| Segments covered |

- By Region: - North America, United States (US), Canada, Europe, United Kingdom (UK), Germany, France, Rest of Europe, Asia Pacific, China, Japan, India, South Korea, Rest of Asia Pacific, Rest of the world, KEY MARKET PLAYERS, Qualcomm, Broadcom, TP-Link, ZTE, Mediatek, Keysight Technologies, MaxLinear, Huawei, Commscope, Vantiva, LitePoint, Rohde & Schwarz, Intel, HFCL, Netgear, SDMC Technology, Senscomm Semiconductor, H3C, VVDN Technologies, Actiontec Electronics, ADB Global, Ruijie Networks, Edgewater Wireless Systems, Privacy Management Software Market Forecast & Trends, Global Size, The privacy management software market size is expected to grow from USD 2.7 billion in 2023 to USD 15.2 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 41.9% during the forecast period. As privacy regulations became more stringent, privacy impact assessments (PIAs) gained prominence. Privacy management software incorporated PIA frameworks to evaluate the potential risks and impacts on individuals' privacy associated with data processing activities. These tools facilitated the systematic assessment of data flows, risk identification, and implementation of appropriate mitigations. Modern privacy management software has evolved into comprehensive platforms that provide organizations with holistic privacy governance capabilities. These platforms integrate various modules, including data inventory, risk assessments, vendor management, policy management, privacy by design, and ongoing compliance monitoring. They offer centralized visibility, automation, and analytics to enable proactive privacy management, risk mitigation, and ongoing compliance with evolving regulations., Recession Impact on the Privacy management software market, The global recession caused by the COVID-19 pandemic has had a mixed impact on the privacy management software market. Factors like the Russia-Ukraine war, the global pandemic, inflation, rising interest rates, and rising oil prices have resulted in recession across the various regions. These market uncertainties have resulted in reduced spending by organizations that may impact the demand for privacy management software across industries in the short term. The impact of a recession on the privacy management software market may vary across industries. Certain verticals, such as finance, healthcare, and retail & eCommerce, where privacy and data protection are critical, may prioritize privacy management software investments despite economic challenges. In contrast, industries heavily affected by the recession may delay or reduce spending on privacy management software until economic conditions improve. In addition, The Russia-Ukraine war has been accompanied by reports of cyber espionage, hacking attempts, and disinformation campaigns. These activities highlight the importance of robust cybersecurity measures. This will likely drive the growth of privacy management software during the forecast period. While the recession has a mixed impact on the privacy management software market, the long-term prospects for the industry remain positive. The continued growth in internet penetration, the increasing popularity of mobile devices, advent of technologies such as AI, IoT, cloud, and changing regulatory landscape across the globe, are likely to drive continued growth in the market. However, the impact of the recession on the market is likely to be felt for some time, particularly in terms of investment and advertising revenue., Privacy Management Software, Driver: Need for personal data protection with increasing privacy concerns, With the exponential growth of digital technologies and the extensive collection and processing of personal data, individuals are becoming more aware of the potential risks to their privacy. Organizations are increasingly demanding to protect personal data and ensure responsible data handling practices. Data privacy management software enables organizations to establish effective data governance frameworks. It helps organizations define data handling policies, track data flows, and implement controls to ensure responsible data processing practices. This promotes accountability and transparency in data management. As per the Cisco Consumer Privacy Survey 2022, organizations can perform a variety of activities to fulfill customer demands and build trust. These include complying with all applicable privacy laws and regulations, refraining from selling the customer’s personal information, avoiding data breaches that might expose personal data, allowing the customer to configure their privacy settings, and providing clear information on how the customer’s data is being used. As per the survey, 39% of consumers selected how their data is being used as the top priority., Restraint: integration of privacy management software with existing systems, Privacy management software must seamlessly integrate with various existing systems and databases within an organization. However, compatibility issues can arise due to differences in data formats, protocols, or system architectures. These technical disparities can make the integration process complex and time-consuming. Organizations often have unique processes and requirements when it comes to privacy management. Integrating privacy management software may require customization and configuration to align with specific workflows, data structures, and business rules. This customization can be tedious and may require specialized expertise., In some cases, existing systems may already have privacy management features or modules. Integrating additional privacy management software can result in duplication of efforts and redundant functionalities. This duplication can lead to confusion, increased complexity, and wasted resources. Organizations should conduct thorough planning and analysis to overcome this, involving key stakeholders from IT, privacy, and relevant departments. It is crucial to assess the compatibility of privacy management software with existing systems, anticipate customization needs, allocate sufficient resources for data migration and mapping, and provide employees comprehensive training and change management support., Opportunity: Growing spending on cybersecurity initiatives, As cyber threats become more sophisticated and prevalent, organizations allocate more resources to bolster their cybersecurity measures. As per a recent meeting at the White House, several tech giants such as Apple, AWS, and IBM announced new cybersecurity initiatives from 2021 to 2025.This includes investing in privacy management software as an essential component of their overall security strategy. Privacy management software helps protect sensitive data, prevent unauthorized access, and mitigate the risks of data breaches and privacy violations. In addition, Privacy management software provides tools and features to facilitate compliance, such as data mapping, consent management, and incident response capabilities. The increasing emphasis on regulatory compliance drives the need for privacy management software and justifies the increased spending in this area., Challenge: Time to implement data privacy management software, The duration to implement data privacy management software can vary significantly depending on several factors, including the complexity of the software, the organization’s size and structure, the scope of the implementation, and the level of customization required. As per a survey conducted by g2.com in March 2021, the implementation time for products including TrustArc, DataGrail, Secure Privacy, SAI360, Collibra, SureCloud, DPOrganizer, and OneTrust was in the range of 24 days to 160 days. The shortest implementation time has been cited as DPOrganizer at just under one month, followed by Secure Privacy, with an implementation time of a month and a half. At the same time, the longest implementation periods are reported at just over five months. SAI360 reported an implementation period of 159 days, and Collibra completed theirs in 156 days. This will engage the IT and security teams in implementing and integrating the privacy management software and may impact the performance of other applications and business performance. Thus, the implementation time for various vendors of privacy management software will pose a challenge in adopting privacy management software across industry verticals., Based on deployment mode, the on-premises segment is projected to witness the highest market share during the forecast period., Organizations opting for on-premises privacy management software prioritize data control, customization, and compliance with internal policies. They are willing to take on the responsibility of managing the software and infrastructure to maintain full control over their privacy management processes. However, it is important to carefully assess the organization's needs, resources, and capabilities before deciding on an on-premises deployment mode. The adoption of on-premises privacy management software is not as widespread as cloud-based solutions. However, for organizations with specific needs and priorities, such as data security, compliance, integration requirements, or cost considerations, on-premises solutions remain viable. Organizations should carefully evaluate their unique circumstances, risk appetite, and long-term objectives before deciding on the most suitable deployment mode for their privacy management software.

|

| Key companies profiled |

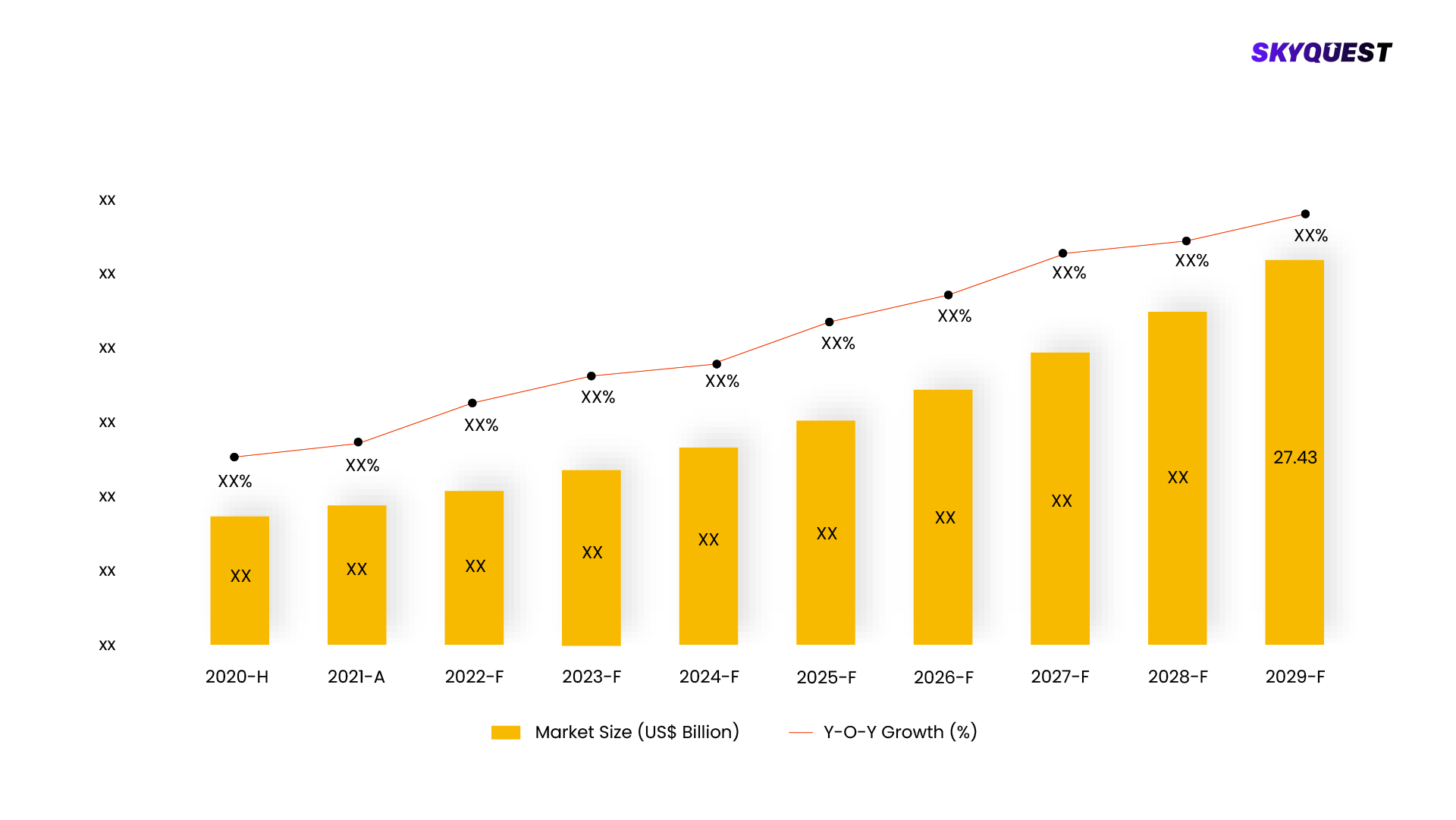

- market is estimated at USD 1.0 billion in 2023 and is projected to reach USD 24.2 billion by 2030, at a CAGR of 57.2% from 2023 to 2030. The primary factor driving the growth of the Wi-Fi 7 market is the increasing demand for data-intensive, low-latency applications and use cases due to pandemic-driven lifestyle changes.

- Driver: The rising adoption of Internet of Things

- The IoT is driving the need for higher data rates and lower latency. As more and more devices are connected to the internet, the amount of data being transferred is increasing exponentially. This strains existing Wi-Fi networks, which cannot always meet the demand. Wi-Fi 7 is designed to address this issue by offering significantly higher data rates and lower latency. The IoT is increasing the demand for more reliable and secure wireless connections. Many IoT devices are used in critical applications, such as healthcare and industrial automation. In these applications, the wireless connection must be reliable and secure. Wi-Fi 7 offers several features that improve reliability and security, such as OFDMA and Target Wake Time (TWT). IoT is creating new opportunities for Wi-Fi 7. For example, Wi-Fi 7 can connect smart home devices like thermostats, lights, and security cameras. It can also connect industrial IoT devices, such as robots and sensors. These new applications are driving demand for Wi-Fi 7 and helping grow the market.

- Restraint: High costs of installation

- Wi-Fi 7 devices are expected to be more expensive than previous generations due to the increased complexity and cost of the new features and capabilities. This could limit the adoption of Wi-Fi 7 devices, especially in developing countries. The high cost of Wi-Fi 7 devices is a major restraint in the market. Wi-Fi 7 devices are more complex than previous generations of Wi-Fi devices, which makes them more difficult to install. This could lead to higher labor costs for installers.

- Opportunity: Deployment of OpenRoaming and Passpoint technology gathering pace

- WBA OpenRoaming is a roaming federation service that provides a global automatic and secure Wi-Fi experience. It creates the framework to connect billions of users and things to millions of Wi-Fi networks in the wireless ecosystem without needing logins, registrations, or passwords, facilitating non-stop connectivity and empowering new opportunities in the 5G era. The WBA Annual Industry Report 2023 underlines that the global momentum for WBA OpenRoaming outreached a milestone of one million hotspots in early 2022. Passpoint technology removes the friction associated with onboarding and offboarding within the hotspots. The WBA report states that 62% of service providers, equipment manufacturers, and enterprises globally will have already deployed Passpoint/OpenRoaming technology or are planning to do so by the end of 2023. A further 25% are expected to deploy the technology by 2025. Among the people adopting OpenRoaming technology, 51% consider improving the overall customer experience as its key driver.

- Challenge: High probability of spectrum congestion

- Spectrum congestion presents a significant challenge for the Wi-Fi 7 market, particularly due to the shared usage of the 6 GHz band with other applications such as radar and weather forecasting. This congestion adversely affects Wi-Fi 7 network performance, reducing data rates, increased latency, and higher packet loss. Consequently, activities requiring significant bandwidth, like streaming videos and online gaming, become difficult, as does real-time communication, such as VoIP calls. Spectrum congestion also leads to dropped calls, interrupted streaming, and other related issues.

- Wi-Fi 7 market Ecosystem

- The Wi-Fi 7 market comprises several hardware manufacturers, network server providers, service providers, system integrators, platform providers, and end users working together to deliver Wi-Fi 7 solutions for large-scale IoT deployments.

- By vertical, the media and entertainment segment holds the largest market size during the forecast period.

- Wi-Fi 7, a significant technological advancement, holds immense potential for transforming the media and entertainment industries. By significantly enhancing speed, range, and reliability, Wi-Fi 7 empowers organizations in various ways. It enables seamless streaming of high-quality content, including 4K and 8K videos, without buffering or lag, enabling real-time delivery of premium content to consumers. Moreover, Wi-Fi 7 facilitates the provision of virtual reality and augmented reality experiences, allowing businesses to create immersive environments for their customers. It also revolutionizes gaming by enabling high-speed delivery of gaming content, including the ability to stream games from remote servers to local devices. This eliminates the need for powerful gaming hardware and expands the indoor and outdoor gaming range. Wi-Fi 7 is set to unlock new possibilities and elevate user experiences in these industries.

- By location type, the outdoor segment is expected to register the fastest growth rate during the forecast period.

- Wi-Fi 7 can provide high-speed wireless connectivity to large crowds at concerts, sporting events, and trade shows. This will allow attendees to stream videos, share photos, and use social media without experiencing any lag or buffering. Wi-Fi 7 can wirelessly connect public venues such as parks, libraries, and train stations to the internet. This will enable users to stay connected while on the move. Wi-Fi 7 can be used to connect a wide range of devices in industrial applications, including sensors, actuators, and control systems. This will enable firms to automate their operations and increase efficiency. Outdoor wireless networking provides a testbed for new Wi-Fi 7 features and capabilities. The harsh conditions of outdoor environments can be a challenge for wireless networks, but they also provide an opportunity to test new technologies and see how they perform in real-world conditions. Wi-Fi 7 vendors are working closely with outdoor wireless networking providers to test and refine new features, and this feedback is helping to shape the development of Wi-Fi 7.

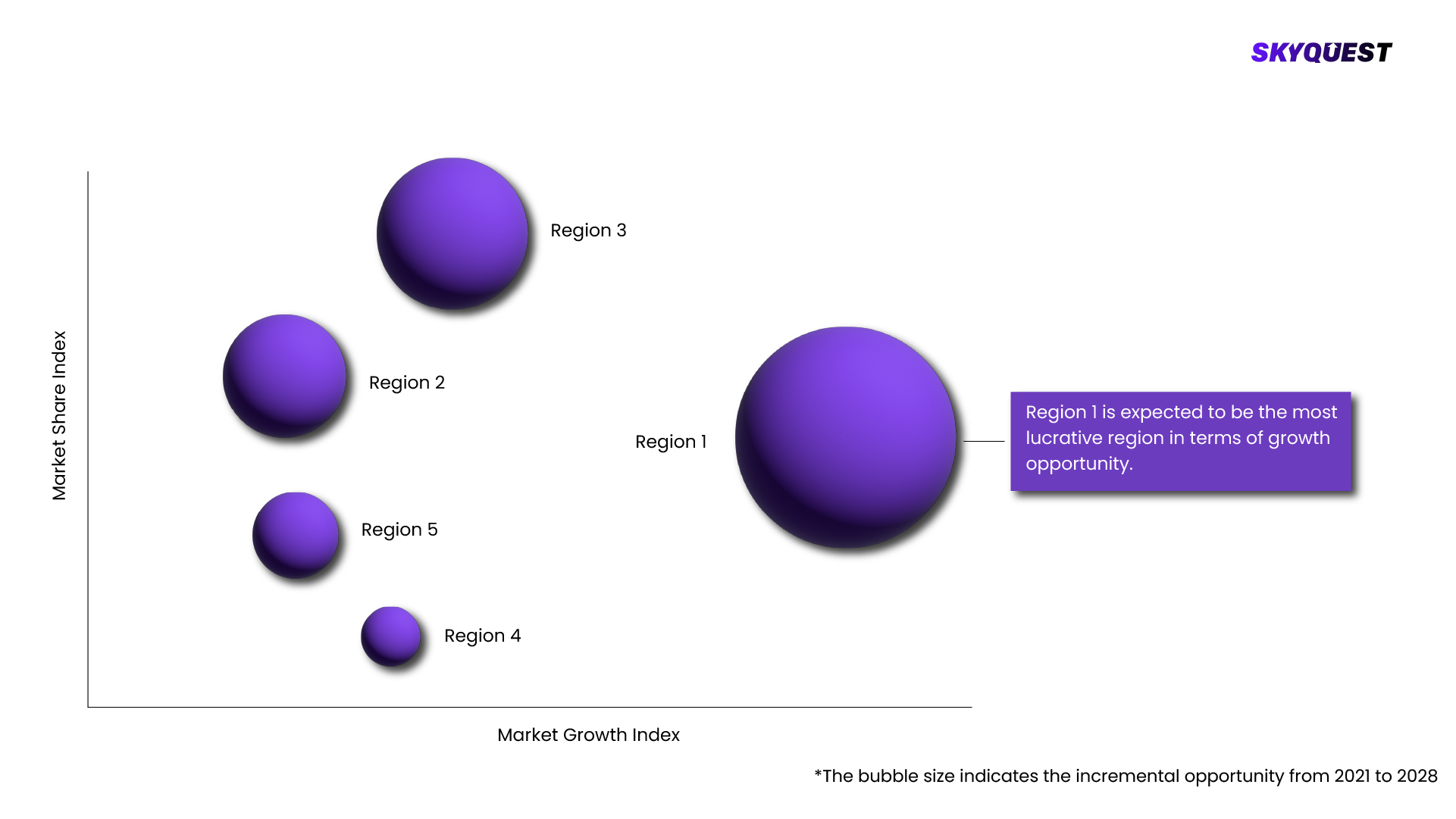

- North America is expected to hold the highest growth rate during the forecast period.

- The Wi-Fi 7 market in North America is expected to grow significantly in the coming years. The market is driven by the increasing demand for high-speed internet connectivity and the growing popularity of smart devices. North America is a major market for Wi-Fi technology. The region has a large and growing population of smartphone users, and there is a high demand for high-speed internet connectivity in homes and businesses. The increasing popularity of smart devices is also driving the demand for Wi-Fi technology. Smart devices, such as smart TVs, smart speakers, and smart thermostats, require a reliable, high-speed internet connection. The major factors driving the market’s growth are the increasing demand for high-speed internet connectivity, the growing popularity of smart devices, and the introduction of new Wi-Fi 7 devices and services. The key players in the Wi-Fi 7 market in North America are Qualcomm, Broadcom, MediaTek, Intel, and STMicroelectronics. These companies invest heavily in research and development to develop new Wi-Fi 7 chipsets and solutions. They are also partnering with major smartphone manufacturers and service providers to bring Wi-Fi 7 to the market.

- Recent Developments

- In December 2022, Rohde & Schwarz and Broadcom collaborated to announce the availability of an automated test solution for Broadcom Wi-Fi 7 chipsets.

- In January 2023, MediaTek introduced Consumer-Ready Wi-Fi 7 Products in product categories, including residential gateways, mesh routers, televisions, streaming devices, smartphones, tablets, laptops, and more at CES 2023.

- In March 2023, Lounea partnered with TP-Link to become Finland’s first Wi-Fi 7 operator to offer Wi-Fi 7 standards for home wireless networks.

- KEY MARKET SEGMENTS

- Based on Offering:

- Hardware

- System on Chip

- Access Points

- Routers

- Other Hardware

- Solutions

- Services

- Professional Services

- Managed Services

- Based on Location Type:

- Indoor

- Outdoor

- Based on Application:

- Immersive Technologies

- HD Video Streaming and Video Streaming

- Smart Home Devices

- IoT and Industry 4.0

- Telemedicine

- Public Wi-Fi and Dense Environments

- Other Applications

- Based on Vertical:

- Retail

- Manufacturing

- Media and Entertainment

- Healthcare and Life Sciences

- Transportation and Logistics

- Travel and Hospitality

- Education

- Residential

- Other Verticals

- By Region:

- North America

- United States (US)

- Canada

- Europe

- United Kingdom (UK)

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Rest of the world

- KEY MARKET PLAYERS

- Qualcomm

- Broadcom

- TP-Link

- ZTE

- Mediatek

- Keysight Technologies

- MaxLinear

- Huawei

- Commscope

- Vantiva

- LitePoint

- Rohde & Schwarz

- Intel

- HFCL

- Netgear

- SDMC Technology

- Senscomm Semiconductor

- H3C

- VVDN Technologies

- Actiontec Electronics

- ADB Global

- Ruijie Networks

- Edgewater Wireless Systems

- Privacy Management Software Market Forecast & Trends, Global Size

- The privacy management software market size is expected to grow from USD 2.7 billion in 2023 to USD 15.2 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 41.9% during the forecast period. As privacy regulations became more stringent, privacy impact assessments (PIAs) gained prominence. Privacy management software incorporated PIA frameworks to evaluate the potential risks and impacts on individuals' privacy associated with data processing activities. These tools facilitated the systematic assessment of data flows, risk identification, and implementation of appropriate mitigations. Modern privacy management software has evolved into comprehensive platforms that provide organizations with holistic privacy governance capabilities. These platforms integrate various modules, including data inventory, risk assessments, vendor management, policy management, privacy by design, and ongoing compliance monitoring. They offer centralized visibility, automation, and analytics to enable proactive privacy management, risk mitigation, and ongoing compliance with evolving regulations.

- Recession Impact on the Privacy management software market

- The global recession caused by the COVID-19 pandemic has had a mixed impact on the privacy management software market. Factors like the Russia-Ukraine war, the global pandemic, inflation, rising interest rates, and rising oil prices have resulted in recession across the various regions. These market uncertainties have resulted in reduced spending by organizations that may impact the demand for privacy management software across industries in the short term. The impact of a recession on the privacy management software market may vary across industries. Certain verticals, such as finance, healthcare, and retail & eCommerce, where privacy and data protection are critical, may prioritize privacy management software investments despite economic challenges. In contrast, industries heavily affected by the recession may delay or reduce spending on privacy management software until economic conditions improve. In addition, The Russia-Ukraine war has been accompanied by reports of cyber espionage, hacking attempts, and disinformation campaigns. These activities highlight the importance of robust cybersecurity measures. This will likely drive the growth of privacy management software during the forecast period. While the recession has a mixed impact on the privacy management software market, the long-term prospects for the industry remain positive. The continued growth in internet penetration, the increasing popularity of mobile devices, advent of technologies such as AI, IoT, cloud, and changing regulatory landscape across the globe, are likely to drive continued growth in the market. However, the impact of the recession on the market is likely to be felt for some time, particularly in terms of investment and advertising revenue.

- Privacy Management Software

- Driver: Need for personal data protection with increasing privacy concerns

- With the exponential growth of digital technologies and the extensive collection and processing of personal data, individuals are becoming more aware of the potential risks to their privacy. Organizations are increasingly demanding to protect personal data and ensure responsible data handling practices. Data privacy management software enables organizations to establish effective data governance frameworks. It helps organizations define data handling policies, track data flows, and implement controls to ensure responsible data processing practices. This promotes accountability and transparency in data management. As per the Cisco Consumer Privacy Survey 2022, organizations can perform a variety of activities to fulfill customer demands and build trust. These include complying with all applicable privacy laws and regulations, refraining from selling the customer’s personal information, avoiding data breaches that might expose personal data, allowing the customer to configure their privacy settings, and providing clear information on how the customer’s data is being used. As per the survey, 39% of consumers selected how their data is being used as the top priority.

- Restraint: integration of privacy management software with existing systems

- Privacy management software must seamlessly integrate with various existing systems and databases within an organization. However, compatibility issues can arise due to differences in data formats, protocols, or system architectures. These technical disparities can make the integration process complex and time-consuming. Organizations often have unique processes and requirements when it comes to privacy management. Integrating privacy management software may require customization and configuration to align with specific workflows, data structures, and business rules. This customization can be tedious and may require specialized expertise.

- In some cases, existing systems may already have privacy management features or modules. Integrating additional privacy management software can result in duplication of efforts and redundant functionalities. This duplication can lead to confusion, increased complexity, and wasted resources. Organizations should conduct thorough planning and analysis to overcome this, involving key stakeholders from IT, privacy, and relevant departments. It is crucial to assess the compatibility of privacy management software with existing systems, anticipate customization needs, allocate sufficient resources for data migration and mapping, and provide employees comprehensive training and change management support.

- Opportunity: Growing spending on cybersecurity initiatives

- As cyber threats become more sophisticated and prevalent, organizations allocate more resources to bolster their cybersecurity measures. As per a recent meeting at the White House, several tech giants such as Apple, AWS, and IBM announced new cybersecurity initiatives from 2021 to 2025.This includes investing in privacy management software as an essential component of their overall security strategy. Privacy management software helps protect sensitive data, prevent unauthorized access, and mitigate the risks of data breaches and privacy violations. In addition, Privacy management software provides tools and features to facilitate compliance, such as data mapping, consent management, and incident response capabilities. The increasing emphasis on regulatory compliance drives the need for privacy management software and justifies the increased spending in this area.

- Challenge: Time to implement data privacy management software

- The duration to implement data privacy management software can vary significantly depending on several factors, including the complexity of the software, the organization’s size and structure, the scope of the implementation, and the level of customization required. As per a survey conducted by g2.com in March 2021, the implementation time for products including TrustArc, DataGrail, Secure Privacy, SAI360, Collibra, SureCloud, DPOrganizer, and OneTrust was in the range of 24 days to 160 days. The shortest implementation time has been cited as DPOrganizer at just under one month, followed by Secure Privacy, with an implementation time of a month and a half. At the same time, the longest implementation periods are reported at just over five months. SAI360 reported an implementation period of 159 days, and Collibra completed theirs in 156 days. This will engage the IT and security teams in implementing and integrating the privacy management software and may impact the performance of other applications and business performance. Thus, the implementation time for various vendors of privacy management software will pose a challenge in adopting privacy management software across industry verticals.

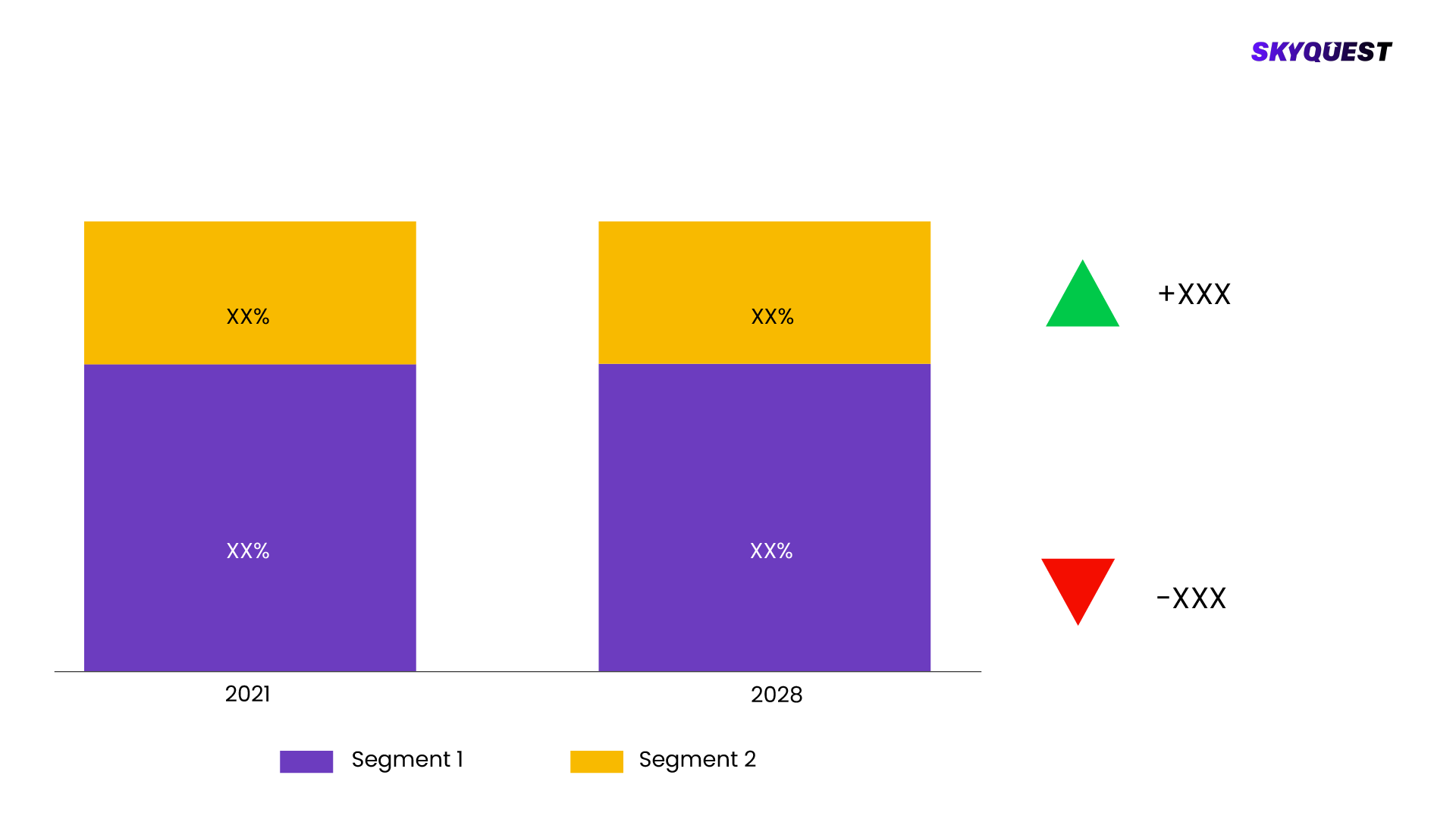

- Based on deployment mode, the on-premises segment is projected to witness the highest market share during the forecast period.

- Organizations opting for on-premises privacy management software prioritize data control, customization, and compliance with internal policies. They are willing to take on the responsibility of managing the software and infrastructure to maintain full control over their privacy management processes. However, it is important to carefully assess the organization's needs, resources, and capabilities before deciding on an on-premises deployment mode. The adoption of on-premises privacy management software is not as widespread as cloud-based solutions. However, for organizations with specific needs and priorities, such as data security, compliance, integration requirements, or cost considerations, on-premises solutions remain viable. Organizations should carefully evaluate their unique circumstances, risk appetite, and long-term objectives before deciding on the most suitable deployment mode for their privacy management software.

- By Vertical, the healthcare segment is expected to grow at a higher CAGR during the forecast period.

- Privacy management software plays a crucial role in the healthcare industry, where patient privacy and data protection are paramount. Privacy management software is essential in the healthcare industry for ensuring compliance with privacy regulations, protecting patient data, managing consent, facilitating secure data sharing, handling privacy incidents, maintaining accountability, and managing data subject rights. By leveraging privacy management software, healthcare organizations can enhance patient privacy, maintain regulatory compliance, and foster trust in the healthcare ecosystem.

- Privacy management software significantly benefits the healthcare industry by ensuring regulatory compliance, protecting patient data, facilitating consent management, enabling secure data sharing, assisting in privacy incident management, enhancing accountability, and supporting data subject rights management. By leveraging privacy management software, healthcare organizations can strengthen patient privacy, maintain compliance with privacy regulations, and build trust in handling sensitive patient information.

- Based on Region, North America to hold the largest market share during the forecast period.

- The privacy landscape in North America is characterized by a mix of federal, state, and sector-specific privacy laws, evolving regulatory frameworks, advocacy efforts, and public demand for privacy rights. The push for comprehensive federal privacy legislation and the need to navigate the complexities of privacy compliance is expected to drive the growth of the market in the region. Regional privacy laws and regulations, industry standards, and evolving privacy expectations influence privacy management practices in North America. Various industry-specific regulations and standards influence data protection practices in North America. For instance, the Payment Card Industry Data Security Standard (PCI DSS) sets requirements for handling payment card data, while the National Institute of Standards and Technology (NIST) provides cybersecurity and privacy frameworks widely adopted by organizations. In addition, the adoption of cloud technology is also driving cross-border data transfers. Organizations in North America now rely on mechanisms such as Standard Contractual Clauses (SCCs) and Binding Corporate Rules (BCRs) to ensure lawful cross-border data transfers. With the outbreak of COVID-19, consumer awareness regarding data privacy and the importance of protecting personal information has grown with the growing usage of digital platforms, leading to increased expectations for privacy safeguards from organizations. As per EY Global Consumer Privacy Survey 2020, 58% of respondents in North America are more conscious about the personal information shared via digital communication platforms than before the pandemic. These factors are likely to drive the adoption of privacy management software in the region.

- Recent Developments:

- In May 2023, OneTrust launched AI-driven document classification to support organizations to completely identify and classifying unstructured data to enhance data governance and data discovery.

- In April 2023, BigID announced a technology partnership with Thales, a data security technology provider, to combine BigID data intelligence and Thales CipherTrust Platform to encrypt, anonymize, and delete data.

- In May 2021, Securiti announced the collaboration between Security and Workday by launching Securiti for Workday to enhance security, privacy, governance, and compliance for sensitive employee and financial data within the Workday platform.

- In March 2021, IBM announced the launch of the launch of IBM OpenPages Data Privacy Management, a new module in the OpenPages platform that enables organizations to meet new data privacy challenges.

- In December 2020, Exterro acquired AccessData, a forensic investigation technology provider, to help customers manage legal governance, risk, and compliance (GRC) obligations.

- In June 2020, TrustArc partnered with BigID, a leading provider of data discovery and intelligence solutions for privacy, protection, and insights. This collaboration aims to assist organizations in discovering, classifying, understanding, and safeguarding personal and sensitive data to ensure ongoing privacy compliance.

- KEY MARKET SEGMENTS

- Based on Application:

- Data Discovery & Mapping

- Data Subject Access Request (DSAR)

- Privacy Impact Assessment (PIA)

- Consent & Preference Management (CPM)

- Incident & Breach Management

- Vendor & Third-Party Risk Management

- Other Applications

- Based on Deployment Mode:

- Cloud

- On-premises

- Based on Organization Size:

- Large Enterprises

- SMEs

- Based on Vertical:

- BFSI

- Government & Defense

- Healthcare

- Retail & eCommerce

- Manufacturing

- IT & Telecommunications

- Other Verticals

- Based on Region:

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- KEY MARKET PLAYERS

- One Trust

- TrustArc

- Security

- SAI global

- SAP SE

|