Report ID: SQMIG25I2037

Report ID: SQMIG25I2037

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG25I2037 |

Region:

Global |

Published Date: August, 2025

Pages:

186

|Tables:

93

|Figures:

76

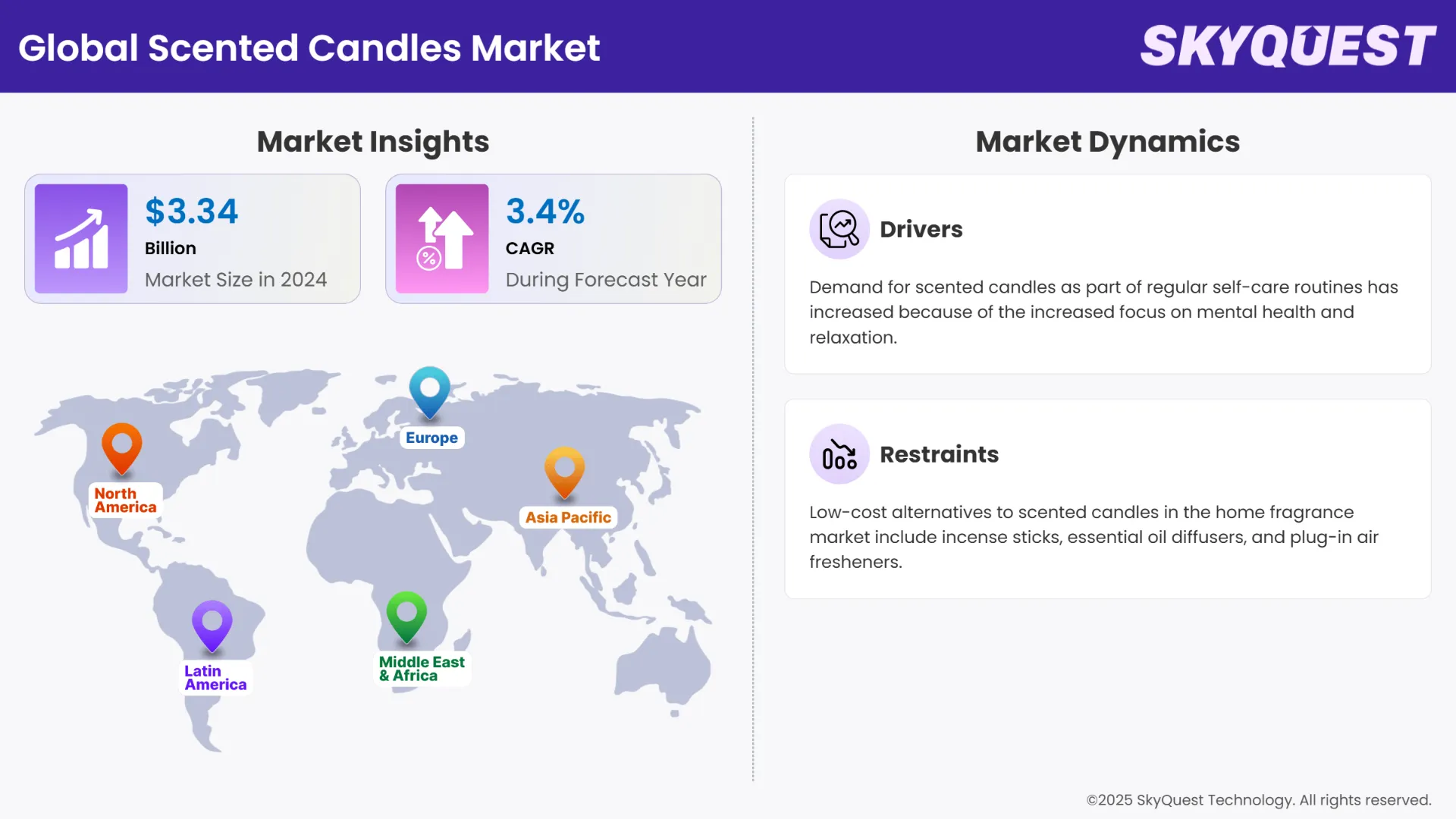

Global Scented Candles Market size was valued at USD 3.34 Billion in 2024 and is poised to grow from USD 3.45 Billion in 2025 to USD 4.51 Billion by 2033, growing at a CAGR of 3.4% in the forecast period (2026–2033).

The growing popularity of aromatherapy, the introduction of a wide range of fragrances and products, the growing trend toward natural ingredients and sustainability, the growing interest of consumers in home décor and ambiance, and the widespread use of these products as gifts are all contributing factors to the growing scented candles market share.

In addition, the global scented candles market is expanding due to several factors, such as rising consumer interest in self-care and home décor. With the increased focus on relaxation and well-being, scented candles have emerged as a popular option for establishing a peaceful ambiance. The trend toward interior design and home improvement is driving up demand for candles because they are viewed as both decorative and practical. As scented candles are associated with mindfulness and the advantages of aromatherapy, millennials and Gen Z consumers are especially drawn to them. Moreover, producers are able to satisfy a broad spectrum of customer preferences by offering a variety of fragrances and customizable options. As they make high-end and specialized products easily accessible, e-commerce platforms have greatly increased scented candles market penetration.

As consumers place a greater value on sustainability, reusable and modular candle designs are becoming increasingly popular. These cutting-edge technologies drastically cut down on packaging waste by substituting visually appealing containers for wax refills. Due to the eco-friendly design and variety of scents, Canadian brand LOHN saw a 40% increase in recurring business when it expanded its refillable candle line throughout North America in March 2025. Gen Z and millennial customers who respect responsible consumption will be drawn to each refill pod's biodegradable wax in compostable packaging.

To get more insights on this market click here to Request a Free Sample Report

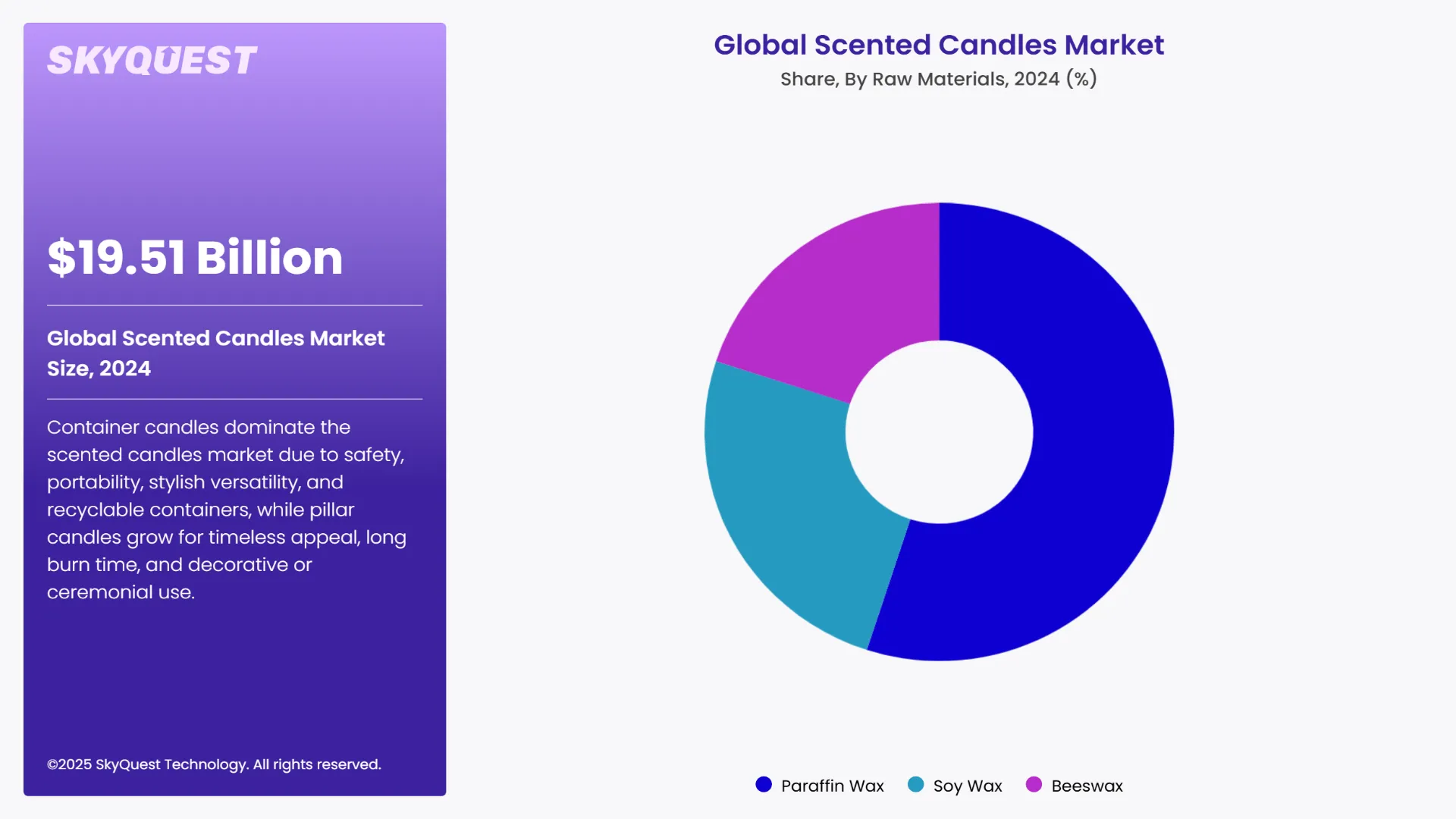

The global scented candles market is segmented into products, categories, raw materials, distribution channels, and region. By products, the market is classified into container-based and pillar. Depending on categories, it is bifurcated into mass and premium. According to raw materials, the market is divided into paraffin wax, soy wax, and beeswax. As per distribution channels, it is categorized into hypermarkets & supermarkets, convenience stores, and online stores. Regionally, it is analyzed across North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

As per the 2024 scented candles market analysis, at 59.6%, container-based is the leading category with the most significant share of the market. Container candles have proliferated because they are so easy and safe to use and usually more decorative and versatile in terms of the many ways they can be placed/displayed and composed for the décor of a setting. The containers themselves are recyclable when the candle has been used, and they, too, can appeal to diverse interior design concepts that can range from minimalist to extravagantly luxurious designs. Most importantly, container-based candles are desirable by consumers who want a candle that showcases stylish beauty but has also functional and/ or useful characteristics, allowing it to be portable and protected.

The pillar category is expected to dominate the market based on its ability to appeal to timelessness, long burn time, and functional use for decorative purposes or ceremonial use, for example, vigils. While pillar candles provide form, variation of visual interest with multiple sizes, and since they require no container, candles in this category are hastily utilized for religious, hospitality, and special events usage. With a fixed design, the aesthetic quality and abundance of sizes and even colors make them remain a traditional choice for consumers looking functional and stylish.

As per the 2024 scented candles market forecast, the market is dominated by premium versions. The premium segment has the biggest market share due to its premium ingredients, sophisticated fragrances, and lavish packaging. Premium scented candles are often made with superior-grade wax, such as soy or beeswax. After that, specialty fragrance blends or natural essential oils are added. They are also well known for their elegant and often imaginative designs, which serve as both a source of fragrance and a focal point for interior design. Premium-scented candles are typically associated with high-end brands and designers, and their price reflects the quality of the materials and craftsmanship that went into making them.

The mass segment is anticipated to dominate the scented candles industry due to its accessibility, affordability, and appeal to consumers on a tight budget. These candles are widely available in department stores, supermarkets, and online, so a broad spectrum of people can buy them. Mass-market candles are available in a variety of scents and designs to fit both everyday use and gift-giving, all without compromising style or functionality.

To get detailed segments analysis, Request a Free Sample Report

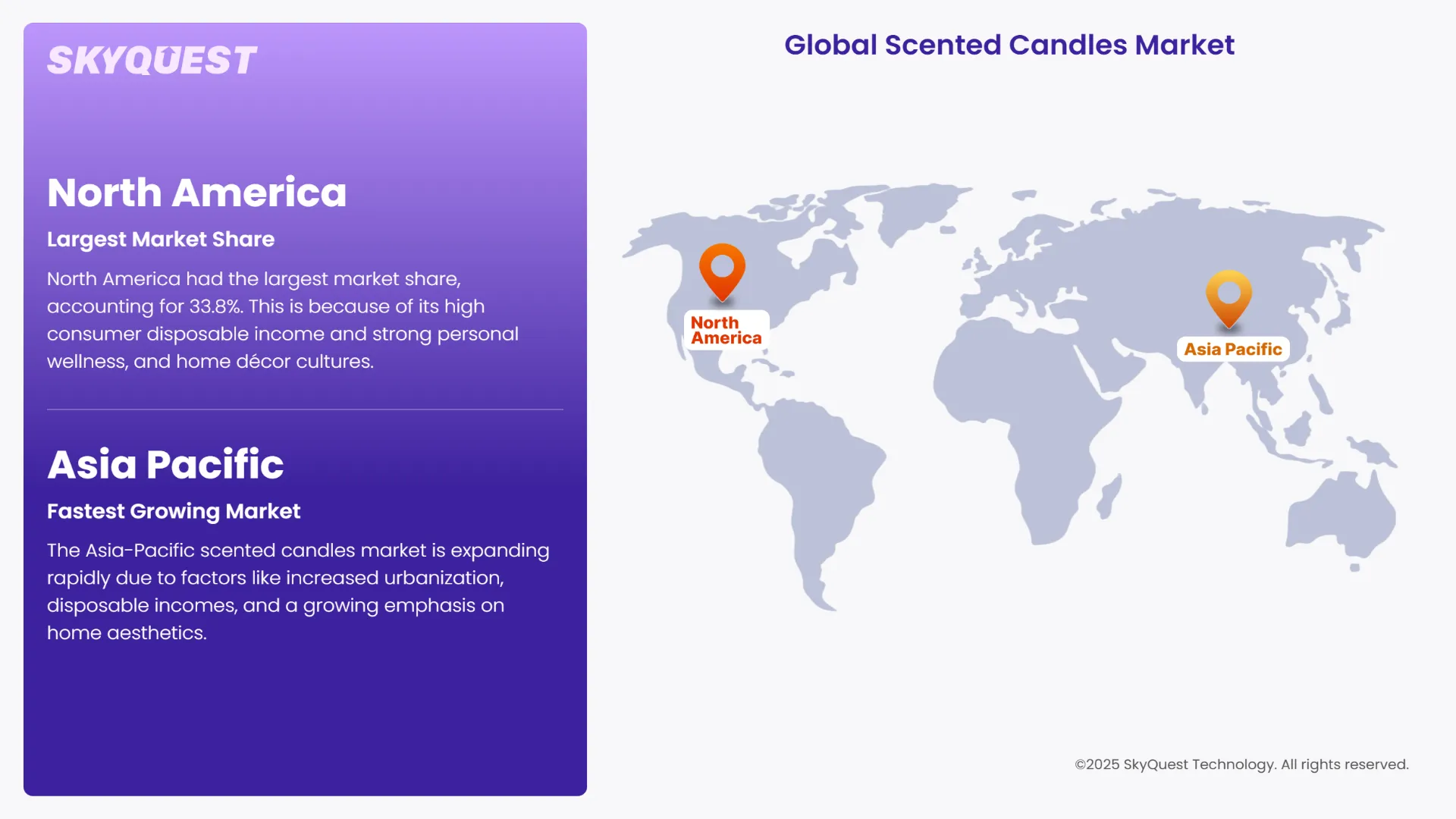

As per the scented candles market regional analysis, in 2024, North America had the largest market share, accounting for 33.8%. This is because of its high consumer disposable income and strong personal wellness, and home décor cultures. Additionally, a substantial customer base that values the ambiance and fragrance that scented candles provide is driving the market's growth. The region is also home to numerous artisanal brands and leading candle manufacturers, which is propelling the market's growth.

U.S. Scented Candles Market

In 2024, the US accounted for 83.2% of the North American scented candles sector. The US market is primarily driven by changing consumer tastes and lifestyle trends that prioritize home ambiance and self-care. Given the increased emphasis on mental health and stress-relieving qualities, the ambiance created by a scented candle will be popular. Another factor fueling the market's growth is the increasing acceptance of social media and online shopping. In 2024, there will be 273.49 million online shoppers in the United States, a 5.6% increase, according to the research report.

Canada Scented Candles Market

The scented candles market is growing in Canada as more people link candles to relaxation, aromatherapy, and wellbeing. Companies that use natural materials and environmentally friendly packaging, such as Vancouver Candle Co. and Mala the Brand, have become more well-known. Retailers like Indigo and Hudson's Bay have expanded the range of candles they offer due to a strong gifting culture and increased demand during the holiday seasons. This is especially true for fragrances associated with Canadian landscapes and nature.

The Asia-Pacific scented candles market is expanding rapidly due to factors like increased urbanization, disposable incomes, and a growing emphasis on home aesthetics. The demand for high-end home fragrance products is rising in nations like China, India, and Australia. During the 2024 Singles' Day and Diwali promotions, candle sales skyrocketed on e-commerce platforms such as Shopee and Tmall, with sandalwood and lavender emerging as the most popular scents.

South Korea Scented Candles Market

The scented candles market growth in South Korea is driven due to the nation's robust self-care movement and the appeal of minimalist interior design. Candles are frequently used by Korean consumers as a stress reliever and mood enhancer. Companies like Soohyang and W.DRESSROOM gained popularity in 2024 due to fragrance collections that complemented seasonal moods and K-pop trends. In response to the increasing demand from Gen Z and millennials, department stores such as Shinsegae have expanded the amount of shelf space devoted to artisanal candles.

Japan Scented Candles Market

The Japanese scented candles market is being driven by both contemporary wellness trends and traditional aesthetics. Delicate, soothing fragrances like yuzu, green tea, and hinoki (cypress) appeal to Japanese consumers. MUJI added regional fragrances inspired by Hokkaido and Kyoto to its candle lineup in 2024. Additionally, the need for clean-burning candles in more compact, reusable containers is being driven by the rise in single-person households and smaller living areas.

The European scented candles market continues to be a center for high-end, handcrafted goods, with a growing focus on clean-label and sustainable ingredients. Customers favor candles made of natural soy or beeswax and scented with essential oils. Etsy and artisan markets helped local candle makers gain popularity in a number of EU countries in 2024. Stricter environmental regulations are also pushing local businesses to use recyclable jars and fewer artificial fragrances.

UK Scented Candles Market

Luxury branding and wellness marketing are the main forces behind the scented candles market in the UK. The market is dominated by regional brands like Jo Malone and The White Company, but independent companies that sell vegan or refillable candles are becoming increasingly well-liked. Candle sales around Mother's Day and Christmas increased by 20% in 2024, according to John Lewis. Popular fragrances like oud, rose, and bergamot are frequently associated with feelings of emotional well-being and spa-like experiences.

France Scented Candles Market

The French scented candles market has a long history of perfumery, with companies like Diptyque and Cire Trudon setting the standard for opulent, fragrant candles. French buyers value beautiful designs and complex fragrances. In 2024, candles produced locally were given more space at Galeries Lafayette's yearly home décor exhibition. The enduring appeal of floral and woody fragrances influenced by Provence and Grasse demonstrates the connection between fragrance, lifestyle, and artistic expression in France.

Germany Scented Candles Market

Sustainability, well-being, and minimalism are the main factors driving the scented candles market in Germany. Consumers favor natural soy-based candles with calming fragrances like lavender and eucalyptus. More organic candle lines were added by DM and Rossmann in 2024 as demand increased during the colder months when hygge-style living preferences peaked. The market is also shifting toward more environmentally conscious and conscientious consumption due to German start-ups that concentrate on carbon-neutral production and refillable jars.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Raising Awareness of Self-Care and Wellness

Growth in Customization and E-Commerce

Accessible, Low-Cost Alternatives

Safety and Health Issues

Request Free Customization of this report to help us to meet your business objectives.

In the scented candles industry, which is highly fragmented, there are competing mass market manufacturers and high-end artisanal competitors. Major competitors focus on innovation in their fragrances, sustainable packaging and seasonal products, to maintain customer excitement among such fierce competition. Some also have scented candles market strategies like limited editions, subscription boxes and partnerships with celebrity brands. While Lower retail price mass market competitors like Bath & Body Works rely on their network of retail locations and promotional pricing to maintain volume growth, premium brands like Diptyque spend resources based on using sophisticated designs in their packaging and sustainable refillable options.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected by means of Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, the global scented candles market remains on a steady trend of success driven by growth in areas such as wellbeing, home environment, and gifting. To this end, perennial, sustainable goods are reaping the benefits of e-commerce and influencer brand marketing across market verticals. The innovations in eco-friendly packaging, scent creation, and design are enabling growth, despite continued competition from cheaper options and consumer health concerns. Start-ups are transforming the consumer landscape with transparency and artisan characteristics, while established brands are finding paths to meet consumer preferences for 'clean' ingredients and a level of customization. Since scented candles exist at the intersection of luxury, décor and wellbeing, the market is poised to remain a high-growth market for both mass and niche players.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 3.34 Billion |

| Market size value in 2033 | USD 4.51 Billion |

| Growth Rate | 3.4% |

| Base year | 2024 |

| Forecast period | 2026-2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Scented Candles Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Scented Candles Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Scented Candles Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Scented Candles Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Global Scented Candles Market size was valued at USD 3.34 Billion in 2024 and is poised to grow from USD 3.45 Billion in 2025 to USD 4.51 Billion by 2033, growing at a CAGR of 3.4% in the forecast period (2026–2033).

In the scented candles industry, which is highly fragmented, there are competing mass market manufacturers and high-end artisanal competitors. Major competitors focus on innovation in their fragrances, sustainable packaging and seasonal products, to maintain customer excitement among such fierce competition. Some also have scented candles market strategies like limited editions, subscription boxes and partnerships with celebrity brands. While Lower retail price mass market competitors like Bath & Body Works rely on their network of retail locations and promotional pricing to maintain volume growth, premium brands like Diptyque spend resources based on using sophisticated designs in their packaging and sustainable refillable options. 'Yankee Candle', 'Bath & Body Works', 'The White Company', 'Diptyque', 'Jo Malone', 'Nest Fragrances', 'Voluspa', 'P.F. Candle Co.', 'Boy Smells', 'Paddywax', 'Candle-lite', 'Archipelago Botanicals', 'Colonial Candle'

Demand for scented candles as part of regular self-care routines has increased because of the increased focus on mental health and relaxation. Scented candles are now considered wellness aids due to the benefits of aromatherapy, which include reduced stress, improved sleep, and elevated mood. Customers, particularly Millennials and Gen Z, are increasingly buying candles for their alleged therapeutic benefits in addition to their scent or aesthetic appeal.

The demand from customers for sustainable, eco-friendly, non-toxic, and biodegradable candles continues to rise. From bases of soy and coconut wax to recyclable packaging for containers and lead-free wicks, sustainability seems to be impacting product design and packaging. Companies like Diptyque and P.F. Candle Co. launched sustainable lines in 2025 that utilize FSC-certified packaging and offer compostable refills, fulfilling customer values and environmental goals.

As per the scented candles market regional analysis, in 2024, North America had the largest market share, accounting for 33.8%. This is because of its high consumer disposable income and strong personal wellness, and home décor cultures. Additionally, a substantial customer base that values the ambiance and fragrance that scented candles provide is driving the market's growth. The region is also home to numerous artisanal brands and leading candle manufacturers, which is propelling the market's growth.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients