US Liquid Biopsy Market

Report ID: UCMIR35J2123

Report ID:

UCMIR35J2123 |

Region:

Regional |

Published Date: Upcoming |

Pages:

165

|Tables:

0

|Figures:

0

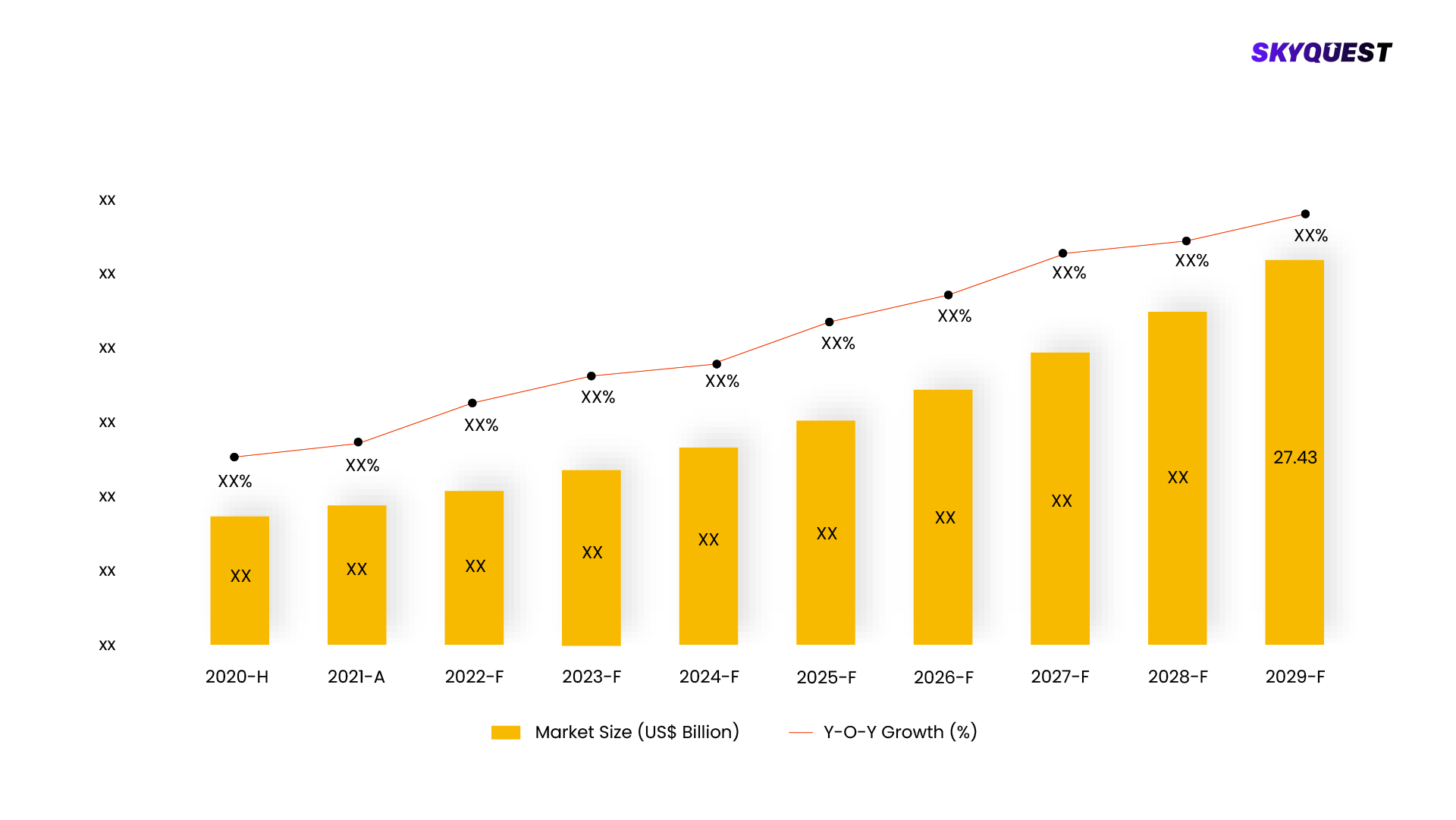

The US liquid biopsy market has demonstrated substantial growth, commencing with a market size of USD 362.82 million in 2022 and poised for remarkable expansion, with projections to reach approximately USD 1,816.95 million by 2032. This growth trajectory is underpinned by a compelling compound annual growth rate (CAGR) of 17.48% during the forecast period spanning from 2023 to 2032. The escalating demand for non-invasive diagnostic solutions, advancements in genomics and molecular diagnostics, and the potential to detect various cancers and diseases at an early stage are driving the adoption of liquid biopsy technologies. The benefits of reduced patient discomfort, quicker results, and real-time monitoring are augmenting market growth. Moreover, ongoing research and development efforts, collaborations between industry players and research institutions, and favorable regulatory environments are contributing to the market's expansion. As precision medicine gains prominence and the importance of personalized treatment strategies becomes increasingly evident, the US liquid biopsy market is anticipated to witness sustained investments in technology refinement and clinical applications, further propelling its substantial growth in the coming years.

This report is being written to illustrate the market opportunity by region and by segments, indicating opportunity areas for the vendors to tap upon. To estimate the opportunity, it was very important to understand the current market scenario and the way it will grow in future.

Production and consumption patterns are being carefully compared to forecast the market. Other factors considered to forecast the market are the growth of the adjacent market, revenue growth of the key market vendors, scenario-based analysis, and market segment growth.

The market size was determined by estimating the market through a top-down and bottom-up approach, which was further validated with industry interviews. Considering the nature of the market we derived the Life Sciences Tools & Services by segment aggregation, the contribution of the Life Sciences Tools & Services in Pharmaceuticals, Biotechnology & Life Sciences and vendor share.

To determine the growth of the market factors such as drivers, trends, restraints, and opportunities were identified, and the impact of these factors was analyzed to determine the market growth. To understand the market growth in detail, we have analyzed the year-on-year growth of the market. Also, historic growth rates were compared to determine growth patterns.

The US Liquid Biopsy Market is segmented by Biomarker Types, Application, Sample, End User. We are analyzing the market of these segments to identify which segment is the largest now and in the future, which segment has the highest growth rate, and the segment which offers the opportunity in the future.

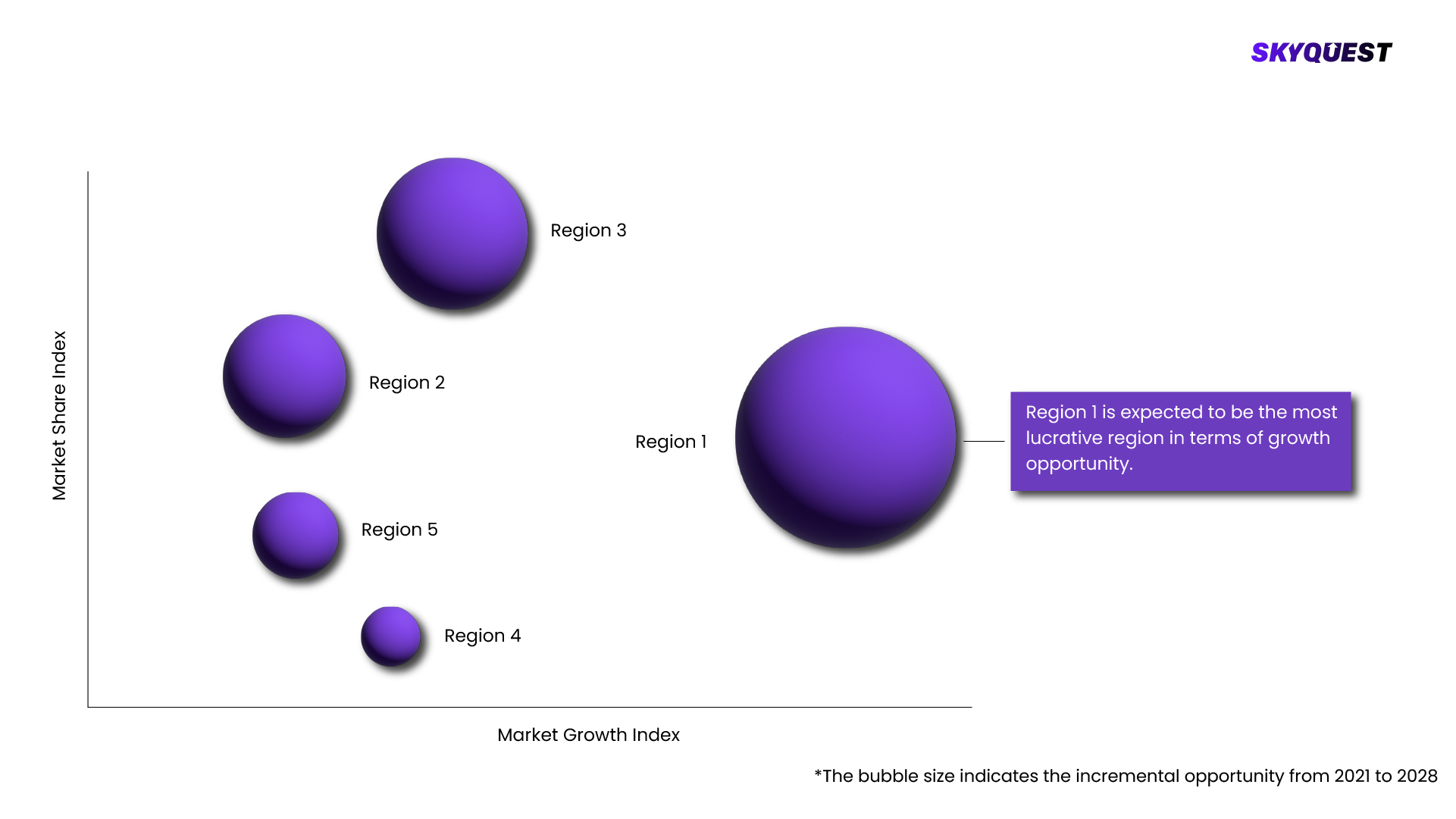

US Liquid Biopsy Market is being analyzed by North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA) regions. Key countries including the U.S., Canada, Germany, France, UK, Italy, Spain, China, India, Japan, Brazil, GCC Countries, and South Africa among others were analyzed considering various micro and macro trends.

SkyQuest's expert analysts have conducted a risk analysis to understand the impact of external extremities on US Liquid Biopsy Market. We analyzed how geopolitical influence, natural disasters, climate change, legal scenario, economic impact, trade & economic policies, social & ethnic concerns, and demographic changes might affect US Liquid Biopsy Market's supply chain, distribution, and total revenue growth.

To understand the competitive landscape, we are analyzing key US Liquid Biopsy Market vendors in the market. To understand the competitive rivalry, we are comparing the revenue, expenses, resources, product portfolio, region coverage, market share, key initiatives, product launches, and any news related to the US Liquid Biopsy Market.

To validate our hypothesis and validate our findings on the market ecosystem, we are also conducting a detailed porter's five forces analysis. Competitive Rivalry, Supplier Power, Buyer Power, Threat of Substitution, and Threat of New Entry each force is analyzed by various parameters governing those forces.

The US Liquid Biopsy Market is being analyzed by SkyQuest's analysts with the help of 20+ scheduled Primary interviews from both the demand and supply sides. We have already invested more than 250 hours on this report and are still refining our date to provide authenticated data to your readers and clients. Exhaustive primary and secondary research is conducted to collect information on the market, peer market, and parent market.

Our cross-industry experts and revenue-impact consultants at SkyQuest enable our clients to convert market intelligence into actionable, quantifiable results through personalized engagement.

| Report Attribute | Details |

|---|---|

| The base year for estimation | 2021 |

| Historical data | 2016 – 2022 |

| Forecast period | 2022 – 2028 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered |

|

| Regional scope | North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA) |

| Country scope | U.S., Canada, Germany, France, UK, Italy, Spain, China, India, Japan, Brazil, GCC Countries, South Africa |

| Key companies profiled |

|

| Customization scope | Free report customization (15% Free customization) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Reap the benefits of customized purchase options to fit your specific research requirements. |

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

For the US Liquid Biopsy Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the US Liquid Biopsy Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the US Liquid Biopsy Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the US Liquid Biopsy Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

The market for US Liquid Biopsy was estimated to be valued at US$ XX Mn in 2021.

The US Liquid Biopsy Market is estimated to grow at a CAGR of XX% by 2028.

The US Liquid Biopsy Market is segmented on the basis of Biomarker Types, Application, Sample, End User.

Based on region, the US Liquid Biopsy Market is segmented into North America, Europe, Asia Pacific, Middle East & Africa and Latin America.

The key players operating in the US Liquid Biopsy Market are sights, The US liquid biopsy market size was exhibited at USD 362.82 million in 2022 and is projected to hit around USD 1,816.95 million by 2032, growing at a CAGR of 17.48% during the forecast period from 2023 to 2032. , Key Points:, On the basis of biomarker types, the circulating tumor cells (CTC) segment is anticipated to dominate the market from 2023 to 2032., On the basis of application, the cancer therapeutic application segment had the major market share in 2021., On the basis of the sample, the blood sample segment is predicted to expand at the biggest rate from 2023 to 2032., On the basis of end-user, the hospitals and laboratories segment had the major market share in 2021., Market Overview, A technique that involves diagnosing and tracking diseases like cancer is known as liquid biopsy. This technique involves sampling and analyzing biological tissues in a liquid condition. Liquid biopsies are mainly preferred to eliminate the discomfort associated with operations. For instance, blood and urine are the liquid samples utilized in the method. Both of these samples are obtained painlessly and readily. It is mainly a practical application of two developments in medical science, human genome sequencing and the growing sensitivity of detection measures and assays. Additionally, it provides a risk-free and efficient option for patients who are unable to have a tissue biopsy due to the risks associated, such as those with lung cancer who have tumors that are too close to the heart. Clinical utility challenges, lack of sensitivity, and specificity of liquid biopsy tests are some of the key factors hindering the growth of liquid biopsy., COVID-19 Impact:, COVID-19 had a major influence on the number of patients receiving cancer screening, diagnosis, and treatment. Oncology clinics were re-profiled to treat COVID-19 patients due to increased demand caused by the rising number of COVID-19 patients being hospitalized. However, as governments gradually reduce travel restrictions, testing numbers are projected to rise once more. Since the COVID-19 pandemic, responding to increased cancer incidence has become a critical medical challenge on a worldwide scale. Because numerous COVID-19 patients had cancer, cancer has been recognized as a risk factor for COVID-19. More study in this area is expected to benefit cancer research by assisting in better understanding the dynamics of infection. This is also expected to raise demand for liquid biopsy products., Market Dynamics:, Drivers: Rise in the prevalence of cancer, On a worldwide basis, the number of cancer patients has grown dramatically. For instance, according to World Health Organization, the leading cause of death is cancer, accounting for nearly 10 million deaths in 2020. Some of the causes of the increased incidence of cancer include environmental factors, cigarette smoking, viral disorders such as Hepatitis B and C, and lifestyle changes. Liquid biopsy provides several advantages over traditional cancer diagnostic procedures, including reduced cost, earlier prognosis, therapy monitoring, tumor heterogeneity discovery, acquired drug resistance, and patient comfort (by eliminating the need for surgery). The liquid biopsy is expected to become the first choice for diagnosis of a wide variety of cancers, such as Central Nervous System (CNS) and pancreatic cancer., Restraints: Certain liquid biopsies have reduced sensitivity, Detecting ctDNA in liquid biopsies is technically difficult since the quantities of DNA of any particular cancer mutation in a cancer patient's plasma might be very low, especially after therapy or surgery. According to the sampling statistics, there may be less than one detectable copy of the ctDNA with the cancer mutation in each sample of plasma from a patient. As a result, even if ctDNA is present in the plasma at a low level, it may not be found in the patient sample. This results in false-negative results in which ctDNA is not discovered despite its presence, decreasing the predictive value of liquid biopsy testing for cancer., Opportunities: The increasing influence of companion diagnostics, Companion diagnostics are tests or assays that assist healthcare practitioners to make treatment decisions for patients based on the optimal response to therapy. Co-development of companion diagnostics with therapeutic goods has the potential to significantly transform the drug development process and accelerate the commercialization of drug candidates. This is done by producing safer medications with improved therapeutic efficacy rapidly and cost-effectively. The market for companion diagnostics has considerable growth potential due to the rising need for high-priced specialized therapies and safer medications. The increasing relevance of companion diagnostics is also propelling the liquid biopsy market growth., Segments Insight, Biomarker Type Insights, Based on the biomarker type, the U.S. Liquid Biopsy Market is segmented into circulating tumor cells (CTCs), circulating tumor DNA (CTDNA), extracellular vesicles (EVs), and other biomarkers. Due to the increased cancer prevalence, the Circulating Tumor Cells(CTC) category is anticipated to dominate the liquid biopsy market over the forecast period. The cells that break out from primary or secondary cancers and enter the bloodstream are known as Circulating Tumor Cells. The predictive and prognostic biomarkers in various cancers, including lungs, breast, and prostate, are CTC. Additionally, the circulating tumor DNA segment is expected to grow significantly during the forecast period., Sample Insights, Based on the sample, the U.S. Liquid Biopsy Market is segmented into blood samples, urine samples, and others. The Blood sample category is expected to expand at the fastest rate over the review period. A blood test is painless and has no risks, along with this, it cuts down cost and time to diagnose a problem. Blood-based liquid biopsy is popular as it can detect CTCs, cfDNAs, exosomes, and microvesicles. Additionally, the urine sample segment is expected to grow significantly over the forecast period. The urine-based sample collection has various advantages over blood sample collection including increased patient compliance for cancer screening and the ability to monitor patients more frequently. , Application Insights, Based on the application, the U.S. Liquid Biopsy Market is segmented into cancer therapeutic applications, reproductive health, and other therapeutic application. The cancer application category had the most market share in 2020. The growing prevalence of cancer and the increase in research studies on liquid biopsy for cancer applications are driving the growth of this market. A type of test that can be used for cancer screening at an early stage is a liquid biopsy. It can be used to determine how well the treatment is working and whether the cancer has returned. The ctDNA tests may be able to detect more cancers at an early stage, which reduces the risk of death from that cancer., End-User Insights, Based on the end-user, the U.S. Liquid Biopsy Market is segmented into hospitals and laboratories, academic and research centers, and other end users. The laboratories market category had the most market share in 2021. The increased outsourcing of liquid biopsy testing to reference labs is driving the growth of this industry. The revenue growth of hospitals is mainly driven by the emergence of cancer specialty hospitals in developing countries with the availability of advanced procedures, such as liquid biopsy., Recent Developments, In July 2021, Biocept, Inc. has received a South Korean Patent for the Primer-Switch technology, which uses real-time PCR and related analytical methods to discover rare mutations in circulating tumor DNA (ctDNA). In February 2021, Guardant Reveal, the first blood-only liquid biopsy test for detecting residual and recurring illness from a single blood draw, has been made available by Guardant Health, Inc., KEY MARKET SEGMENTS, By Biomarker Types , Circulating Tumor Cells (CTCs), Circulating Tumor DNA (CTDNA), Extracellular vesicles (EVS), Other Biomarkers, By Application , Cancer Therapeutic Application, Reproductive Health, Other Therapeutic Application, By Sample , Blood Sample, Urine Sample , Other, By End User , Hospitals and Laboratories, Academic and Research Centers, Other End Users, KEY MARKET PLAYERS, ANGLE plc, Biocept Inc., Bio-Rad Laboratories Inc., Epigenomics AG, Exact Sciences Corporation, F. Hoffmann-La Roche AG, Guardant Health Inc. , Illumina Inc., MDxHealth SA , Menarini Silicon Biosystems, QIAGEN N.V. , Thermo Fisher Scientific Inc..

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Report ID: UCMIR35J2123

sales@skyquestt.com

USA +1 351-333-4748