Pulmonary Drug Delivery Systems Market Insights

Market Overview:

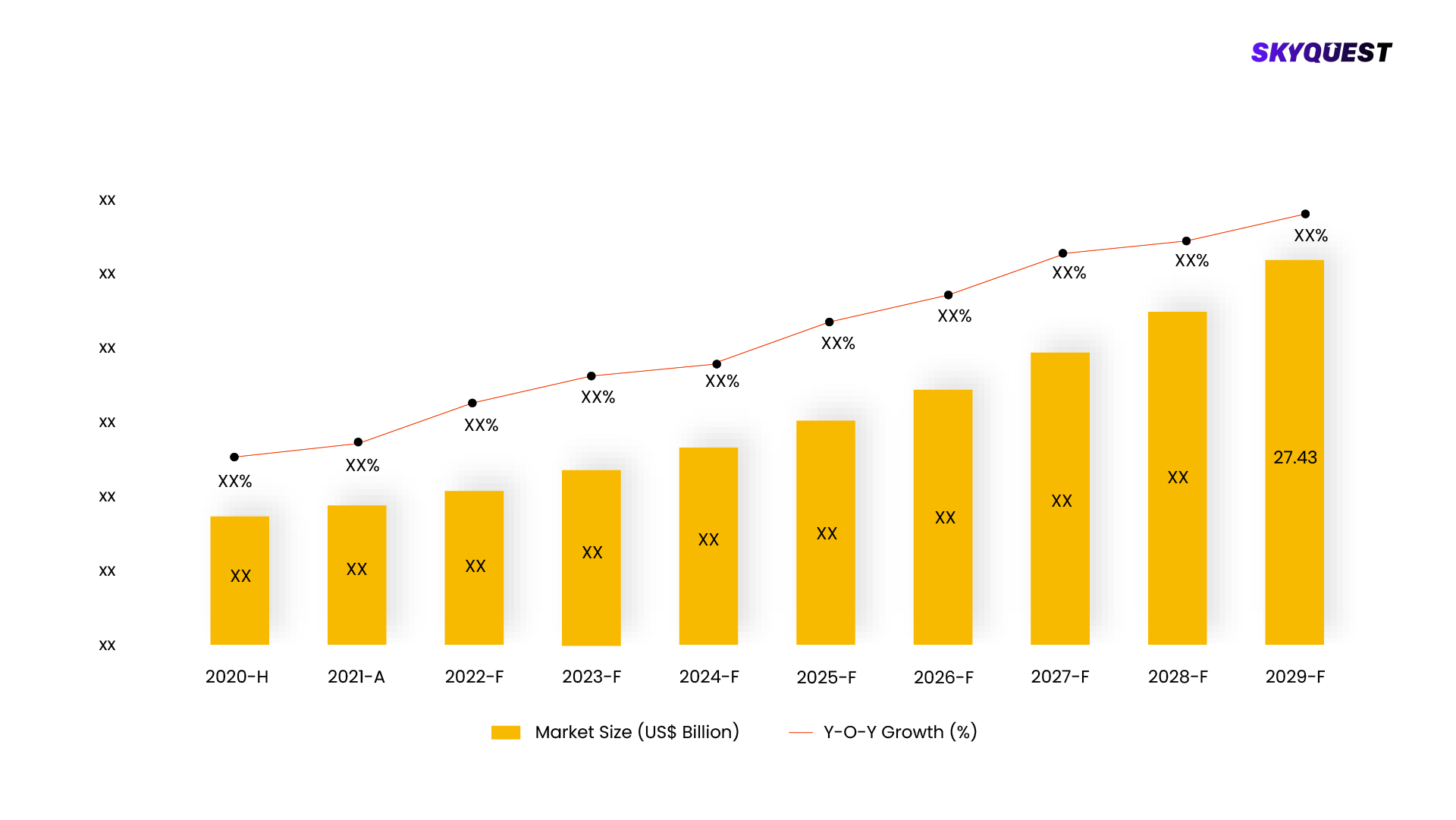

The size of the global market for pulmonary drug delivery devices/systems, which was estimated at USD 36.5 billion in 2016, is projected to increase at a CAGR of 4.7% from 2017 to 2021. In the near future, it is anticipated that the prevalence of chronic respiratory disorders will rise, accelerating the demand for pulmonary drug delivery systems (PDDS).

Pulmonary Drug Delivery Systems Market, Forecast & Y-O-Y Growth Rate, 2020 - 2028

To get more reports on the above market click here to

GET FREE SAMPLEThis report is being written to illustrate the market opportunity by region and by segments, indicating opportunity areas for the vendors to tap upon. To estimate the opportunity, it was very important to understand the current market scenario and the way it will grow in future.

Production and consumption patterns are being carefully compared to forecast the market. Other factors considered to forecast the market are the growth of the adjacent market, revenue growth of the key market vendors, scenario-based analysis, and market segment growth.

The market size was determined by estimating the market through a top-down and bottom-up approach, which was further validated with industry interviews. Considering the nature of the market we derived the Pharmaceuticals by segment aggregation, the contribution of the Pharmaceuticals in Pharmaceuticals, Biotechnology & Life Sciences and vendor share.

To determine the growth of the market factors such as drivers, trends, restraints, and opportunities were identified, and the impact of these factors was analyzed to determine the market growth. To understand the market growth in detail, we have analyzed the year-on-year growth of the market. Also, historic growth rates were compared to determine growth patterns.

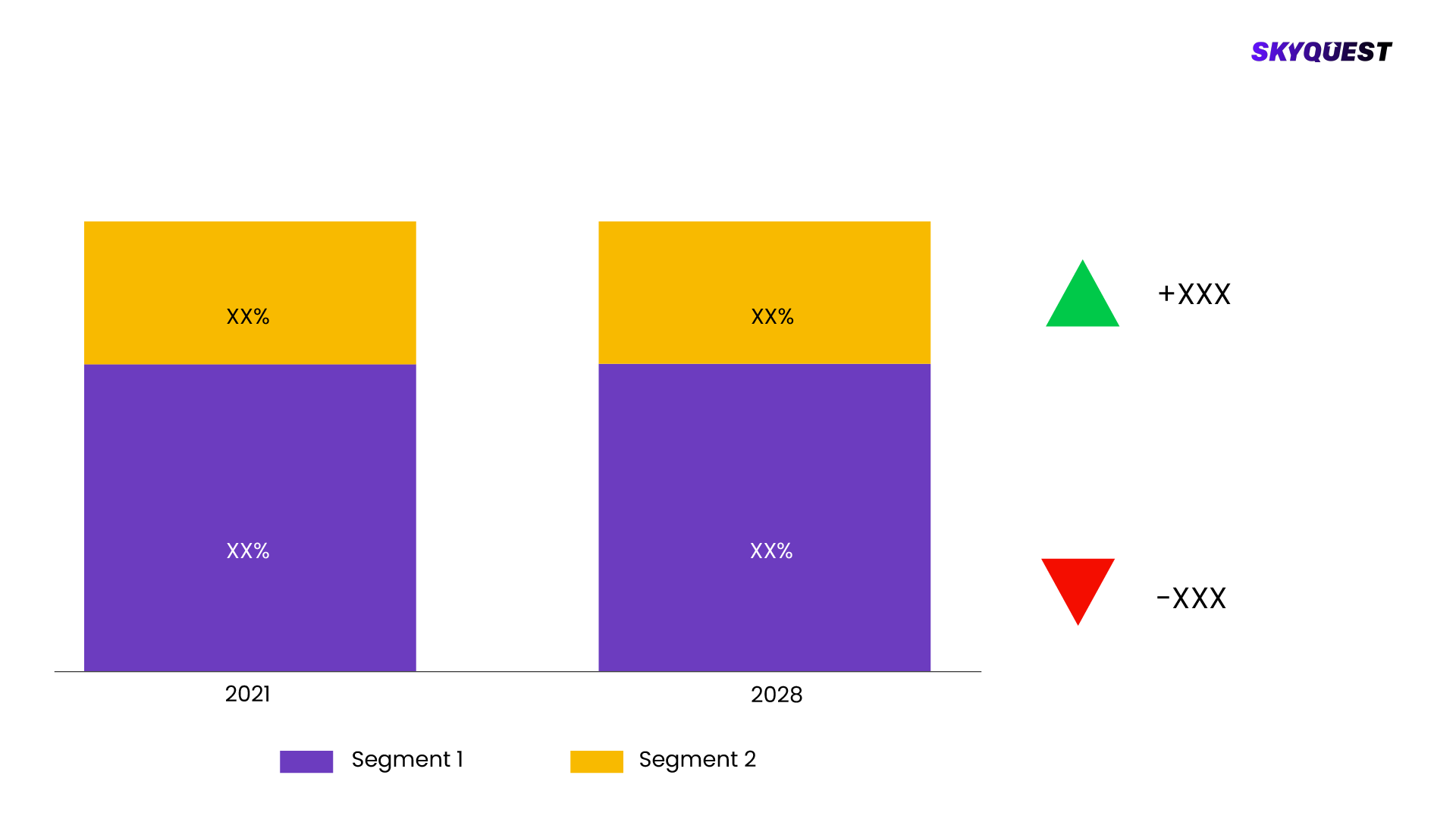

Segmentation Analysis:

The Pulmonary Drug Delivery Systems Market is segmented by Product, Application, Distribution Channel, End-use, Region. We are analyzing the market of these segments to identify which segment is the largest now and in the future, which segment has the highest growth rate, and the segment which offers the opportunity in the future.

Pulmonary Drug Delivery Systems Market Basis Point Share Analysis, 2021 Vs. 2028

To get detailed analysis on all segments

BUY NOW

- Based on Product the market is segmented as, Metered Dose Inhalers, Dry Powder Inhalers, Nebulizers, Mesh, Vibrating, Static, Pneumatic, Vented, Breath Actuated, Ultrasonic, Accessories

- Based on Application the market is segmented as, Asthma, Cystic Fibrosis, COPD, Allergic Rhinitis, Others

- Based on Distribution Channel the market is segmented as, Retail Pharmacies, Hospital Pharmacies, E-Commerce

- Based on End-use the market is segmented as, Hospitals & Clinics, Homecare

- Based on Region the market is segmented as, North America, Europe, Asia Pacific, Latin America

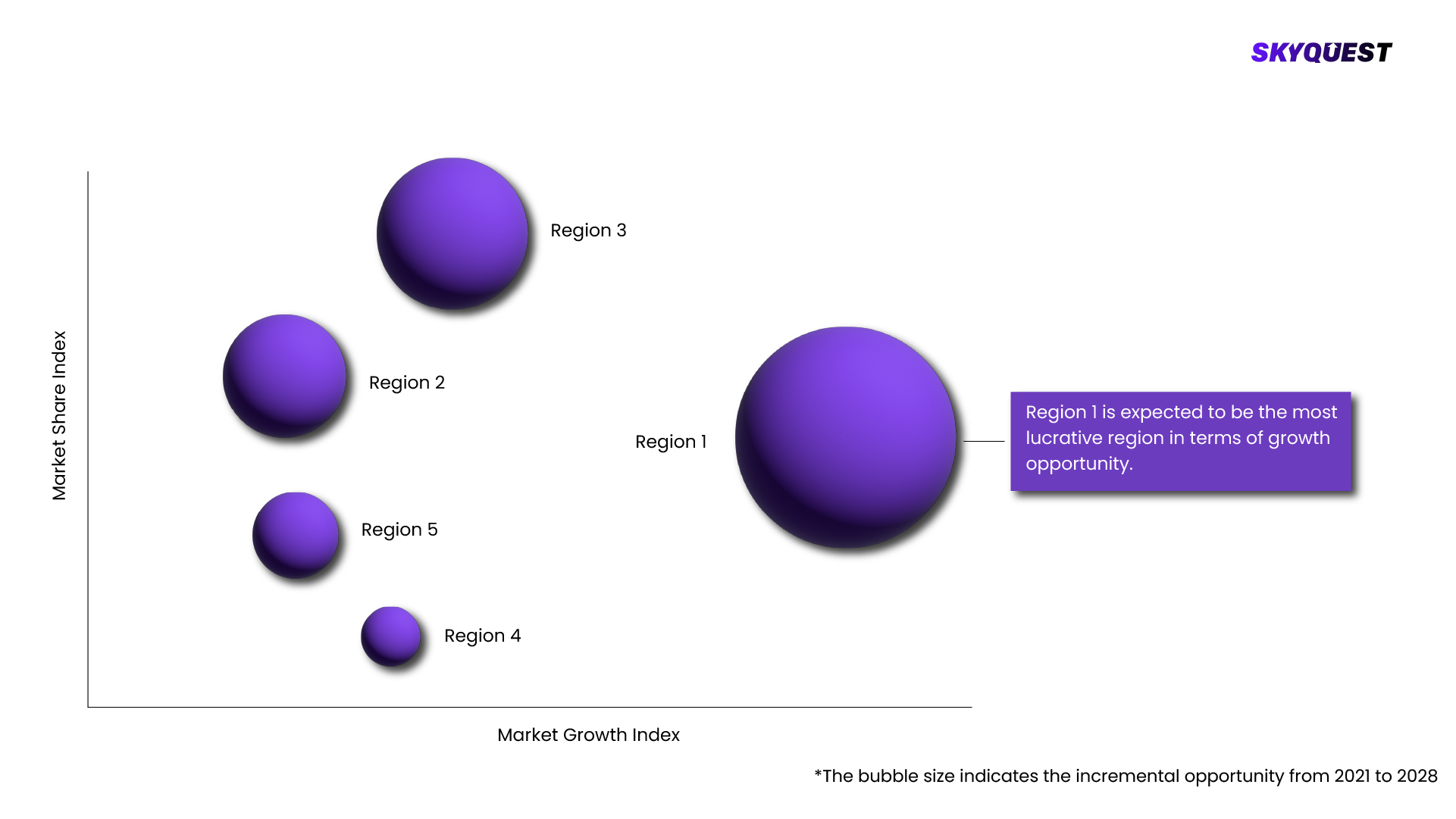

Regional Analysis:

Pulmonary Drug Delivery Systems Market is being analyzed by North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA) regions. Key countries including the U.S., Canada, Germany, France, UK, Italy, Spain, China, India, Japan, Brazil, GCC Countries, and South Africa among others were analyzed considering various micro and macro trends.

Pulmonary Drug Delivery Systems Market Attractiveness Analysis, By Region 2020-2028

To know more about the market opportunities by region and country, click here to

REQUEST FREE CUSTOMIZATIONPulmonary Drug Delivery Systems Market : Risk Analysis

SkyQuest's expert analysts have conducted a risk analysis to understand the impact of external extremities on Pulmonary Drug Delivery Systems Market. We analyzed how geopolitical influence, natural disasters, climate change, legal scenario, economic impact, trade & economic policies, social & ethnic concerns, and demographic changes might affect Pulmonary Drug Delivery Systems Market's supply chain, distribution, and total revenue growth.

Competitive landscaping:

To understand the competitive landscape, we are analyzing key Pulmonary Drug Delivery Systems Market vendors in the market. To understand the competitive rivalry, we are comparing the revenue, expenses, resources, product portfolio, region coverage, market share, key initiatives, product launches, and any news related to the Pulmonary Drug Delivery Systems Market.

To validate our hypothesis and validate our findings on the market ecosystem, we are also conducting a detailed porter's five forces analysis. Competitive Rivalry, Supplier Power, Buyer Power, Threat of Substitution, and Threat of New Entry each force is analyzed by various parameters governing those forces.

Key Players Covered in the Report:

- involved in the development of novel MDIs and the high acceptance rate of these devices in developing regions, such as Asia Pacific and Latin America, are some of the factors responsible for the revenue generated by this segment.

- Dry Powder Inhaler (DPI) segment is anticipated to grow at a lucrative rate during the future period. Advantages such as cost-effectiveness, short administration, and preparation time, and others are anticipated to increase the use of these inhalers by end users. Due to technological advancements, DPI emerged as a preferred medical device for the treatment of a diverse range of respiratory disorders, which has in turn increased the utilization of these products. The abovementioned factors are likely to propel the growth of this segment.

- Nebulizers are projected to grow at a steady rate over the future period. These devices are the most frequently used inhalation devices in hospitals. Nebulizers have a high adoption rate in home care and emergency medicine due to their benefits, such as greater comfort, administration of large dosage, and favorable reimbursement scenario, which is expected to help maintain a steady demand for this product segment.

- The accessories segment is estimated to grow at a CAGR of 5.6% owing to the launch of new products and extensive R&D in this field. These products are necessary for efficient drug delivery to a patient’s lungs. Abovementioned factors are anticipated to support the segment development

- Application Insights

- The asthma segment held the dominant share in 2016. An effective inhalation therapy that uses DPIs and MDIs is considered to be the basis of asthma management. Owing to the high number of people affected by asthma, the demand, and usage of devices such as MDIs and DPIs for asthma management are increasing, boosting the growth of this application.

- The dynamic growth of the COPD segment can be attributed to the high incidence and mortality of this disease. Favorable reimbursement policies for the treatment of COPD and a rise in the number of government and non-government organizations that provide COPD treatment are increasing revenue generated by this segment. Owing to these factors, the COPD segment is expected to grow consistently.

- Treatment of allergic rhinitis involves the use of nasal sprays, dry powder inhalers, and allergy shots. According to the National Center for Health Statistics (NCHS), in 2016, 20 million adults aged more than 18 years and 6.1 million children in the U.S. were diagnosed with allergic rhinitis. Due to a large patient pool, the demand for PDDS devices is projected to increase, resulting in the development of this segment.

- The other application segment is anticipated to exhibit progress owing to the rise in patients diagnosed with various chronic diseases. According to the CDC, in 2016, 29.4 million adults were diagnosed with sinusitis in the U.S. Treatment of such diseases demands the use of PDDS. These factors are expected to provide this segment growth opportunity.

- Distribution Channel Insights

- Hospital pharmacies segment held the dominant share of the PDDS in 2016 and is projected to continue its dominance in the future. Hospitals provide extensive treatments, care, quick reimbursements, and insurance policies owing to which patients prefer hospital pharmacies. Furthermore, an increased number of hospitalizations is expected to boost the growth of this segment.

- Retail pharmacies are expected to show steady growth over the future period, owing to easy accessibility and affordability. Hospitals and clinics rely on retail pharmacies as a backup for medications. Moreover, most of the home care products are available in retail pharmacies. These factors are likely to be responsible for the constant growth of this segment.

- E-commerce is anticipated to grow at a CAGR of 5.4% during the forecast period. Various factors such as improving healthcare infrastructure in developing regions and convenience of purchasing in comparison to retail or hospital pharmacies have supported the growth of this distribution channel to a great extent.

- The trend of online purchasing and the demand for it is growing due to comfort, flexibility, and convenience, which is increasing the revenue generated by this segment. Moreover, online shopping offers discounts that benefit customers. These factors are expected to collectively boost the demand for online pharmacies.

- End-use Insights

- As of 2016, hospitals accounted for the largest revenue share of the PDDS. Hospitals are currently advancing in terms of technology usage. Technologically advanced medical devices are being extensively used in hospitals to improve point-of-care. Furthermore, hospitals also provide a wide array of treatments for various respiratory diseases.

- In developed regions such as North America and Europe, hospitals also provide quick reimbursements for COPD treatment under the Medicare program. These facts are expected to stimulate the utilization of PDDS devices in hospital settings, leading to growth.

- The home care segment is expected to exhibit lucrative growth over the future period. Growing preference for home healthcare is expected to boost the use of PDDS devices in home care settings. An increase in the cost of health care services and a shortage of healthcare facilities have also led to an increase in demand for home care services.

- The introduction of technologically advanced devices, which are portable and small-sized, has resulted in patients using such products at home. These devices are convenient, easy-to-use, and do not require any special training to operate. These associated advantages are expected to increase the adoption of PDDS in home care, thereby boosting the growth of this segment.

- Regional Insights

- North America held the dominant share of PDDS and was valued at USD 14.9 billion in 2016. This growth can be attributed to the rising incidence of diseases such as COPD and asthma. A rise in the number of patients affected by these diseases, increases the demand for diagnostic devices, such as PDDS, thereby boosting the growth of this region.

- In addition, the local presence of key pharmaceutical and medical devices players, advanced healthcare infrastructure, aging population, high disposable income, and lifestyle changes are factors contributing to the overall growth of the North America respiratory drug delivery devices market.

- Asia Pacific region is anticipated to grow at an exponential rate of 6.2% due to the high prevalence of COPD, which indicates a substantial socioeconomic burden in this region. Continuous increase in the number of asthmatic and allergic rhinitis patients is also a major factor that is anticipated to propel the market demand for PDDS in the Asia Pacific region during the forecast period.

- Furthermore, a rise in the number of supportive nongovernment organizations, such as the Asia Pacific Association of Allergy, Asthma and Clinical Immunology (APAAACI), is estimated to increase awareness about the treatment of respiratory disorders amongst patients, leading to market growth. Continuous increase in R&D activities by key market players to develop novel respiratory devices is also expected to support the growth of the Asia Pacific region.

- KEY MARKET SEGMENTS

- By Product

- Metered Dose Inhalers

- Dry Powder Inhalers

- Nebulizers

- Mesh

- Vibrating

- Static

- Pneumatic

- Vented

- Breath Actuated

- Ultrasonic

- Accessories

- By Application

- Asthma

- Cystic Fibrosis

- COPD

- Allergic Rhinitis

- Others

- By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- E-Commerce

- By End-use

- Hospitals & Clinics

- Homecare

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- KEY PLAYERS

- GlaxoSmithKline plc

- Philips Respironics

- Boehringer Ingelheim GmbH

- Novartis AG

- 3M Healthcare

- GF Health Products, Inc.

- Merck & Co., Inc.

- AstraZeneca

SkyQuest's Expertise:

The Pulmonary Drug Delivery Systems Market is being analyzed by SkyQuest's analysts with the help of 20+ scheduled Primary interviews from both the demand and supply sides. We have already invested more than 250 hours on this report and are still refining our date to provide authenticated data to your readers and clients. Exhaustive primary and secondary research is conducted to collect information on the market, peer market, and parent market.

Our cross-industry experts and revenue-impact consultants at SkyQuest enable our clients to convert market intelligence into actionable, quantifiable results through personalized engagement.

Scope Of Report

| Report Attribute |

Details |

| The base year for estimation |

2021 |

| Historical data |

2016 – 2022 |

| Forecast period |

2022 – 2028 |

| Report coverage |

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered |

- By Product - Metered Dose Inhalers, Dry Powder Inhalers, Nebulizers, Mesh, Vibrating, Static, Pneumatic, Vented, Breath Actuated, Ultrasonic, Accessories

- By Application - Asthma, Cystic Fibrosis, COPD, Allergic Rhinitis, Others

- By Distribution Channel - Retail Pharmacies, Hospital Pharmacies, E-Commerce

- By End-use - Hospitals & Clinics, Homecare

- By Region - North America, Europe, Asia Pacific, Latin America

|

| Regional scope |

North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA) |

| Country scope |

U.S., Canada, Germany, France, UK, Italy, Spain, China, India, Japan, Brazil, GCC Countries, South Africa |

| Key companies profiled |

- involved in the development of novel MDIs and the high acceptance rate of these devices in developing regions, such as Asia Pacific and Latin America, are some of the factors responsible for the revenue generated by this segment.

- Dry Powder Inhaler (DPI) segment is anticipated to grow at a lucrative rate during the future period. Advantages such as cost-effectiveness, short administration, and preparation time, and others are anticipated to increase the use of these inhalers by end users. Due to technological advancements, DPI emerged as a preferred medical device for the treatment of a diverse range of respiratory disorders, which has in turn increased the utilization of these products. The abovementioned factors are likely to propel the growth of this segment.

- Nebulizers are projected to grow at a steady rate over the future period. These devices are the most frequently used inhalation devices in hospitals. Nebulizers have a high adoption rate in home care and emergency medicine due to their benefits, such as greater comfort, administration of large dosage, and favorable reimbursement scenario, which is expected to help maintain a steady demand for this product segment.

- The accessories segment is estimated to grow at a CAGR of 5.6% owing to the launch of new products and extensive R&D in this field. These products are necessary for efficient drug delivery to a patient’s lungs. Abovementioned factors are anticipated to support the segment development

- Application Insights

- The asthma segment held the dominant share in 2016. An effective inhalation therapy that uses DPIs and MDIs is considered to be the basis of asthma management. Owing to the high number of people affected by asthma, the demand, and usage of devices such as MDIs and DPIs for asthma management are increasing, boosting the growth of this application.

- The dynamic growth of the COPD segment can be attributed to the high incidence and mortality of this disease. Favorable reimbursement policies for the treatment of COPD and a rise in the number of government and non-government organizations that provide COPD treatment are increasing revenue generated by this segment. Owing to these factors, the COPD segment is expected to grow consistently.

- Treatment of allergic rhinitis involves the use of nasal sprays, dry powder inhalers, and allergy shots. According to the National Center for Health Statistics (NCHS), in 2016, 20 million adults aged more than 18 years and 6.1 million children in the U.S. were diagnosed with allergic rhinitis. Due to a large patient pool, the demand for PDDS devices is projected to increase, resulting in the development of this segment.

- The other application segment is anticipated to exhibit progress owing to the rise in patients diagnosed with various chronic diseases. According to the CDC, in 2016, 29.4 million adults were diagnosed with sinusitis in the U.S. Treatment of such diseases demands the use of PDDS. These factors are expected to provide this segment growth opportunity.

- Distribution Channel Insights

- Hospital pharmacies segment held the dominant share of the PDDS in 2016 and is projected to continue its dominance in the future. Hospitals provide extensive treatments, care, quick reimbursements, and insurance policies owing to which patients prefer hospital pharmacies. Furthermore, an increased number of hospitalizations is expected to boost the growth of this segment.

- Retail pharmacies are expected to show steady growth over the future period, owing to easy accessibility and affordability. Hospitals and clinics rely on retail pharmacies as a backup for medications. Moreover, most of the home care products are available in retail pharmacies. These factors are likely to be responsible for the constant growth of this segment.

- E-commerce is anticipated to grow at a CAGR of 5.4% during the forecast period. Various factors such as improving healthcare infrastructure in developing regions and convenience of purchasing in comparison to retail or hospital pharmacies have supported the growth of this distribution channel to a great extent.

- The trend of online purchasing and the demand for it is growing due to comfort, flexibility, and convenience, which is increasing the revenue generated by this segment. Moreover, online shopping offers discounts that benefit customers. These factors are expected to collectively boost the demand for online pharmacies.

- End-use Insights

- As of 2016, hospitals accounted for the largest revenue share of the PDDS. Hospitals are currently advancing in terms of technology usage. Technologically advanced medical devices are being extensively used in hospitals to improve point-of-care. Furthermore, hospitals also provide a wide array of treatments for various respiratory diseases.

- In developed regions such as North America and Europe, hospitals also provide quick reimbursements for COPD treatment under the Medicare program. These facts are expected to stimulate the utilization of PDDS devices in hospital settings, leading to growth.

- The home care segment is expected to exhibit lucrative growth over the future period. Growing preference for home healthcare is expected to boost the use of PDDS devices in home care settings. An increase in the cost of health care services and a shortage of healthcare facilities have also led to an increase in demand for home care services.

- The introduction of technologically advanced devices, which are portable and small-sized, has resulted in patients using such products at home. These devices are convenient, easy-to-use, and do not require any special training to operate. These associated advantages are expected to increase the adoption of PDDS in home care, thereby boosting the growth of this segment.

- Regional Insights

- North America held the dominant share of PDDS and was valued at USD 14.9 billion in 2016. This growth can be attributed to the rising incidence of diseases such as COPD and asthma. A rise in the number of patients affected by these diseases, increases the demand for diagnostic devices, such as PDDS, thereby boosting the growth of this region.

- In addition, the local presence of key pharmaceutical and medical devices players, advanced healthcare infrastructure, aging population, high disposable income, and lifestyle changes are factors contributing to the overall growth of the North America respiratory drug delivery devices market.

- Asia Pacific region is anticipated to grow at an exponential rate of 6.2% due to the high prevalence of COPD, which indicates a substantial socioeconomic burden in this region. Continuous increase in the number of asthmatic and allergic rhinitis patients is also a major factor that is anticipated to propel the market demand for PDDS in the Asia Pacific region during the forecast period.

- Furthermore, a rise in the number of supportive nongovernment organizations, such as the Asia Pacific Association of Allergy, Asthma and Clinical Immunology (APAAACI), is estimated to increase awareness about the treatment of respiratory disorders amongst patients, leading to market growth. Continuous increase in R&D activities by key market players to develop novel respiratory devices is also expected to support the growth of the Asia Pacific region.

- KEY MARKET SEGMENTS

- By Product

- Metered Dose Inhalers

- Dry Powder Inhalers

- Nebulizers

- Mesh

- Vibrating

- Static

- Pneumatic

- Vented

- Breath Actuated

- Ultrasonic

- Accessories

- By Application

- Asthma

- Cystic Fibrosis

- COPD

- Allergic Rhinitis

- Others

- By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- E-Commerce

- By End-use

- Hospitals & Clinics

- Homecare

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- KEY PLAYERS

- GlaxoSmithKline plc

- Philips Respironics

- Boehringer Ingelheim GmbH

- Novartis AG

- 3M Healthcare

- GF Health Products, Inc.

- Merck & Co., Inc.

- AstraZeneca

|

| Customization scope |

Free report customization (15% Free customization) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options |

Reap the benefits of customized purchase options to fit your specific research requirements. |

Objectives of the Study

- To forecast the market size, in terms of value, for various segments with respect to five main regions, namely, North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA)

- To provide detailed information regarding the major factors influencing the growth of the Market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the micro markets with respect to the individual growth trends, future prospects, and contribution to the total market

- To provide a detailed overview of the value chain and analyze market trends with the Porter's five forces analysis

- To analyze the opportunities in the market for various stakeholders by identifying the high-growth Segments

- To identify the key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for the market leaders

- To analyze competitive development such as joint ventures, mergers and acquisitions, new product launches and development, and research and development in the market

What does this Report Deliver?

- Market Estimation for 20+ Countries

- Historical data coverage: 2016 to 2022

- Growth projections: 2022 to 2028

- SkyQuest's premium market insights: Innovation matrix, IP analysis, Production Analysis, Value chain analysis, Technological trends, and Trade analysis

- Customization on Segments, Regions, and Company Profiles

- 100+ tables, 150+ Figures, 10+ matrix

- Global and Country Market Trends

- Comprehensive Mapping of Industry Parameters

- Attractive Investment Proposition

- Competitive Strategies Adopted by Leading Market Participants

- Market drivers, restraints, opportunities, and its impact on the market

- Regulatory scenario, regional dynamics, and insights of leading countries in each region

- Segment trends analysis, opportunity, and growth

- Opportunity analysis by region and country

- Porter's five force analysis to know the market's condition

- Pricing analysis

- Parent market analysis

- Product portfolio benchmarking