| Forecast period | 2026-2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Outdoor Power Equipment Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Outdoor Power Equipment Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Outdoor Power Equipment Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Outdoor Power Equipment Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Global Outdoor Power Equipment Market size was valued at USD 52.17 Billion in 2024 and is poised to grow from USD 55.24 Billion in 2025 to USD 87.39 Billion by 2033, growing at a CAGR of 5.9% in the forecast period (2026–2033).

The competitive landscape of the global outdoor power equipment industry in 2024 is characterized by intense rivalry among well-established global players focusing on innovation, sustainability, and strategic partnerships to maintain and expand their market shares. Leading companies such as Husqvarna Group, Stihl, and Deere & Company are investing heavily in electric and battery-powered equipment to cater to the growing demand for eco-friendly and noise-reduced solutions. 'Husqvarna Group', 'Stihl Group', 'Strategic Value Partners (SVP)', 'Vista Outdoor', 'Deere & Company', 'Honda Motor Co., Ltd.', 'Toro Company', 'Briggs & Stratton Corporation', 'Ariens Company', 'MTD Products Inc.', 'Black & Decker (Stanley Black & Decker)', 'Kubota Corporation', 'Greenworks Tools', 'Ryobi'

Environmental awareness among consumers and regulatory pressures have significantly increased the demand for electric and battery-operated outdoor power equipment. In 2024, companies like EGO Power+ have expanded their battery-powered product portfolios, offering high-performance cordless lawn mowers, trimmers, and blowers that provide comparable power to traditional gas models but with zero emissions and reduced noise pollution. This shift supports sustainability goals and aligns with stricter environmental regulations globally, making eco-friendly products a key growth driver in the market.

Rise of Autonomous and Robotic Equipment: Automation is becoming a dominant market trend as consumers and professionals seek labor-saving solutions. Leading manufacturers like John Deere have launched autonomous lawn care and landscaping robots in 2024 that can navigate complex yard layouts and perform tasks like mowing and leaf removal with minimal human supervision. These machines improve safety by reducing manual handling of equipment and boost productivity by enabling continuous operation, especially in commercial applications.

Why is North America Charging Ahead of Outdoor Power Equipment?

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients