Report ID: SQMIG45I2291

Report ID: SQMIG45I2291

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG45I2291 |

Region:

Global |

Published Date: June, 2025

Pages:

194

|Tables:

96

|Figures:

71

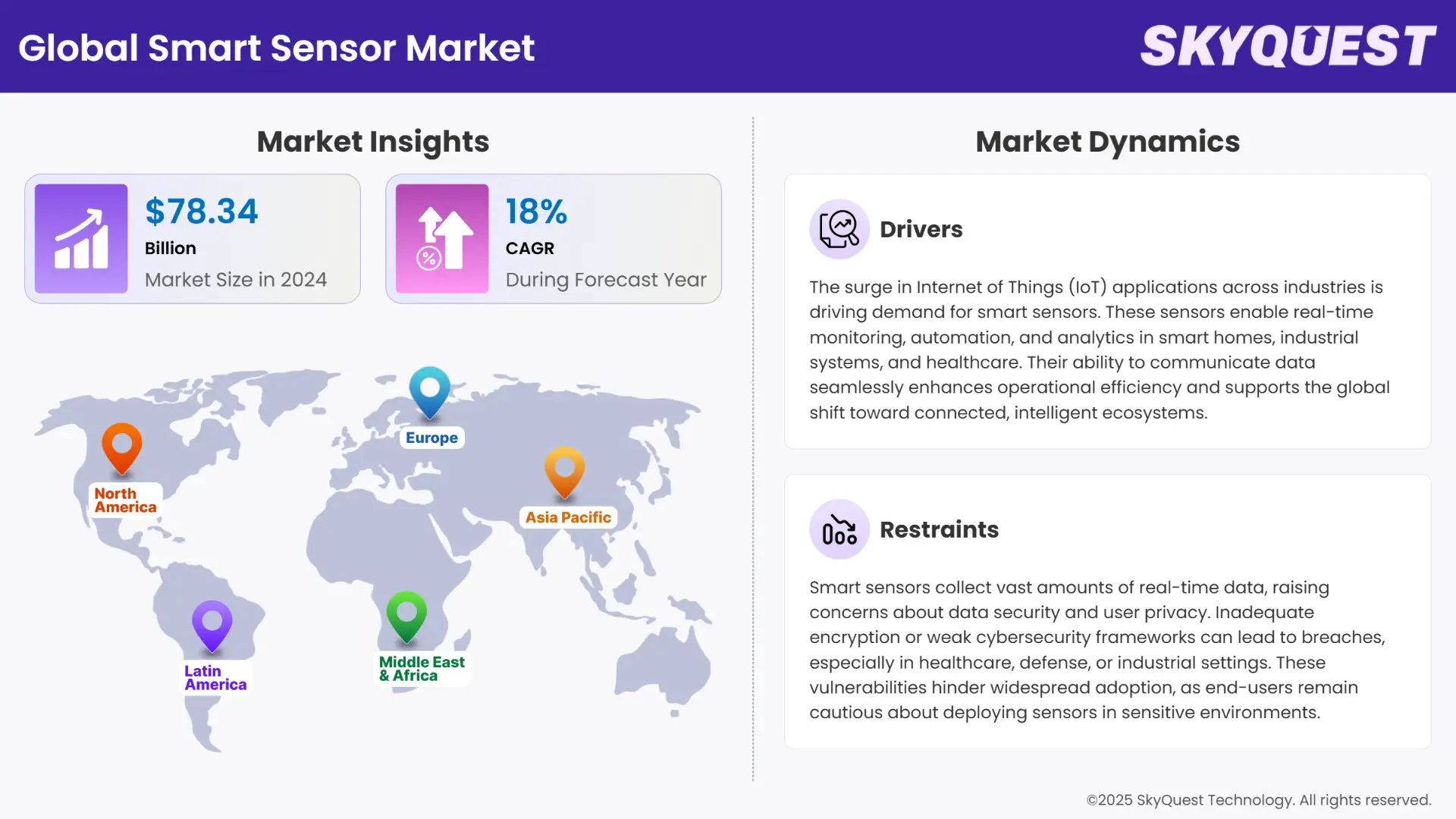

Global Smart Sensor Market size was valued at USD 78.34 Billion in 2024 poised to grow between USD 92.44 Billion in 2025 to USD 347.47 Billion by 2033, growing at a CAGR of 18% in the forecast period 18%.

The explosive growth of Internet of Things (IoT) applications is a key driver of the global smart sensor market. As industries transition to connected ecosystems, smart sensors have become essential for enabling real-time data collection, processing, and communication. From smart homes with automated lighting and climate control to industrial IoT systems monitoring machinery and production lines, these sensors serve as the critical interface between the physical and digital worlds. This rising IoT penetration demands more intelligent, multifunctional sensors capable of supporting data-driven decision-making, thereby significantly boosting the demand and development of smart sensor technologies worldwide.

Technological progress in Micro-Electro-Mechanical Systems (MEMS) has been a key trend driving the global smart sensor sector’s evolution. MEMS technology allows the creation of tiny mechanical and electrical components on a single chip, enhancing sensor precision, reliability, and efficiency. These improvements make smart sensors lighter, more compact, and power-efficient—key requirements for integration into modern devices like smartphones, fitness trackers, medical equipment, and automotive systems. As manufacturers continue to leverage MEMS advancements to develop more capable and cost-effective sensors, the range of smart sensor applications expands, further supporting widespread market growth across consumer electronics, healthcare, and industrial sectors.

How does AI Improve Decision-Making in Sensor-Driven Systems?

Artificial Intelligence (AI) is significantly impacting the global smart sensor market by enhancing the functionality and value of sensor-driven systems. AI algorithms enable smart sensors to not only collect data but also analyze and interpret it in real time, leading to faster, more accurate decision-making across applications such as predictive maintenance, autonomous vehicles, and smart healthcare. This shift from basic sensing to intelligent sensing increases demand for AI-integrated sensors. For example, Bosch developed smart sensors with embedded AI for wearables and industrial monitoring, allowing local data processing and reducing latency. This fusion of AI and sensor technology is transforming market expectations and accelerating adoption.

In May 2025, STMicroelectronics unveiled an AI-enabled inertial measurement unit (IMU) that combines precise activity tracking and high‑g impact sensing within a compact package. By embedding AI directly into the sensor, devices can reconstruct complex motion events on-device, enhancing IoT and wearable performance through streamlined, real‑time data processing.

To get more insights on this market click here to Request a Free Sample Report

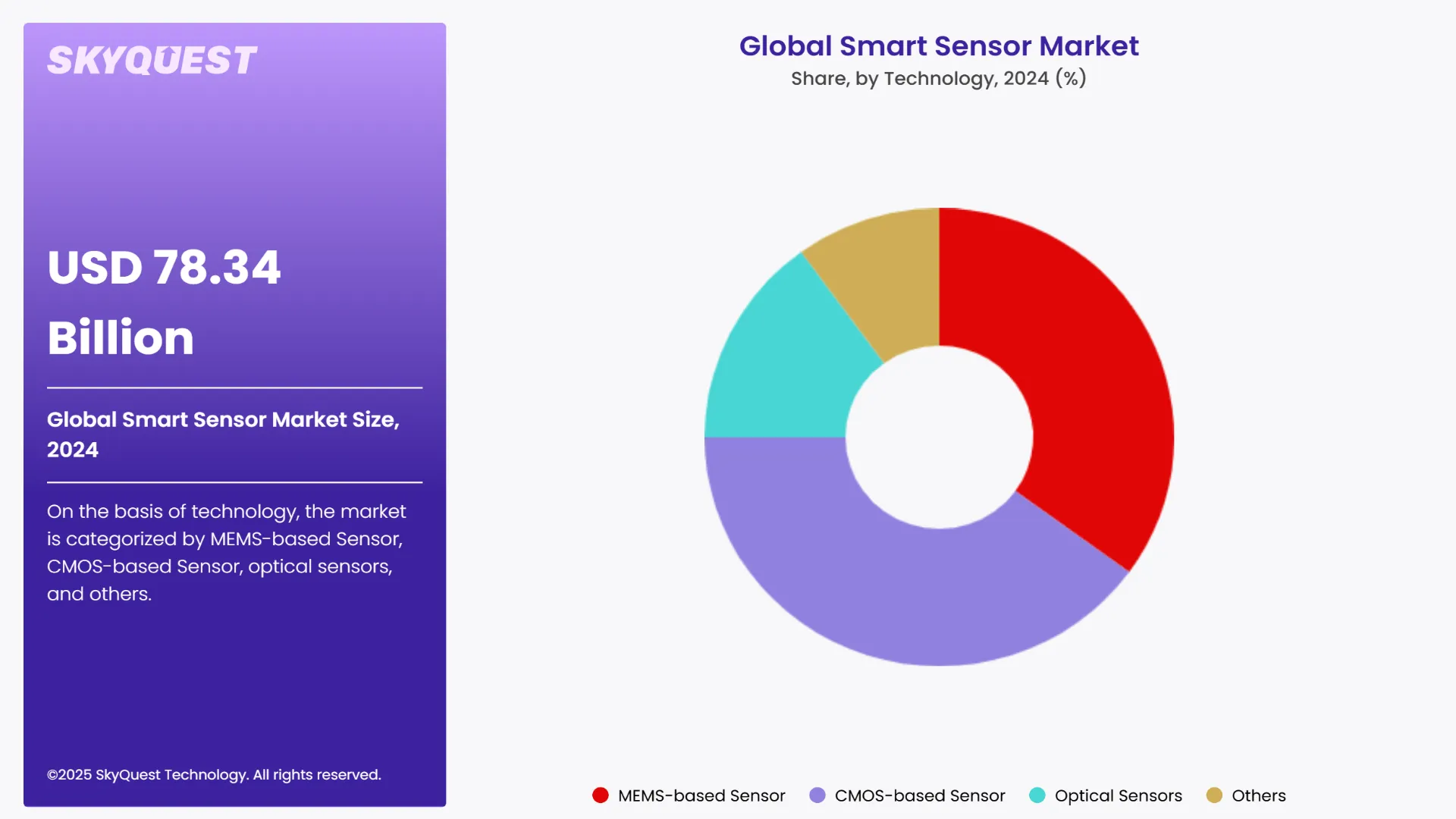

Global Smart Sensor market is segmented by type, technology, component, end user, and geography. The market is categorized by type on the basis of temperature & humidity sensors, pressure sensors, flow sensors, touch sensors, image sensors, motion & occupancy sensors, position sensors, light sensors, and others. On the basis of technology, the market is categorized by MEMS-based Sensor, CMOS-based Sensor, optical sensors, and others. Based on components, the market is categorized by analog to digital converters, digital to analog converters, transceivers, amplifiers, microcontrollers, and others. By end user, the market is segmented into industrial, commercial, and residential. On the basis of geography, the market is categorized by North America, Europe, Asia Pacific, Latin America, and Middle East and Africa.

Based on the global smart sensor market forecast, Image-type smart sensors are driving innovation in the industry due to their critical role in applications like facial recognition, industrial vision systems, autonomous vehicles, and healthcare diagnostics. These sensors capture and process visual data, enabling real-time analysis and decision-making. Their dominance stems from rising demand for intelligent surveillance, quality inspection, and computer vision capabilities, making them essential in sectors prioritizing precision, automation, and advanced situational awareness.

Touch-type smart sensors are poised to become the fastest‑growing segment in the global smart sensor market because consumer demand for intuitive human–machine interfaces is skyrocketing. As smartphones, wearables, industrial controls, and automotive consoles increasingly adopt touch-enabled features, manufacturers are investing heavily in high‑precision, low‑power touch sensors, driving rapid market expansion.

Micro‑Electro‑Mechanical Systems (MEMS) innovation is dominating the global smart sensor market by delivering ultra‑compact, low‑power, and highly precise sensors integrated into smartphones, wearables, automotive systems, and industrial equipment. MEMS fabrication on silicon ensures strong mechanical reliability and seamless integration with CMOS processing, accelerating adoption. As demand for miniaturized motion, pressure, and environmental sensors grows—with MEMS commanding over 60 % market share—this technology continues to dominate due to its unmatched scalability, accuracy, and cost‑efficiency.

Complementary Metal-Oxide-Semiconductor (CMOS) sensors are poised to become the fastest-growing segment in the global smart sensor market due to their low power consumption, cost efficiency, and seamless integration with microelectronics. Fuelled by surging demand in consumer electronics, automotive ADAS, and IoT applications, CMOS sensors offer high-resolution imaging and efficient on-chip processing, enabling scalable, intelligent deployment.

To get detailed segments analysis, Request a Free Sample Report

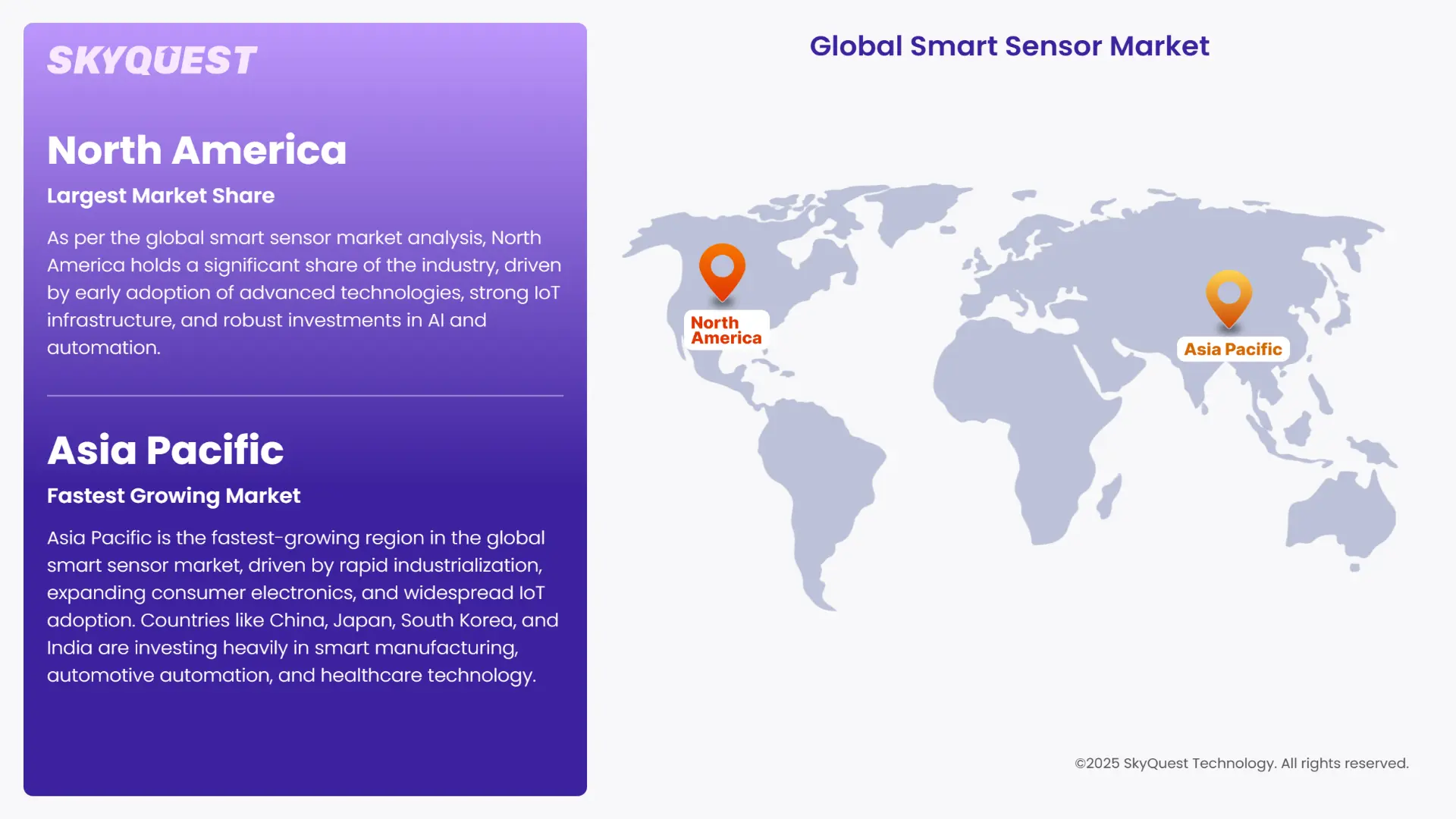

As per the global smart sensor market analysis, North America holds a significant share of the industry, driven by early adoption of advanced technologies, strong IoT infrastructure, and robust investments in AI and automation. The region benefits from a high concentration of key market players, research institutions, and tech-savvy industries. Growing demand across healthcare, automotive, and consumer electronics sectors, alongside supportive government initiatives, continues to fuel innovation and expansion of smart sensor applications across the region.

The United States is the dominant contributor to North America’s smart sensor market, driven by strong demand in automotive, healthcare, and industrial automation. The presence of major tech firms and startups focused on AI and IoT has accelerated sensor innovation. Government initiatives supporting smart infrastructure and advanced manufacturing also boost adoption. Increasing use in wearable devices and autonomous vehicles continues to position the U.S. as a leader in smart sensor integration.

Canada’s contribution to the North America’s smart sensor market is growing rapidly due to rising adoption of smart technologies in healthcare, manufacturing, and security sectors. The country emphasizes AI-integrated sensor systems, especially in industrial IoT applications. Government-backed innovation programs and expanding research in sensor technology foster a supportive ecosystem. With growing investments in smart infrastructure and sustainable tech, Canada is becoming a key regional player in intelligent sensing solutions.

Asia Pacific is the fastest-growing region in the global smart sensor market, driven by rapid industrialization, expanding consumer electronics, and widespread IoT adoption. Countries like China, Japan, South Korea, and India are investing heavily in smart manufacturing, automotive automation, and healthcare technology. The region benefits from cost-effective production, strong government support, and a rising tech-savvy population, making it a central hub for smart sensor innovation and deployment across diverse industries.

Japan plays a vital role in the Asia Pacific smart sensor market due to its leadership in robotics, automotive technology, and advanced manufacturing. Smart sensors are widely integrated into factory automation, healthcare devices, and autonomous systems. Government initiatives like Society 5.0 and strong R&D infrastructure further accelerate innovation. Japan’s focus on precision, miniaturization, and AI-driven sensor applications enhances its global standing in delivering cutting-edge, high-performance smart sensor solutions.

South Korea contributes significantly to the Asia Pacific smart sensor market, driven by its world-class electronics and semiconductor industries. Companies like Samsung and LG lead innovations in image and motion sensors, especially consumer electronics and smart home applications. Government-backed investments in smart factories, 5G, and IoT integration have strengthened adoption. With a strong focus on AI and sensor fusion, South Korea is rapidly expanding its global smart sensor footprint.

Europe is a key player in the global smart sensor market, driven by widespread adoption of Industry 4.0, smart manufacturing, and stringent environmental regulations. Countries like Germany, the UK, and France are investing heavily in automotive automation, smart healthcare, and energy-efficient infrastructure. The region benefits from strong R&D capabilities, supportive government initiatives, and a growing focus on sustainability, which collectively fuel demand for advanced, AI-integrated smart sensor technologies.

Germany plays a leading role in the Europe smart sensor market due to its strong foundation in automotive manufacturing, industrial automation, and Industry 4.0 initiatives. The country emphasizes precision engineering and real-time data monitoring, driving high demand for advanced sensor technologies. Integration of smart sensors in robotics, factory systems, and autonomous vehicles has positioned Germany as a technological powerhouse, accelerating innovation and adoption within both the European and global smart sensor ecosystems.

France significantly contributes to the Europe smart sensor market by advancing AI-integrated sensor technologies across urban planning, energy, and healthcare. Government-backed initiatives such as smart cities and environmental monitoring projects have increased demand for intelligent sensing systems. France’s strong R&D infrastructure and focus on automation in transport and industry foster innovation, enabling widespread sensor deployment and establishing the country as a growing force in smart sensor-driven digital transformation.

The United Kingdom is a major contributor to the Europe smart sensor market through its innovation in IoT, healthcare, and environmental monitoring. The country’s growing investments in smart infrastructure and sustainable technologies have led to the widespread use of image and touch sensors. Additionally, advancements in AI, sensor fusion, and wireless networks are fueling market growth, making the UK a key hub for smart sensor development across regional outlook and beyond.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Rising Adoption of IoT and Connected Devices

Growth in Automotive and ADAS Applications

Security and Privacy Concerns

Limited Standardization Across Devices

Request Free Customization of this report to help us to meet your business objectives.

The global smart sensor market outlook is highly competitive, with key players including Honeywell, STMicroelectronics, Bosch, Texas Instruments, and Infineon Technologies. Companies focus on innovation, AI integration, and strategic partnerships. For instance, Bosch invests in automotive sensor R&D, while STMicroelectronics collaborates on IoT solutions. Honeywell emphasizes industrial automation, and Infineon expands its MEMS sensor portfolio through acquisitions, all aiming to enhance performance, reduce costs, and strengthen global market presence.

As per the global smart sensor industry analysis, the startup ecosystem is rapidly expanding, fuelled by the convergence of AI, IoT, and edge computing. These startups are focusing on specialized applications like environmental sensing, human presence detection, and supply chain automation. With a strong emphasis on low-power, compact, and intelligent designs, they are disrupting traditional markets. Their agility in R&D and ability to address niche demands is accelerating the adoption of smart sensor technology across diverse sectors.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected by means of Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, the global smart sensor industry is witnessing robust growth driven by IoT proliferation, MEMS advancements, and AI integration. As industries embrace intelligent ecosystems, smart sensors are becoming essential across sectors like automotive, healthcare, consumer electronics, and industrial automation. Innovations such as AI-enabled vision sensors, touch interfaces, and battery-free tags reflect growing demands for efficiency, precision, and sustainability.

While challenges like privacy concerns and lack of standardization persist, companies and startups alike are actively addressing them through R&D and strategic collaborations. With strong momentum in North America, Europe, and Asia Pacific, the global smart sensor market strategies is transforming how data is sensed, processed, and applied—ushering into a new era of connected intelligence and real-time decision-making on both enterprise and consumer fronts.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 78.34 Billion |

| Market size value in 2033 | USD 347.47 Billion |

| Growth Rate | 18% |

| Base year | 2024 |

| Forecast period | 18% |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Smart Sensor Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Smart Sensor Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Smart Sensor Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Smart Sensor Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients