Report ID: SQMG15G2010

Report ID: SQMG15G2010

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMG15G2010 |

Region:

Global |

Published Date: June, 2025

Pages:

195

|Tables:

125

|Figures:

77

Global Recycled Plastic Market size was valued at USD 55.63 Billion in 2024 and is poised to grow from USD 60.91 Billion in 2025 to USD 125.89 Billion by 2033, growing at a CAGR of 9.5% during the forecast period (2026–2033).

The global recycled plastics market is consistently expanding owing to raised environmental concerns and plastic waste regulations, as well as demand from end-use industries such as packaging, automotive and construction. The growing awareness of circular economy and increasing consumer preferences for sustainable products are influencing manufacturers to incorporate recycled materials into their supply chains. In addition, advancements in sorting and recycling technologies are also improving the quality and consistency of recycled plastics, reinforcing the competitive position of recycled plastics against virgin materials. In terms of new policies and incentives many large economies are also increasing the investment and policy impetus behind growing recycling infrastructure, all supporting the recycled plastics market growth.

Nonetheless, several major constraints exist including the high initial costs of recycling facilities, and technological constraints on recycling certain kinds of plastic. Quality inconsistency and contamination issues still plague recyclers and manufacturers and often limits the applicability of recycled plastics in high-performance products. Even in areas of the world where waste management systems are underdeveloped, the collection of recyclables, and sorting of recyclables continues to lag and impact supply reliability. In spite of the many obstacles, increasing investment and international collaboration in waste management and sustainability initiatives are expected to gradually overcome these constraints and support the market's long-term viability.

How is AI Enhancing Sorting Efficiency in Plastic Recycling?

Artificial Intelligence is changing plastic recycling. It can simplify or automate the sorting process. AI can sort plastics by color, shape, and material quickly and easily, and automation will speed up sorting, improve quality of recycled materials by increasing material purity, and lessen human related mistakes.

One example, AMP Robotics, with their AI platform, has substantially increased sorted quantities. A study completed by the US Plastics Pact revealed that AMP's AI system can sort twice as many items every minute than manual sorters, but also with greater accuracy and consistency. This is key to meet increasing demand for high-quality recycled plastics in various markets.

How is AI Facilitating Advanced Plastic Recycling Technologies?

AI is helping to develop new recycling technology, especially chemical and enzymatic recycling. Given the large datasets available, AI can be used to optimize chemical processes used to break plastics down into their basic components so that new high-quality materials can be created from recycled plastics. This practice promotes a more sustainable circular economy through less reliance on additional virgin plastic.

For example, Samsara Eco's enzymatic recycling is receiving quite a bit of investment and partnerships, and AI is used in their process, and they can now recycle polyester and nylon endlessly. The fancy name for the problem is "depolymerization," and they are addressing this issue of decreased plastic quality in traditional recycling methods but can potentially overcome this limitation of traditional recycling.

To get more insights on this market click here to Request a Free Sample Report

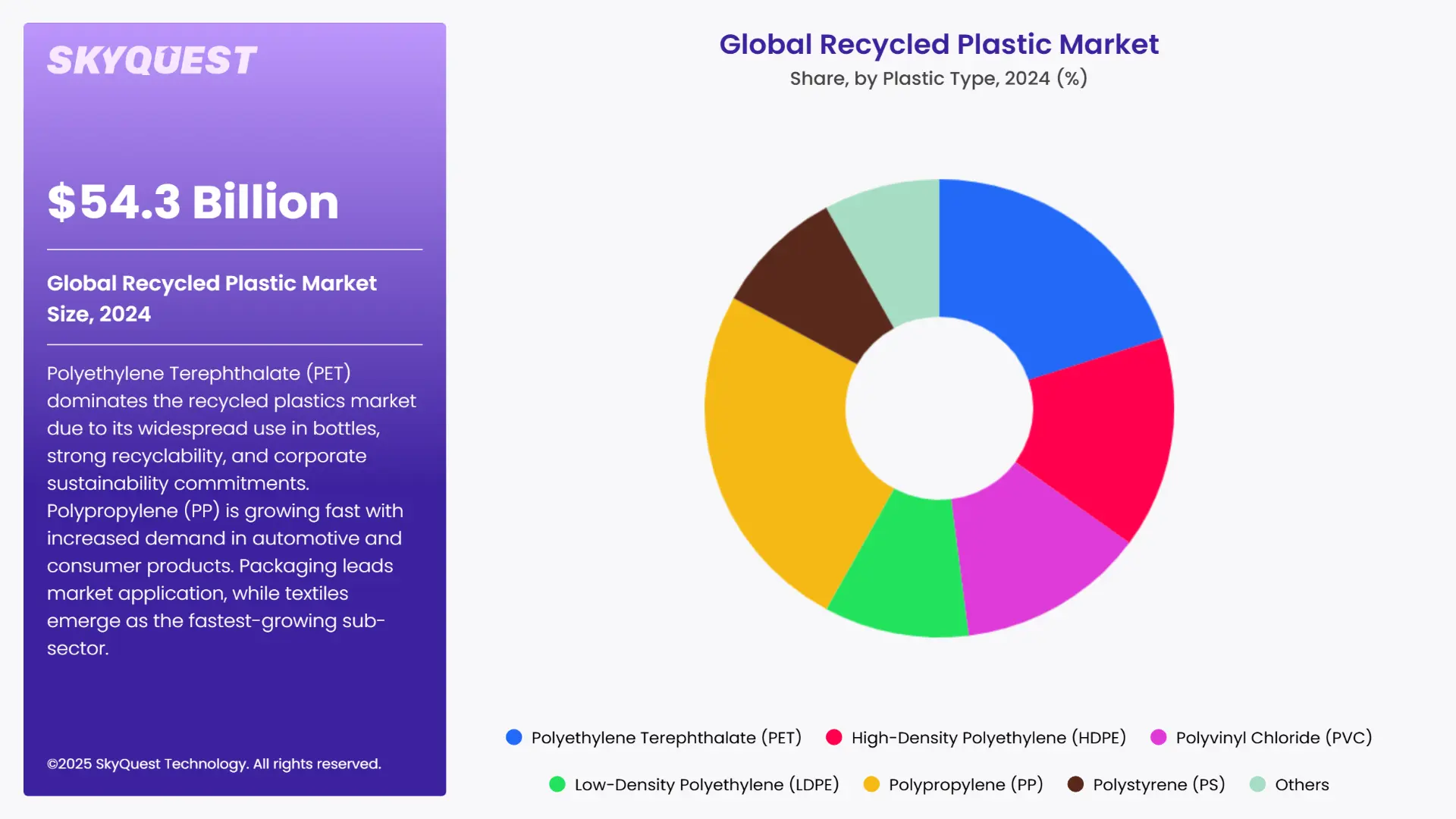

The global recycled plastic market is segmented by Plastic Type, Source, Recycling Process, Application and region. Based on Plastic Type, the market is segmented into Polyethylene Terephthalate (PET), High-Density Polyethylene (HDPE), Polyvinyl Chloride (PVC), Low-Density Polyethylene (LDPE), Polypropylene (PP), Polystyrene (PS) and Others. Based on Source, the market is segmented into Post-Consumer Recycled (PCR) and Post-Industrial Recycled. Based on Recycling Process, the market is segmented into Mechanical Recycling, Chemical Recycling and Energy Recycling. Based on Application, the market is segmented into Packaging, Building & Construction, Automotive, Textiles, Electrical & Electronics and Others. Based on region, the recycled plastic market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

Polyethylene Terephthalate (PET) holds the largest share of the market for recycled plastics, due to the widespread use of PET in beverage bottles and food packaging. PET is highly recyclable, light-weight, and strong, making it a preferred raw material for specific (but not all) manufacturers. The rising global consumption of bottled drinks, increased environmental awareness, and a robust network of collection, sorting, and recycling programs help to ensure that PET will continue to dominate the recycled plastics market. Increased regulatory controls to promote the use of recycled content in packaging have also helped fuel demand for PET. Corporate commitments from brands with sustainability plans will only expand PET's market position, as PET can be used in closed-loop recycling systems.

Polypropylene (PP) is experiencing the most significant growth in the recycled plastics market demand, due to increased focus on the use of recycled PP in automotive parts and containers and consumer products. Improvements in awareness around plastic sustainability are also enabling increased recovery rates for PP products. As new technologies emerge in PP recycling processes, it is likely that the recovery rate will continue to rise. The versatility and durability of PP products, as well as increasing demand for post-consumer recycled plastics' percentage in industry applications, are likely to continue their growth trajectory.

As the world's greatest application for recycled plastics, the packaging industry has seen considerable growth in recent years due to not only the push from brand owners creating sustainable packaging but also the large number of brands doing business in the packaging industry every year. The major sectors such as, food & beverage, food service, FMCG, and E-Commerce have begun sourcing recycled plastics in their packaging systems to reduce environmental impact and government resistance. In Packaging, innovation in the area of recycled content packaging solutions has encouraged rapid growth with brand commitments in ceasing the use of virgin plastics, costs savings in using recycled plastics, and the ability of recycled plastics to still provide functional packaging (bottles, containers, films, wraps, etc..).

On the other hand, textiles is the fastest growing sub-sector in the recycled plastics market. Sustainable fashion is a major focus for brands who are accelerating their sustainability journey by working to produce recycled polyester (rPET) from plastic bottles and residual recycled fibers. Consumer preference for green products is pushing the demand for recycled plastics while advances in fiber recovery technology and production processing are directly contributing to growth for this sector.

To get detailed segments analysis, Request a Free Sample Report

North America dominates the recycled plastic market share due to well-established recycling systems, strict regulatory frameworks, and growing corporate sustainability initiatives. Increasing demand for eco-friendly packaging in the food, beverage, and retail sectors fuels consumption. Major players are investing in modern recycling technologies and post-consumer resin production. Government policies at both federal and state levels support plastic bans, recycled content mandates, and circular economy targets. Public awareness around plastic pollution continues to rise, encouraging recycling participation and the development of domestic recycled plastic infrastructure.

U.S. Recycled Plastic Market

The U.S. is the region's leader in the recycled plastics market share, in part because of sufficient policy support and guidance through initiatives such as the U.S. Plastics Pact, which has an ambitious target of 100 percent reusable, recyclable, or compostable plastic packaging by 2025. Coca-Cola, in 2024, announced that it would be using 100 percent recycled PET bottles for many products sold in a variety of states. Subsequently, this announcement will increase demand for rPET. Additionally, some states, such as California and Oregon, have requirements for recycled content for plastic beverage containers that will spur industry growth.

Canada Recycled Plastic Market

The Canadian federal and provincial governments are playing a role in expanding the recycled plastics market demand through nationally recognized policies such as the Zero Plastic Waste Agenda. In 2023, the government funded up to $10 million in upgrades for recycling infrastructure in Ontario and British Columbia. Major retailers like Loblaws, have made commitments to reduce virgin plastic in their packaging. When Canada introduced the ban of six single-use plastics in the summer of 2022, it contributed to on-going incremental innovation across multiple sectors, aiding innovations to use recycled plastic.

The recycled plastic market growth in Europe is the fastest growing in the world given strict environmental regulation, consumer awareness of recycling, and EU circular economy targets, among other things. Regulations like the European Plastics Pact and plastic taxes have forced the industry to utilize recycled content. Europe already has a well-established recycling infrastructure, high levels of waste collection, and ongoing investment in mechanical and chemical recycling processes. The growth of public-private partnership funding has increased opportunities for innovation, especially while various industries in packaging, automotive, and construction already relied on recycled plastics to meet sustainability goals and support environmental regulations.

Germany Recycled Plastic Market

Germany continues to be the leading country for recycled plastics with over 65% of plastic packaging recycled in 2023. Germany's commitment to Extended Producer Responsibility (EPR) schemes, innovative sorting technologies and the support of Saperatec by Henkel in innovative recycling solutions of flexible packaging has led to increased capabilities of recycled use in Germany.

France Recycled Plastic Market

France is continuing its efforts to increase recycled plastics by putting mandates in place to have all plastic packaging recyclable by 2025. In 2024, Veolia increased the capacity of its plastic recycling facility in Vernon by 50%. French government subsidies have also encouraged European corporations to use recycled materials in their production. Corporations like Danone have reported increased rPET use in PET water bottles of over 50%, and industry alignment is evident.

Spain Recycled Plastic Market

Spain has implemented a tax for non-recycled plastic packaging (€0.45/kg) that began in 2023, which has encouraged businesses to move towards recycled products. Ecoembes, the national recycling organization, reported a 9% increase in their year-on-year collection of plastic packaging for 2023. Companies like Repsol have also made investments of over €26 million in new mechanical recycling plants, setting the stage for larger scale and more efficient operations in this recycled plastics market.

The Asia Pacific region is becoming a new giant in the recycled plastic market size due to rising urbanization, an increase in plastic waste, and government-led sustainability advancement and initiatives. Countries like Japan, South Korea, and India are implementing some aggressive policies, including EPR and waste segregation, as well as harnessing investments through technology to set their recyclers up for success. The COVID-19 pandemic has also sped up the growth of e-commerce and takeaway food deliveries that drives demand for sustainable packaging. In many cases multinational corporations have collaborated with local recyclers to meet their internal goals to help the environment. And in Asia, we are also seeing a growing number of small emerging enterprises driven to be sustainable by innovating around low-cost, scalable recycling methods to meet demand.

Japan Recycled Plastic Market

Japan has been one of the world's leading recyclers for many years with a recycling rate for plastic bottles above 85%. In 2023, Suntory Beverage & Food worked with Kyoei Industry to open a new PET recycling plant in Saitama, Japan, with a closed loop recycling process. Current laws and policies in Japan are generally supportive of chemical recycling developments as well as innovators of hard-to-recycle plastics to enable ongoing expansion of the recycled plastic market.

South Korea Recycled Plastic Market

South Korea's Roadmap for Carbon Neutrality and Green Growth has been supportive of developing recycled plastic market through monetary incentives and technology grants. In 2024, LG Chem announced a new plant in Seosan for recycling post-consumer plastics into products for electronics and plastic packaging production. South Korea recycled 56% of its plastic waste in 2023, which is really high compared to other countries.

India Recycled Plastic Market

India is building momentum around extended producer responsibility (EPR) policies and new regulations governing plastic waste management. The Plastic Waste Management Amendment in 2023 required recycled content in packaging. Major FMCG organizations including Hindustan Unilever and ITC Limited have committed to obtain more than 25 percent of the total plastic packaging content from recycled materials in their journeys towards packaging sustainability by 2025. These commitments have motivated domestic recycling initiatives and start-ups.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Rising Environmental Regulations and Government Initiatives

Increasing Consumer Demand for Sustainable Products

Quality and Contamination Challenges in Recycled Plastics

Volatility in Virgin Plastic Prices Affecting Competitiveness

Request Free Customization of this report to help us to meet your business objectives.

To stay competitive in the recycled plastic market, companies are focusing on advancing eco-friendly recycling technologies, improving material quality, and expanding applications across industries. Collaborations between manufacturers, waste management firms, and technology providers drive innovation and enhance recycling efficiency. Emphasizing compliance with environmental regulations and adopting circular economy principles ensures sustainability and legal adherence. Additionally, investing in advanced sorting and chemical recycling methods improves the purity of recycled plastics and broadens usage potential. These strategic efforts enable market players to reduce plastic waste, lower environmental impact, and maintain a strong presence in the growing recycled plastic market.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected using Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, the global Recycled Plastic market is set for robust growth, driven by rising environmental concerns, strict regulations on plastic waste, and growing demand across packaging, automotive, and construction sectors. Key drivers include technological advancements in AI-powered sorting, chemical and enzymatic recycling, and strong consumer preference for sustainable products. Regions like North America, Europe, and Asia-Pacific are leading the market with supportive policies, infrastructure development, and corporate sustainability initiatives. PET dominates the market, while polypropylene and textiles show fastest growth. Despite quality, contamination, and cost-related challenges, increased investments and circular economy practices are expected to support long-term market expansion. Leading players focus on innovation, closed-loop systems, and high-quality recycled material production.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 55.63 Billion |

| Market size value in 2033 | USD 125.89 Billion |

| Growth Rate | 9.5% |

| Base year | 2024 |

| Forecast period | 2026-2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Recycled Plastic Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Recycled Plastic Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Recycled Plastic Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Recycled Plastic Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Governments globally are implementing restrictions on plastic waste, mandating certain amounts of recycled content, and providing downstream recycling investments through initiatives like EU circular economy targets and U.S. EPA funding. These actions encourage global adoption of recycled plastic and increasing production capacity.

Innovative technologies including AI-based sorting, chemical recycling, and enzymatic recycling have improved quality, efficiency, and scalability of recycled materials and will allow recycled plastics to better compete with virgin materials while broadening applications in high-performance and food-grade materials as well.

Consumers have a preference for eco-friendly packaging with over 70% indicating they prefer sustainable options, thus leading brands to a faster adoption of recycled plastics to stand-out and address sustainability.

This trend is also helping to stimulate market growth primarily for the largest user of plastic, which is packaging, including food, beverage, consumer, and other fast-moving, goods. Although packaging is the largest user of plastic, automotive, construction, and textiles also use a lot of plastic. In fact, textiles are the fastest-growing category due to the demands of sustainable fashion.

Declining virgin plastic prices, associated with crude oil prices, less the price competitiveness of recycled plastics, narrowing producer margins, constraining infrastructure investment, and slowing take-up in markets lacking stringent regulatory requirements.

Challenges are scarce waste management infrastructure, quality variability, and pollution. Opportunities arise from increasing urbanization, favorable government policies, corporate sustainability objectives, and uptake of low-cost, scalable recycling technologies with local conditions in mind.

Global Recycled Plastic Market size was valued at USD 55.63 Billion in 2024 and is poised to grow from USD 60.91 Billion in 2025 to USD 125.89 Billion by 2033, growing at a CAGR of 9.5% during the forecast period (2026–2033).

To stay competitive in the recycled plastic market, companies are focusing on advancing eco-friendly recycling technologies, improving material quality, and expanding applications across industries. Collaborations between manufacturers, waste management firms, and technology providers drive innovation and enhance recycling efficiency. Emphasizing compliance with environmental regulations and adopting circular economy principles ensures sustainability and legal adherence. Additionally, investing in advanced sorting and chemical recycling methods improves the purity of recycled plastics and broadens usage potential. These strategic efforts enable market players to reduce plastic waste, lower environmental impact, and maintain a strong presence in the growing recycled plastic market. 'BlueAlp', 'Mura Technology', 'ReCircle', 'Plastics For Change', 'Oceanworks', 'Banyan Nation', 'GreenMantra Technologies', 'Plastic Energy', 'Recykal', 'PureCycle Technologies', 'Carbios', 'MBA Polymers', 'KW Plastics', 'Suez Recycling', 'TerraCycle', 'Indorama Ventures', 'ALPLA Recycling', 'Veolia', 'Avangard Innovative', 'Jayplas'

Global advocacy for a stronger awareness of environmental regulation is a major driver for the recycled plastics market. Governments worldwide are restricting use of early stage single-use plastics and mandating minimum recycled content in plastic products. For example, The European Union’s Circular Economy Action Plan aims for all plastic packaging to be recyclable/ reusable by 2030 and is enhancing recycled plastics. The U.S. Environmental Protection Agency (EPA) also encourages recycling of plastic and provides funding via grant opportunities and public-private partnerships. For example, in 2023, Dow Inc. stated it would commit to using 1 million metric tons of recycled polymers each year, by 2030, in direct response to regulatory pressure and sustainability mandates and signifying to the industry to adapt to regulatory demand.

Short-Term: The market is witnessing a notable increase in post-consumer plastic collection and recycling efforts. Governments and local municipalities are implementing stricter waste segregation laws and incentivizing collection networks. This is driving immediate supply for recycled plastic, especially polyethylene terephthalate (rPET) and high-density polyethylene (HDPE). Corporate sustainability goals and single-use plastic bans in various regions are also accelerating demand for readily available recycled inputs.

North America dominates the recycled plastic market share due to well-established recycling systems, strict regulatory frameworks, and growing corporate sustainability initiatives. Increasing demand for eco-friendly packaging in the food, beverage, and retail sectors fuels consumption. Major players are investing in modern recycling technologies and post-consumer resin production. Government policies at both federal and state levels support plastic bans, recycled content mandates, and circular economy targets. Public awareness around plastic pollution continues to rise, encouraging recycling participation and the development of domestic recycled plastic infrastructure.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients