Report ID: SQMIG45A2627

Report ID: SQMIG45A2627

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG45A2627 |

Region:

Global |

Published Date: June, 2025

Pages:

193

|Tables:

146

|Figures:

70

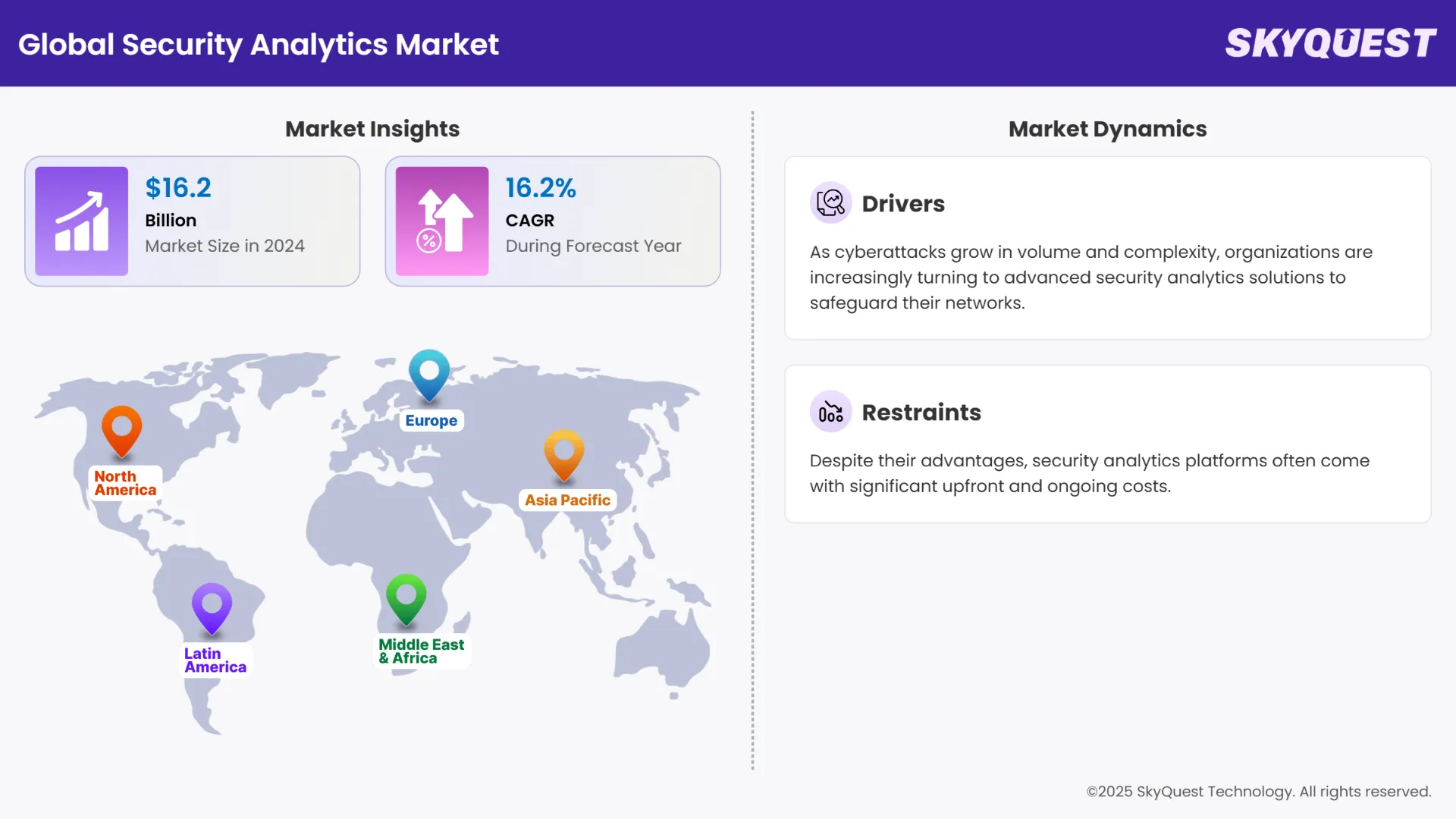

Global Security Analytics Market size was valued at USD 16.2 Billion in 2024 and is poised to grow from USD 18.82 Billion in 2025 to USD 62.57 Billion by 2033, growing at a CAGR of 16.2% in the forecast period (2026–2033).

The security analytics market is experiencing rapid evolution, driven by the increasing sophistication of cyber threats and the growing importance of data protection. Organizations across industries are adopting security analytics solutions to gain real-time insights into threats and to proactively defend against attacks. One of the key drivers of this market is the integration of artificial intelligence (AI) and machine learning (ML), which significantly enhances threat detection and response capabilities by enabling predictive analytics and anomaly detection.

A notable trend in the market is the growing preference for cloud-based security analytics. These solutions offer scalability, flexibility, and lower infrastructure costs, making them ideal for businesses of all sizes. Additionally, there's a rising emphasis on User and Entity Behavior Analytics (UEBA), which helps detect insider threats and anomalous activities by analyzing behavior patterns rather than just system logs or predefined threat signatures.

From a regional perspective, North America dominates the market due to the high incidence of cyberattacks, strong regulatory frameworks, and the presence of major technology players. Europe follows closely, propelled by digital transformation efforts and strict data protection regulations such as GDPR. The Asia Pacific region is expected to witness the fastest growth owing to the rising adoption of digital technologies, especially in emerging economies like India and China, coupled with increasing awareness of cybersecurity.

How is Artificial Intelligence Reshaping the Security Analytics Market?

Artificial Intelligence (AI) revolutionizes the security analytics market by enabling faster, smarter, and more proactive threat detection and response mechanisms. Traditional security tools often rely on rule-based systems that can be bypassed by sophisticated attackers. In contrast, AI-powered analytics can identify anomalies, detect zero-day vulnerabilities, and adapt to evolving threats in real-time, significantly improving the efficiency of cybersecurity defenses.

Machine learning algorithms, a core component of AI, analyze vast volumes of structured and unstructured data to uncover hidden patterns and signals of malicious activity that human analysts might miss. This has empowered organizations to shift from reactive to predictive security models. Additionally, AI-driven automation reduces the burden on cybersecurity teams by handling routine tasks such as log analysis, alert prioritization, and threat triage, allowing experts to focus on more strategic concerns.

Furthermore, as enterprises move toward cloud environments and adopt complex digital infrastructures, the demand for scalable and intelligent security solutions continues to rise. AI not only helps manage this complexity but also enhances decision-making through actionable insights.

To get more insights on this market click here to Request a Free Sample Report

The security analytics market is segmented by component, application, organization size, industry vertical, deployment mode, and region. Based on components, the market is segmented into solutions and services. Based on application, the market is segmented into web security analytics, network security analytics, endpoint security analytics, application security analytics, and others. Based on organization size, the market is segmented into SMEs and large enterprises. Based on industry vertical, the market is segmented into BFSI, telecom & IT, consumer goods and retail, healthcare, government & defense, manufacturing, energy and utilities and others. Based on deployment mode, the market is segmented into clouds and on-premises. Based on region, the market is segmented into North America, Asia-Pacific, Europe, Latin America, and Middle East & Africa.

Why is Network Security Analytics the Backbone of Enterprise Protection?

As per the global security analytics market outlook, network security analytics currently holds a dominant segment in the market. This is because network infrastructure is the backbone of enterprise IT environments, and securing it is critical to prevent breaches, data exfiltration, and lateral movement of threats. Organizations prioritize monitoring network traffic, identifying anomalies, and detecting intrusions across their entire digital footprint. The complexity and volume of network data make this segment essential for comprehensive threat visibility.

As per the global security analytics market forecast, the endpoint security analytics segment is witnessing rapid growth. This growth is driven by the proliferation of remote work, mobile devices, and bring-your-own-device (BYOD) policies, which have expanded the attack surface at endpoints like laptops, smartphones, and IoT devices. Endpoint devices are often targeted by sophisticated malware and ransomware, making advanced analytics for endpoint detection and response (EDR) vital. Additionally, the integration of AI/ML into endpoint analytics enhances detection accuracy and automated response, accelerating adoption.

How Does IT Infrastructure Complexity Impact Security Needs in Large Enterprises?

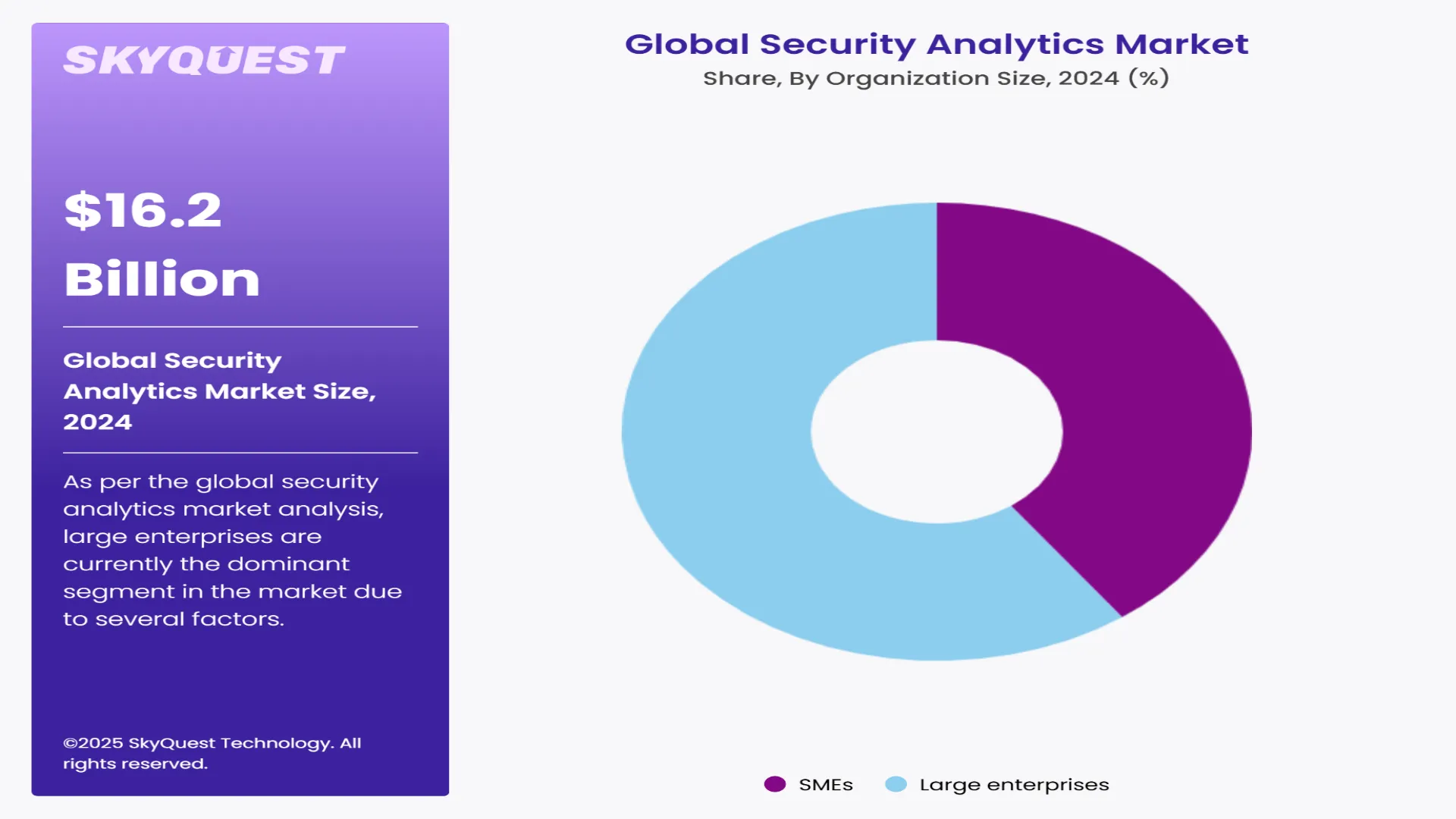

As per the global security analytics market analysis, large enterprises are currently the dominant segment in the market due to several factors. These organizations typically have complex and extensive IT infrastructures that include multiple data centers, cloud environments, diverse endpoints, and wide-reaching network ecosystems. Because of this complexity, they face a broader and more sophisticated array of cyber threats, ranging from advanced persistent threats (APTs) to insider attacks.

SMEs represent the fastest-growing segment in the security analytics industry. Traditionally, SMEs faced challenges in adopting advanced cybersecurity solutions due to limited budgets, lack of in-house expertise, and resource constraints. However, recent trends are changing this landscape. The increasing frequency and severity of cyberattacks targeting SMEs have raised awareness about the critical need for security analytics. Cybercriminals often view SMEs as softer targets because they typically have weaker defenses, making them attractive for ransomware, phishing, and data theft attacks.

To get detailed segments analysis, Request a Free Sample Report

Why is North America Setting the Pace for Security Analytics Innovation?

As per regional forecast, North America leads the global security analytics market due to its early adoption of advanced technologies and a strong emphasis on cybersecurity infrastructure. The presence of numerous technology giants, coupled with high investments in AI, cloud computing, and IoT, drives the need for real-time security monitoring and analytics. Additionally, stringent regulatory frameworks such as HIPAA, CCPA, and industry-specific compliance mandates push enterprises to adopt comprehensive security analytics solutions to safeguard sensitive data and maintain customer trust.

Security Analytics Market in United States

As per regional outlook, the United States is the largest contributor to the North America security analytics market. The rise in sophisticated cyberattacks targeting critical infrastructure, government, and private sectors has prompted enterprises to heavily invest in AI-powered security analytics platforms that offer predictive threat detection and automated incident response. The US government’s proactive stance on cybersecurity, including funding for innovation and strong legislation, further propels market growth. Additionally, the US is a hub for cybersecurity startups and established vendors, driving continuous advancements and competitive offerings in security analytics.

Security Analytics Market in Canada

Canada’s increasing focus on digital transformation and privacy laws such as PIPEDA has accelerated the adoption of cloud-based security analytics solutions. Canadian enterprises prioritize protecting data privacy and securing endpoints across distributed networks, especially as remote work becomes more prevalent. The growing cybersecurity workforce and government initiatives to strengthen cyber resilience are significant factors encouraging businesses to invest in scalable, AI-driven security analytics platforms tailored to Canadian regulatory requirements.

How is Asia-Pacific Transforming Cybersecurity with Cutting-Edge Analytics?

Asia's rapid digitization, expanding internet user base, and rising cybercrime incidents are driving unprecedented demand for security analytics across the region. Government-led cybersecurity strategies, particularly in emerging economies, aim to build resilient digital infrastructure, increasing the need for advanced analytics. The proliferation of mobile devices, IoT, and smart city projects in Asia also contributes to a complex threat landscape, requiring real-time analytics for threat detection and response.

Security Analytics Market in Japan

Japan's highly developed technological ecosystem and focus on smart manufacturing and critical infrastructure security position it as a key market. The government actively promotes AI and machine learning integration within cybersecurity frameworks, helping organizations detect and mitigate threats faster. Japan's unique blend of traditional industries and digital innovation creates a demand for tailored analytics solutions that protect both operational technology and IT environments.

Security Analytics Market in South Korea

As per industry analysis, South Korea's exceptional internet penetration rate and digital economy expansion have made cybersecurity a top priority. The government enforces stringent cybersecurity regulations, fostering a proactive security culture in sectors like finance, telecommunications, and manufacturing. Investments in real-time security analytics, threat intelligence sharing, and automated incident response solutions highlight South Korea’s position as an innovation leader in the security analytics market.

How is Europe Driving Security Analytics Adoption Amidst Stringent Regulations?

Europe’s focus on data protection and privacy, exemplified by the GDPR, creates a compelling need for advanced security analytics to monitor, detect, and respond to cyber threats. European enterprises are increasingly integrating AI and behavioral analytics to meet compliance and security requirements. The region’s collaborative cybersecurity initiatives and investments in threat intelligence platforms also facilitate market growth.

Security Analytics Market in Germany

Germany, as Europe’s industrial powerhouse, faces unique cybersecurity challenges in protecting its manufacturing and automotive sectors. With a high dependency on operational technology (OT) and Industrial Control Systems (ICS), Germany demands specialized security analytics solutions that can detect threats across both IT and OT environments. Compliance with strict data protection laws further drives adoption of comprehensive analytics tools focused on risk mitigation and intellectual property protection.

Security Analytics Market in United Kingdom

The UK’s market benefits from strong regulatory frameworks and high-profile cyber incidents that have raised awareness among organizations. Key sectors such as finance, healthcare, and government are investing heavily in AI-enabled security analytics platforms that provide predictive threat intelligence and compliance reporting. The UK also emphasizes public-private partnerships and threat intelligence sharing, bolstering the effectiveness of security analytics deployments.

Security Analytics Market in Italy

Italy is experiencing growing cybersecurity investments as businesses and government agencies respond to increasing cyber threats and evolving EU compliance mandates. SMEs, traditionally slower to adopt advanced cybersecurity, are increasingly recognizing the need for accessible and scalable security analytics solutions. Italy’s rising focus on cloud security and digital innovation projects supports expanding adoption of real-time threat detection and automated analytics platforms.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Security Analytics Market Drivers

Rising Frequency and Sophistication of Cyber Threats

Increasing Regulatory Compliance Requirements

Security Analytics Market Restraints

High Implementation and Operational Costs

Shortage of Skilled Cybersecurity Professionals

Request Free Customization of this report to help us to meet your business objectives.

The global security analytics industry is highly competitive, with established cybersecurity giants and innovative startups vying for market share through strategic alliances, technology integrations, and cloud-based service enhancements. Leading players such as IBM Corporation, Cisco Systems, Splunk Inc., FireEye, and Palo Alto Networks are continuously expanding their product portfolios to stay ahead of evolving threats. These companies are investing heavily in artificial intelligence (AI), machine learning (ML), and behavioral analytics to offer intelligent threat detection and faster incident response. Startups and mid-sized firms are also disrupting the space with niche offerings in UEBA (User and Entity Behavior Analytics) and cloud-native platforms, targeting underserved segments like SMEs and hybrid cloud environments.

As per market strategies, IBM partnered with Palo Alto Networks to integrate IBM’s QRadar SIEM (Security Information and Event Management) with Palo Alto’s Cortex XSOAR platform. This collaboration aimed to enhance automation and orchestration of threat detection and response workflows.

The global security analytics industry is rapidly evolving, driven not only by large enterprises and established technology firms but also by a dynamic ecosystem of innovative startups. These startups are leveraging cutting-edge technologies such as artificial intelligence, machine learning, and big data analytics to develop advanced solutions that provide real-time threat detection, incident response, and predictive security insights.

Top Player’s Company Profiles

Recent Developments in Security Analytics Market

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected by means of Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, key drivers of market growth include increasing cybersecurity threats and attacks. Rising number of cybercrimes and security breaches across the world are expected to grow the global security analytics market. Major driving factors behind security analytics market are faster detection and remediation of cyber threats, effective threat detection, real time visibility, finding root cause of cyber incidents, better tracking & reduction of frauds. North America is expected to witness growth and hold the biggest market share during the forecast period. The US and Canada dominate the market owing to presence of organizations like Cisco, IBM with advanced infrastructure, which allows higher penetration of device. Governments and regulatory bodies worldwide are enforcing stricter compliance standards, including the General Data Protection Regulation (GDPR), Payment Card Industry Data Security Standard (PCI DSS), and Health Insurance Portability and Accountability Act (HIPAA).

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 16.2 Billion |

| Market size value in 2033 | USD 62.57 Billion |

| Growth Rate | 16.2% |

| Base year | 2024 |

| Forecast period | 2026-2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Security Analytics Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Security Analytics Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Security Analytics Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Security Analytics Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients