Report ID: SQMIG45A2132

Report ID: SQMIG45A2132

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG45A2132 |

Region:

Global |

Published Date: July, 2025

Pages:

196

|Tables:

93

|Figures:

68

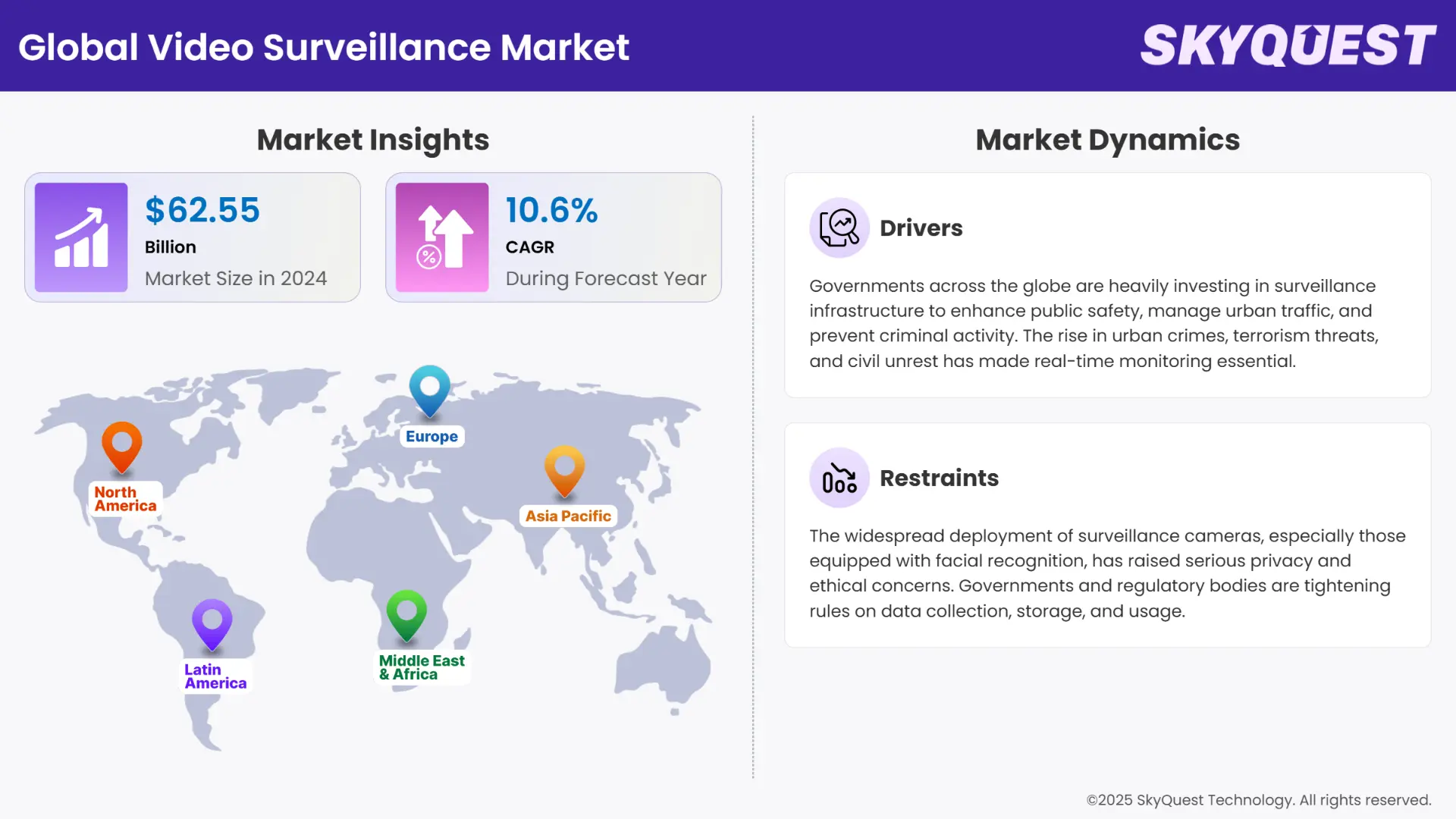

Global Video Surveillance Market size was valued at USD 62.55 Billion in 2024 and is poised to grow from USD 69.18 Billion in 2025 to USD 154.89 Billion by 2033, growing at a CAGR of 10.6% in the forecast period (2026–2033).

The global video surveillance market is experiencing robust growth, driven by rising security concerns, technological advancements, and increasing urbanization. This market growth is fueled by the transition from traditional analog systems to IP-based surveillance, which offers superior image quality, remote accessibility, and integration capabilities with advanced analytics. Artificial Intelligence (AI), particularly facial recognition, object detection, and behavioral analytics, plays a pivotal role in transforming video surveillance from passive monitoring to intelligent, real-time threat detection systems. North America and Europe also contribute significantly to market growth, driven by increasing demand for modernized surveillance in sectors such as retail, transportation, and government facilities. The emergence of cloud-based surveillance, edge computing, and 5G connectivity further enhances system efficiency and scalability, positioning the video surveillance market for sustained expansion in the coming years.

How Does AI Improve Accuracy and Speed in Identity Verification?

AI is profoundly reshaping the video surveillance market by enhancing system intelligence, automation, and decision-making capabilities. In 2024, the integration of AI technologies has notably accelerated, transforming surveillance from mere video recording to proactive security solutions. AI enables real-time video analytics, such as facial recognition, license plate recognition, object tracking, and abnormal behavior detection—helping organizations prevent incidents before they occur. The deployment of deep learning algorithms and computer vision has improved the accuracy and speed of threat identification across public spaces, transportation hubs, and corporate facilities.

To get more insights on this market click here to Request a Free Sample Report

The global video surveillance market is segmented into offering, vertical, system type, and region. Based on offering, the market is segmented into hardware, software, and service. Based on segmentation by vertical, the market is segmented into commercial, infrastructure, military & defense, residential, public facilities, and industrial sectors. Based on system type, the market is segmented into analog, IP and hybrid. Based on region, the market is segmented into North America, Asia-Pacific, Europe, Latin America, and Middle East & Africa.

What Factors are Driving the Shift from Analog to IP Systems?

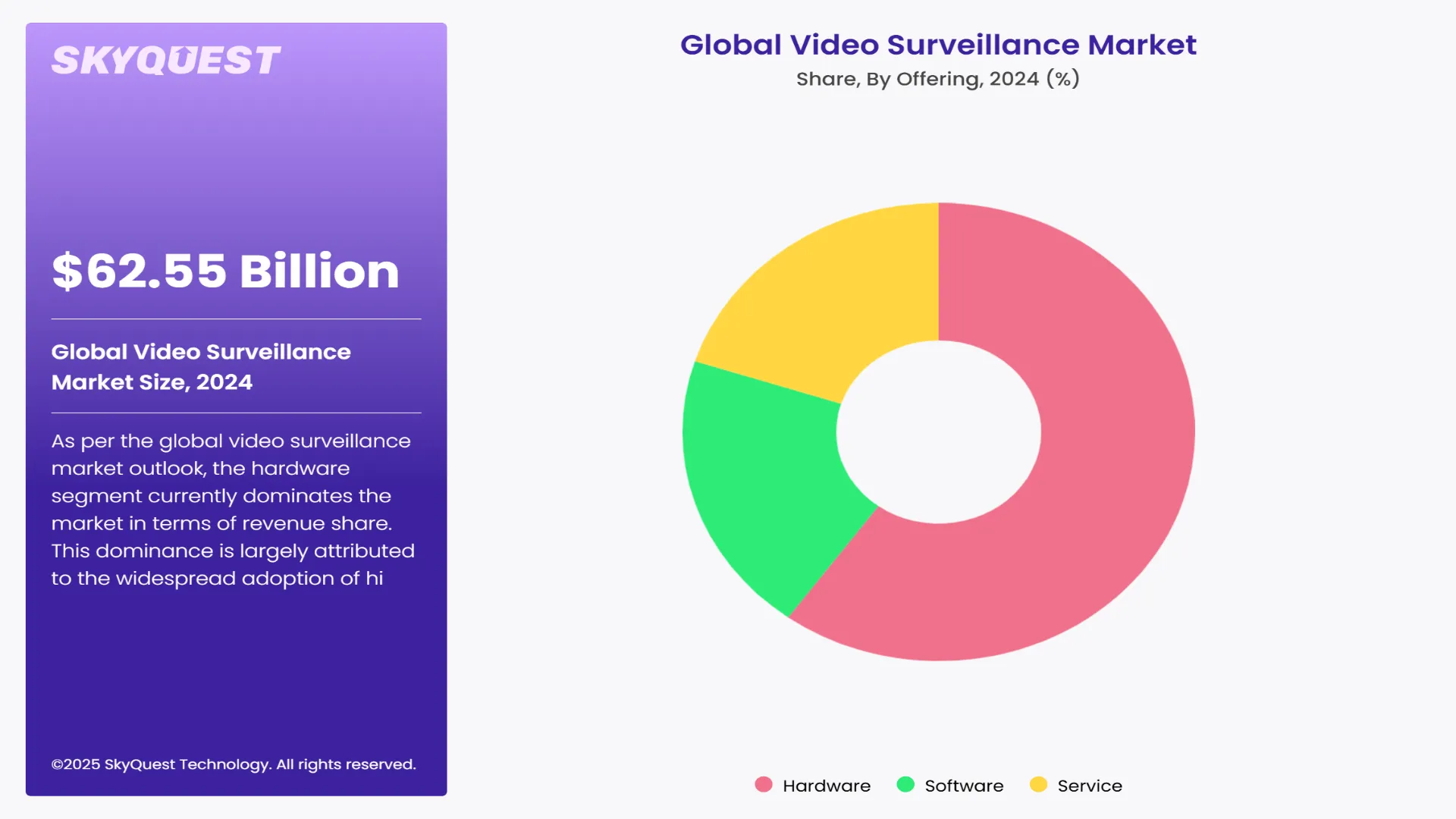

As per the global video surveillance market outlook, the hardware segment currently dominates the market in terms of revenue share. This dominance is largely attributed to the widespread adoption of high-definition and smart surveillance cameras across the public and private sectors. The push for smart cities, expanding transportation networks, and increasing demand for perimeter security have fueled massive installations of surveillance hardware. Additionally, rapid upgrades from analog to IP systems and the need for advanced physical monitoring in critical infrastructure continue to solidify hardware as the leading segment.

As per global video surveillance market forecast, the software segment is witnessing the fastest growth in the market. This includes video management software (VMS), analytics platforms, and AI-powered surveillance tools. The surge in demand is driven by the integration of artificial intelligence (AI) and machine learning, enabling capabilities like facial recognition, motion detection, behavioral analytics, and real-time alerts. Cloud-based surveillance software is also gaining traction due to its scalability, centralized control, and lower infrastructure costs.

Why are IP Systems Preferred for Modern Security Deployments?

IP segment currently dominates the global market due to its superior image quality, scalability, and ease of integration with advanced technologies like AI and cloud computing. Unlike analog systems, IP cameras support high-definition video, remote monitoring, and real-time alerts. Their ability to work with intelligent analytics platforms has made them the preferred choice for modern security installations across smart cities, enterprises, and transportation infrastructure. The growing need for centralized surveillance and advanced functionality continues to solidify IP systems as the market leader.

As per global video surveillance market analysis, the hybrid segment witnessed the fastest growth, particularly in developing regions and among small to mid-sized businesses. These systems offer a cost-effective way to upgrade existing analog infrastructure while incorporating IP capabilities. By allowing organizations to transition gradually to fully digital setups, hybrid systems provide flexibility without requiring complete hardware replacement, driving their accelerated adoption.

To get detailed segments analysis, Request a Free Sample Report

What Drives the Video Surveillance Market in North America?

As per regional outlook, North America is a mature and technologically advanced region in the video surveillance market, driven by strong government support for security modernization, smart infrastructure, and rising demand for advanced surveillance in public safety, retail, and transportation. The presence of major players like Motorola Solutions and Honeywell, combined with early adoption of AI and cloud-based surveillance, boosts innovation in this region.

Video Surveillance Market in the U.S.

The United States holds the largest video surveillance market share in North America. Federal and local governments are heavily investing in surveillance systems for crime prevention, traffic monitoring, and border control. High demand for real-time analytics, AI-based monitoring, and cloud video storage is propelling growth, particularly in smart cities and enterprise applications.

Video Surveillance Market in Canada

As per regional analysis, in Canada, the market is growing steadily due to urban safety initiatives, increasing adoption of smart surveillance in public transportation, and infrastructure security. Canadian organizations are emphasizing privacy-compliant video solutions, and there is increasing interest in hybrid cloud models and AI-powered video analytics for proactive threat detection.

How are Smart Cities Driving Surveillance Demand in Asia-Pacific?

Asia-Pacific is the fastest-growing region in the global video surveillance market. Rapid urbanization, increasing crime rates, and strong government-led smart city programs are key drivers. High camera deployment density in countries like China, India, South Korea, and Japan, along with advanced manufacturing capabilities, contribute to regional dominance.

Video Surveillance Market in Japan

Japan's focus on high-tech surveillance solutions, including facial recognition and edge AI, supports its market growth. The country uses video surveillance widely in transportation (railways, subways), public spaces, and during international events, driving demand for smart, efficient, and privacy-compliant systems.

Video Surveillance Market in South Korea

As per industry analysis, South Korea is a leading adopter of smart surveillance due to its advanced ICT infrastructure. Government and private sector projects deploy AI-based monitoring, traffic control, and behavioral analytics. South Korean companies are also major exporters of surveillance technology, further boosting market momentum.

What is Driving the Video Surveillance Market in Europe?

Europe is witnessing stable growth in the video surveillance market, supported by modernization of public safety infrastructure, expansion of transportation networks, and increasing emphasis on anti-terrorism initiatives. However, strict data protection regulations like GDPR influence how surveillance systems are deployed, with a shift toward privacy-first, AI-optimized solutions.

Video Surveillance Market in Germany

Germany's market is growing steadily, with increasing adoption in commercial and industrial sectors. Security modernization in airports, railway stations, and public infrastructure is driving demand for high-resolution IP cameras and AI-based analytics, especially under smart city initiatives.

Video Surveillance Market in the U.K.

The United Kingdom has one of the highest per capita deployments of surveillance cameras in Europe. Government agencies continue to invest in public safety and transportation security, while private enterprises are adopting cloud-based video systems with real-time analytics for improved incident management.

Video Surveillance Market in Italy

Italy is expanding its video surveillance footprint through initiatives focused on urban safety, smart parking, and tourism zone monitoring. There is growing interest in integrating AI tools like license plate recognition and behavioral analysis into municipal surveillance projects, especially in larger cities and tourist hotspots.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Video Surveillance Market Drivers

Rising Demand for Public Safety and Crime Prevention

Integration of AI and Video Analytics

Video Surveillance Market Restraints

Privacy Concerns and Regulatory Challenges

High Initial Costs and Infrastructure Requirements

Request Free Customization of this report to help us to meet your business objectives.

The competitive landscape of the video surveillance industry is marked by aggressive innovation, strategic mergers, and the integration of artificial intelligence (AI), cloud, and edge technologies. Leading companies such as Hikvision, Dahua, Axis Communications, and Hanwha Vision continue to dominate through extensive global distribution networks and cutting-edge R&D capabilities. These players are focusing on developing smart, AI-powered cameras with real-time analytics and minimal latency.

As per market strategies, in April 2024, Hikvision partnered with NVIDIA to embed GPU-based edge AI capabilities into its next-gen smart cameras, enabling real-time behavior detection and vehicle classification without reliance on central servers.

Startups are playing a pivotal role in reshaping the video surveillance market by introducing agile, AI-driven, and cloud-native solutions that address modern security challenges. One such startup has gained attention for its focus on real-time behavioral analytics, offering a platform that can detect unusual movements, loitering, or crowd formation using edge computing—ideal for smart city deployments and event management.

Top Player’s Company Profiles

Recent Developments in Video Surveillance Market

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected by means of Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, key drivers of market growth include the increasing concerns over public and private security. Companies invest in AI-equipped and future evidence video surveillance systems. AI-driven video creates automatic analysis of objects and facial recognition, liberating human operators to address more important duties such as security alerts. Increasing concern about crime and terrorism is motivating us to use video surveillance. This high cost can be prohibitive to small businesses and organizations, which limits their ability to use state-of-the-art surveillance solutions and slows down the growth in the market.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 62.55 Billion |

| Market size value in 2033 | USD 154.89 Billion |

| Growth Rate | 10.6% |

| Base year | 2024 |

| Forecast period | 2026-2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Video Surveillance Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Video Surveillance Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Video Surveillance Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Video Surveillance Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients